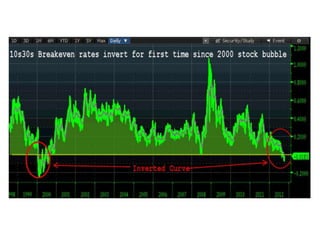

10s30s inverted for first time since dot.com bubble

Download as PPTX, PDF1 like265 views

1 of 1

Download to read offline

Recommended

Misery Index in Europe: Unemployment Rate plus Inflation Rate

Misery Index in Europe: Unemployment Rate plus Inflation RateFasanara Capital ltd

Ìý

The document discusses unsustainable imbalances in the Eurozone as measured by the misery index, which adds the unemployment rate to the inflation rate. High unemployment and inflation indicate economic troubles for Eurozone countries. Reducing these rates would help correct imbalances in the Eurozone economy.Fasanara Outlook Sept Investors Presentation 2013 | Artificial Markets are St...

Fasanara Outlook Sept Investors Presentation 2013 | Artificial Markets are St...Fasanara Capital ltd

Ìý

This document provides an investor and media kit from Fasanara Capital Ltd dated September 19th, 2013. It includes an investment outlook and discussion of portfolio positioning. Key points include:

- Markets remain structurally fragile due to overleverage, low liquidity, and optimism. Tapering will eventually happen but recent postponement led to a short-lived relief rally.

- Rates are the biggest risk to equities as tapering and rising rates could negatively impact markets. China's corporate debt is also a concern if growth slows.

- The portfolio has hedging, value, and tactical books. The hedging book seeks opportunities in volatility and downside protection. The value bookAbstract from MARCH 2012 fasanara 'fat tail risk hedging programs' FTRHPs

Abstract from MARCH 2012 fasanara 'fat tail risk hedging programs' FTRHPsFasanara Capital ltd

Ìý

This document discusses portfolio hedging strategies, including security-specific hedging, macro overlay hedging, and Fat Tail Risk Hedging Programs. It provides examples of strategies to hedge various tail risks, such as short positions in Japanese equities and currency to hedge risks of a credit crunch or default scenario. Short positions in shipping companies and rates are discussed to hedge risks associated with a decline in China's commodity imports. Purchasing out of the money options on currencies like the Swiss Franc and Danish Krone are presented as ways to hedge against an EU break up scenario. Short positions in Japanese rates and long gold are discussed as hedges against an inflation scenario. Declining Chinese export growth is cited asFasanara Capital | Investment Outlook | May 3rd 2017

Fasanara Capital | Investment Outlook | May 3rd 2017Fasanara Capital ltd

Ìý

Fasanara Capital | Investment Outlook

1. Fake Markets: How Artificial Money Flows Kill Data Dependency, Affect Market Functioning and Change the Structure of the Market

Hard data ceased to be a driver for markets, valuation metrics for bonds and equities which held valid for over a century are now deemed secondary. Narratives and money flows trump hard data, overwhelmingly.

‘Fake Markets’ are defined as markets where the magnitude and duration of artificial flows from global Central Banks or passive investment vehicles have managed to overwhelm and narcotize data-dependency and macro factors. A stuporous state of durable, un-volatile over-valuation, arrested activity, unconsciousness produced by the influence of artificial money flows.

- Passive Flows: The Prehistoric Elephant In The Room

- ETFs Are Taking Over Markets

- The Impact of Passive Investors on Active Investors: the Induction Trap

- How Narratives Evolve To Cover For Fake Markets

- Defendit Numerus: There is Safety in Numbers

- What Could We Get Wrong

2. Be Short, Be Patient, Be Ready

Markets driven by Central Banks, passive investment vehicles and retail investors are unfit to price any premium for any risk. If we are right and this is indeed a bubble (both in equity and in bonds), it will eventually bust; it is only a matter of time. The higher it goes, the higher it can go, as more swathes of private investors are pulled in. The more violently it can subsequently bust.

The risk of a combined bust of equity and bonds is a plausible one. It matters all the more as 90%+ of investors still work under the basic framework of a balanced portfolio, exposed in different proportions to equity and bonds, both long. That includes risk parity funds, a leveraged version of balanced portfolio. That includes alternative risk premia funds, a nice commercial disguise for a mostly long-only beta risk, where premia is extracted from record rich markets that made those premia tautologically minuscule.

Fasanara Capital | Investment Outlook | January 17th 2017

Fasanara Capital | Investment Outlook | January 17th 2017Fasanara Capital ltd

Ìý

Fasanara Capital | Investment Outlook

1. The Future Is Wide Open: Avoid The ‘Illusion Of Knowledge’ Trap

The single most dangerous thinking trap / optical illusion for investors today is to look at Trump, Brexit and Italy Referendum as non-events, buried in the past. We believe that 2017 may likely be driven by the same factors that failed to shape 2016. The non-events of 2016 are likely to be the drivers of 2017. Finally, we will get to find out if Brexit means Brexit, if Trump means Trump, if a failed Italian referendum means early elections and a membership of the EMU in jeopardy down the line.

2. Structural Shift: These Are Transformational Times

The macro outlook of the next years will be influenced the most by these structural trends:

› Protectionism, De-Globalization & De-Dollarization. In Pursuit of Inclusive Growth

› End of ‘Pax Americana’. The ascent of China. Geopolitical risks on the rise

› End of ‘Pax QE’. Markets without steroids, but still delusional.

› 4th Industrial Revolution: labor participation rate falling from 63% to 40% in 10 years?

3. Our Baseline Scenario: Bubble Unwind, Equities and Bonds Down

Starting this 2017, our major macro convictions are as follows:

› Global Tapering to progress

› US Dollar to keep grinding higher

› European Political Instability to worsen

› US Equities to weaken

Fasanara Capital | Investment Outlook | May 3rd 2016

Fasanara Capital | Investment Outlook | May 3rd 2016Fasanara Capital ltd

Ìý

1. Reflation Phase To Be Temporary, More Downside Ahead

Earlier on in 2016, ‘random and violent markets’ went off to panic mode out of (i) fears over China’s messy stock market and devaluing currency, (ii) plummeting oil price, (iii) strong US Dollar. Today, we believe complacent markets are similarly illogical and over-shooting, this time on the way up. As we re-assess the validity of the underlying risks, we expect a shift in narrative in the few months ahead and a sizeable sell-off for risk assets.

2. Four Key Conviction Ideas

We analyze below our key ideas for the next 12 months:

Short Chinese Renminbi Thesis. In Q1, China only managed to keep GDP in shape by means of graciously expanding credit by a monumental 1 trn $. Unsurprisingly, at 250% total debt on GDP, you cannot borrow 10% of GDP per quarter for long, without a currency adjustment, whether desired or not.

Short Oil Thesis. Long-term, we believe Oil will follow a volatile path around a declining trend-line, which will take it one day to sub-10$. Within 2016, we expect global aggregate demand to stay anemic and supply to surprise on the upside, inventories to grow, primarily due to the accelerating speed of technological progress.

Short S&P Thesis. To us, the S&P is priced to perfection, despite a most cloudy environment for growth and risk assets, thus representing a good value short, for limited upside is combined with the risk of a sizeable sell-off in the months ahead.

Short European Banks Thesis. We believe that micro policies at the local level, while valid, are impotent against heavy structural macro headwinds, and only the macro environment can save the banking sector in its current form in the longer-term. Macro structural headwinds for banks these days are too heavy a burden (negative sloped interest rate curves, deeply negative interest rates, deflationary economy, depressed GDP growth, over-regulation, Fintech), and will likely push valuations to new lows in the months/years ahead.

Fasanara Capital | Investment Outlook | October 26th 2015

Fasanara Capital | Investment Outlook | October 26th 2015Fasanara Capital ltd

Ìý

‘Deflationary Boom Markets’

‘Deflationary Boom Markets’ is the name of the game. Deflation forces Central Banks into action. Central banks to push Bonds and Equities higher, inflating the bubble some more, although on a rougher path and with higher volatility than we got accustomed to in recent years.

Fasanara Capital | Investment Outlook | June 1st 2015

Fasanara Capital | Investment Outlook | June 1st 2015Fasanara Capital ltd

Ìý

This document provides an investment outlook and analysis from Fasanara Capital. It discusses recent volatility in the bond markets, particularly the German bund market, and provides Fasanara Capital's medium and long-term views. In the medium term, they expect bund yields to fall further, European government bond spreads to tighten, and European equities to rise. In the long term, they believe deflationary trends will continue in Europe and central banks will need to continue monetary stimulus to prevent economic deterioration, which could eventually lead to a break in the euro currency peg.Fasanara Capital Investment Outlook | February 1st 2015

Fasanara Capital Investment Outlook | February 1st 2015Fasanara Capital ltd

Ìý

Fasanara Capital Investment Outlook | February 1st 2015

1. Seismic Activity On The Rise

2. No Volatility No Gain

3. The Role Of Optionality

4. Crystal Ball

5. Deflation Is A Multi-Year Process

6. Three Big Trades for 2015Fasanara Capital | Investment Outlook | December 1st 2014

Fasanara Capital | Investment Outlook | December 1st 2014Fasanara Capital ltd

Ìý

The document discusses investment outlooks for 2015, focusing on three defining market features and three major trade opportunities. Regarding the defining features, it argues that deflation is just beginning in Europe and will continue driving European Central Bank policy in 2015. It also notes that competitive policy responses among countries are becoming increasingly confrontational. Finally, it suggests Keynesian views advocating government intervention are gaining prominence over Austrian views in academic debates. The three major trade opportunities discussed are related to European deflation, peripheral European bonds offering optionality, and further monetary easing in Japan under Abenomics.Fasanara Capital Investment Outlook | September 1st 2014

Fasanara Capital Investment Outlook | September 1st 2014Fasanara Capital ltd

Ìý

- Tensions with Russia over Ukraine are seen as transitory but could cause market volatility in the near-term. Deflation in Europe is viewed as a more structural issue that will affect markets for the long-term.

- The ECB is expected to take a three step approach - enhancing terms for T-LTROs, finalizing stress tests, and delivering their own version of quantitative easing.

- Three top investment opportunities are seen in European deflation trades benefiting from ECB action, peripheral European equity with upside from an inflated bubble, and Japanese equity benefiting from further stimulus.Fasanara Capital I Investment Outlook I April 1st 2014

Fasanara Capital I Investment Outlook I April 1st 2014Fasanara Capital ltd

Ìý

The document discusses the investment outlook and portfolio positioning of Fasanara Capital. It states that despite weak economics and high valuations, the path of least resistance for markets in the short term is higher, as long as tensions in Ukraine do not escalate. Within equities, the portfolio prefers Italy, Greece, and Japan over US markets. The portfolio is positioned for a scenario where Russia de-escalates tensions in Ukraine, allowing markets to rise to new highs, especially in peripheral Europe. However, it remains hedged for a potential escalation causing a more significant market correction.Fasanara Capital | Investment Outlook | December 16th 2013

Fasanara Capital | Investment Outlook | December 16th 2013Fasanara Capital ltd

Ìý

This document provides an investment outlook and analysis of opportunities for 2014. It maintains a strategy of being long certain equities outside the US while preparing for volatility. The US and Europe are seen as in bubble territory for stocks and credit. Japan is pursuing aggressive monetary policies that could drive further equity gains and yen weakness. China's growth is positive in the short term but credit risks loom in coming years. Corrections are anticipated, with tapering, disappointing data, or earnings declines as possible catalysts. The document recommends hedging positions and selectivity in international equities and commodities tied to China.Fasanara Capital | Investment Outlook | October 7th 2013

Fasanara Capital | Investment Outlook | October 7th 2013Fasanara Capital ltd

Ìý

- The document provides an investment outlook and analysis of global markets from Fasanara Capital.

- It warns that markets have become too optimistic in the face of political and economic risks, making them fragile, and advocates maintaining hedges against a potential downturn.

- While near-term risks in Europe and the US have been postponed, the author believes volatility will increase and markets will experience a steep 10-20% correction when risks materialize.Fasanara Capital | Investment Outlook | June 28th 2013

Fasanara Capital | Investment Outlook | June 28th 2013Fasanara Capital ltd

Ìý

This document provides an investment outlook and analysis from Fasanara Capital. Some key points:

1) Bernanke clarified the Fed's timeline for tapering QE, which removes the double benefit of QE and GDP growth. Markets may be range-bound or fall over the summer.

2) Interest rate increases pose a major risk to equities. Correlations between equities and bonds may shift to be positive rather than the current negative correlation.

3) Japan remains short yen and rates, and now adds a tactical long position in Japanese equities expecting a positive July. Short yen is the largest position.

4) China's vulnerability to slowing growth and credit issues could impactFasanara Capital | Investment Outlook - June 28th 2013

Fasanara Capital | Investment Outlook - June 28th 2013Fasanara Capital ltd

Ìý

This document provides an investment outlook and analysis from Fasanara Capital. Some key points:

1) Bernanke clarified the Fed's timeline for tapering QE, which removes the double benefit of QE and GDP growth. Markets may be range-bound or fall over the summer.

2) Interest rate increases pose a major risk to equities. Correlations between equities and bonds may shift to be positive rather than the current negative correlation.

3) Japan remains short yen and rates, and now adds a tactical long position in Japanese equities expecting a positive July. Short yen is the largest position.

4) China's vulnerability and potential for more stimulus are noted asFasanara Capital | Investment Outlook | May 3rd 2013

Fasanara Capital | Investment Outlook | May 3rd 2013Fasanara Capital ltd

Ìý

The document discusses recent market trends and the relationship between two opposing forces - the "Bubble Chain" and the "Deleveraging Chain".

The Bubble Chain refers to rising asset prices driven by central bank liquidity, moving from government bonds to corporate credit to equities. However, a Deleveraging Chain is also occurring, shown through weakness in commodities, emerging markets, and gold. These two chains send inconsistent signals about the economy.

The document argues one chain will have to give way at some point, allowing for a realignment. It also analyzes gold's recent sharp decline, putting forward several hypotheses for what triggered it and what implications it could have. The author remains uncertain about whichFasanara Capital | Investment Outlook | April 5th 2013

Fasanara Capital | Investment Outlook | April 5th 2013Fasanara Capital ltd

Ìý

The document discusses recent political events in Italy and Cyprus and their implications. It says that irrational political behavior has increased the potential for policy mistakes in Europe. Both Italy and Cyprus saw illogical decision making in their handling of political and financial issues. This raises concerns that volatility in politics and markets will increase going forward. The document recommends hedging against the risk of a break up of the eurozone given the rising divisions within Europe and potential for more countries to rebel against austerity.Fasanara Capital | Appendix | Portfolio Buckets

Fasanara Capital | Appendix | Portfolio BucketsFasanara Capital ltd

Ìý

The document discusses several scenarios that could play out in the global economy and financial markets over the next few years. The base case scenario remains one of slow deleveraging similar to Japan, but the system is vulnerable to shocks that could flip the equilibrium. Six potential scenarios are outlined: inflation, defaults, renewed credit crunch, EU breakup, China hard landing, USD devaluation. The strategy positions the portfolio to withstand most potential outcomes and benefit from "fat tail events" that are currently mispriced. Concerns are raised about high valuations in credit markets and underestimation of risks like rising interest rates.Fasanara Capital | Investment Outlook | March 1st 2013

Fasanara Capital | Investment Outlook | March 1st 2013Fasanara Capital ltd

Ìý

1) Italian elections resulted in a hung parliament, increasing political uncertainty and vulnerability in European markets in the coming weeks. However, the author remains broadly positive in the medium term.

2) Germany may ultimately loosen its stance on austerity to gain approval for a grand coalition government in Italy, as talk of policy changes can be effective in calming markets.

3) The potential failure of OMT interventions in Italy could trigger a disastrous market reaction and move the region closer to a disorderly break up of the Eurozone, one of the author's tail risk scenarios. Overall the author sees more volatility ahead due to Italy but remains positive in the medium term.Fasanara Capital | Investment Outlook | February 1st 2013

Fasanara Capital | Investment Outlook | February 1st 2013Fasanara Capital ltd

Ìý

1) The author remains positive on equity markets in the short term but believes the rally is built on shaky foundations due to central bank liquidity and is sensitive to shocks.

2) Central bank liquidity is the chief driver of market performance, making rallies nominal rather than real. The author advocates differentiating between real and nominal rallies.

3) One of the author's key concerns is an inflation scenario brought on by currency debasement and debt monetization, which they believe may be in its early stages.Fasanara Capital | Investment Outlook | January 11th 2013

Fasanara Capital | Investment Outlook | January 11th 2013Fasanara Capital ltd

Ìý

The document provides an investment outlook and analysis from Fasanara Capital. It summarizes that:

1) Markets are expected to continue rallying in the short term but correct markedly in the next few months once the EMU crisis flares up again.

2) Positions in Europe will be held with incremental hedging, as the rally is based on false assumptions and will be terminated prematurely.

3) Italy may provide opportunities around national elections in late February as volatility is expected to rise.Fasanara Capital | Investment Outlook | January 7th 2012

Fasanara Capital | Investment Outlook | January 7th 2012Fasanara Capital ltd

Ìý

The document provides an investment outlook from Fasanara Capital. It argues that markets remain in a fragile state with multiple potential outcomes, including inflation, defaults, or stagnation. Due to widespread risks, the base case scenario for 2012 is a stagnant market environment with volatile trading and potential shocks. Given embedded risks, current valuations do not adequately compensate investors. The outlook advocates maintaining short positions and hedges to manage fat tail risks in these dysfunctional markets.Fasanara Capital | Weekly Investment Outlook | December 17th 2011

Fasanara Capital | Weekly Investment Outlook | December 17th 2011Fasanara Capital ltd

Ìý

The document provides an investment outlook and analysis of the European sovereign debt crisis and financial markets. It discusses the failure of recent ECB actions to restore confidence, predicts a confidence collapse scenario. It examines debt flows and stock levels facing European countries in 2012, risks to bank deposits and consumer spending. It argues that Germany will be left alone to handle the crisis but faces opposition from struggling countries and its own economic problems, making large-scale solutions difficult to achieve.Fasanara Capital | Investment Outlook | November 16th 2012

Fasanara Capital | Investment Outlook | November 16th 2012Fasanara Capital ltd

Ìý

The document provides an investment outlook from Fasanara Capital. It discusses cutting directional risks in the short term and maintaining a neutral beta portfolio while keeping relative value plays across markets. It maintains the view that risks in Spain, Greece, and the US fiscal cliff are overdone and sees a better chance of a 20% rally than drop in the next 3-4 months. It also discusses maintaining hedges given rock bottom risk premia and accumulating optionality against potential tail risks in the coming years.US Biotech at tech bubble levels

US Biotech at tech bubble levelsFasanara Capital ltd

Ìý

Biotech valuations have reached levels comparable to the tech bubble of the late 1990s according to an analysis of biotech equity valuations against broader market indexes. Biotech companies now comprise over 20% of the NASDAQ index, representing hundreds of billions in total market value. Concerns were raised that some biotech firms have promising science but their current valuations far exceed anything justified by their actual business fundamentals.Fasanara capital | Investment Outlook: October 26th 2012

Fasanara capital | Investment Outlook: October 26th 2012Fasanara Capital ltd

Ìý

The document provides an investment outlook and analysis of the European markets and economy. It discusses three main points:

1) In the short-term, valuations in Europe are expected to remain supported through the end of the year due to central bank intervention, with the possibility of further gains if sovereign bond spreads compress further.

2) In the medium-term, the author believes the European crisis is likely to flare up again in early 2013 due to austerity measures negatively impacting economies or a rejection of bailouts by Germany.

3) Long-term, central bank attempts to reduce risks may have unintended consequences of creating larger potential impacts in the future through more extreme outcomes. The author discusses several scenarios thatItaly vs Germany Government Bond Spreads

Italy vs Germany Government Bond SpreadsFasanara Capital ltd

Ìý

Italy-Germany Government Bond Spreads shows the difference in yields between 10-year Italian bonds (BTPs) and German bonds (Bunds). Currently, BTP yields are higher than Bund yields, indicating that investors require a higher return to take on the risk of owning Italian debt versus German debt. The widening spread reflects increasing concerns from investors about Italy's fiscal situation and long-term economic prospects relative to Germany.More Related Content

More from Fasanara Capital ltd (20)

Fasanara Capital Investment Outlook | February 1st 2015

Fasanara Capital Investment Outlook | February 1st 2015Fasanara Capital ltd

Ìý

Fasanara Capital Investment Outlook | February 1st 2015

1. Seismic Activity On The Rise

2. No Volatility No Gain

3. The Role Of Optionality

4. Crystal Ball

5. Deflation Is A Multi-Year Process

6. Three Big Trades for 2015Fasanara Capital | Investment Outlook | December 1st 2014

Fasanara Capital | Investment Outlook | December 1st 2014Fasanara Capital ltd

Ìý

The document discusses investment outlooks for 2015, focusing on three defining market features and three major trade opportunities. Regarding the defining features, it argues that deflation is just beginning in Europe and will continue driving European Central Bank policy in 2015. It also notes that competitive policy responses among countries are becoming increasingly confrontational. Finally, it suggests Keynesian views advocating government intervention are gaining prominence over Austrian views in academic debates. The three major trade opportunities discussed are related to European deflation, peripheral European bonds offering optionality, and further monetary easing in Japan under Abenomics.Fasanara Capital Investment Outlook | September 1st 2014

Fasanara Capital Investment Outlook | September 1st 2014Fasanara Capital ltd

Ìý

- Tensions with Russia over Ukraine are seen as transitory but could cause market volatility in the near-term. Deflation in Europe is viewed as a more structural issue that will affect markets for the long-term.

- The ECB is expected to take a three step approach - enhancing terms for T-LTROs, finalizing stress tests, and delivering their own version of quantitative easing.

- Three top investment opportunities are seen in European deflation trades benefiting from ECB action, peripheral European equity with upside from an inflated bubble, and Japanese equity benefiting from further stimulus.Fasanara Capital I Investment Outlook I April 1st 2014

Fasanara Capital I Investment Outlook I April 1st 2014Fasanara Capital ltd

Ìý

The document discusses the investment outlook and portfolio positioning of Fasanara Capital. It states that despite weak economics and high valuations, the path of least resistance for markets in the short term is higher, as long as tensions in Ukraine do not escalate. Within equities, the portfolio prefers Italy, Greece, and Japan over US markets. The portfolio is positioned for a scenario where Russia de-escalates tensions in Ukraine, allowing markets to rise to new highs, especially in peripheral Europe. However, it remains hedged for a potential escalation causing a more significant market correction.Fasanara Capital | Investment Outlook | December 16th 2013

Fasanara Capital | Investment Outlook | December 16th 2013Fasanara Capital ltd

Ìý

This document provides an investment outlook and analysis of opportunities for 2014. It maintains a strategy of being long certain equities outside the US while preparing for volatility. The US and Europe are seen as in bubble territory for stocks and credit. Japan is pursuing aggressive monetary policies that could drive further equity gains and yen weakness. China's growth is positive in the short term but credit risks loom in coming years. Corrections are anticipated, with tapering, disappointing data, or earnings declines as possible catalysts. The document recommends hedging positions and selectivity in international equities and commodities tied to China.Fasanara Capital | Investment Outlook | October 7th 2013

Fasanara Capital | Investment Outlook | October 7th 2013Fasanara Capital ltd

Ìý

- The document provides an investment outlook and analysis of global markets from Fasanara Capital.

- It warns that markets have become too optimistic in the face of political and economic risks, making them fragile, and advocates maintaining hedges against a potential downturn.

- While near-term risks in Europe and the US have been postponed, the author believes volatility will increase and markets will experience a steep 10-20% correction when risks materialize.Fasanara Capital | Investment Outlook | June 28th 2013

Fasanara Capital | Investment Outlook | June 28th 2013Fasanara Capital ltd

Ìý

This document provides an investment outlook and analysis from Fasanara Capital. Some key points:

1) Bernanke clarified the Fed's timeline for tapering QE, which removes the double benefit of QE and GDP growth. Markets may be range-bound or fall over the summer.

2) Interest rate increases pose a major risk to equities. Correlations between equities and bonds may shift to be positive rather than the current negative correlation.

3) Japan remains short yen and rates, and now adds a tactical long position in Japanese equities expecting a positive July. Short yen is the largest position.

4) China's vulnerability to slowing growth and credit issues could impactFasanara Capital | Investment Outlook - June 28th 2013

Fasanara Capital | Investment Outlook - June 28th 2013Fasanara Capital ltd

Ìý

This document provides an investment outlook and analysis from Fasanara Capital. Some key points:

1) Bernanke clarified the Fed's timeline for tapering QE, which removes the double benefit of QE and GDP growth. Markets may be range-bound or fall over the summer.

2) Interest rate increases pose a major risk to equities. Correlations between equities and bonds may shift to be positive rather than the current negative correlation.

3) Japan remains short yen and rates, and now adds a tactical long position in Japanese equities expecting a positive July. Short yen is the largest position.

4) China's vulnerability and potential for more stimulus are noted asFasanara Capital | Investment Outlook | May 3rd 2013

Fasanara Capital | Investment Outlook | May 3rd 2013Fasanara Capital ltd

Ìý

The document discusses recent market trends and the relationship between two opposing forces - the "Bubble Chain" and the "Deleveraging Chain".

The Bubble Chain refers to rising asset prices driven by central bank liquidity, moving from government bonds to corporate credit to equities. However, a Deleveraging Chain is also occurring, shown through weakness in commodities, emerging markets, and gold. These two chains send inconsistent signals about the economy.

The document argues one chain will have to give way at some point, allowing for a realignment. It also analyzes gold's recent sharp decline, putting forward several hypotheses for what triggered it and what implications it could have. The author remains uncertain about whichFasanara Capital | Investment Outlook | April 5th 2013

Fasanara Capital | Investment Outlook | April 5th 2013Fasanara Capital ltd

Ìý

The document discusses recent political events in Italy and Cyprus and their implications. It says that irrational political behavior has increased the potential for policy mistakes in Europe. Both Italy and Cyprus saw illogical decision making in their handling of political and financial issues. This raises concerns that volatility in politics and markets will increase going forward. The document recommends hedging against the risk of a break up of the eurozone given the rising divisions within Europe and potential for more countries to rebel against austerity.Fasanara Capital | Appendix | Portfolio Buckets

Fasanara Capital | Appendix | Portfolio BucketsFasanara Capital ltd

Ìý

The document discusses several scenarios that could play out in the global economy and financial markets over the next few years. The base case scenario remains one of slow deleveraging similar to Japan, but the system is vulnerable to shocks that could flip the equilibrium. Six potential scenarios are outlined: inflation, defaults, renewed credit crunch, EU breakup, China hard landing, USD devaluation. The strategy positions the portfolio to withstand most potential outcomes and benefit from "fat tail events" that are currently mispriced. Concerns are raised about high valuations in credit markets and underestimation of risks like rising interest rates.Fasanara Capital | Investment Outlook | March 1st 2013

Fasanara Capital | Investment Outlook | March 1st 2013Fasanara Capital ltd

Ìý

1) Italian elections resulted in a hung parliament, increasing political uncertainty and vulnerability in European markets in the coming weeks. However, the author remains broadly positive in the medium term.

2) Germany may ultimately loosen its stance on austerity to gain approval for a grand coalition government in Italy, as talk of policy changes can be effective in calming markets.

3) The potential failure of OMT interventions in Italy could trigger a disastrous market reaction and move the region closer to a disorderly break up of the Eurozone, one of the author's tail risk scenarios. Overall the author sees more volatility ahead due to Italy but remains positive in the medium term.Fasanara Capital | Investment Outlook | February 1st 2013

Fasanara Capital | Investment Outlook | February 1st 2013Fasanara Capital ltd

Ìý

1) The author remains positive on equity markets in the short term but believes the rally is built on shaky foundations due to central bank liquidity and is sensitive to shocks.

2) Central bank liquidity is the chief driver of market performance, making rallies nominal rather than real. The author advocates differentiating between real and nominal rallies.

3) One of the author's key concerns is an inflation scenario brought on by currency debasement and debt monetization, which they believe may be in its early stages.Fasanara Capital | Investment Outlook | January 11th 2013

Fasanara Capital | Investment Outlook | January 11th 2013Fasanara Capital ltd

Ìý

The document provides an investment outlook and analysis from Fasanara Capital. It summarizes that:

1) Markets are expected to continue rallying in the short term but correct markedly in the next few months once the EMU crisis flares up again.

2) Positions in Europe will be held with incremental hedging, as the rally is based on false assumptions and will be terminated prematurely.

3) Italy may provide opportunities around national elections in late February as volatility is expected to rise.Fasanara Capital | Investment Outlook | January 7th 2012

Fasanara Capital | Investment Outlook | January 7th 2012Fasanara Capital ltd

Ìý

The document provides an investment outlook from Fasanara Capital. It argues that markets remain in a fragile state with multiple potential outcomes, including inflation, defaults, or stagnation. Due to widespread risks, the base case scenario for 2012 is a stagnant market environment with volatile trading and potential shocks. Given embedded risks, current valuations do not adequately compensate investors. The outlook advocates maintaining short positions and hedges to manage fat tail risks in these dysfunctional markets.Fasanara Capital | Weekly Investment Outlook | December 17th 2011

Fasanara Capital | Weekly Investment Outlook | December 17th 2011Fasanara Capital ltd

Ìý

The document provides an investment outlook and analysis of the European sovereign debt crisis and financial markets. It discusses the failure of recent ECB actions to restore confidence, predicts a confidence collapse scenario. It examines debt flows and stock levels facing European countries in 2012, risks to bank deposits and consumer spending. It argues that Germany will be left alone to handle the crisis but faces opposition from struggling countries and its own economic problems, making large-scale solutions difficult to achieve.Fasanara Capital | Investment Outlook | November 16th 2012

Fasanara Capital | Investment Outlook | November 16th 2012Fasanara Capital ltd

Ìý

The document provides an investment outlook from Fasanara Capital. It discusses cutting directional risks in the short term and maintaining a neutral beta portfolio while keeping relative value plays across markets. It maintains the view that risks in Spain, Greece, and the US fiscal cliff are overdone and sees a better chance of a 20% rally than drop in the next 3-4 months. It also discusses maintaining hedges given rock bottom risk premia and accumulating optionality against potential tail risks in the coming years.US Biotech at tech bubble levels

US Biotech at tech bubble levelsFasanara Capital ltd

Ìý

Biotech valuations have reached levels comparable to the tech bubble of the late 1990s according to an analysis of biotech equity valuations against broader market indexes. Biotech companies now comprise over 20% of the NASDAQ index, representing hundreds of billions in total market value. Concerns were raised that some biotech firms have promising science but their current valuations far exceed anything justified by their actual business fundamentals.Fasanara capital | Investment Outlook: October 26th 2012

Fasanara capital | Investment Outlook: October 26th 2012Fasanara Capital ltd

Ìý

The document provides an investment outlook and analysis of the European markets and economy. It discusses three main points:

1) In the short-term, valuations in Europe are expected to remain supported through the end of the year due to central bank intervention, with the possibility of further gains if sovereign bond spreads compress further.

2) In the medium-term, the author believes the European crisis is likely to flare up again in early 2013 due to austerity measures negatively impacting economies or a rejection of bailouts by Germany.

3) Long-term, central bank attempts to reduce risks may have unintended consequences of creating larger potential impacts in the future through more extreme outcomes. The author discusses several scenarios thatItaly vs Germany Government Bond Spreads

Italy vs Germany Government Bond SpreadsFasanara Capital ltd

Ìý

Italy-Germany Government Bond Spreads shows the difference in yields between 10-year Italian bonds (BTPs) and German bonds (Bunds). Currently, BTP yields are higher than Bund yields, indicating that investors require a higher return to take on the risk of owning Italian debt versus German debt. The widening spread reflects increasing concerns from investors about Italy's fiscal situation and long-term economic prospects relative to Germany.