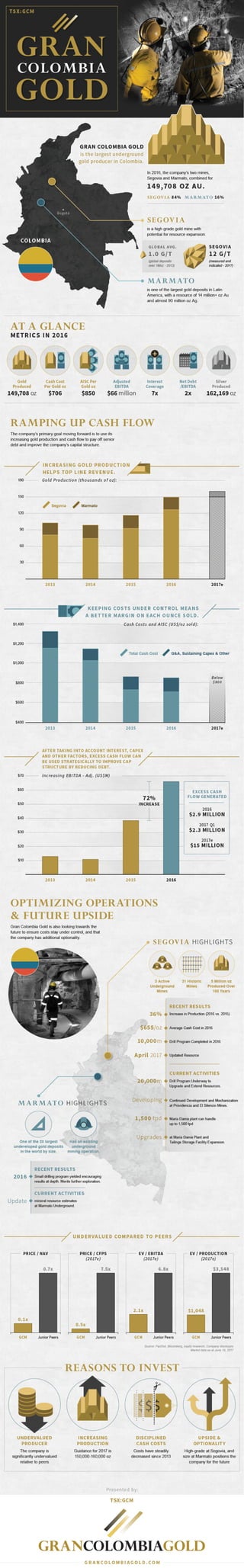

Gran Colombia Gold Infographic - June 2017

0 likes1,430 views

Gran Colombia Gold Infographic - June 2017 http://www.visualcapitalist.com/company-spotlight/gran-colombia-gold/

1 of 1

Download to read offline

Recommended

Gcm corporate presentation - february 2021 - final

Gcm corporate presentation - february 2021 - finalGranColombiaGold

Ěý

The document is a corporate presentation for Gran Colombia Gold Corp., which is the leading high-grade gold producer in Colombia. Some key points:

- Gran Colombia owns the Segovia Operations, which is a high-grade underground gold mine in Colombia that produced over 196,000 ounces of gold in 2020 at an average head grade of 14.5 g/t.

- The company also has a 53.5% equity stake in Caldas Gold Corp., which is developing the Marmato Project, an underground gold mine expansion project in Colombia.

- Gran Colombia has met gold guidance for five consecutive years and is now paying a monthly dividend of CA$0.15 per share, with the potential forGcm corporate presentation - january 2021

Gcm corporate presentation - january 2021GranColombiaGold

Ěý

This document provides an overview of Gran Colombia Gold Corp. as the leading high-grade gold producer in Colombia. Some key points:

- Gran Colombia's core assets are the Segovia Operations, a high-grade underground gold mine, and a 53.5% stake in Caldas Gold which owns the Marmato Project.

- In 2020, Gran Colombia is on track to produce between 218,000 to 226,000 ounces of gold at a total cash cost of $620-670 per ounce and AISC of $950-1,000 per ounce.

- The company has a strong balance sheet with increasing cash flows that allow it to pay a monthly dividend of CA$0.015Gcm corporate presentation - december 2020

Gcm corporate presentation - december 2020GranColombiaGold

Ěý

- Gran Colombia Gold is a high-grade gold producer in Colombia with its core asset being the Segovia Operations, one of the highest grade underground gold mines globally.

- In 2019, Gran Colombia produced over 240,000 ounces of gold and is on track to produce between 218,000 to 226,000 ounces in 2020.

- The company has a strong balance sheet, generating significant free cash flow that is being used to pay down debt and implement a monthly dividend. Gran Colombia represents an opportunity for re-rating given its high-grade assets, production growth profile, and attractive valuation.Gcm corporate presentation -october 2020 - final

Gcm corporate presentation -october 2020 - finalGranColombiaGold

Ěý

- The document is a corporate presentation for Gran Colombia Gold outlining its high-grade gold assets in Colombia.

- Gran Colombia is a mid-tier gold producer with its flagship Segovia Operations asset and a 53.5% stake in the Marmato Project.

- In 2019, Gran Colombia produced a total of 240,000 ounces of gold between Segovia and Marmato, and has continued to reduce costs while growing production.Gcm corporate presentation - september 2020 (final)

Gcm corporate presentation - september 2020 (final)GranColombiaGold

Ěý

This document provides an overview of Gran Colombia Gold Corp., a gold mining company with operations in Colombia. It summarizes the company's key assets - its Segovia Operations and its 57.5% interest in the Marmato Project. It also discusses Gran Colombia's COVID-19 response measures to protect employees and support local communities. Additionally, the document outlines the company's recent financial and operating performance, with annual gold production reaching 240,000 ounces in 2019. Gran Colombia is positioned as an emerging mid-tier gold producer in Colombia with significant growth potential.Gran Colombia Gold - Corporate Presentation September 2020

Gran Colombia Gold - Corporate Presentation September 2020GranColombiaGold

Ěý

This document provides an overview of Gran Colombia Gold Corp., a gold mining company with operations in Colombia. It summarizes the company's key assets which include the Segovia Operations and Marmato Project. At Segovia, Gran Colombia is the 100% owner of one of the largest underground gold mines in the world. At Marmato, it owns 57.5% and is expanding existing mines and exploring for new resources. The document discusses Gran Colombia's COVID-19 response measures to protect employees and support local communities. It also provides details on the company's production growth, cost reductions, strong balance sheet, and potential for significant re-rating given its low valuation compared to peers.Gran Colombia Gold Q2 2020 Results Presentation

Gran Colombia Gold Q2 2020 Results PresentationGranColombiaGold

Ěý

Gran Colombia Gold reported its Q2 2020 results. Production was lower than Q2 2019 due to impacts from COVID-19, including reduced workforce availability. Total cash costs per ounce increased to $713. The company updated its 2020 annual production guidance range to 218,000-226,000 ounces. Despite operational challenges from the pandemic, Gran Colombia maintained positive adjusted EBITDA and free cash flow. The company also announced the adoption of a dividend policy to pay shareholders quarterly dividends.Gran Colombia Gold- Corporate presentation May 2020

Gran Colombia Gold- Corporate presentation May 2020GranColombiaGold

Ěý

- Gran Colombia proposes to acquire Guyana Goldfields and Gold X to create a high-growth, Latin American focused intermediate gold producer.

- The combined company would have production of over 275koz in 2020 growing to over 500koz/year through development of 3 growth projects, with potential for synergies between the Guyana assets of over $200M.

- The transactions are accretive and would provide a larger, well-capitalized producer with increased scale, production growth opportunities, and the ability to consolidate in Latin America.FY and Q4 2019 results presentation

FY and Q4 2019 results presentationGranColombiaGold

Ěý

The document provides highlights from Gran Colombia Gold's Q4 and full year 2019 results. Key points include:

- Gold production for Q4 was 65,237 ounces and 239,991 ounces for the full year.

- Cash costs per ounce and AISC per ounce decreased from the previous year.

- Revenue, adjusted EBITDA, operating cash flow, and free cash flow all increased significantly compared to 2018.

- Reserves and resources at the company's Segovia Operations remained strong with additions in 2019.

- The company continues to strengthen its balance sheet with decreasing debt levels and increasing cash.Gran Colombia Gold October 2019

Gran Colombia Gold October 2019GranColombiaGold

Ěý

- Gran Colombia is a high-grade underground gold producer focused in Colombia with production of 218,000 ounces in 2018.

- It operates the high-grade Segovia Operations, which accounted for 89% of production in 2018 and has head grades that averaged 17.1 g/t.

- The company is on track to produce between 225,000 to 240,000 ounces of gold in 2019.Corporate Presentation- October 2019

Corporate Presentation- October 2019GranColombiaGold

Ěý

- Gran Colombia is a high-grade underground gold producer focused in Colombia with production of 218,000 ounces in 2018.

- It operates the high-grade Segovia Operations, which accounted for 89% of production in 2018 and has head grades that averaged 17.1 g/t.

- The company is on track to produce between 225,000 to 240,000 ounces of gold in 2019.Gran Colombia Gold Presentation- 2019 Denver Gold Forum

Gran Colombia Gold Presentation- 2019 Denver Gold ForumGranColombiaGold

Ěý

Gran Colombia Gold is a leading high-grade underground gold producer with its principal mining operations at Segovia in Colombia. In 2018, Gran Colombia produced 218,000 ounces of gold at its Segovia and Marmato operations. The company is focused on increasing production to between 225,000-240,000 ounces in 2019 through continued optimization of its mining plans and infrastructure improvements at Segovia. Gran Colombia maintains a strong balance sheet with over $50 million in cash and steadily decreasing debt.Q2 2019 results presentation

Q2 2019 results presentationGranColombiaGold

Ěý

Gran Colombia Gold reported its financial results for the second quarter of 2019, highlighting increased production and lower costs compared to the same period last year. Gold production at its Segovia Operations increased 18% year-over-year to over 1,143 tonnes per day. Total cash costs per ounce decreased to $638, driving the company's all-in sustaining costs down to $855 per ounce. For the full year 2019, Gran Colombia has increased its gold production guidance to between 225,000 to 240,000 ounces and expects average all-in sustaining costs to remain below $925 per ounce.Gran Colombia Gold Q1 2019 Results Presentation

Gran Colombia Gold Q1 2019 Results PresentationGranColombiaGold

Ěý

Gran Colombia Gold reported its Q1 2019 results, highlighting:

1) Record quarterly gold production of 60,601 ounces due to higher grades at Segovia Operations.

2) Total cash costs decreased to $621/oz, below guidance, driven by lower costs at Segovia.

3) Adjusted EBITDA reached a new quarterly high of $35.3 million.Fourth Quarter and Year End 2018 Results Webcast

Fourth Quarter and Year End 2018 Results WebcastGranColombiaGold

Ěý

Gran Colombia Gold Reports Fourth Quarter and Full Year 2018 Results; Reaches New Highs for Production, Adjusted EBITDA and Operating Cash Flow; Balance Sheet Strengthened; Increasing Focus on Growth PipelineGran Colombia Gold- March 2019

Gran Colombia Gold- March 2019GranColombiaGold

Ěý

Gran Colombia is a mid-tier gold mining company that produced 218,000 ounces of gold in 2018. It operates the high-grade Segovia Operations in Colombia, which includes three underground mines. Segovia has produced over 5 million ounces of gold through its history. Gran Colombia also owns the Marmato Project in Colombia, which has mineral resources of over 8 million ounces of gold. The company is focused on growth through expanding mining operations and exploration at its core assets in Colombia.GCM Corporate Presentation 02 28, 2019

GCM Corporate Presentation 02 28, 2019GranColombiaGold

Ěý

This document summarizes a presentation by Gran Colombia Gold Corp. regarding an offering of securities. It notes that the presentation should be read together with the company's preliminary prospectus, as the presentation does not include all information in the prospectus. The document also states that the securities being offered have not been registered in the U.S. and are not being offered to U.S. persons, except under certain exemptions. It provides details on where to find the preliminary prospectus.Gcm Corporate presentation - February 2019

Gcm Corporate presentation - February 2019GranColombiaGold

Ěý

Gran Colombia is a Canadian-based mid-tier gold producer with its primary focus in Colombia where it is currently the largest underground gold and silver producer with several mines in operation at its Segovia and Marmato Operations. Gran Colombia is continuing to focus on exploration, expansion and modernization activities at its high-grade Segovia Operations.Q3 2018 Results

Q3 2018 ResultsGranColombiaGold

Ěý

Gran Colombia Gold reported financial and operating results for the third quarter of 2018. Gold production increased to 57,163 ounces, up 54% compared to the third quarter of 2017. Revenue for the quarter was $66.6 million, an increase of 56% year-over-year. Cash costs per ounce averaged $657 for the quarter, a decrease from $748 in Q3 2017. For the first nine months of 2018, gold production totaled 162,741 ounces with revenue of $200.3 million and cash costs averaging $674 per ounce. Gran Colombia is on track to meet its 2018 annual production guidance of between 214,000 to 220,000 ounces of gold.Corporate Presentation - Silver and Gold Summit

Corporate Presentation - Silver and Gold SummitGranColombiaGold

Ěý

Gran Colombia Gold produced over 214,000 ounces of gold in the last 12 months from its Segovia operations in Colombia and Marmato mine. It is focused on continuing to expand and mechanize underground mining at Segovia, where recent drilling discovered a new structure at depth. The company has strengthened its balance sheet in 2018 through debt refinancing and repayments. It is on track to meet its 2018 production guidance of 210,000-220,000 ounces of gold.Corporate Presentation - Denver Gold Forum - September 2018

Corporate Presentation - Denver Gold Forum - September 2018GranColombiaGold

Ěý

Gran Colombia Gold is a mid-tier gold producer focused on its high-grade Segovia Operations in Colombia. It is continuing to improve operations at Segovia through infrastructure investments, drilling programs, and mine development. Production is expected to be 210,000-220,000 ounces in 2018, up from 2017. All-in sustaining costs are also decreasing as operations are optimized. The company has strengthened its balance sheet through debt refinancing in 2018.Q2 2018 Results

Q2 2018 ResultsGranColombiaGold

Ěý

Gran Colombia Gold reported its Q2-2018 results, highlighting:

- Transformation of its capital structure is now complete after refinancing debt and settling debentures.

- $15.7 million spent at its Segovia operations in H1-2018 on exploration, development, and capital projects.

- Drilled 11,186 meters of its planned 20,000 meter drilling campaign at Segovia, discovering a new structure at depth in the El Silencio mine.

- Technical studies and up to 10,000 meters of drilling underway at its Marmato project.

- Acquired a 15% equity interest in Sandspring Resources, whose Toroparu project hosts 10.4 million ounces ofAnnual General Meeting Presentation

Annual General Meeting PresentationGranColombiaGold

Ěý

This document provides an overview of Gran Colombia Gold's annual general meeting. It summarizes the company's accomplishments in 2017, including meeting production guidance and generating excess cash flow. It also provides an update on priorities and progress for 2018, including improving the capital structure, continuing optimized operations at Segovia, and technical studies and drilling at Marmato. Key metrics shown include increasing gold production and declining costs. The simplified capital structure is presented, reflecting a reduction in potential shares from debt refinancing in 2018.Q1 2018 Results

Q1 2018 ResultsGranColombiaGold

Ěý

Gran Colombia Gold reported its Q1-2018 results, highlighting increased production and improved costs. Gold production for the quarter was 52,672 ounces, up 35% from Q1-2017. Total cash costs decreased to $670/ounce from $748/ounce last year. The company continues to focus on optimizing its Segovia operations and exploring expansion options at Marmato to increase production and reduce costs. Gran Colombia is also focused on improving its capital structure by refinancing its debt obligations.Q4 2017 Results

Q4 2017 ResultsGranColombiaGold

Ěý

- Gran Colombia Gold reported its Q4 and full year 2017 results, with gold production of 51,699 ounces in Q4 and 173,821 ounces for the full year.

- At its Segovia Operations, the company increased mineral resources by 13% and updated reserves to 660,000 ounces of gold.

- For 2018, the company expects gold production of 182,000-193,000 ounces at an average total cash cost below $735/ounce and average AISC below $950/ounce.Corporate Presentation - Marmato Underground

Corporate Presentation - Marmato UndergroundGranColombiaGold

Ěý

The document discusses the Marmato gold deposit located in Colombia. It provides details on the deposit's geology, exploration history, and recent drilling results. Key points include:

- Marmato has produced an estimated 2.6-3.5 million ounces of gold historically from various underground mines.

- Recent drilling by GCG has discovered a new "Deeps Zone" below the existing mines, with drill intercepts up to 357 meters of 1.43 g/t gold.

- A 2017 resource estimate for Marmato outlines over 3.8 million ounces of gold in measured and indicated categories, and over 4 million ounces in inferred across vein and porphyry styles of mineralization. Q3 2017 Results

Q3 2017 ResultsGranColombiaGold

Ěý

Gran Colombia Gold reported its Q3-2017 results. Gold production for the quarter was 37,039 ounces, lower than the previous year due to a 42-day civil disruption at its Segovia operations in Colombia. For the first nine months of 2017, gold production totaled 122,122 ounces. The company raised its 2017 annual gold production guidance to a range of 165,000 to 170,000 ounces. Gran Colombia also reported excess cash flow of $7.8 million for the first nine months of 2017.Corporate Presentation - September 2017

Corporate Presentation - September 2017GranColombiaGold

Ěý

Gran Colombia Gold is a Canadian-listed gold producer focused on its high-grade Segovia Operations in Colombia. It is continuing to expand and mechanize underground mining operations at Segovia, which produced over 165,000 ounces of gold in the last 12 months. Gran Colombia also owns the Marmato Project, one of the largest undeveloped gold deposits globally. It is evaluating expanding underground mining at Marmato while incorporating additional deep mineralization resources. The company aims to continue reducing debt and potential share dilution ahead of debt maturities using excess cash flow. Gran Colombia sees upside from further resource expansion and exploration at its assets in Colombia.Beyond Bitcoin_ Crypto Investment in Altcoins.docx

Beyond Bitcoin_ Crypto Investment in Altcoins.docxcryptotrend16

Ěý

Bitcoin may be the king of crypto, but it's far from the only investment worth considering. Altcoins—alternative cryptocurrencies—offer incredible opportunities for portfolio diversification, high-growth potential, and innovative blockchain applications. But with thousands of options available, how do you pick the right ones?

This in-depth guide, “Beyond Bitcoin: Crypto Investment in Altcoins,” explores everything you need to know about investing in altcoins. Whether you’re a seasoned trader or just stepping into the crypto space, this article provides actionable insights to help you navigate the altcoin market with confidence.

We break down the key reasons why altcoins matter, including their role in portfolio diversification, DeFi growth, and emerging blockchain technologies. You’ll learn how to evaluate altcoins effectively, analyzing factors like technology, tokenomics, and developer activity.

Want to trade altcoins successfully? This guide covers trading strategies, risk management techniques, and expert-backed market insights to help you make smarter investment decisions. Plus, we highlight the power of crypto communities, market sentiment, and real-time trading signals in shaping altcoin trends.

Backed by Investors Collective’s commitment to providing expert insights and real-time updates, this article ensures you’re well-equipped to make informed investment choices. We also tackle frequently asked questions about altcoin investing, covering everything from staking rewards to security best practices.

If you're looking to go beyond Bitcoin and unlock the full potential of the crypto market, this guide is a must-read. Join the Investors Collective community, stay ahead of the curve, and start investing in altcoins with confidence today!More Related Content

More from GranColombiaGold (20)

FY and Q4 2019 results presentation

FY and Q4 2019 results presentationGranColombiaGold

Ěý

The document provides highlights from Gran Colombia Gold's Q4 and full year 2019 results. Key points include:

- Gold production for Q4 was 65,237 ounces and 239,991 ounces for the full year.

- Cash costs per ounce and AISC per ounce decreased from the previous year.

- Revenue, adjusted EBITDA, operating cash flow, and free cash flow all increased significantly compared to 2018.

- Reserves and resources at the company's Segovia Operations remained strong with additions in 2019.

- The company continues to strengthen its balance sheet with decreasing debt levels and increasing cash.Gran Colombia Gold October 2019

Gran Colombia Gold October 2019GranColombiaGold

Ěý

- Gran Colombia is a high-grade underground gold producer focused in Colombia with production of 218,000 ounces in 2018.

- It operates the high-grade Segovia Operations, which accounted for 89% of production in 2018 and has head grades that averaged 17.1 g/t.

- The company is on track to produce between 225,000 to 240,000 ounces of gold in 2019.Corporate Presentation- October 2019

Corporate Presentation- October 2019GranColombiaGold

Ěý

- Gran Colombia is a high-grade underground gold producer focused in Colombia with production of 218,000 ounces in 2018.

- It operates the high-grade Segovia Operations, which accounted for 89% of production in 2018 and has head grades that averaged 17.1 g/t.

- The company is on track to produce between 225,000 to 240,000 ounces of gold in 2019.Gran Colombia Gold Presentation- 2019 Denver Gold Forum

Gran Colombia Gold Presentation- 2019 Denver Gold ForumGranColombiaGold

Ěý

Gran Colombia Gold is a leading high-grade underground gold producer with its principal mining operations at Segovia in Colombia. In 2018, Gran Colombia produced 218,000 ounces of gold at its Segovia and Marmato operations. The company is focused on increasing production to between 225,000-240,000 ounces in 2019 through continued optimization of its mining plans and infrastructure improvements at Segovia. Gran Colombia maintains a strong balance sheet with over $50 million in cash and steadily decreasing debt.Q2 2019 results presentation

Q2 2019 results presentationGranColombiaGold

Ěý

Gran Colombia Gold reported its financial results for the second quarter of 2019, highlighting increased production and lower costs compared to the same period last year. Gold production at its Segovia Operations increased 18% year-over-year to over 1,143 tonnes per day. Total cash costs per ounce decreased to $638, driving the company's all-in sustaining costs down to $855 per ounce. For the full year 2019, Gran Colombia has increased its gold production guidance to between 225,000 to 240,000 ounces and expects average all-in sustaining costs to remain below $925 per ounce.Gran Colombia Gold Q1 2019 Results Presentation

Gran Colombia Gold Q1 2019 Results PresentationGranColombiaGold

Ěý

Gran Colombia Gold reported its Q1 2019 results, highlighting:

1) Record quarterly gold production of 60,601 ounces due to higher grades at Segovia Operations.

2) Total cash costs decreased to $621/oz, below guidance, driven by lower costs at Segovia.

3) Adjusted EBITDA reached a new quarterly high of $35.3 million.Fourth Quarter and Year End 2018 Results Webcast

Fourth Quarter and Year End 2018 Results WebcastGranColombiaGold

Ěý

Gran Colombia Gold Reports Fourth Quarter and Full Year 2018 Results; Reaches New Highs for Production, Adjusted EBITDA and Operating Cash Flow; Balance Sheet Strengthened; Increasing Focus on Growth PipelineGran Colombia Gold- March 2019

Gran Colombia Gold- March 2019GranColombiaGold

Ěý

Gran Colombia is a mid-tier gold mining company that produced 218,000 ounces of gold in 2018. It operates the high-grade Segovia Operations in Colombia, which includes three underground mines. Segovia has produced over 5 million ounces of gold through its history. Gran Colombia also owns the Marmato Project in Colombia, which has mineral resources of over 8 million ounces of gold. The company is focused on growth through expanding mining operations and exploration at its core assets in Colombia.GCM Corporate Presentation 02 28, 2019

GCM Corporate Presentation 02 28, 2019GranColombiaGold

Ěý

This document summarizes a presentation by Gran Colombia Gold Corp. regarding an offering of securities. It notes that the presentation should be read together with the company's preliminary prospectus, as the presentation does not include all information in the prospectus. The document also states that the securities being offered have not been registered in the U.S. and are not being offered to U.S. persons, except under certain exemptions. It provides details on where to find the preliminary prospectus.Gcm Corporate presentation - February 2019

Gcm Corporate presentation - February 2019GranColombiaGold

Ěý

Gran Colombia is a Canadian-based mid-tier gold producer with its primary focus in Colombia where it is currently the largest underground gold and silver producer with several mines in operation at its Segovia and Marmato Operations. Gran Colombia is continuing to focus on exploration, expansion and modernization activities at its high-grade Segovia Operations.Q3 2018 Results

Q3 2018 ResultsGranColombiaGold

Ěý

Gran Colombia Gold reported financial and operating results for the third quarter of 2018. Gold production increased to 57,163 ounces, up 54% compared to the third quarter of 2017. Revenue for the quarter was $66.6 million, an increase of 56% year-over-year. Cash costs per ounce averaged $657 for the quarter, a decrease from $748 in Q3 2017. For the first nine months of 2018, gold production totaled 162,741 ounces with revenue of $200.3 million and cash costs averaging $674 per ounce. Gran Colombia is on track to meet its 2018 annual production guidance of between 214,000 to 220,000 ounces of gold.Corporate Presentation - Silver and Gold Summit

Corporate Presentation - Silver and Gold SummitGranColombiaGold

Ěý

Gran Colombia Gold produced over 214,000 ounces of gold in the last 12 months from its Segovia operations in Colombia and Marmato mine. It is focused on continuing to expand and mechanize underground mining at Segovia, where recent drilling discovered a new structure at depth. The company has strengthened its balance sheet in 2018 through debt refinancing and repayments. It is on track to meet its 2018 production guidance of 210,000-220,000 ounces of gold.Corporate Presentation - Denver Gold Forum - September 2018

Corporate Presentation - Denver Gold Forum - September 2018GranColombiaGold

Ěý

Gran Colombia Gold is a mid-tier gold producer focused on its high-grade Segovia Operations in Colombia. It is continuing to improve operations at Segovia through infrastructure investments, drilling programs, and mine development. Production is expected to be 210,000-220,000 ounces in 2018, up from 2017. All-in sustaining costs are also decreasing as operations are optimized. The company has strengthened its balance sheet through debt refinancing in 2018.Q2 2018 Results

Q2 2018 ResultsGranColombiaGold

Ěý

Gran Colombia Gold reported its Q2-2018 results, highlighting:

- Transformation of its capital structure is now complete after refinancing debt and settling debentures.

- $15.7 million spent at its Segovia operations in H1-2018 on exploration, development, and capital projects.

- Drilled 11,186 meters of its planned 20,000 meter drilling campaign at Segovia, discovering a new structure at depth in the El Silencio mine.

- Technical studies and up to 10,000 meters of drilling underway at its Marmato project.

- Acquired a 15% equity interest in Sandspring Resources, whose Toroparu project hosts 10.4 million ounces ofAnnual General Meeting Presentation

Annual General Meeting PresentationGranColombiaGold

Ěý

This document provides an overview of Gran Colombia Gold's annual general meeting. It summarizes the company's accomplishments in 2017, including meeting production guidance and generating excess cash flow. It also provides an update on priorities and progress for 2018, including improving the capital structure, continuing optimized operations at Segovia, and technical studies and drilling at Marmato. Key metrics shown include increasing gold production and declining costs. The simplified capital structure is presented, reflecting a reduction in potential shares from debt refinancing in 2018.Q1 2018 Results

Q1 2018 ResultsGranColombiaGold

Ěý

Gran Colombia Gold reported its Q1-2018 results, highlighting increased production and improved costs. Gold production for the quarter was 52,672 ounces, up 35% from Q1-2017. Total cash costs decreased to $670/ounce from $748/ounce last year. The company continues to focus on optimizing its Segovia operations and exploring expansion options at Marmato to increase production and reduce costs. Gran Colombia is also focused on improving its capital structure by refinancing its debt obligations.Q4 2017 Results

Q4 2017 ResultsGranColombiaGold

Ěý

- Gran Colombia Gold reported its Q4 and full year 2017 results, with gold production of 51,699 ounces in Q4 and 173,821 ounces for the full year.

- At its Segovia Operations, the company increased mineral resources by 13% and updated reserves to 660,000 ounces of gold.

- For 2018, the company expects gold production of 182,000-193,000 ounces at an average total cash cost below $735/ounce and average AISC below $950/ounce.Corporate Presentation - Marmato Underground

Corporate Presentation - Marmato UndergroundGranColombiaGold

Ěý

The document discusses the Marmato gold deposit located in Colombia. It provides details on the deposit's geology, exploration history, and recent drilling results. Key points include:

- Marmato has produced an estimated 2.6-3.5 million ounces of gold historically from various underground mines.

- Recent drilling by GCG has discovered a new "Deeps Zone" below the existing mines, with drill intercepts up to 357 meters of 1.43 g/t gold.

- A 2017 resource estimate for Marmato outlines over 3.8 million ounces of gold in measured and indicated categories, and over 4 million ounces in inferred across vein and porphyry styles of mineralization. Q3 2017 Results

Q3 2017 ResultsGranColombiaGold

Ěý

Gran Colombia Gold reported its Q3-2017 results. Gold production for the quarter was 37,039 ounces, lower than the previous year due to a 42-day civil disruption at its Segovia operations in Colombia. For the first nine months of 2017, gold production totaled 122,122 ounces. The company raised its 2017 annual gold production guidance to a range of 165,000 to 170,000 ounces. Gran Colombia also reported excess cash flow of $7.8 million for the first nine months of 2017.Corporate Presentation - September 2017

Corporate Presentation - September 2017GranColombiaGold

Ěý

Gran Colombia Gold is a Canadian-listed gold producer focused on its high-grade Segovia Operations in Colombia. It is continuing to expand and mechanize underground mining operations at Segovia, which produced over 165,000 ounces of gold in the last 12 months. Gran Colombia also owns the Marmato Project, one of the largest undeveloped gold deposits globally. It is evaluating expanding underground mining at Marmato while incorporating additional deep mineralization resources. The company aims to continue reducing debt and potential share dilution ahead of debt maturities using excess cash flow. Gran Colombia sees upside from further resource expansion and exploration at its assets in Colombia.Recently uploaded (20)

Beyond Bitcoin_ Crypto Investment in Altcoins.docx

Beyond Bitcoin_ Crypto Investment in Altcoins.docxcryptotrend16

Ěý

Bitcoin may be the king of crypto, but it's far from the only investment worth considering. Altcoins—alternative cryptocurrencies—offer incredible opportunities for portfolio diversification, high-growth potential, and innovative blockchain applications. But with thousands of options available, how do you pick the right ones?

This in-depth guide, “Beyond Bitcoin: Crypto Investment in Altcoins,” explores everything you need to know about investing in altcoins. Whether you’re a seasoned trader or just stepping into the crypto space, this article provides actionable insights to help you navigate the altcoin market with confidence.

We break down the key reasons why altcoins matter, including their role in portfolio diversification, DeFi growth, and emerging blockchain technologies. You’ll learn how to evaluate altcoins effectively, analyzing factors like technology, tokenomics, and developer activity.

Want to trade altcoins successfully? This guide covers trading strategies, risk management techniques, and expert-backed market insights to help you make smarter investment decisions. Plus, we highlight the power of crypto communities, market sentiment, and real-time trading signals in shaping altcoin trends.

Backed by Investors Collective’s commitment to providing expert insights and real-time updates, this article ensures you’re well-equipped to make informed investment choices. We also tackle frequently asked questions about altcoin investing, covering everything from staking rewards to security best practices.

If you're looking to go beyond Bitcoin and unlock the full potential of the crypto market, this guide is a must-read. Join the Investors Collective community, stay ahead of the curve, and start investing in altcoins with confidence today!Synektik_presentation_Q3_2023 FY_EN final.pptx

Synektik_presentation_Q3_2023 FY_EN final.pptxSynektikSA

Ěý

SYNEKTIK SA Synektik SA | Investor Presentation Q3 2023 FY Synektik_presentation_Q4_FY_2023_EN_final.pptx

Synektik_presentation_Q4_FY_2023_EN_final.pptxSynektikSA

Ěý

SYNEKTIK SA Synektik SA | Investor Presentation Q4 2023 FY Eni | Capital Markets Update - 27 February 2025

Eni | Capital Markets Update - 27 February 2025Eni

Ěý

ENI CAPITAL MARKETS UPDATE 2025-2028 - 27 February 2025North Arrow Minerals Corporate Update for the PDAC 2025

North Arrow Minerals Corporate Update for the PDAC 2025narminerals

Ěý

Update on North Arrow's ongoing exploration activity at the Kraaipan Gold Project in Botswana and exploration plans for the rest of 2025 on the property. Best Altcoins for Crypto Investors Right Now.docx

Best Altcoins for Crypto Investors Right Now.docxcryptotrend16

Ěý

The crypto market is evolving fast, and while Bitcoin remains the king, altcoins are where the real growth potential lies. But with thousands of options out there, how do you know which ones are worth your investment? That’s exactly what we cover in this expert-backed guide.

At Investors Collective, we don’t just follow trends—we break them down, analyze them, and give you the insights you need to invest wisely. In this article, we explore the best altcoins to invest in right now, highlighting their unique features, growth potential, and why they stand out in the crowded crypto space.

From Ethereum’s smart contract dominance to Solana’s lightning-fast transactions, and Polygon’s game-changing scalability, we cover the biggest names reshaping the future of blockchain. Whether you’re a beginner or an experienced investor, you’ll find valuable insights into each altcoin’s strengths, weaknesses, and long-term potential.

We’ll also tackle frequently asked questions, such as how to choose the best altcoins, where to store them safely, and whether altcoins are a better investment than Bitcoin. Plus, we break down key strategies to help you navigate the volatile crypto market with confidence.

Why read this article?

âś” Stay ahead of the market with real-time insights

âś” Learn about the most promising altcoins for high growth potential

âś” Discover expert-backed strategies for smart crypto investing

âś” Get answers to common questions from seasoned investors

âś” Join a community of like-minded traders at Investors Collective

If you’re looking to expand your crypto portfolio and invest in projects with real-world utility, this article is a must-read. Ready to unlock new opportunities? Let’s dive in! 🚀International Finance Lecture şÝşÝߣs Chp. 2

International Finance Lecture şÝşÝߣs Chp. 2ayhannadiri94

Ěý

Ineternational Finance lecture slides chp. 2Collective Mining | Corporate Presentation - February 2025

Collective Mining | Corporate Presentation - February 2025Collective Mining

Ěý

Collective Mining | Corporate Presentation - February 2025

Visit our website for more information: www.collectivemining.comEni | 2024 Full Year Results - 27 February 2025

Eni | 2024 Full Year Results - 27 February 2025Eni

Ěý

Eni: results for the fourth quarter and Full Year of 2024Chris Anastasopoulos: ESG Metrics & Financial Leadership

Chris Anastasopoulos: ESG Metrics & Financial LeadershipChris Anastasopoulos

Ěý

Environmental, Social, and Governance (ESG) metrics have become an essential aspect of modern financial leadership, influencing decision-making, investment strategies, and corporate governance. As global markets continue to evolve, organizations that incorporate ESG considerations into their financial planning gain a competitive advantage, ensuring long-term sustainability and resilience. These metrics allow companies to assess risks and opportunities effectively while addressing the shifting priorities of investors. Financial leaders must recognize the importance of ESG metrics, strategically align them with their business objectives, and develop transparent reporting mechanisms to demonstrate their commitment to sustainable growth.

The role of ESG in financial leadership extends beyond compliance. It involves integrating sustainability into core business strategies, fostering responsible corporate behavior, and responding to increasing demands from stakeholders, including investors, consumers, and regulatory bodies. As ESG reporting continues to gain prominence, financial leaders must develop structured approaches to implementing ESG frameworks, ensuring alignment with global standards and regulatory expectations. This report delves into the significance of ESG metrics in financial leadership, exploring their impact on investment decisions, regulatory trends, and corporate performance.Collective Mining | Corporate Presentation - February 2025

Collective Mining | Corporate Presentation - February 2025Collective Mining

Ěý

Collective Mining | Corporate Presentation - February 2025.

For more information, visit our website: www.collectivemining.com