Options Margin

0 likes472 views

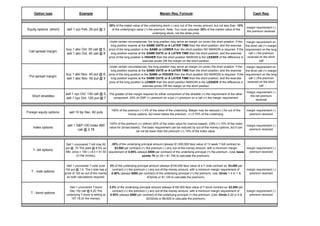

1) For short equity options, the margin requirement is 20% of the underlying stock value plus the premium received, minus any out-of-the-money amount, with a minimum of 10% of the underlying value. 2) For call and put spreads, the margin requirement can be reduced or eliminated depending on the expiration and exercise prices of the long and short options. 3) For short straddles, the margin requirement is the greater of the two leg requirements plus the other leg's premium. 4) For foreign equity and index options, the margin requirement is generally 100% of the premium plus a percentage of the underlying value, minus any out-of-the-money amount or premium received.

1 of 1

Download to read offline

Ad

Recommended

Options Strategies Jan2009 Nmims

Options Strategies Jan2009 Nmimsvickysajnani

Ěý

An options contract grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. There are two basic types of options - calls, which give the right to buy, and puts, which give the right to sell. The premium paid for the option includes both the intrinsic value and time value. Intrinsic value is the amount the option is in-the-money, while time value reflects the probability the option will go in-the-money before expiration. Factors like the underlying price, strike price, volatility and time to expiration all impact the premium.Value of options presentation

Value of options presentationTrevor Ruwa

Ěý

The document provides an overview of option valuation and pricing models. It discusses intrinsic value, put-call parity, and binomial and Black-Scholes option pricing models. The binomial model uses a tree approach to allow stock prices to move up or down over multiple periods to expiration. The Black-Scholes model provides a closed-form solution and values options based on stock price, strike price, volatility, time to expiration, and risk-free rate. An example applies the Black-Scholes formula to compute prices for a call and put option.Derivatives

DerivativesRaj Anwar

Ěý

This document discusses valuation in derivatives markets. It begins by defining derivatives and describing the main types, including linear derivatives like forwards and futures, and non-linear derivatives like options. It then discusses how derivatives are used for hedging, speculating, arbitrage, and accessing remote markets. The rest of the document focuses on valuation methods, covering yield curves, binomial option pricing models, and the Black-Scholes equation. It emphasizes that in mature markets, valuation is based on replicating portfolios to eliminate risk.Valuation of options

Valuation of optionsDivya nishanth

Ěý

The document discusses key concepts related to option pricing models. It provides explanations of intrinsic value, time value, put-call parity, binomial option pricing model, and Black-Scholes option pricing model. The binomial model uses a discrete-time approach to value options, while Black-Scholes uses a continuous-time approach and calculus. Both aim to determine the fair price of an option based on factors like the underlying asset price, strike price, time to expiration, risk-free rate, and volatility.Option Pricing Theory and Option Pricing Theory and Applications

Option Pricing Theory and Option Pricing Theory and Applications izaacaura2

Ěý

The document explains the theory and applications of option pricing, detailing how options provide the right to buy (call) or sell (put) an underlying asset at a predetermined price before expiration. It discusses various factors affecting option value, including asset price, strike price, variance, time to expiration, and interest rates, and contrasts American and European options in terms of exercise timing. Additionally, it explores valuing equity in troubled firms as options and the implications of conflicts between stockholders and bondholders.Option Probability

Option ProbabilityEricHartford

Ěý

This document discusses various methodologies for estimating the probability of options finishing in-the-money (ITM), highlighting limitations of standard approaches such as the standard deviation model and the Black-Scholes option pricing formula. It provides examples, calculations, and alternative methods including delta approximations and Monte Carlo simulations, emphasizing the importance of selecting the right volatility input. Additionally, it critiques the use of delta as an estimate of probability while recommending more precise probability calculations for options trading.Presentation3 Very Imp

Presentation3 Very Impkunal2279

Ěý

This document provides an introduction to currency options and their use for hedging currency risk. It defines key terms like call options, put options, premiums, strikes and expiries. It explains how options can be used to hedge the currency risk of imports and exports by providing protection against adverse exchange rate movements while allowing participation in favorable movements. Examples are given of how importers and exporters can construct hedges using specific call and put options. The risk-reward characteristics of buying and selling options are also discussed.Option greeks

Option greeksRishi Learning Academy

Ěý

This document discusses option Greeks, which are measures of how the price of an option changes in response to changes in other variables such as the price of the underlying asset, volatility, and time to expiration. It defines the key Greeks - delta, gamma, theta, and vega - and provides formulas for calculating each one. It also discusses how understanding Greeks allows options traders to hedge positions against risks and maintain delta neutrality.An Introduction to Derivatives

An Introduction to Derivatives Anup Chakraborty

Ěý

Derivatives are financial instruments whose value is dependent on an underlying asset such as a commodity, currency, stock, bond, or market index. Common derivative products include forwards, futures, options, and swaps. Forwards involve a customized over-the-counter agreement to buy or sell an asset in the future at an agreed upon price, while futures trade on an exchange with standardized contracts. Options provide the right but not the obligation to buy or sell the underlying asset at a predetermined strike price by a specified date. The value of derivatives is influenced by factors like the price and volatility of the underlying asset.Option strategies

Option strategiesNilay Mishra

Ěý

The document outlines various options trading strategies, including long and short calls, long puts, covered calls, and combinations of these strategies. Each strategy includes details such as when to use it, associated risks and rewards, and breakeven points, aiming to help investors make informed decisions based on their market outlook. The strategies cater to different market conditions, from aggressive bullish or bearish positions to neutral views with limited risks.Strips and straps

Strips and strapssunil5111991

Ěý

This document discusses two options trading strategies: strips and straps. Strips involve buying 1 at-the-money call and 2 at-the-money puts, betting that the underlying stock price will experience significant volatility and decrease. Straps involve buying 2 at-the-money calls and 1 at-the-money put, betting that the underlying stock price will experience significant volatility but increase. Both strategies have unlimited profit potential and limited risk, with the maximum loss being the net premium paid.Cheatcheatlivemuraja 110210213524-phpapp01

Cheatcheatlivemuraja 110210213524-phpapp01Taha Imam

Ěý

This document provides information about linear programming models, assumptions, and problem types. It discusses:

1) LP models make assumptions of proportionality, additivity, divisibility, and certainty. They can be iconic, analog, or mathematical representations of real problems.

2) Problem types discussed include product mix, blending, scheduling, inventory/portfolio problems, and multiple objective problems.

3) An example blending problem is provided to maximize profits by determining how to blend two petroleum components into regular and premium gasoline products based on specifications.Options trading strategies

Options trading strategiesankursaraf92

Ěý

The document discusses various options trading strategies including bull call spread, bear put spread, straddle, strangle, covered call, protective put, and calendar spread. For each strategy, it provides details on when to use it, the associated risks and rewards, and break-even points. Worked examples with numerical values are given to illustrate how to implement the strategies and analyze their potential payoffs.Option Basics

Option BasicsHSBC InvestDirect (India) Limited

Ěý

This document provides an overview of options contracts, including calls and puts. It defines key terms like strike price, expiration date, premium price, and describes the rights of buyers and sellers. The document also explains the components of an option's price, including intrinsic value and time value. Overall, the document serves as an introduction to basic option concepts.Ch09 hullfundamentals7thed

Ch09 hullfundamentals7thedtrevorsum67890

Ěý

This document provides an overview of options markets and terminology. It discusses the different types of options including calls and puts, as well as long and short option positions. It also summarizes payoffs for these positions and how dividends, stock splits, and other corporate actions affect option terms. The document concludes with descriptions of warrants, executive stock options, and convertible bonds.Debt basics

Debt basicssudhanshuarora1

Ěý

The document provides an overview of key concepts related to fixed income investments, including:

1) It describes the basic structure of a bond, including the issuer, maturity date, coupon payments, principal, and par value.

2) It explains bond ratings and the different rating scales used by agencies like CRISIL and ICRA to classify bonds based on their credit risk.

3) It covers yield calculations including yield to maturity and the concept of current yield, as well as factors that influence the yield curve and term structure.

4) It outlines various types of risk associated with fixed income investments like credit risk, interest rate risk, reinvestment risk, liquidity risk, and how these risksOption pricing model

Option pricing modelVishal Jain

Ěý

The document discusses option pricing models. It covers the Binomial model and the Black-Scholes model. The Black-Scholes model assumes the stock price follows a geometric Brownian motion and uses a partial differential equation to derive a closed-form solution for pricing European stock options. It requires parameters such as the stock price, exercise price, risk-free interest rate, time to maturity, and volatility. The model provides a theoretical fair value for options.Financial risk management

Financial risk managementNam Ngo

Ěý

This document provides an overview of topics to be covered in a module on financial risk management. The topics include:

1) Managing risk using stock index futures and interest rate derivatives like bond options.

2) Futures contracts for stocks, bonds, bills, and their use for speculation, arbitrage, and hedging. Concepts like delta and gamma hedging.

3) Risk measures like Value at Risk that will be examined statistically and through Monte Carlo simulations and principal component analysis.

4) Modeling volatility in stock prices and interest rates using parametric and non-parametric models, as well as multivariate models.

5) Credit risk measures and credit derivatives like credit default#StumpStumpo: Challenge RMS to model any re/insurance contract in RMS's Contr...

#StumpStumpo: Challenge RMS to model any re/insurance contract in RMS's Contr...RMS

Ěý

The document outlines the #stumpstumpo challenge initiated by RMS's CEO, inviting participants to tweet re/insurance contracts for evaluation with RMS's Contract Definition Language (CDL). It showcases various complex insurance scenarios and solutions, including layered coverage structures for earthquake losses, ceded treaty swaps, and deductibles handling. The text highlights the capabilities of CDL in modeling intricate insurance contracts and emphasizes the innovative applications of structure language in the reinsurance industry.Black schole

Black scholechintu_thakkar9

Ěý

The document provides an overview of the Black-Scholes option pricing model (BSOPM). It describes the key assumptions of the BSOPM, including that the underlying stock pays no dividends, markets are efficient, and prices are lognormally distributed. It also outlines how the BSOPM can be used to calculate theoretical option prices from historical data on the stock price, strike price, time to expiration, interest rate, and volatility. The document discusses implied volatility and how it differs from historical volatility, as well as limitations of the BSOPM.Dynamic Price Competition and Tacit Collusion I

Dynamic Price Competition and Tacit Collusion ITakuya Irie

Ěý

This document provides an overview of dynamic price competition and tacit collusion. It first discusses conventional wisdom and static approaches like the kinked demand curve model. It then introduces the theory of supergames, where a repeated price competition game can have multiple equilibria sustaining collusion if the discount factor is high enough. Specific applications discussed include how market concentration can facilitate tacit collusion by changing the discount factor threshold, and how long information lags or fluctuating demand can make collusion harder to sustain.Dynamic Price Competition and Tacit Collusion II

Dynamic Price Competition and Tacit Collusion IITakuya Irie

Ěý

This document outlines the key points of a presentation on dynamic price competition and tacit collusion. It discusses how imperfect information about rivals' prices can hinder full collusion and instead lead to periodic price wars. It presents a simple model where firms charge a monopoly price pm in a collusive phase but then punish deviations with a low price for T periods. The optimal punishment length is finite if the probability of low demand α is below 1/2. The document also introduces models of price competition with price rigidities and asynchronous pricing. It discusses Markov perfect equilibrium and how to derive the necessary conditions for a symmetric MPE using dynamic programming equations. Finally, it notes that in a symmetric MPE, average per-period profits must exceedoption pricing

option pricingRudreshSamant

Ěý

The document discusses key concepts related to option pricing models. It provides an overview of the binomial option pricing model (BOPM) and Black-Scholes option pricing model (BSOPM). The BOPM values options using a discrete time approach where the underlying asset price can move up or down over time. The BSOPM uses a continuous time approach to value options based on the stochastic behavior of the underlying asset price over time. Both models are based on the principle of risk neutral valuation and creating a riskless hedge to determine the appropriate discount rate.Black scholes model

Black scholes modelLuckshay Batra

Ěý

The document provides a comprehensive overview of the Black-Scholes model, a key financial theory for pricing options developed in 1973. It covers various aspects such as the Black-Scholes formula, its derivation, applications, and extensions like stochastic volatility and quanto options. Key concepts such as the Wiener process, Ito's lemma, volatility, transaction costs, and option pricing models are discussed in detail, aimed at financial professionals and investors.static_hedge

static_hedgeAbukar Ali, CQF

Ěý

1) The document discusses pricing options when volatility is uncertain and lies within a bounded range. It describes constructing a portfolio using a long call option and shorting the underlying asset to hedge against volatility risk.

2) It then discusses using static hedging to hedge options, like hedging a long digital call position using a short call spread. The goal is to find the optimal number of short calls to minimize residual risk, done by solving a partial differential equation.

3) Technical difficulties prevented finding the optimal hedge ratio using an Excel solver as planned. Instead, the document ends by listing references for further reading on uncertain volatility modeling and hedging techniques.No arbitrage and randomization of derivatives pricing

No arbitrage and randomization of derivatives pricingIlya Gikhman

Ěý

This document critiques the no-arbitrage pricing principle, arguing it is valid only in a deterministic context while being inadequate in stochastic scenarios. The author presents an alternative derivatives pricing approach that includes defining market and spot prices to account for market risk, emphasizing the importance of risk factors in pricing. The analysis highlights the flaws in interpreting no-arbitrage pricing as universally applicable and suggests a more nuanced view of forward contract pricing.Basics of derivatives

Basics of derivativesanandlihinar

Ěý

This document provides an overview of derivatives, including their basic uses and types. It discusses how derivatives can be used to manage risk through hedging or change risk exposure. The main types of derivatives covered are forwards, futures, options, and swaps. Forwards and futures involve an agreement to buy or sell an asset at a future date. Options provide the right but not obligation to buy or sell an asset. Swaps involve exchanging cash flows over time, such as interest rates or currencies.Capm 1

Capm 1ansalmch1

Ěý

The Capital Asset Pricing Model (CAPM) asserts that the expected return of an asset is determined by its sensitivity to non-diversifiable market risk, as measured by beta. Under CAPM, the expected return of an asset is equal to the risk-free rate plus a risk premium that is proportional to the asset's beta. CAPM provides a model for determining the cost of capital of an asset by relating the expected return of the asset to its risk compared to the market portfolio.Options Strategy Chart

Options Strategy ChartWilliam Hodge

Ěý

This document outlines various bullish, bearish, and neutral options strategies including their maximum potential gain, maximum possible loss, and breakeven points. It provides examples of buying or selling calls, puts, straddles, spreads, and using options to hedge an existing stock position.Buying & selling securities

Buying & selling securitiessurajhawa

Ěý

1. Order size refers to the number of shares bought or sold, which can be a round lot of 100 shares (or multiples of 100) or an odd lot of 1-99 shares.

2. Time limits on orders specify how long an order is valid, such as one day, week, or month. Open orders remain open until filled or cancelled, while fill-or-kill and discretionary orders give brokers flexibility in execution.

3. Short selling allows investors to borrow and sell securities they do not own, hoping to purchase them later at a lower price. It carries higher risk than long positions as losses are unlimited.More Related Content

What's hot (20)

An Introduction to Derivatives

An Introduction to Derivatives Anup Chakraborty

Ěý

Derivatives are financial instruments whose value is dependent on an underlying asset such as a commodity, currency, stock, bond, or market index. Common derivative products include forwards, futures, options, and swaps. Forwards involve a customized over-the-counter agreement to buy or sell an asset in the future at an agreed upon price, while futures trade on an exchange with standardized contracts. Options provide the right but not the obligation to buy or sell the underlying asset at a predetermined strike price by a specified date. The value of derivatives is influenced by factors like the price and volatility of the underlying asset.Option strategies

Option strategiesNilay Mishra

Ěý

The document outlines various options trading strategies, including long and short calls, long puts, covered calls, and combinations of these strategies. Each strategy includes details such as when to use it, associated risks and rewards, and breakeven points, aiming to help investors make informed decisions based on their market outlook. The strategies cater to different market conditions, from aggressive bullish or bearish positions to neutral views with limited risks.Strips and straps

Strips and strapssunil5111991

Ěý

This document discusses two options trading strategies: strips and straps. Strips involve buying 1 at-the-money call and 2 at-the-money puts, betting that the underlying stock price will experience significant volatility and decrease. Straps involve buying 2 at-the-money calls and 1 at-the-money put, betting that the underlying stock price will experience significant volatility but increase. Both strategies have unlimited profit potential and limited risk, with the maximum loss being the net premium paid.Cheatcheatlivemuraja 110210213524-phpapp01

Cheatcheatlivemuraja 110210213524-phpapp01Taha Imam

Ěý

This document provides information about linear programming models, assumptions, and problem types. It discusses:

1) LP models make assumptions of proportionality, additivity, divisibility, and certainty. They can be iconic, analog, or mathematical representations of real problems.

2) Problem types discussed include product mix, blending, scheduling, inventory/portfolio problems, and multiple objective problems.

3) An example blending problem is provided to maximize profits by determining how to blend two petroleum components into regular and premium gasoline products based on specifications.Options trading strategies

Options trading strategiesankursaraf92

Ěý

The document discusses various options trading strategies including bull call spread, bear put spread, straddle, strangle, covered call, protective put, and calendar spread. For each strategy, it provides details on when to use it, the associated risks and rewards, and break-even points. Worked examples with numerical values are given to illustrate how to implement the strategies and analyze their potential payoffs.Option Basics

Option BasicsHSBC InvestDirect (India) Limited

Ěý

This document provides an overview of options contracts, including calls and puts. It defines key terms like strike price, expiration date, premium price, and describes the rights of buyers and sellers. The document also explains the components of an option's price, including intrinsic value and time value. Overall, the document serves as an introduction to basic option concepts.Ch09 hullfundamentals7thed

Ch09 hullfundamentals7thedtrevorsum67890

Ěý

This document provides an overview of options markets and terminology. It discusses the different types of options including calls and puts, as well as long and short option positions. It also summarizes payoffs for these positions and how dividends, stock splits, and other corporate actions affect option terms. The document concludes with descriptions of warrants, executive stock options, and convertible bonds.Debt basics

Debt basicssudhanshuarora1

Ěý

The document provides an overview of key concepts related to fixed income investments, including:

1) It describes the basic structure of a bond, including the issuer, maturity date, coupon payments, principal, and par value.

2) It explains bond ratings and the different rating scales used by agencies like CRISIL and ICRA to classify bonds based on their credit risk.

3) It covers yield calculations including yield to maturity and the concept of current yield, as well as factors that influence the yield curve and term structure.

4) It outlines various types of risk associated with fixed income investments like credit risk, interest rate risk, reinvestment risk, liquidity risk, and how these risksOption pricing model

Option pricing modelVishal Jain

Ěý

The document discusses option pricing models. It covers the Binomial model and the Black-Scholes model. The Black-Scholes model assumes the stock price follows a geometric Brownian motion and uses a partial differential equation to derive a closed-form solution for pricing European stock options. It requires parameters such as the stock price, exercise price, risk-free interest rate, time to maturity, and volatility. The model provides a theoretical fair value for options.Financial risk management

Financial risk managementNam Ngo

Ěý

This document provides an overview of topics to be covered in a module on financial risk management. The topics include:

1) Managing risk using stock index futures and interest rate derivatives like bond options.

2) Futures contracts for stocks, bonds, bills, and their use for speculation, arbitrage, and hedging. Concepts like delta and gamma hedging.

3) Risk measures like Value at Risk that will be examined statistically and through Monte Carlo simulations and principal component analysis.

4) Modeling volatility in stock prices and interest rates using parametric and non-parametric models, as well as multivariate models.

5) Credit risk measures and credit derivatives like credit default#StumpStumpo: Challenge RMS to model any re/insurance contract in RMS's Contr...

#StumpStumpo: Challenge RMS to model any re/insurance contract in RMS's Contr...RMS

Ěý

The document outlines the #stumpstumpo challenge initiated by RMS's CEO, inviting participants to tweet re/insurance contracts for evaluation with RMS's Contract Definition Language (CDL). It showcases various complex insurance scenarios and solutions, including layered coverage structures for earthquake losses, ceded treaty swaps, and deductibles handling. The text highlights the capabilities of CDL in modeling intricate insurance contracts and emphasizes the innovative applications of structure language in the reinsurance industry.Black schole

Black scholechintu_thakkar9

Ěý

The document provides an overview of the Black-Scholes option pricing model (BSOPM). It describes the key assumptions of the BSOPM, including that the underlying stock pays no dividends, markets are efficient, and prices are lognormally distributed. It also outlines how the BSOPM can be used to calculate theoretical option prices from historical data on the stock price, strike price, time to expiration, interest rate, and volatility. The document discusses implied volatility and how it differs from historical volatility, as well as limitations of the BSOPM.Dynamic Price Competition and Tacit Collusion I

Dynamic Price Competition and Tacit Collusion ITakuya Irie

Ěý

This document provides an overview of dynamic price competition and tacit collusion. It first discusses conventional wisdom and static approaches like the kinked demand curve model. It then introduces the theory of supergames, where a repeated price competition game can have multiple equilibria sustaining collusion if the discount factor is high enough. Specific applications discussed include how market concentration can facilitate tacit collusion by changing the discount factor threshold, and how long information lags or fluctuating demand can make collusion harder to sustain.Dynamic Price Competition and Tacit Collusion II

Dynamic Price Competition and Tacit Collusion IITakuya Irie

Ěý

This document outlines the key points of a presentation on dynamic price competition and tacit collusion. It discusses how imperfect information about rivals' prices can hinder full collusion and instead lead to periodic price wars. It presents a simple model where firms charge a monopoly price pm in a collusive phase but then punish deviations with a low price for T periods. The optimal punishment length is finite if the probability of low demand α is below 1/2. The document also introduces models of price competition with price rigidities and asynchronous pricing. It discusses Markov perfect equilibrium and how to derive the necessary conditions for a symmetric MPE using dynamic programming equations. Finally, it notes that in a symmetric MPE, average per-period profits must exceedoption pricing

option pricingRudreshSamant

Ěý

The document discusses key concepts related to option pricing models. It provides an overview of the binomial option pricing model (BOPM) and Black-Scholes option pricing model (BSOPM). The BOPM values options using a discrete time approach where the underlying asset price can move up or down over time. The BSOPM uses a continuous time approach to value options based on the stochastic behavior of the underlying asset price over time. Both models are based on the principle of risk neutral valuation and creating a riskless hedge to determine the appropriate discount rate.Black scholes model

Black scholes modelLuckshay Batra

Ěý

The document provides a comprehensive overview of the Black-Scholes model, a key financial theory for pricing options developed in 1973. It covers various aspects such as the Black-Scholes formula, its derivation, applications, and extensions like stochastic volatility and quanto options. Key concepts such as the Wiener process, Ito's lemma, volatility, transaction costs, and option pricing models are discussed in detail, aimed at financial professionals and investors.static_hedge

static_hedgeAbukar Ali, CQF

Ěý

1) The document discusses pricing options when volatility is uncertain and lies within a bounded range. It describes constructing a portfolio using a long call option and shorting the underlying asset to hedge against volatility risk.

2) It then discusses using static hedging to hedge options, like hedging a long digital call position using a short call spread. The goal is to find the optimal number of short calls to minimize residual risk, done by solving a partial differential equation.

3) Technical difficulties prevented finding the optimal hedge ratio using an Excel solver as planned. Instead, the document ends by listing references for further reading on uncertain volatility modeling and hedging techniques.No arbitrage and randomization of derivatives pricing

No arbitrage and randomization of derivatives pricingIlya Gikhman

Ěý

This document critiques the no-arbitrage pricing principle, arguing it is valid only in a deterministic context while being inadequate in stochastic scenarios. The author presents an alternative derivatives pricing approach that includes defining market and spot prices to account for market risk, emphasizing the importance of risk factors in pricing. The analysis highlights the flaws in interpreting no-arbitrage pricing as universally applicable and suggests a more nuanced view of forward contract pricing.Basics of derivatives

Basics of derivativesanandlihinar

Ěý

This document provides an overview of derivatives, including their basic uses and types. It discusses how derivatives can be used to manage risk through hedging or change risk exposure. The main types of derivatives covered are forwards, futures, options, and swaps. Forwards and futures involve an agreement to buy or sell an asset at a future date. Options provide the right but not obligation to buy or sell an asset. Swaps involve exchanging cash flows over time, such as interest rates or currencies.Capm 1

Capm 1ansalmch1

Ěý

The Capital Asset Pricing Model (CAPM) asserts that the expected return of an asset is determined by its sensitivity to non-diversifiable market risk, as measured by beta. Under CAPM, the expected return of an asset is equal to the risk-free rate plus a risk premium that is proportional to the asset's beta. CAPM provides a model for determining the cost of capital of an asset by relating the expected return of the asset to its risk compared to the market portfolio.Similar to Options Margin (20)

Options Strategy Chart

Options Strategy ChartWilliam Hodge

Ěý

This document outlines various bullish, bearish, and neutral options strategies including their maximum potential gain, maximum possible loss, and breakeven points. It provides examples of buying or selling calls, puts, straddles, spreads, and using options to hedge an existing stock position.Buying & selling securities

Buying & selling securitiessurajhawa

Ěý

1. Order size refers to the number of shares bought or sold, which can be a round lot of 100 shares (or multiples of 100) or an odd lot of 1-99 shares.

2. Time limits on orders specify how long an order is valid, such as one day, week, or month. Open orders remain open until filled or cancelled, while fill-or-kill and discretionary orders give brokers flexibility in execution.

3. Short selling allows investors to borrow and sell securities they do not own, hoping to purchase them later at a lower price. It carries higher risk than long positions as losses are unlimited.RMIT Vietnam - Risk Management - Options

RMIT Vietnam - Risk Management - OptionsTai Tran

Ěý

This document discusses risk management concepts including options hedging, option structures, exchange-traded options vs over-the-counter options, and leverage. It also covers option valuation using the Black-Scholes model and interest rate caps. Key points include that options hedge the underlying asset's price risk, leverage allows outsized gains from a small initial investment in options, and the Black-Scholes model is commonly used to value options based on the underlying asset price, strike price, time to expiration, interest rates, and volatility.Ifm derivatives 01[1].03.07

Ifm derivatives 01[1].03.07Kapil Chhabra

Ěý

A derivative is a financial instrument whose value is dependent on an underlying asset. The main types of derivatives are forwards, futures, options, and swaps. Forwards are customized contracts to buy or sell an asset at a future date at a fixed price. Futures are exchange-traded contracts with standardized terms. Options provide the right but not obligation to buy or sell an asset at a future date at a specified price. Swaps involve exchanging cash flows of two parties over time based on some underlying factors. Derivatives allow for hedging risks and speculating on market movements.FD.ppt

FD.pptvibhsSharma

Ěý

Derivatives are financial contracts whose value is based on an underlying asset or condition. The two main types are futures and options. Futures obligate the buyer and seller to exchange a standardized asset at a predetermined price and date. Options provide the right, but not obligation, to buy or sell the underlying asset at a strike price by expiration. Derivatives are used for speculation and hedging risk. Major derivatives exchanges include the Chicago Board of Trade and Chicago Board Options Exchange. The Commodity Futures Trading Commission regulates futures and some options while the Securities and Exchange Commission regulates stock options.Derivative-Management-17102022-042815pm.ppt

Derivative-Management-17102022-042815pm.pptMubashirAli440246

Ěý

Derivatives are financial contracts whose value is based on an underlying asset or condition. The two main types are futures and options. Futures obligate the buyer and seller to exchange a standardized asset at a predetermined price and date. Options provide the right, but not obligation, to buy or sell the underlying asset at a strike price by expiration. Derivatives are used for speculation and hedging risk. Major derivatives exchanges include the Chicago Board of Trade and Chicago Board Options Exchange. The Commodity Futures Trading Commission regulates futures and some options while the Securities and Exchange Commission regulates stock options.Trading Options Course Outline

Trading Options Course Outlineguestb5b9c2

Ěý

The document serves as a comprehensive guide to options trading, covering fundamental concepts, intermediate and advanced strategies, and practical trading techniques. It explains the mechanics of options, the role of clearinghouses, and various trading strategies, including spreads and synthetic options. Each section is structured to provide systematic learning from basics to advanced strategies that traders can apply in practice.Csc3 Inv Products Ch 9

Csc3 Inv Products Ch 9guestf79d1b7

Ěý

There are various ways to buy and sell equity securities, including buying outright with cash or using leverage through a margin account to go long or short. Margin trading allows for greater returns through leverage but also carries more risk. Short selling on margin also allows for predicting price declines but requires maintaining a minimum account balance. There are different order types to consider like market orders, limit orders, and stop orders when entering buy and sell transactions.Futures_Options

Futures_OptionsNeeraj Kaushik

Ěý

The document provides an overview of futures, forwards, and options contracts. It defines each type of contract and describes their key characteristics and differences. Futures contracts involve an obligation to buy or sell an asset at a set price and date. Forwards are similar but traded over-the-counter. Options provide the right but not obligation to buy or sell an asset and have different payoff profiles depending on long or short positions. The document includes examples of how profits and losses are realized for each contract type.Derivatives

Derivativessuraj_jobanputra

Ěý

Derivatives are financial contracts whose value is derived from an underlying asset such as securities, commodities, currency, or indexes. There are several types of derivatives including forwards, futures, options, and swaps. Derivatives are used to hedge risk by allowing investors to profit from favorable price movements in the underlying asset while protecting against unfavorable changes. Key features of derivatives contracts include the underlying asset, price or rate of the derivative, and settlement date.DRM Ch 1-Introduction.pptx

DRM Ch 1-Introduction.pptxBharatiya Vidya Bhavan's Usha and Lakshmi Mittal Institute of Management

Ěý

A derivative is a financial instrument whose value is based on an underlying asset such as a stock, currency, or commodity. Derivatives include forwards, futures, swaps, and options. Forwards and swaps are traded over-the-counter (OTC) while futures and options are traded on exchanges. Options provide the right but not the obligation to buy or sell the underlying asset, while futures/forwards obligate the parties to fulfill the contract. Derivatives allow risk transfer and provide leverage to market participants.Introdaction of derivative market

Introdaction of derivative marketAnkur Sarswat

Ěý

Derivatives are financial instruments whose value is dependent on an underlying asset. The three main types of derivatives are forwards, futures, and options. Forwards and futures are contracts to buy or sell an asset at a future date at a predetermined price, while options provide the right but not obligation to buy or sell an asset at a strike price. Derivatives allow traders to hedge risk, reduce transaction costs, manage portfolios, and enhance liquidity. Key participants in derivatives markets include hedgers who offset risk, speculators who take on risk, and arbitrageurs who exploit pricing discrepancies across markets.Introdaction of derivative market

Introdaction of derivative marketAnkur Sarswat

Ěý

Derivatives are financial instruments whose value is dependent on an underlying asset. The three main types of derivatives are forwards, futures, and options. Forwards and futures are contracts to buy or sell an asset at a future date at a predetermined price, while options provide the right but not obligation to buy or sell an asset at a strike price. Derivatives allow traders to hedge risk, reduce transaction costs, manage portfolios, and enhance liquidity in markets.Chapter 10

Chapter 10Dr. Muath Asmar

Ěý

This document provides an overview of derivative securities markets based on a chapter from a textbook on financial markets and institutions. It defines derivatives and describes their main uses for hedging and speculation. It also outlines various types of derivative contracts including forwards, futures, options, swaps, and discusses the key characteristics and uses of these contracts. The document concludes with tables showing the size of various derivative markets from 1999 to 2016.Chapter (10)

Chapter (10)Dr. Muath Asmar

Ěý

This document provides an overview of derivative securities markets. It defines derivatives as financial securities whose payoff is linked to another security. Derivatives allow parties to exchange risk. Common derivatives discussed include forwards, futures, options, swaps, and other instruments. The document also examines the characteristics and uses of various derivative contracts and the markets in which they trade.Forward Vs Future.pptx

Forward Vs Future.pptxRishavGupta83

Ěý

- Forward and futures contracts lock in a price today for the purchase or sale of an asset in the future. Futures contracts are standardized and traded on exchanges, while forwards are customized contracts between parties.

- Both parties to a futures or forward contract are committed to fulfill their side of the deal. The party with the long position agrees to buy the asset, while the short position agrees to sell. Margin requirements ensure contracts are honored.

- Futures contracts are marked to market daily, meaning the contract price changes to the current market price. Gains or losses are deposited or withdrawn from the parties' accounts, keeping them indifferent to price changes until settlement. This reduces the incentive to default on contracts.Financial derivatives ppt

Financial derivatives pptVaishnaviSavant

Ěý

A derivative is a financial instrument whose value is derived from the value of another asset, known as the underlying. There are three main types of traders in the derivatives market: hedgers who use derivatives to reduce risk, speculators who trade for profits, and arbitrageurs who take advantage of price discrepancies across markets. Derivatives can be traded over-the-counter (OTC) or on an exchange, and provide various economic benefits such as risk reduction and enhanced market liquidity.Forward Vs Future and it's indepth knowledge

Forward Vs Future and it's indepth knowledgekumarsinghrahul232

Ěý

The document provides an overview of forward and futures contracts, highlighting their role as derivative securities that enable price locking for future transactions. It discusses the differences between forwards and futures, including their trading mechanisms, margin requirements, and the concept of marking to market. Additionally, the document explores applications such as hedging and arbitrage, detailing examples to illustrate how these financial instruments function in real-world scenarios.Financial markets and Institution options.pptx

Financial markets and Institution options.pptxsiyad22

Ěý

The document provides an extensive overview of various options types including call and put options, their exercise styles, underlying assets, and trading placements. It details key concepts in option trading such as intrinsic and time values, strategies for bullish and bearish markets, and numerous spread strategies such as vertical and horizontal spreads, butterflies, and condors. Additionally, it describes the mechanisms of risk management and hedging using combinations of options.Ad

More from William Hodge (9)

Comics Guide_20211130[31201].pdf

Comics Guide_20211130[31201].pdfWilliam Hodge

Ěý

A basic guide to advanced comic book collecting. The guide has something for everyone, and I really do mean that. At ~80 pages, a host of topics are explored including types of collecting, pricing guides, collection management, speculating vs. investing, comic grading, supply and demand, using pricing data wisely, goal setting and more.

In addition to practical real-world advice, we've included various charts and graphs to improve your understanding of various topics. QR codes have been embedded that allow you to use your cell phone's camera to jump to Youtube playlists and videos that complement the written text.

My mission through my YouTube channel, as with this book, is to help make sense of comic collecting for anyone, no matter where you are in your collecting journey. And I hope reading this guide helps you enjoy your journey a little bit more. Please subscribe to my YouTube

https://www.youtube.com/channel/UChcoxgpVUCLalncz2tcU1oQAML Letter

AML LetterWilliam Hodge

Ěý

Company Name, Inc. certifies to Company Name USA, Inc. that it has implemented anti-money laundering programs and a customer identification program that contains procedures for verifying customer identities, maintaining verification records, comparing customers to terrorist lists, and notifying customers about information collection. These programs have been applied to all current investment advisory customers.Superv. Cont. Chk List

Superv. Cont. Chk ListWilliam Hodge

Ěý

1. This document outlines the firm's supervisory procedures and controls for various areas including designations of supervisors, employee policies, training, licensing, communications, financial operations, and anti-money laundering programs.

2. Key areas covered include designation of supervisors and their responsibilities, outside business activities of employees, supervisory controls over correspondence and advertising, and designations of individuals responsible for areas like compliance.

3. The document also specifies the firm's procedures for areas like books and records, net capital calculations, and anti-money laundering compliance in accordance with applicable regulations.Generic Confidentiality Agreement

Generic Confidentiality AgreementWilliam Hodge

Ěý

1) Customer Firm Associates, L.P. is providing confidential organizational and financial documentation to Broker Dealer Inc. in connection with opening investment accounts.

2) Broker Dealer Inc. agrees to keep this information strictly confidential and only share it with employees who need to know for evaluating the accounts.

3) The confidentiality agreement does not apply to information that becomes publicly available, was previously known, or is obtained from another source not bound by confidentiality.Annual Ria Anti Money Laundering Cert. Clean

Annual Ria Anti Money Laundering Cert. CleanWilliam Hodge

Ěý

1. The firm certifies that it complies with anti-money laundering procedures when acting as a nominee for transactions, such as obtaining and maintaining documents identifying principals.

2. The firm monitors that principal's assets are not from illegal activities and that principals and accounts are not involved in illegal activities or subject to blocking by OFAC.

3. The firm agrees to notify Troika Dialog USA if any of these conditions change so that Troika Dialog USA can take actions like filing suspicious activity reports or blocking access.Qib Certification

Qib CertificationWilliam Hodge

Ěý

This document certifies that the undersigned is a Qualified Institutional Buyer (QIB) and Qualified Purchaser as defined by SEC

Rule 144A and the Investment Company Act. It places a check mark next to the type of institution it represents and makes

representations about owning a minimum amount of eligible securities. It also represents that it meets the criteria to be

considered a Qualified Purchaser, including not being formed for the specific purpose of investing in certain securities. The

document contains the undersigned's certification that it understands the confidential nature of any offering documents received

for Rule 144A securities.Research Checklist Generic

Research Checklist GenericWilliam Hodge

Ěý

This document is a compliance checklist for research analysts that outlines required disclosures, certifications, controls, and approvals when generating and distributing research reports. It specifies that analysts must disclose any conflicts of interest, certify that their opinions are unbiased, and that compensation does not influence their views. It also requires information barriers between research and investment banking, supervisory approval for reports distributed in the US, and training and attestations on insider trading policies for relevant employees. Additionally, the firm must file an annual Rule 2711 Certification to attest it has procedures to comply with regulations regarding research report distribution.Compliance Rules Grid

Compliance Rules GridWilliam Hodge

Ěý

This document outlines a supervisory control system and compliance program with various rules and procedures that must be followed on different time intervals, ranging from daily to annually. It covers areas such as supervisory procedures, branch office activities, personnel matters, financial reporting, customer accounts, communications, business continuity, anti-money laundering, and trade reporting. Many of the rules and procedures referenced are from FINRA and SEC regulations.Compliance Overview

Compliance OverviewWilliam Hodge

Ěý

The document provides an overview of US regulatory compliance for the securities industry. It discusses the history of securities regulation in the US following the 1929 stock market crash, including key legislation such as the Securities Act of 1933 and the Securities Exchange Act of 1934 which established the SEC. It also outlines the roles and functions of various compliance departments, including advisory services, training, monitoring, and fostering a culture of compliance.Ad