1 of 84

Download to read offline

Ad

Recommended

coca cola Reconciliation of Non-GAAP Financial Measures

coca cola Reconciliation of Non-GAAP Financial Measuresfinance9

╠²

The document provides a reconciliation of the Coca-Cola Company's reported diluted earnings per share under GAAP to its underlying diluted earnings per share for the years 1990 to 2003. It explains that management believes certain non-GAAP measures can provide useful comparisons by excluding items that impact comparability across periods. For each year, it details gains, charges and accounting changes that were excluded from underlying EPS. The reconciliation aims to show underlying business trends by excluding impacts not related to fundamental operations.general dynamics Restated Certificate of Incorporation

general dynamics Restated Certificate of Incorporation finance9

╠²

This document is a Restated Certificate of Incorporation for General Dynamics Corporation. It was adopted by the Board of Directors on October 6, 2004 and filed with the Secretary of State of Delaware on that same date. The document restates the original Certificate of Incorporation from 1952 and does not further amend or supplement it. It then lists 22 purposes of the corporation related to manufacturing, research, transportation, mining, real estate, purchasing other businesses, intellectual property, issuing financial instruments, and acting as a selling agent.hca annual reports2001

hca annual reports2001finance9

╠²

- HCA is one of the largest healthcare services companies in the US, operating 184 hospitals across 23 states, England, and Switzerland as of 2001.

- In 2001, HCA invested $1.4 billion in capital expenditures, with plans to invest $1.6 billion in 2002 and $1.8 billion in 2003 primarily to expand capacity, improve access, and upgrade infrastructure like emergency departments.

- Population growth in Sunbelt regions where many HCA hospitals operate is driving increased demand for healthcare services, along with new technologies and an aging population requiring more care.coca cola Reconciliation of Q2 and YTD 2007 Non-GAAP Financial Measures

coca cola Reconciliation of Q2 and YTD 2007 Non-GAAP Financial Measuresfinance9

╠²

The document provides non-GAAP financial measures for The Coca-Cola Company in addition to its GAAP reported financial results. Management believes the non-GAAP measures allow for more meaningful comparisons of current results to historical periods by excluding certain items that impact overall comparability. The non-GAAP measures are used by management in making financial, operating, and planning decisions to evaluate performance. Tables reconcile the non-GAAP measures to GAAP measures and provide supplemental financial data for quarterly and year-to-date periods, including operating income by segment.coca cola Reconciliation of Non-GAAP Financial Measures for 2008 Lehman Broth...

coca cola Reconciliation of Non-GAAP Financial Measures for 2008 Lehman Broth...finance9

╠²

The document discusses the company's reporting of financial results according to GAAP and the use of non-GAAP measures by management to provide additional meaningful comparisons. It provides reconciliations of GAAP measures to non-GAAP measures for years 2004-2005 and quarters 1-2 of 2006 that exclude certain items impacting comparability in order to reflect underlying business trends. Management uses these non-GAAP measures for financial decision making and performance evaluation.coca cola 2005 Proxy ┬╗

coca cola 2005 Proxy ┬╗finance9

╠²

The document is a proxy statement from The Coca-Cola Company informing shareholders about the upcoming Annual Meeting of Shareowners on April 19, 2005. It provides details about voting procedures, the agenda which includes electing directors and ratifying auditors, and responses to frequently asked questions about voting. Shareholders are encouraged to vote by proxy prior to the meeting.enterprise gp holdings Organizational and Ownership Structure Chart

enterprise gp holdings Organizational and Ownership Structure Chart finance9

╠²

- Dan L. Duncan, EPCO, Inc, Dan Duncan LLC and other affiliates own 77.44% of the ownership units of Enterprise GP Holdings L.P. as of April 30, 2008.

- The remaining 22.55% of ownership units are held by public investors.

- Enterprise GP Holdings L.P. owns the general partner interests and limited partner interests in Enterprise Products Partners L.P., Energy Transfer Equity L.P., and other related companies.enterprise gp holdings Standards of Business Conduct

enterprise gp holdings Standards of Business Conductfinance9

╠²

The document outlines the Standards of Business Conduct for Enterprise GP Holdings L.P., EPE Holdings, LLC, and their divisions and subsidiaries. It establishes ethical guidelines for employees and contractors regarding conflicts of interest, use of company resources, gifts, political activities, and other interactions. Representatives must avoid situations that could compromise their objectivity or the company's interests, and report any violations of the Standards. Adherence to the policies is required to maintain employment or contracts.enterprise gp holdings Audit, Conflicts & Governance Committee

enterprise gp holdings Audit, Conflicts & Governance Committeefinance9

╠²

The document establishes an Audit, Conflicts and Governance Committee for EPE Holdings, LLC to assist with Board oversight of financial reporting, compliance, auditor independence, and related-party transactions. The Committee is responsible for appointing and overseeing the independent auditor, reviewing financial statements and disclosures, overseeing compliance and legal matters, and assessing risk. However, the Committee's role is oversight and it relies on management and the auditor for accurate financial reporting and audits.enterprise gp holdings Code of Conduct & Related Policies

enterprise gp holdings Code of Conduct & Related Policiesfinance9

╠²

This document outlines a code of conduct for EPCO, Inc. employees. It describes 10 sections: [1] Introduction and purpose, [2] General business principles, [3] Legal and ethical obligations, [4] Company compliance policies, [5] Procedures for obtaining guidance, [6] Reporting compliance violations, [7] Discipline and consequences, [8] Individual responsibility and duty, [9] Waivers of the code, and [10] Employee certification. The code is intended to govern employees' business activities and represent the code of ethics required by the Sarbanes-Oxley Act.02/11/09 HCA Announces Offering of $300 Million Senior Secured Second Lien Notes

02/11/09 HCA Announces Offering of $300 Million Senior Secured Second Lien Notesfinance9

╠²

HCA announced plans to offer $300 million in senior secured second lien notes due in 2017. Proceeds from the offering will be used to repay existing debt, including amounts owed under HCA's credit facilities. The notes have not been registered with the SEC and cannot be offered in the US without registration or an exemption. The announcement contains forward-looking statements about HCA's plans and expectations that are subject to risks and uncertainties.hca annual reports2000

hca annual reports2000finance9

╠²

The document is the 2000 annual report of HCA - The Healthcare Company. It summarizes that in 2000, HCA achieved strong financial and operating performance including over 6% revenue growth, improved margins, and investments of over $1.5 billion in facilities. The company also repurchased $874 million of its common stock. This performance was driven by a focus on patient, physician, and employee satisfaction as well as initiatives to standardize processes while decentralizing decision-making power. Going forward, HCA aims to further develop shared services and a focus on patient safety to strengthen its position.hca annual reports2002

hca annual reports2002finance9

╠²

The document is HCA's 2002 annual report. It summarizes that 2002 was a successful year for HCA financially and in resolving investigations by the federal government. HCA reinvested $1.7 billion in its existing facilities and acquired additional hospitals. It also initiated several long-term programs to develop its workforce, such as scholarships through HCA Cares and military training through Army PaYS, to address the national nursing shortage. The CEO and COO were pleased with progress in 2002, their first full year in their roles, and committed to continued investment in facilities, technology, and employees.hca annual reports2003

hca annual reports2003finance9

╠²

HCA's 2003 annual report discusses developments that positioned the company for future growth. Key points include:

1) HCA invested over $1.8 billion to update its existing facilities with new technology and increase capacity.

2) The acquisition of Health Midwest expanded HCA's presence in the Kansas City market.

3) HCA invested $130 million to improve its revenue management and supply chain operations by consolidating them into regional centers.

4) New patient safety technologies like barcoded medication administration were deployed across HCA hospitals.hca annual reports2004

hca annual reports2004finance9

╠²

The document is HCA's 2004 annual report to shareholders. It discusses HCA's financial highlights for 2004 including revenues of $23.5 billion and net income of $1.246 billion. It also discusses challenges faced in 2004 such as reductions in Medicare payments and hurricanes. The letter to shareholders discusses how HCA deployed $3.05 billion in cash flows to invest in capital projects, increase dividends, and repurchase shares. Challenges discussed for 2005 include rising costs of medical devices and caring for the uninsured population.hca annual reports2005

hca annual reports2005finance9

╠²

- Hurricane Katrina caused catastrophic flooding in New Orleans, including at HCA's Tulane University Hospital.

- On Tuesday morning, the hospital's CEO realized flooding was rising over a foot per hour and they had only a few hours before losing power. They had to evacuate seven ventilator patients immediately.

- Through heroic efforts by the hospital staff and support from HCA and other organizations, the ventilator patients and others were evacuated from the roof via helicopter by early Tuesday morning, despite immense challenges including no boat or helicopter pad. This marked the beginning of a massive evacuation effort to rescue over 1,200 patients, staff, and family members from the hospital.JP Morgan Presentation 15-Feb-2008

JP Morgan Presentation 15-Feb-2008finance9

╠²

The document is a series of maps showing the rise in obesity rates among US adults from 1985 to 2006 based on data from the CDC's Behavioral Risk Factor Surveillance System. The maps show obesity, defined as a BMI of 30 or higher, increasing from below 10% in most states in 1985 to over 30% in many states by 2006, indicating a significant nationwide rise in obesity over the past few decades.HCA Presents at Bank of America 2008 Credit Conference 20-Nov-2008

HCA Presents at Bank of America 2008 Credit Conference 20-Nov-2008finance9

╠²

HCA Healthcare's management provided forward-looking statements during their presentation that are protected under safe harbor provisions. They cautioned that current plans and financial projections may differ from forward-looking statements due to known and unknown risks and uncertainties. The presentation also included certain non-GAAP financial measures that are reconciled to the most directly comparable GAAP measures.tyson foods 2007 Sustainability Report

tyson foods 2007 Sustainability Report finance9

╠²

The document is Tyson Foods' 2007 sustainability report, which provides information on the company's economic, social, and environmental performance. It discusses Tyson's commitment to sustainability in areas such as ethics and governance, employee relations, food safety, animal welfare, and community involvement. The report also outlines Tyson's strategies and goals for optimizing operations, expanding internationally, and developing innovative food solutions.tyson foods Investor Fact Book

tyson foods Investor Fact Book finance9

╠²

Tyson Foods is the world's largest processor and marketer of chicken, beef, and pork. In fiscal year 2008, Tyson Foods had sales of $26.9 billion and employed over 107,000 team members. Tyson Foods operates vertically integrated poultry and meat production facilities across the United States and internationally, producing over 40 million chickens, 141,860 cattle, and 393,360 hogs per week on average. The company sells its protein products through various distribution channels, including retail consumer products, food service, and international markets.tyson foods 2008 Annual Report

tyson foods 2008 Annual Report finance9

╠²

Tyson Foods had a challenging year financially in 2008 due to high input costs for chicken raising, but was able to remain profitable due to strong performances in pork and beef. The company continued pursuing its strategy of building a multinational business through acquisitions in Brazil, India, and China that will position it for long-term international growth as the global middle class expands. Tyson is also working to develop innovative new products and markets for non-prime meat products through initiatives in renewable fuels, pet foods, nutraceuticals, and biotechnology.general dynamics 2008 Proxy Statement

general dynamics 2008 Proxy Statement finance9

╠²

The document is a notice and proxy statement for the 2008 Annual Meeting of Shareholders of General Dynamics Corporation. It notifies shareholders that the meeting will be held on May 7, 2008 to elect directors, conduct an advisory vote on selecting KPMG LLP as the independent auditor, and consider two shareholder proposals. It provides instructions for shareholders on attending the meeting, voting procedures, revoking proxies, and vote requirements.general dynamics 2007 Annual Report

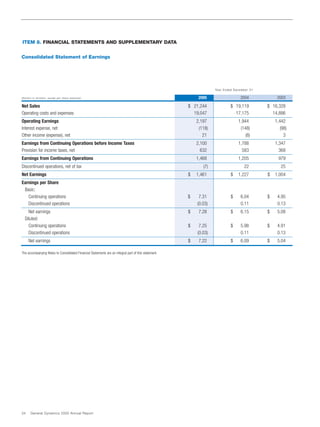

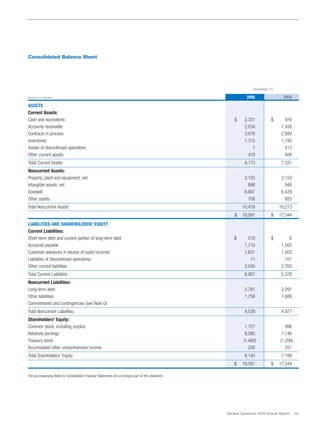

general dynamics 2007 Annual Report finance9

╠²

This document is General Dynamics' annual report for 2007. It discusses the company's strong financial performance in 2007, with record sales, earnings, cash flow, orders, and backlog. Specifically, net sales increased 13% to $27.24 billion. Earnings from continuing operations grew 21% to $2.08 billion. Cash from continuing operations was $2.95 billion, up 37%. The annual report provides an overview of each of General Dynamics' business segments and their performance in 2007, noting growth across Aerospace, Combat Systems, and Marine Systems.general dynamics Amended and Restated Bylaws

general dynamics Amended and Restated Bylawsfinance9

╠²

This document outlines the amended and restated bylaws of General Dynamics Corporation as of February 4, 2009. It addresses topics such as the location of registered offices, procedures for stockholder meetings, requirements for the board of directors, responsibilities of corporate officers, and procedures for capital stock transactions. The bylaws establish rules for notice, quorum, voting, and other governance matters to guide the operations of the corporation according to Delaware law.Business sentiment stabilized in May, but exportersŌĆÖ anxiety and labor shorta...

Business sentiment stabilized in May, but exportersŌĆÖ anxiety and labor shorta...ąåąĮčüčéąĖčéčāčé ąĄą║ąŠąĮąŠą╝č¢čćąĮąĖčģ ą┤ąŠčüą╗č¢ą┤ąČąĄąĮčī čéą░ ą┐ąŠą╗č¢čéąĖčćąĮąĖčģ ą║ąŠąĮčüčāą╗čīčéą░čåč¢ą╣

╠²

Key points:

Ō×ó The highest uncertainty in the 3-month perspective was recorded among exporters, 20.7%

Ō×ó The share of enterprises planning to scale down operations over a 2-year horizon rose to 5%, but 95% do not expect a decline or foresee growth

Ō×ó Labor shortages remain the main obstacle ŌĆö 63% of businesses noted this issue

Ō×ó The second most common obstacles were safety risks and rising prices

Ō×ó Power outages remain a relatively minor issue ŌĆö only 7% mentioned it

Most key indicators of business sentiment remained stable in May. The Business Activity Recovery Index remained unchanged from April at 0.13. The aggregated indicator of industrial prospects, which reflects short-term expectations, slightly declined to 0.11 from 0.12 in MarchŌĆōApril.

These are the findings of the 37th monthly survey conducted by the IER among 474 industrial enterprises.

Uncertainty in the three-month outlook remained unchanged primarily for key production indicators.

ŌĆ£However, we recorded the highest level of three-month uncertainty among exporters. Every fifth exporter ŌĆö 20.7% ŌĆö currently does not know what their export dynamics will be over the next 3ŌĆō4 months,ŌĆØ said IER Executive Director Oksana Kuziakiv.

Uncertainty decreased over longer horizons ŌĆö 6-month and 2-year periods. Currently, only 28.7% of respondents find it difficult to predict their activities two years in advance. This is the lowest share since at least October 2022, when 42.3% of businesses reported uncertainty.

ŌĆ£In May, the share of those planning to reduce their enterpriseŌĆÖs activity over two years increased to 5%. This is still a small number, though higher than AprilŌĆÖs 1.4%. Nearly 80% donŌĆÖt foresee major changes. In fact, 95% of respondents indicate that they will either remain unchanged or experience slight growth. Considering the instability, security, and economic challenges Ukraine faces, this is a very good result,ŌĆØ said Oksana Kuziakiv.

The share of enterprises that increased production in May fell from 26.2% to 19.5%, while the share of those that reduced output grew from 10% to 13.5%. The share of businesses planning to increase production in the next 3ŌĆō4 months slightly declined, from 40.8% to 39.9%.

The total share of enterprises operating at full or near-full production capacity slightly increased in May, from 62% to 63%.

ŌĆ£In January this year, the share of those operating at over 75% of capacity rose significantly. Since then, it has remained relatively unchanged. For example, in May, 53% of companies were in this category,ŌĆØ noted Oksana Kuziakiv.

Expectations for new orders remain cautious: the share of companies with order portfolios longer than a year slightly decreased, from 16% to 15%. On average, the duration of new orders increased from 4.9 to 5 months.

ŌĆ£This happened because the share of those with orders for just one to two months declined from 33% to 24%. Likely, these orders were redistributed: some now work ŌĆśon the fly,ŌĆÖ others shifted into the three-to-five month category,Analytical procedures for audit and assurance

Analytical procedures for audit and assuranceNguytHi7

╠²

Didu nay iluoc sua.d6i theo-quy dinh tai Dieu 1 cua euytit dinh s6 t146l2004/eDN[{NN vd vi6c sua a6i oiau z quyciainl s6 +lstzooatqo NHt[\r 2gt4t2oo4 cira thdng ioc

Ngan hang Nhd nu6c ban hdnh HO th5ng tiri khoan k6 toan c6c T6 chric tin dung, c6 hi0u luc

kd tu ngdy 04 thaag 10 nlm 2004More Related Content

More from finance9 (20)

enterprise gp holdings Audit, Conflicts & Governance Committee

enterprise gp holdings Audit, Conflicts & Governance Committeefinance9

╠²

The document establishes an Audit, Conflicts and Governance Committee for EPE Holdings, LLC to assist with Board oversight of financial reporting, compliance, auditor independence, and related-party transactions. The Committee is responsible for appointing and overseeing the independent auditor, reviewing financial statements and disclosures, overseeing compliance and legal matters, and assessing risk. However, the Committee's role is oversight and it relies on management and the auditor for accurate financial reporting and audits.enterprise gp holdings Code of Conduct & Related Policies

enterprise gp holdings Code of Conduct & Related Policiesfinance9

╠²

This document outlines a code of conduct for EPCO, Inc. employees. It describes 10 sections: [1] Introduction and purpose, [2] General business principles, [3] Legal and ethical obligations, [4] Company compliance policies, [5] Procedures for obtaining guidance, [6] Reporting compliance violations, [7] Discipline and consequences, [8] Individual responsibility and duty, [9] Waivers of the code, and [10] Employee certification. The code is intended to govern employees' business activities and represent the code of ethics required by the Sarbanes-Oxley Act.02/11/09 HCA Announces Offering of $300 Million Senior Secured Second Lien Notes

02/11/09 HCA Announces Offering of $300 Million Senior Secured Second Lien Notesfinance9

╠²

HCA announced plans to offer $300 million in senior secured second lien notes due in 2017. Proceeds from the offering will be used to repay existing debt, including amounts owed under HCA's credit facilities. The notes have not been registered with the SEC and cannot be offered in the US without registration or an exemption. The announcement contains forward-looking statements about HCA's plans and expectations that are subject to risks and uncertainties.hca annual reports2000

hca annual reports2000finance9

╠²

The document is the 2000 annual report of HCA - The Healthcare Company. It summarizes that in 2000, HCA achieved strong financial and operating performance including over 6% revenue growth, improved margins, and investments of over $1.5 billion in facilities. The company also repurchased $874 million of its common stock. This performance was driven by a focus on patient, physician, and employee satisfaction as well as initiatives to standardize processes while decentralizing decision-making power. Going forward, HCA aims to further develop shared services and a focus on patient safety to strengthen its position.hca annual reports2002

hca annual reports2002finance9

╠²

The document is HCA's 2002 annual report. It summarizes that 2002 was a successful year for HCA financially and in resolving investigations by the federal government. HCA reinvested $1.7 billion in its existing facilities and acquired additional hospitals. It also initiated several long-term programs to develop its workforce, such as scholarships through HCA Cares and military training through Army PaYS, to address the national nursing shortage. The CEO and COO were pleased with progress in 2002, their first full year in their roles, and committed to continued investment in facilities, technology, and employees.hca annual reports2003

hca annual reports2003finance9

╠²

HCA's 2003 annual report discusses developments that positioned the company for future growth. Key points include:

1) HCA invested over $1.8 billion to update its existing facilities with new technology and increase capacity.

2) The acquisition of Health Midwest expanded HCA's presence in the Kansas City market.

3) HCA invested $130 million to improve its revenue management and supply chain operations by consolidating them into regional centers.

4) New patient safety technologies like barcoded medication administration were deployed across HCA hospitals.hca annual reports2004

hca annual reports2004finance9

╠²

The document is HCA's 2004 annual report to shareholders. It discusses HCA's financial highlights for 2004 including revenues of $23.5 billion and net income of $1.246 billion. It also discusses challenges faced in 2004 such as reductions in Medicare payments and hurricanes. The letter to shareholders discusses how HCA deployed $3.05 billion in cash flows to invest in capital projects, increase dividends, and repurchase shares. Challenges discussed for 2005 include rising costs of medical devices and caring for the uninsured population.hca annual reports2005

hca annual reports2005finance9

╠²

- Hurricane Katrina caused catastrophic flooding in New Orleans, including at HCA's Tulane University Hospital.

- On Tuesday morning, the hospital's CEO realized flooding was rising over a foot per hour and they had only a few hours before losing power. They had to evacuate seven ventilator patients immediately.

- Through heroic efforts by the hospital staff and support from HCA and other organizations, the ventilator patients and others were evacuated from the roof via helicopter by early Tuesday morning, despite immense challenges including no boat or helicopter pad. This marked the beginning of a massive evacuation effort to rescue over 1,200 patients, staff, and family members from the hospital.JP Morgan Presentation 15-Feb-2008

JP Morgan Presentation 15-Feb-2008finance9

╠²

The document is a series of maps showing the rise in obesity rates among US adults from 1985 to 2006 based on data from the CDC's Behavioral Risk Factor Surveillance System. The maps show obesity, defined as a BMI of 30 or higher, increasing from below 10% in most states in 1985 to over 30% in many states by 2006, indicating a significant nationwide rise in obesity over the past few decades.HCA Presents at Bank of America 2008 Credit Conference 20-Nov-2008

HCA Presents at Bank of America 2008 Credit Conference 20-Nov-2008finance9

╠²

HCA Healthcare's management provided forward-looking statements during their presentation that are protected under safe harbor provisions. They cautioned that current plans and financial projections may differ from forward-looking statements due to known and unknown risks and uncertainties. The presentation also included certain non-GAAP financial measures that are reconciled to the most directly comparable GAAP measures.tyson foods 2007 Sustainability Report

tyson foods 2007 Sustainability Report finance9

╠²

The document is Tyson Foods' 2007 sustainability report, which provides information on the company's economic, social, and environmental performance. It discusses Tyson's commitment to sustainability in areas such as ethics and governance, employee relations, food safety, animal welfare, and community involvement. The report also outlines Tyson's strategies and goals for optimizing operations, expanding internationally, and developing innovative food solutions.tyson foods Investor Fact Book

tyson foods Investor Fact Book finance9

╠²

Tyson Foods is the world's largest processor and marketer of chicken, beef, and pork. In fiscal year 2008, Tyson Foods had sales of $26.9 billion and employed over 107,000 team members. Tyson Foods operates vertically integrated poultry and meat production facilities across the United States and internationally, producing over 40 million chickens, 141,860 cattle, and 393,360 hogs per week on average. The company sells its protein products through various distribution channels, including retail consumer products, food service, and international markets.tyson foods 2008 Annual Report

tyson foods 2008 Annual Report finance9

╠²

Tyson Foods had a challenging year financially in 2008 due to high input costs for chicken raising, but was able to remain profitable due to strong performances in pork and beef. The company continued pursuing its strategy of building a multinational business through acquisitions in Brazil, India, and China that will position it for long-term international growth as the global middle class expands. Tyson is also working to develop innovative new products and markets for non-prime meat products through initiatives in renewable fuels, pet foods, nutraceuticals, and biotechnology.general dynamics 2008 Proxy Statement

general dynamics 2008 Proxy Statement finance9

╠²

The document is a notice and proxy statement for the 2008 Annual Meeting of Shareholders of General Dynamics Corporation. It notifies shareholders that the meeting will be held on May 7, 2008 to elect directors, conduct an advisory vote on selecting KPMG LLP as the independent auditor, and consider two shareholder proposals. It provides instructions for shareholders on attending the meeting, voting procedures, revoking proxies, and vote requirements.general dynamics 2007 Annual Report

general dynamics 2007 Annual Report finance9

╠²

This document is General Dynamics' annual report for 2007. It discusses the company's strong financial performance in 2007, with record sales, earnings, cash flow, orders, and backlog. Specifically, net sales increased 13% to $27.24 billion. Earnings from continuing operations grew 21% to $2.08 billion. Cash from continuing operations was $2.95 billion, up 37%. The annual report provides an overview of each of General Dynamics' business segments and their performance in 2007, noting growth across Aerospace, Combat Systems, and Marine Systems.general dynamics Amended and Restated Bylaws

general dynamics Amended and Restated Bylawsfinance9

╠²

This document outlines the amended and restated bylaws of General Dynamics Corporation as of February 4, 2009. It addresses topics such as the location of registered offices, procedures for stockholder meetings, requirements for the board of directors, responsibilities of corporate officers, and procedures for capital stock transactions. The bylaws establish rules for notice, quorum, voting, and other governance matters to guide the operations of the corporation according to Delaware law.Recently uploaded (20)

Business sentiment stabilized in May, but exportersŌĆÖ anxiety and labor shorta...

Business sentiment stabilized in May, but exportersŌĆÖ anxiety and labor shorta...ąåąĮčüčéąĖčéčāčé ąĄą║ąŠąĮąŠą╝č¢čćąĮąĖčģ ą┤ąŠčüą╗č¢ą┤ąČąĄąĮčī čéą░ ą┐ąŠą╗č¢čéąĖčćąĮąĖčģ ą║ąŠąĮčüčāą╗čīčéą░čåč¢ą╣

╠²

Key points:

Ō×ó The highest uncertainty in the 3-month perspective was recorded among exporters, 20.7%

Ō×ó The share of enterprises planning to scale down operations over a 2-year horizon rose to 5%, but 95% do not expect a decline or foresee growth

Ō×ó Labor shortages remain the main obstacle ŌĆö 63% of businesses noted this issue

Ō×ó The second most common obstacles were safety risks and rising prices

Ō×ó Power outages remain a relatively minor issue ŌĆö only 7% mentioned it

Most key indicators of business sentiment remained stable in May. The Business Activity Recovery Index remained unchanged from April at 0.13. The aggregated indicator of industrial prospects, which reflects short-term expectations, slightly declined to 0.11 from 0.12 in MarchŌĆōApril.

These are the findings of the 37th monthly survey conducted by the IER among 474 industrial enterprises.

Uncertainty in the three-month outlook remained unchanged primarily for key production indicators.

ŌĆ£However, we recorded the highest level of three-month uncertainty among exporters. Every fifth exporter ŌĆö 20.7% ŌĆö currently does not know what their export dynamics will be over the next 3ŌĆō4 months,ŌĆØ said IER Executive Director Oksana Kuziakiv.

Uncertainty decreased over longer horizons ŌĆö 6-month and 2-year periods. Currently, only 28.7% of respondents find it difficult to predict their activities two years in advance. This is the lowest share since at least October 2022, when 42.3% of businesses reported uncertainty.

ŌĆ£In May, the share of those planning to reduce their enterpriseŌĆÖs activity over two years increased to 5%. This is still a small number, though higher than AprilŌĆÖs 1.4%. Nearly 80% donŌĆÖt foresee major changes. In fact, 95% of respondents indicate that they will either remain unchanged or experience slight growth. Considering the instability, security, and economic challenges Ukraine faces, this is a very good result,ŌĆØ said Oksana Kuziakiv.

The share of enterprises that increased production in May fell from 26.2% to 19.5%, while the share of those that reduced output grew from 10% to 13.5%. The share of businesses planning to increase production in the next 3ŌĆō4 months slightly declined, from 40.8% to 39.9%.

The total share of enterprises operating at full or near-full production capacity slightly increased in May, from 62% to 63%.

ŌĆ£In January this year, the share of those operating at over 75% of capacity rose significantly. Since then, it has remained relatively unchanged. For example, in May, 53% of companies were in this category,ŌĆØ noted Oksana Kuziakiv.

Expectations for new orders remain cautious: the share of companies with order portfolios longer than a year slightly decreased, from 16% to 15%. On average, the duration of new orders increased from 4.9 to 5 months.

ŌĆ£This happened because the share of those with orders for just one to two months declined from 33% to 24%. Likely, these orders were redistributed: some now work ŌĆśon the fly,ŌĆÖ others shifted into the three-to-five month category,Analytical procedures for audit and assurance

Analytical procedures for audit and assuranceNguytHi7

╠²

Didu nay iluoc sua.d6i theo-quy dinh tai Dieu 1 cua euytit dinh s6 t146l2004/eDN[{NN vd vi6c sua a6i oiau z quyciainl s6 +lstzooatqo NHt[\r 2gt4t2oo4 cira thdng ioc

Ngan hang Nhd nu6c ban hdnh HO th5ng tiri khoan k6 toan c6c T6 chric tin dung, c6 hi0u luc

kd tu ngdy 04 thaag 10 nlm 2004Issues of Trust Returns-ITR 7 CA. Ashok D. Mehta

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehtaimccci

╠²

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehta

INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptx

INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptxAnkush Upadhyay

╠²

This presentation analyzes investment strategies for a 30-year-old risk-averse investor with Ōé╣50 lakhs. Based on a 35:65 equity-debt allocation, it recommends equity investments in HAL, BEL, and Bajaj Auto due to their strong financials and low debt, and debt investments in government and tax-free bonds with stable yields. The analysis balances risk and return for long-term portfolio growth in the defense sector and public sector bonds.How Abhay Bhutada Foundation Strengthens Cultural Education at Shivsrushti.pdf

How Abhay Bhutada Foundation Strengthens Cultural Education at Shivsrushti.pdfSwapnil Pednekar

╠²

This presentation highlights how the Abhay Bhutada Foundation is actively strengthening cultural education through its long-term support of Shivsrushti, a heritage theme park near Pune dedicated to the life of Chhatrapati Shivaji Maharaj. By funding regular maintenance, technological upgrades, and inclusive programs, the Foundation ensures that Shivsrushti remains an engaging learning space for students and visitors. The park combines traditional craftsmanship with digital storytelling to make history accessible and memorable. It also empowers local youth and artisans through training and employment while promoting hands-on education through creative workshops. With plans for future expansion, Shivsrushti stands as a living example of cultural preservation powered by collaboration and philanthropy.chapter 5.pptx: Urban Poverty and Public Policy

chapter 5.pptx: Urban Poverty and Public PolicyAtoshe Elmi

╠²

This chapter analysis Urban Poverty and Public Policy Shakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24

Shakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24Business Analysis

╠²

Qualitative Fundamental Analysis of Shakti Pumps (India) share for its future growth potential (based on the Annual Report FY2024)

Get a sense of the Shakti Pumps (India)'s business activities, by understanding its values, business and risks.

YouTube video: https://youtu.be/lx5SxXcu90g

Order a printed copy of this presentation: BusinessAnalysis.BA.info@gmail.com

--

Disclaimer:

We are not SEBI RIAs. This presentation is not an investment advice. It is only for study and reference purposes.The Rise of UPI & Cashless Transactions: How Mobile Payment Apps Are Transfor...

The Rise of UPI & Cashless Transactions: How Mobile Payment Apps Are Transfor...Digital Shende

╠²

Explore how UPI (Unified Payments Interface) and mobile payment apps like Google Pay, PhonePe, Paytm, and Amazon Pay are revolutionizing financial transactions in India. This ║▌║▌▀ŻShare delves into the business models behind these apps, why their services are free, and how they profit from commissions, data, and additional financial products. Discover the strategic shift towards becoming super apps, offering a full suite of financial services beyond simple payments. Perfect for anyone interested in fintech, digital payments, and the future of banking in India.

SWING TRADING COURSE BY FINANCEWORLD.IO (PDF)

SWING TRADING COURSE BY FINANCEWORLD.IO (PDF)AndrewBorisenko3

╠²

Ride the Market Waves ŌĆō Swing Trading Course by FinanceWorld.io

Discover the smart way to profit from market ups and downs with FinanceWorld.ioŌĆÖs comprehensive Swing Trading Course. This detailed PDF guide is perfect for those seeking a flexible, effective trading style that fits busy schedules, providing you with the strategies and confidence to capture short- to medium-term gains.

WhatŌĆÖs Inside This Course:

Introduction to swing trading and how it compares to day and long-term trading

Understanding market cycles and spotting profitable opportunities

Tools and platforms for successful swing trading

Technical analysis: identifying trends, support & resistance, and reversal patterns

Fundamental factors that influence price swings

Entry and exit timing techniques for maximum profit

Position sizing and risk management essentials

Swing trading psychology and staying disciplined

Case studies, real-world trade examples, and practical tips

Who Should Download This PDF?

Aspiring traders seeking a balance between day trading and investing

Busy professionals who want to trade without monitoring markets all day

Anyone looking to improve their trading results with proven, actionable strategies

Why FinanceWorld.io?

Our clear, step-by-step guidance and expert insights make swing trading accessible to all, from beginners to those wanting to refine their approach. FinanceWorld.io gives you the knowledge and confidence to trade smarter, not harder.STOCK TRADING COURSE BY FINANCEWORLD.IO (PDF)

STOCK TRADING COURSE BY FINANCEWORLD.IO (PDF)AndrewBorisenko3

╠²

Unlock the Power of the Stock Market ŌĆō Stock Trading Course by FinanceWorld.io (PDF)

Take your first step towards financial independence with FinanceWorld.ioŌĆÖs in-depth Stock Trading Course. This easy-to-follow PDF guide demystifies the stock market, providing you with all the essential tools and knowledge to begin trading with confidence.

WhatŌĆÖs Included in This Course:

Introduction to stocks and the stock market ecosystem

Understanding shares, indices, and different market sectors

How to open a brokerage account and place your first trades

Fundamental analysis: reading financial statements and news

Technical analysis: chart patterns, trends, and indicators

Time-tested strategies for beginners and experienced traders

Essential risk management techniques to protect your capital

Trading psychology: mastering emotions and staying disciplined

Real-world examples, practice exercises, and actionable tips

Who Is This PDF For?

New investors looking to enter the world of stock trading

Current traders wanting to refine their approach and strategy

Anyone seeking to build wealth through the stock market

Why Choose FinanceWorld.io?

Our expert-written guides strip away the jargon and focus on practical, real-world trading skills. With FinanceWorld.io, you gain clarity, confidence, and a proven roadmap to succeed in the markets.Questions for FCRA Seminar latest Dec 12, 2023

Questions for FCRA Seminar latest Dec 12, 2023imccci

╠²

Questions for FCRA Seminar latest Dec 12, 2023Making Heritage Inclusive at Shivsrushti - How a single donation made cultura...

Making Heritage Inclusive at Shivsrushti - How a single donation made cultura...Raj Kumble

╠²

Learn how Shivsrushti, with support from the Abhay Bhutada Foundation, is blending storytelling and technology for inclusive cultural education.

Reviving Heritage through the Abhay Bhutada FoundationŌĆÖs Support.pdf

Reviving Heritage through the Abhay Bhutada FoundationŌĆÖs Support.pdfRaj Kumble

╠²

This presentation unfolds over seven slides, beginning with an introduction to ShivsrushtiŌĆÖs immersive design and historical focus. It then highlights the strategic nature of the Abhay Bhutada FoundationŌĆÖs support, emphasizing long-term maintenance and educational outreach. The deck explores how the park integrates modern technology to engage visitors, followed by its inclusive access programs for underprivileged students and rural communities. Hands-on learning experiences and community empowerment initiatives illustrate the parkŌĆÖs commitment to active participation and local development. Finally, the presentation concludes by reflecting on the leadership lessons imparted through Shivsrushti and the enduring cultural impact of the FoundationŌĆÖs patronage.USE AND IMPACT OF INSECTICIDES IN MEALYBUG CONTROL.

USE AND IMPACT OF INSECTICIDES IN MEALYBUG CONTROL.ijab2

╠²

Mealy bugs infests anumber of crop plants and results a serious economic loss. Although, there are a

number of insecticides to overcome the yeild losses in crop plants. But, the presence of waxy layer around

its body that make them so difficult to control by means of insecticides. 2025 RWA Report: When Crypto Gets Real | CoinGecko

2025 RWA Report: When Crypto Gets Real | CoinGeckoCoinGecko Research

╠²

The revival of real world assets (RWA) in crypto marked one of 2024ŌĆÖs most quietly transformative narratives. While attention remained fixated on memecoins, Layer 2 ecosystems, and political betting markets, RWA steadily evolved from a niche experiment into one of the most credible and capitalized sectors in crypto.

So, how far have the core RWA verticals come since the start of 2024?

WeŌĆÖve summarized the key highlights, but be sure to dig into the full 18 slides below.Business sentiment stabilized in May, but exportersŌĆÖ anxiety and labor shorta...

Business sentiment stabilized in May, but exportersŌĆÖ anxiety and labor shorta...ąåąĮčüčéąĖčéčāčé ąĄą║ąŠąĮąŠą╝č¢čćąĮąĖčģ ą┤ąŠčüą╗č¢ą┤ąČąĄąĮčī čéą░ ą┐ąŠą╗č¢čéąĖčćąĮąĖčģ ą║ąŠąĮčüčāą╗čīčéą░čåč¢ą╣

╠²

Ad