Annual Gifting

- 1. By Ward J. Wilsey, JD, LLM3655 Nobel Dr. Suite 345San Diego, CA 92122(858) 764-2672Please send an email to wardwilsey@wilseylaw.comif youâd like a copy of these slidesThe Wilsey Law Firm www.wilseylaw.comAnnual Gifting

- 2. Gift TaxesYou are required to pay a 45% tax on transfers you make to other people for less than full and adequate consideration during your lifetimeUnless an Exclusion appliesAnnual ExclusionLifetime Gift Tax Exclusion

- 3. Annual ExclusionYou can give up to $13,000 to a many different people as youâd likeWe generally do this in the context of gifting to children and grandchildrenSpouses can each gift up to $13,000 to each of their children and grandchildren

- 4. Lifetime Gift Tax ExclusionYou can gift up to $1,000,000 during your lifetimeCumulatively, not to as many different people as youâd likeReduces your estate tax exemptionGifts above the $13,000 to any one person figure eat into the this $1,000,000 Lifetime Gift Tax Exclusion

- 5. Estate Tax Exemption$3,500,000 at deathReduced by any lifetime gifting not covered by the annual exclusionEach spouses receives this exemptionUnless they fail to use an A-B Trust (Bypass Trust)

- 6. ReviewYou can gift up to $13,000 to as many different people as youâd like under the Annual Gift Tax ExclusionIf you gift more than $13,000 to any on person, or if they donât have immediate use of that gift, youâll start to use your $1,000,000 Lifetime Gift Tax ExclusionAny use of your $1,000,000 Lifetime Gift Tax Exclusion will reduce your $3,500,000 Estate Tax Exemption

- 7. Methods of GiftingOutright529 PlansYou can gift up to 5 years worth up frontUGMA or UTMAIrrevocable Trust

- 8. Advantages of Gifts to a TrustControlLeverageAsset Protection

- 9. Gifts to a TrustGifts to a Trust generally do not qualify for the annual exclusionMeaning the client must instead use part of their $1,000,000 Lifetime ExclusionGifts only qualify for the annual exclusion if the âdoneeâ has the unfettered right to use the giftSolution is to use a âCrummey Trustâ

- 10. Crummey TrustIrrevocable TrustGifts are made on behalf of Trust beneficiariesTrustees must have the right to withdraw the contributions for a set period of time30 to 45 days is safeAt the end of the time period, the assets are owned by the trustBecause the beneficiary has the right to withdraw the assets, it is a present gift

- 11. Crummey NoticesVery misunderstoodCrummey Notices provide EVIDENCE that the trust beneficiaries:Knew a gift was being made on their behalf; andKnew they had the right to withdraw the giftThe lack of a Crummey Notice does not mean:The trust assets are in the clients estateThe client loses any chance of having the gift qualify for the annual exclusion

- 12. Correcting Failure to Obtain a Crummey NoticeRECAPAll that is required for gifts to a trust to qualify for an annual exclusion is that the beneficiary must:Know a gift was being made on their behalf; andKnow they had the right to withdraw the giftWays to provide evidence that this is the case:Crummey LettersEmailsA signed Affidavit by the beneficiary, even if signed years after the factSmoke signalsWhatever

- 13. RECAPCrummey Notices are best, but anything that provides conclusive evidence of the gift is sufficient

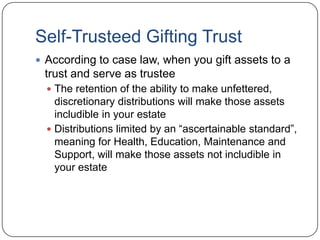

- 14. Self-Trusteed Gifting TrustAccording to case law, when you gift assets to a trust and serve as trusteeThe retention of the ability to make unfettered, discretionary distributions will make those assets includible in your estateDistributions limited by an âascertainable standardâ, meaning for Health, Education, Maintenance and Support, will make those assets not includible in your estate

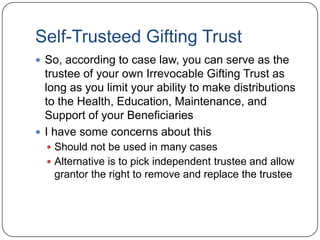

- 15. Self-Trusteed Gifting TrustSo, according to case law, you can serve as the trustee of your own Irrevocable Gifting Trust as long as you limit your ability to make distributions to the Health, Education, Maintenance, and Support of your BeneficiariesI have some concerns about thisShould not be used in many casesAlternative is to pick independent trustee and allow grantor the right to remove and replace the trustee

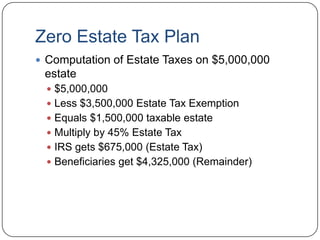

- 16. Zero Estate Tax PlanComputation of Estate Taxes on $5,000,000 estate$5,000,000Less $3,500,000 Estate Tax ExemptionEquals $1,500,000 taxable estateMultiply by 45% Estate TaxIRS gets $675,000 (Estate Tax)Beneficiaries get $4,325,000 (Remainder)

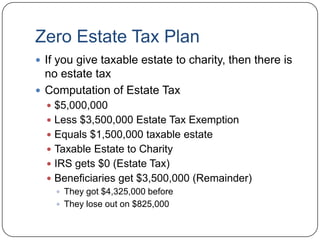

- 17. Zero Estate Tax PlanIf you give taxable estate to charity, then there is no estate taxComputation of Estate Tax$5,000,000Less $3,500,000 Estate Tax ExemptionEquals $1,500,000 taxable estateTaxable Estate to CharityIRS gets $0 (Estate Tax)Beneficiaries get $3,500,000 (Remainder)They got $4,325,000 beforeThey lose out on $825,000

- 18. Zero Estate TaxBut youâve got this Irrevocable TrustIf the Irrevocable Trust invests in part in a life insurance policy with at least a $825,000 death benefit, the Beneficiaries get just as much as they would have had you done nothingBut the IRS gets nothing