CEE SME Banking Club Conference 2015

0 likes107 views

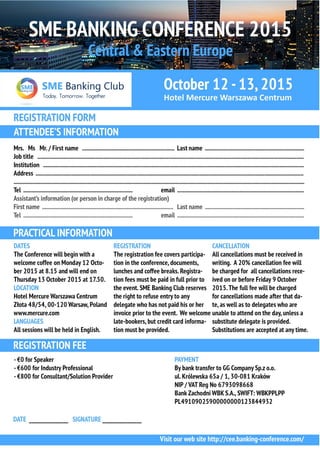

The first annual CEE SME Banking Club Conference 2015. Warsaw, Poland

1 of 3

Download to read offline

Ad

Recommended

Case Study: Falabella

Case Study: FalabellaSME Banking Club

?

Falabella implemented a cybersecurity solution from VUTM to increase security levels across its digital operations in retail, banking, travel, and insurance. The solution included VUTM App & Cloud Server for multifactor authentication, VUTM AES for password and device management, and VUTM Fraud Analysis for user profiling and fraud detection. VUTM's solutions helped Falabella strengthen authentication and protection of clients' confidential information.Case study: Prisma

Case study: PrismaSME Banking Club

?

Prisma Medios de Pago is a banking company in Argentina that partnered with VUTM to implement a biometric authentication solution for its digital onboarding process. The solution uses facial, voice, and fingerprint recognition powered by Microsoft Azure and Cognitive Services to allow users to perform remote transactions safely and with less friction. Prisma chose VUTM's solution because it focuses on empowering users through secure and frictionless transactions, allowing the bank to expand its technological services to other industries. The implemented biometric authentication system manages the user lifecycle and allows remote secure authentication from any device.Case Study: Wilo bank

Case Study: Wilo bankSME Banking Club

?

Wilobank implemented a new onboarding solution using VUTM's authentication, onboarding, and behavior analysis framework. A mobile application was created allowing customers to register using VUTM authentication. This provided a flexible and adaptable solution to market requirements, offering an innovative and simple experience while reducing fraud risk.Digital Factoring for SMEs. CEE Region 2020

Digital Factoring for SMEs. CEE Region 2020SME Banking Club

?

This document summarizes an annual study on digital factoring services for small and medium enterprises (SMEs) in Central and Eastern Europe. It analyzed 12 banks and factoring companies across Poland, Romania, Latvia, and Turkey based on 17 parameters of their online factoring offerings. The study found that the COVID-19 pandemic increased demand for asset-based lending like factoring and drove traditional financial institutions to offer more online products. However, digital factoring offerings in the region still only allow for partial integration with e-invoicing and accounting systems and online/mobile banking. The full study contains an analysis table comparing the 17 parameters for each company and additional documentation.Digital Lending for SMEs. CEE 2020

Digital Lending for SMEs. CEE 2020SME Banking Club

?

The 2020 annual study report analyzes the availability and application process for online loans in the CEE region for SMEs, covering countries like Bulgaria, Poland, and Turkey during the pandemic. It discusses the challenges SMEs face, such as liquidity gaps and the need for quick access to financing, while highlighting trends towards digital lending and the increasing role of fintechs. Key findings include that many banks now offer online lending applications, with over 40% providing fully digital processes tailored to SMEs.Digital SME Sales Tools Study. CEE 2020

Digital SME Sales Tools Study. CEE 2020SME Banking Club

?

The document discusses the digital transformation of SME banking in the CEE region, noting a significant increase in customer acquisition via digital channels from 20% to 50% by early 2020. Key innovations include the implementation of advanced CRM with analytics, AI-powered assistants, and digital communication tools by various banks like Alior and ING Bank. The study highlights successful fintech examples like SMEo and Banca Transilvania's chatbot, demonstrating effective online customer engagement strategies and enhanced operational efficiency for relationship managers.Case Study: The Future of Digital Payments

Case Study: The Future of Digital PaymentsSME Banking Club

?

The document discusses a mobile payment solution launched by several leading banks based on G+D Mobile Security's Convego Hub solution. The solution offers a user-friendly experience, strong security through brand tokenization, and compliance with data regulations. Convego Hub implements an off-the-shelf solution supporting various payment technologies and brands through state-of-the-art mobile security certified by global payment organizations. The solution provides services for physical and digital payments using tokenization and has millions of active users worldwide.§¬§â§Ö§Õ§Ú§ä§à§Ó§Ñ§ß§Ú§Ö - §à§Õ§Ú§ß §Ú§Ù §Ü§Ý§ð§é§Ö§Ó§í§ç §ï§Ý§Ö§Þ§Ö§ß§ä§à§Ó §ï§Ü§à§ã§Ú§ã§ä§Ö§Þ§í §ã§Ú§ã§ä§Ö§Þ§í §à§ß§Ý§Ñ§Û§ß-§Ò§Ñ§ß§Ü§Ñ

§¬§â§Ö§Õ§Ú§ä§à§Ó§Ñ§ß§Ú§Ö - §à§Õ§Ú§ß §Ú§Ù §Ü§Ý§ð§é§Ö§Ó§í§ç §ï§Ý§Ö§Þ§Ö§ß§ä§à§Ó §ï§Ü§à§ã§Ú§ã§ä§Ö§Þ§í §ã§Ú§ã§ä§Ö§Þ§í §à§ß§Ý§Ñ§Û§ß-§Ò§Ñ§ß§Ü§ÑSME Banking Club

?

§¥§à§Ü§å§Þ§Ö§ß§ä §à§á§Ú§ã§í§Ó§Ñ§Ö§ä §å§ã§Ü§à§â§Ö§ß§Ú§Ö §á§Ö§â§Ö§ç§à§Õ§Ñ §Ò§Ñ§ß§Ü§à§Ó§ã§Ü§Ú§ç §å§ã§Ý§å§Ô §Ó §à§ß§Ý§Ñ§Û§ß §Ó §å§ã§Ý§à§Ó§Ú§ñ§ç §á§Ñ§ß§Õ§Ö§Þ§Ú§Ú §Ú §ß§Ö§à§Ò§ç§à§Õ§Ú§Þ§à§ã§ä§î §ã§à§Ù§Õ§Ñ§ß§Ú§ñ §â§Ñ§Ù§Ó§Ú§ä§à§Û §ï§Ü§à§ã§Ú§ã§ä§Ö§Þ§í §Õ§Ý§ñ §à§Ò§Ö§ã§á§Ö§é§Ö§ß§Ú§ñ §Ó§ã§ä§â§Ñ§Ú§Ó§Ñ§ß§Ú§ñ §à§ß§Ý§Ñ§Û§ß-§Ü§â§Ö§Õ§Ú§ä§à§Ó§Ñ§ß§Ú§ñ. §±§â§Ú§Ó§à§Õ§Ú§ä§ã§ñ §Ú§ã§ä§à§â§Ú§ñ §â§Ñ§Ù§Ó§Ú§ä§Ú§ñ §à§ß§Ý§Ñ§Û§ß-§Ü§â§Ö§Õ§Ú§ä§à§Ó§Ñ§ß§Ú§ñ §ã 2008 §Ô§à§Õ§Ñ, §Ó§Ü§Ý§ð§é§Ñ§ñ §Ü§Ý§ð§é§Ö§Ó§í§Ö §ï§ä§Ñ§á§í §Ú §ã§à§Ó§â§Ö§Þ§Ö§ß§ß§í§Ö §ä§Ö§ß§Õ§Ö§ß§è§Ú§Ú §Ó §ï§ä§à§Û §à§Ò§Ý§Ñ§ã§ä§Ú. §´§Ñ§Ü§Ø§Ö §á§à§Õ§é§Ö§â§Ü§Ú§Ó§Ñ§Ö§ä§ã§ñ §Ó§Ñ§Ø§ß§à§ã§ä§î §ä§Ö§ç§ß§à§Ý§à§Ô§Ú§Û, §ä§Ñ§Ü§Ú§ç §Ü§Ñ§Ü §Þ§Ñ§ê§Ú§ß§ß§à§Ö §à§Ò§å§é§Ö§ß§Ú§Ö §Ú §ß§Ö§Û§â§à§ß§ß§í§Ö §ã§Ö§ä§Ú, §Õ§Ý§ñ §á§â§à§è§Ö§ã§ã§Ú§ß§Ô§Ñ §Ù§Ñ§ñ§Ó§à§Ü §Ú §å§á§â§Ñ§Ó§Ý§Ö§ß§Ú§ñ §Ó§Ù§Ñ§Ú§Þ§à§Õ§Ö§Û§ã§ä§Ó§Ú§Ö§Þ §ã §Ü§Ý§Ú§Ö§ß§ä§Ñ§Þ§Ú.SME Banking Club Studies 2020. CEE Region

SME Banking Club Studies 2020. CEE RegionSME Banking Club

?

The document outlines several studies conducted by SME Banking Club on digital banking tools for small and medium enterprises (SMEs) in Central and Eastern Europe. It provides details on upcoming or recently completed studies regarding online banking, mobile banking, digital lending, factoring, trade finance, and digital sales tools. Each study analyzes functionality across 25 banks in countries like Poland, Romania, Bulgaria based on 100+ parameters. Results are presented in Excel tables and PDF reports. Top performing banks will be recognized at an awards gala.Digital Monitoring

Digital MonitoringSME Banking Club

?

§¥§à§Ü§å§Þ§Ö§ß§ä §à§á§Ú§ã§í§Ó§Ñ§Ö§ä §ã§Ú§ã§ä§Ö§Þ§å digital monitoring, §Ü§à§ä§à§â§Ñ§ñ §à§Ò§Ö§ã§á§Ö§é§Ú§Ó§Ñ§Ö§ä §Ü§â§å§Ô§Ý§à§ã§å§ä§à§é§ß§í§Û §Ü§à§ß§ä§â§à§Ý§î §Ú §Ñ§ß§Ñ§Ý§Ú§Ù §è§Ú§æ§â§à§Ó§í§ç §Ò§Ú§Ù§ß§Ö§ã-§á§â§à§è§Ö§ã§ã§à§Ó §Ò§Ñ§ß§Ü§à§Ó, §á§â§Ö§Õ§à§ã§ä§Ñ§Ó§Ý§ñ§ñ §à§ß§Ý§Ñ§Û§ß-§Þ§Ö§ä§â§Ú§Ü§Ú §Ú §Ó§Ú§Ù§å§Ñ§Ý§Ú§Ù§Ñ§è§Ú§ð §Õ§Ñ§ß§ß§í§ç §Õ§Ý§ñ §à§á§Ö§â§Ñ§ä§Ú§Ó§ß§à§Ô§à §â§Ö§Ñ§Ô§Ú§â§à§Ó§Ñ§ß§Ú§ñ §ß§Ñ §Ú§Ù§Þ§Ö§ß§Ö§ß§Ú§ñ. §³§Ú§ã§ä§Ö§Þ§Ñ §Ú§ß§ä§Ö§Ô§â§Ú§â§å§Ö§ä§ã§ñ §ã §â§Ñ§Ù§Ý§Ú§é§ß§í§Þ§Ú §å§Õ§Ñ§Ý§Ö§ß§ß§í§Þ§Ú §ã§Ö§â§Ó§Ú§ã§Ñ§Þ§Ú, §á§à§Ù§Ó§à§Ý§ñ§ñ §à§ä§ã§Ý§Ö§Ø§Ú§Ó§Ñ§ä§î §â§Ñ§Ò§à§ä§à§ã§á§à§ã§à§Ò§ß§à§ã§ä§î §á§Ý§Ñ§ä§æ§à§â§Þ§í §Ú §ï§æ§æ§Ö§Ü§ä§Ú§Ó§ß§à§ã§ä§î §Ó§Ù§Ñ§Ú§Þ§à§Õ§Ö§Û§ã§ä§Ó§Ú§ñ §ã §Ü§Ý§Ú§Ö§ß§ä§Ñ§Þ§Ú. §±§â§Ú§Þ§Ö§ß§Ö§ß§Ú§Ö digital monitoring §à§Ò§Ö§ã§á§Ö§é§Ú§Ó§Ñ§Ö§ä §Ò§í§ã§ä§â§å§ð §Ñ§Õ§Ñ§á§ä§Ñ§è§Ú§ð §Ü §Ú§Ù§Þ§Ö§ß§Ö§ß§Ú§ñ§Þ §Ú §á§à§Ó§í§ê§Ñ§Ö§ä §ß§Ñ§Õ§Ö§Ø§ß§à§ã§ä§î §â§Ñ§Ò§à§ä§í §è§Ú§æ§â§à§Ó§í§ç §ã§Ö§â§Ó§Ú§ã§à§Ó.Creating value for SMEs by creating Ecosystems

Creating value for SMEs by creating EcosystemsSME Banking Club

?

This document discusses trends in online banking for small and medium enterprises (SMEs) in Central and Eastern Europe. It analyzes 25 banks in the region and finds that most offer basic online banking services, while some are beginning to offer more advanced services and create ecosystems for SME customers. The document discusses how banks in Poland like mBank and Santander Bank Polska are integrating value-added services like accounting software and e-invoicing into their online platforms. It maintains that creating ecosystems can help banks cross-sell products and SMEs increase productivity.Charlie India Prague-2019

Charlie India Prague-2019SME Banking Club

?

Katalin Kauzli gave a presentation on building an invoice management service for banks to help small and medium enterprises. Currently, the payments ecosystem is digital but the invoicing process remains largely paper-based. Charlie-India helps banks provide a seamless digital invoicing experience by storing invoices, allowing businesses to issue and receive digital invoices, and integrating invoice data with bank transaction data and accounting systems. A case study from Hungary demonstrated an integrated invoicing and payments ecosystem where invoice and payment data are automatically matched at the bank. The presentation concluded with a demonstration of a real-life invoicing ecosystem simulation to experience the benefits of working with digitally accessible invoice data.How AI changes SME finance

How AI changes SME financeSME Banking Club

?

The document discusses the impact of artificial intelligence (AI) on small and medium enterprise (SME) finance, highlighting key developments such as IBM's Deep Blue defeating chess champion Garry Kasparov and Google's AlphaGo winning against Go champion Lee Sedol. It emphasizes the transition from traditional AI methods to deep learning techniques that allow systems to improve from experience, particularly in financial risk assessment. Efcom is exploring innovative AI strategies for their risk monitoring tool to enhance fraud detection and automate risk control.CHARLIE-INDIA INVOICE HUB

CHARLIE-INDIA INVOICE HUBSME Banking Club

?

This document discusses an invoice hub solution called Charlie-India Invoice HUB that provides invoice-related services to small and medium-sized enterprises (SMEs) to help create value for their customers. It highlights how invoice data is a key asset for both banks and SMEs. The solution allows banks to become an invoice data hub and keep customers within the bank. Developing such a solution in-house would require significant time and resources, so partnering with Charlie-India Invoice HUB provides a ready-made invoicing application and decreases implementation costs and time. The solution includes features like issuing, sending, and managing invoices as well as receiving supplier invoices and enabling one-click payments. This can generate value by realizingE-invoicing webinar

E-invoicing webinarSME Banking Club

?

(1) The document discusses online banking services for SMEs, including e-invoicing. It summarizes a study analyzing 25 banks in the CEE region and their online offerings for SMEs. (2) Key trends identified include the integration of value-added services like online accounting and e-invoicing directly into banks' online platforms. (3) The business rationale for both banks and SMEs to offer and utilize e-invoicing services through banks is described as automation, reduced costs, and access to additional financial services.Online Banking for SMEs. CEE region, June 2019

Online Banking for SMEs. CEE region, June 2019SME Banking Club

?

The document is an annual report by SME Banking Club analyzing online banking functionality for SMEs provided by 25 banks in Central and Eastern Europe. It describes the study methodology, key trends in online banking for SMEs like online customer onboarding and integration of value-added services. The report also includes a ranking of banks based on their online banking offerings for SMEs, with ING Bank ?l?ski, PKO BP, and mBank ranked as the top three providers in the CEE region.Caucasus19

Caucasus19SME Banking Club

?

The document provides information about the 5th annual Caucasus SME Banking Club Conference 2019 to be held on May 16-17, 2019 in Tbilisi, Georgia. The two-day conference will focus on topics related to bank transformations, digital banking, SME finance, and innovations. It will bring together banking professionals from countries across Eastern Europe and Central Asia to share best practices and insights. Attendees can learn about innovations in areas like online lending and customer experience, and network with representatives from major banks in the region. The conference is organized by SME Banking Club and aims to discuss challenges and opportunities in the SME banking sector.Study Tour Poland 2019

Study Tour Poland 2019SME Banking Club

?

This document provides information about a study tour to Poland from April 10-11, 2019 focused on digital SME banking and creating ecosystems for SME customers. The tour will include visits to 3 banks and 2 fintech companies in Warsaw and Lodz to learn about their digital transformation efforts, open banking models, lending to SMEs, and collaborations between banks and fintechs. The goal is for participants to gain insights on Poland's innovation in digital banking for SMEs. The 2-day agenda and registration fees are also outlined. The event is limited to 16 banking and finance professionals.§¶§Ú§ß§Ñ§ß§ã§Ú§â§à§Ó§Ñ§ß§Ú§Ö §®§³§¢

§¶§Ú§ß§Ñ§ß§ã§Ú§â§à§Ó§Ñ§ß§Ú§Ö §®§³§¢SME Banking Club

?

§¶§à§â§å§Þ §á§à§ã§Ó§ñ§ë§Ö§ß §Ó§à§á§â§à§ã§Ñ§Þ §à§Ò§ã§Ý§å§Ø§Ú§Ó§Ñ§ß§Ú§ñ §Ü§Ý§Ú§Ö§ß§ä§à§Ó §Þ§Ñ§Ý§à§Ô§à §Ú §ã§â§Ö§Õ§ß§Ö§Ô§à §Ò§Ú§Ù§ß§Ö§ã§Ñ §Ú §Ó§Ü§Ý§ð§é§Ñ§Ö§ä §á§â§Ñ§Ü§ä§Ú§é§Ö§ã§Ü§Ú§Ö §á§â§Ö§Ù§Ö§ß§ä§Ñ§è§Ú§Ú §ï§Ü§ã§á§Ö§â§ä§à§Ó §Ú §Õ§Ú§ã§Ü§å§ã§ã§Ú§Ú §Õ§Ý§ñ §ä§à§á-§Þ§Ö§ß§Ö§Õ§Ø§Ö§â§à§Ó §Ò§Ñ§ß§Ü§à§Ó. §°§ã§ß§à§Ó§ß§í§Ö §ä§Ö§Þ§í §æ§à§â§å§Þ§Ñ §à§ç§Ó§Ñ§ä§í§Ó§Ñ§ð§ä §Ó§à§Ý§ß§å§ð§ë§Ú§Ö §Ñ§ã§á§Ö§Ü§ä§í §Ü§â§Ö§Õ§Ú§ä§à§Ó§Ñ§ß§Ú§ñ §Ú §Ñ§Ó§ä§à§Þ§Ñ§ä§Ú§Ù§Ñ§è§Ú§Ú §á§â§à§è§Ö§ã§ã§à§Ó §Õ§Ý§ñ §®§³§¢. §µ§é§Ñ§ã§ä§Ú§Ö §Ó§Ü§Ý§ð§é§Ñ§Ö§ä§ã§ñ §Ó §â§Ñ§Ù§ß§å§ð §è§Ö§ß§à§Ó§å§ð §Ü§Ñ§ä§Ö§Ô§à§â§Ú§ð §Ó §Ù§Ñ§Ó§Ú§ã§Ú§Þ§à§ã§ä§Ú §à§ä §ã§ä§Ñ§ä§å§ã§Ñ §å§é§Ñ§ã§ä§ß§Ú§Ü§à§Ó, §Þ§Ö§â§à§á§â§Ú§ñ§ä§Ú§Ö §á§â§à§Û§Õ§Ö§ä §Ó §¬§Ú§Ö§Ó§Ö.Bucharest18

Bucharest18SME Banking Club

?

The document is an invitation to the SME Finance Meeting taking place on November 28 in Bucharest, Romania. The meeting will discuss key digital trends and solutions for SME lending, factoring, and customer onboarding. The agenda includes presentations on digital strategies in SME banking in Central and Eastern Europe and the customer journey in the digital age, as well as a Q&A session and networking reception. Attendees must RSVP by November 23 to confirm attendance.CEE SME Banking Club Conference 2018

CEE SME Banking Club Conference 2018SME Banking Club

?

The SME Banking Club is hosting its IV Annual Conference from October 29-30, 2018, in Warsaw, Poland, focusing on digital transformation trends in SME banking and the roles of new financial players. The event will feature expert speakers from various financial institutions discussing cooperation between banks and fintechs, innovations in SME banking, and digital transformation strategies. Participants can register online and enjoy networking opportunities and presentations on the latest in SME financial services.CEE SME Banking Club Conference 2017

CEE SME Banking Club Conference 2017SME Banking Club

?

The SME Banking Club is organizing the III Annual SME Banking Club Conference in Krakow, Poland from November 23-24, 2017, focusing on digital transformation trends in micro-, small, and medium enterprises (SME) banking. Key speakers include industry leaders and experts who will discuss innovations, customer experiences, and financial services for SMEs. This conference aims to foster networking among business bankers and financial experts while showcasing advancements in SME banking.CEE SME Banking Club Conference 2016

CEE SME Banking Club Conference 2016SME Banking Club

?

The document provides information about the SME Banking Club's annual conference being held on October 23-24, 2016 in Warsaw, Poland. The conference will focus on best practices and innovations in small and medium business banking in Central and Eastern Europe. It will include sessions on trends in CEE banking markets, collaborating with startups, competing with global players, non-financial services, credit risk models, and more. Speakers will represent major banks like BNP Paribas, Nordea, and Sberbank as well as fintech companies. Participants include senior executives from commercial, SME, and business banking. Registration is required through the provided website.Caucasus SME Banking Club Conference 2017

Caucasus SME Banking Club Conference 2017SME Banking Club

?

The Caucasus SME Banking Club Conference 2017 will take place on May 24-25 in Tbilisi, Georgia, at the Biltmore Hotel and Georgia's Innovation Technology Park. This international event will explore topics like startup banking, innovations, and non-financial services for SMEs, featuring discussions and keynote speakers from influential banks and financial institutions in the region. Registration is available online, with various fees for attendees depending on their organizational affiliation.Caucasus SME Banking Club Conference 2016

Caucasus SME Banking Club Conference 2016SME Banking Club

?

The Caucasus SME Banking Conference, scheduled for May 18-19, 2016, in Tbilisi, Georgia, will gather top bank executives to discuss critical topics in SME banking. Key themes include crisis management, innovations in the SME segment, and the financing landscape for small and medium enterprises. The event offers networking opportunities and practical sessions aimed at enhancing operational efficiency and strategic planning in the banking sector.Almaty SME Banking Club Seminar 2018

Almaty SME Banking Club Seminar 2018SME Banking Club

?

13 §Þ§Ñ§â§ä§Ñ 2018 §Ô§à§Õ§Ñ §Ó §¡§Ý§Þ§Ñ§ä§í §á§â§à§Û§Õ§Ö§ä §ã§Ö§Þ§Ú§ß§Ñ§â SME Banking Club §ã§à§Ó§Þ§Ö§ã§ä§ß§à §ã §Ò§Ú§Ù§ß§Ö§ã- §Ú §æ§Ú§ß§Ñ§ß§ã§à§Ó§í§Þ §Ü§à§ß§ã§Ñ§Ý§ä§Ú§ß§Ô§à§Þ, §á§à§ã§Ó§ñ§ë§Ö§ß§ß§í§Û §Ó§à§á§â§à§ã§Ñ§Þ, §ã §Ü§à§ä§à§â§í§Þ§Ú §ã§ä§Ñ§Ý§Ü§Ú§Ó§Ñ§ð§ä§ã§ñ §Ò§Ñ§ß§Ü§Ú §á§â§Ú §â§Ñ§Ò§à§ä§Ö §ã §Þ§Ñ§Ý§í§Þ §Ú §ã§â§Ö§Õ§ß§Ú§Þ §Ò§Ú§Ù§ß§Ö§ã§à§Þ. §µ§é§Ñ§ã§ä§ß§Ú§Ü§Ú §ã§Þ§à§Ô§å§ä §á§à§Ý§å§é§Ú§ä§î §Ñ§Ü§ä§å§Ñ§Ý§î§ß§å§ð §Ú§ß§æ§à§â§Þ§Ñ§è§Ú§ð §à §ä§â§Ö§ß§Õ§Ñ§ç §Ú§ß§ä§Ö§â§ß§Ö§ä- §Ú §Þ§à§Ò§Ú§Ý§î§ß§à§Ô§à §Ò§Ñ§ß§Ü§Ú§ß§Ô§Ñ, §Ò§Ú§Ù§ß§Ö§ã-§ã§Ö§Ô§Þ§Ö§ß§ä§Ñ§è§Ú§Ú, §Ü§â§Ö§Õ§Ú§ä§ß§í§ç §á§â§à§è§Ö§ã§ã§Ñ§ç §Ú §á§à§ã§ä§â§à§Ö§ß§Ú§Ú §ï§æ§æ§Ö§Ü§ä§Ú§Ó§ß§à§Û §ã§ä§â§Ñ§ä§Ö§Ô§Ú§Ú collection. §µ§é§Ñ§ã§ä§Ú§Ö §Ò§Ö§ã§á§Ý§Ñ§ä§ß§à§Ö, §ß§Ö§à§Ò§ç§à§Õ§Ú§Þ§Ñ §á§â§Ö§Õ§Ó§Ñ§â§Ú§ä§Ö§Ý§î§ß§Ñ§ñ §â§Ö§Ô§Ú§ã§ä§â§Ñ§è§Ú§ñ.Almaty SME Banking Club Seminar 2017

Almaty SME Banking Club Seminar 2017SME Banking Club

?

5 §ã§Ö§ß§ä§ñ§Ò§â§ñ 2017 §Ô§à§Õ§Ñ §Ó §¡§Ý§Þ§Ñ§ä§í §á§â§à§ç§à§Õ§Ú§ä §ã§Ö§Þ§Ú§ß§Ñ§â, §à§â§Ô§Ñ§ß§Ú§Ù§à§Ó§Ñ§ß§ß§í§Û SME Banking Club §Ú Clear Junction, §á§à§ã§Ó§ñ§ë§×§ß§ß§í§Û §Ñ§Ü§ä§å§Ñ§Ý§î§ß§í§Þ §Ó§à§á§â§à§ã§Ñ§Þ §Ü§â§Ö§Õ§Ú§ä§à§Ó§Ñ§ß§Ú§ñ §Ú §è§Ú§æ§â§à§Ó§à§Ô§à §Ò§Ñ§ß§Ü§Ú§ß§Ô§Ñ §Õ§Ý§ñ §Þ§Ñ§Ý§à§Ô§à §Ú §ã§â§Ö§Õ§ß§Ö§Ô§à §Ò§Ú§Ù§ß§Ö§ã§Ñ. §µ§é§Ñ§ã§ä§Ú§Ö §Ó §ã§Ö§Þ§Ú§ß§Ñ§â§Ö §Ò§Ö§ã§á§Ý§Ñ§ä§ß§à, §á§â§Ö§Õ§Ó§Ñ§â§Ú§ä§Ö§Ý§î§ß§Ñ§ñ §â§Ö§Ô§Ú§ã§ä§â§Ñ§è§Ú§ñ §à§Ò§ñ§Ù§Ñ§ä§Ö§Ý§î§ß§Ñ. §±§â§à§Ô§â§Ñ§Þ§Þ§Ñ §Ó§Ü§Ý§ð§é§Ñ§Ö§ä §à§Ò§ã§å§Ø§Õ§Ö§ß§Ú§Ö §Þ§Ú§â§à§Ó§í§ç §ä§â§Ö§ß§Õ§à§Ó, §á§â§Ñ§Ü§ä§Ú§é§Ö§ã§Ü§Ú§ç §Ü§Ö§Û§ã§à§Ó §Ú §Ü§â§å§Ô§Ý§í§Û §ã§ä§à§Ý §ã §ï§Ü§ã§á§Ö§â§ä§Ñ§Þ§Ú §Ó §à§Ò§Ý§Ñ§ã§ä§Ú §®§³§¢.Central Asia SME Banking Club Conference 2018

Central Asia SME Banking Club Conference 2018SME Banking Club

?

The document details the agenda for the SME Banking Club Conference 2018 held on October 19, 2018, in Almaty, Kazakhstan, focusing on innovations in financial services for small and medium businesses. Key sessions included presentations on SME banking strategies, digital banking solutions, and the role of microfinance in SME financing, featuring various industry experts as speakers. The event was organized by the SME Banking Club and aimed to address regional issues and best practices in the sector.Sustainable Muslim Community Development.pptx

Sustainable Muslim Community Development.pptxDr T AASIF AHMED

?

Dear Colleagues and Friends,

Community development is a powerful catalyst for national progress. When each community designs its own development model tailored to its unique needs, strengths, and values, transformative change unfolds at the grassroots¡ªlaying the foundation for a stronger, more resilient nation.

Inspired by this principle, I conducted a pilot study across global Muslim communities and formulated the ¡°Muslim Community Development: A?Centre?Approach¡± (MCD Model). This model builds on core community development concepts¡ªempowerment, asset-based planning, inclusivity, and local ownership ¡ªto mobilize community assets and encourage broad participation for sustainable social, economic, and cultural uplift.

I firmly believe the MCD Model offers a valuable framework not only for Muslim communities, but for any community worldwide. While it¡¯s currently in its pilot phase, I¡¯m committed to comparing its results with other community development models to evaluate effectiveness, scalability, and best practices.

Your suggestions, insights, and feedback are warmly welcomed. Please feel free to contact me for further discussion or clarification:

Dr.?T.?Aasif?Ahmed

? aasifahmed.t@gmail.comMore Related Content

More from SME Banking Club (20)

SME Banking Club Studies 2020. CEE Region

SME Banking Club Studies 2020. CEE RegionSME Banking Club

?

The document outlines several studies conducted by SME Banking Club on digital banking tools for small and medium enterprises (SMEs) in Central and Eastern Europe. It provides details on upcoming or recently completed studies regarding online banking, mobile banking, digital lending, factoring, trade finance, and digital sales tools. Each study analyzes functionality across 25 banks in countries like Poland, Romania, Bulgaria based on 100+ parameters. Results are presented in Excel tables and PDF reports. Top performing banks will be recognized at an awards gala.Digital Monitoring

Digital MonitoringSME Banking Club

?

§¥§à§Ü§å§Þ§Ö§ß§ä §à§á§Ú§ã§í§Ó§Ñ§Ö§ä §ã§Ú§ã§ä§Ö§Þ§å digital monitoring, §Ü§à§ä§à§â§Ñ§ñ §à§Ò§Ö§ã§á§Ö§é§Ú§Ó§Ñ§Ö§ä §Ü§â§å§Ô§Ý§à§ã§å§ä§à§é§ß§í§Û §Ü§à§ß§ä§â§à§Ý§î §Ú §Ñ§ß§Ñ§Ý§Ú§Ù §è§Ú§æ§â§à§Ó§í§ç §Ò§Ú§Ù§ß§Ö§ã-§á§â§à§è§Ö§ã§ã§à§Ó §Ò§Ñ§ß§Ü§à§Ó, §á§â§Ö§Õ§à§ã§ä§Ñ§Ó§Ý§ñ§ñ §à§ß§Ý§Ñ§Û§ß-§Þ§Ö§ä§â§Ú§Ü§Ú §Ú §Ó§Ú§Ù§å§Ñ§Ý§Ú§Ù§Ñ§è§Ú§ð §Õ§Ñ§ß§ß§í§ç §Õ§Ý§ñ §à§á§Ö§â§Ñ§ä§Ú§Ó§ß§à§Ô§à §â§Ö§Ñ§Ô§Ú§â§à§Ó§Ñ§ß§Ú§ñ §ß§Ñ §Ú§Ù§Þ§Ö§ß§Ö§ß§Ú§ñ. §³§Ú§ã§ä§Ö§Þ§Ñ §Ú§ß§ä§Ö§Ô§â§Ú§â§å§Ö§ä§ã§ñ §ã §â§Ñ§Ù§Ý§Ú§é§ß§í§Þ§Ú §å§Õ§Ñ§Ý§Ö§ß§ß§í§Þ§Ú §ã§Ö§â§Ó§Ú§ã§Ñ§Þ§Ú, §á§à§Ù§Ó§à§Ý§ñ§ñ §à§ä§ã§Ý§Ö§Ø§Ú§Ó§Ñ§ä§î §â§Ñ§Ò§à§ä§à§ã§á§à§ã§à§Ò§ß§à§ã§ä§î §á§Ý§Ñ§ä§æ§à§â§Þ§í §Ú §ï§æ§æ§Ö§Ü§ä§Ú§Ó§ß§à§ã§ä§î §Ó§Ù§Ñ§Ú§Þ§à§Õ§Ö§Û§ã§ä§Ó§Ú§ñ §ã §Ü§Ý§Ú§Ö§ß§ä§Ñ§Þ§Ú. §±§â§Ú§Þ§Ö§ß§Ö§ß§Ú§Ö digital monitoring §à§Ò§Ö§ã§á§Ö§é§Ú§Ó§Ñ§Ö§ä §Ò§í§ã§ä§â§å§ð §Ñ§Õ§Ñ§á§ä§Ñ§è§Ú§ð §Ü §Ú§Ù§Þ§Ö§ß§Ö§ß§Ú§ñ§Þ §Ú §á§à§Ó§í§ê§Ñ§Ö§ä §ß§Ñ§Õ§Ö§Ø§ß§à§ã§ä§î §â§Ñ§Ò§à§ä§í §è§Ú§æ§â§à§Ó§í§ç §ã§Ö§â§Ó§Ú§ã§à§Ó.Creating value for SMEs by creating Ecosystems

Creating value for SMEs by creating EcosystemsSME Banking Club

?

This document discusses trends in online banking for small and medium enterprises (SMEs) in Central and Eastern Europe. It analyzes 25 banks in the region and finds that most offer basic online banking services, while some are beginning to offer more advanced services and create ecosystems for SME customers. The document discusses how banks in Poland like mBank and Santander Bank Polska are integrating value-added services like accounting software and e-invoicing into their online platforms. It maintains that creating ecosystems can help banks cross-sell products and SMEs increase productivity.Charlie India Prague-2019

Charlie India Prague-2019SME Banking Club

?

Katalin Kauzli gave a presentation on building an invoice management service for banks to help small and medium enterprises. Currently, the payments ecosystem is digital but the invoicing process remains largely paper-based. Charlie-India helps banks provide a seamless digital invoicing experience by storing invoices, allowing businesses to issue and receive digital invoices, and integrating invoice data with bank transaction data and accounting systems. A case study from Hungary demonstrated an integrated invoicing and payments ecosystem where invoice and payment data are automatically matched at the bank. The presentation concluded with a demonstration of a real-life invoicing ecosystem simulation to experience the benefits of working with digitally accessible invoice data.How AI changes SME finance

How AI changes SME financeSME Banking Club

?

The document discusses the impact of artificial intelligence (AI) on small and medium enterprise (SME) finance, highlighting key developments such as IBM's Deep Blue defeating chess champion Garry Kasparov and Google's AlphaGo winning against Go champion Lee Sedol. It emphasizes the transition from traditional AI methods to deep learning techniques that allow systems to improve from experience, particularly in financial risk assessment. Efcom is exploring innovative AI strategies for their risk monitoring tool to enhance fraud detection and automate risk control.CHARLIE-INDIA INVOICE HUB

CHARLIE-INDIA INVOICE HUBSME Banking Club

?

This document discusses an invoice hub solution called Charlie-India Invoice HUB that provides invoice-related services to small and medium-sized enterprises (SMEs) to help create value for their customers. It highlights how invoice data is a key asset for both banks and SMEs. The solution allows banks to become an invoice data hub and keep customers within the bank. Developing such a solution in-house would require significant time and resources, so partnering with Charlie-India Invoice HUB provides a ready-made invoicing application and decreases implementation costs and time. The solution includes features like issuing, sending, and managing invoices as well as receiving supplier invoices and enabling one-click payments. This can generate value by realizingE-invoicing webinar

E-invoicing webinarSME Banking Club

?

(1) The document discusses online banking services for SMEs, including e-invoicing. It summarizes a study analyzing 25 banks in the CEE region and their online offerings for SMEs. (2) Key trends identified include the integration of value-added services like online accounting and e-invoicing directly into banks' online platforms. (3) The business rationale for both banks and SMEs to offer and utilize e-invoicing services through banks is described as automation, reduced costs, and access to additional financial services.Online Banking for SMEs. CEE region, June 2019

Online Banking for SMEs. CEE region, June 2019SME Banking Club

?

The document is an annual report by SME Banking Club analyzing online banking functionality for SMEs provided by 25 banks in Central and Eastern Europe. It describes the study methodology, key trends in online banking for SMEs like online customer onboarding and integration of value-added services. The report also includes a ranking of banks based on their online banking offerings for SMEs, with ING Bank ?l?ski, PKO BP, and mBank ranked as the top three providers in the CEE region.Caucasus19

Caucasus19SME Banking Club

?

The document provides information about the 5th annual Caucasus SME Banking Club Conference 2019 to be held on May 16-17, 2019 in Tbilisi, Georgia. The two-day conference will focus on topics related to bank transformations, digital banking, SME finance, and innovations. It will bring together banking professionals from countries across Eastern Europe and Central Asia to share best practices and insights. Attendees can learn about innovations in areas like online lending and customer experience, and network with representatives from major banks in the region. The conference is organized by SME Banking Club and aims to discuss challenges and opportunities in the SME banking sector.Study Tour Poland 2019

Study Tour Poland 2019SME Banking Club

?

This document provides information about a study tour to Poland from April 10-11, 2019 focused on digital SME banking and creating ecosystems for SME customers. The tour will include visits to 3 banks and 2 fintech companies in Warsaw and Lodz to learn about their digital transformation efforts, open banking models, lending to SMEs, and collaborations between banks and fintechs. The goal is for participants to gain insights on Poland's innovation in digital banking for SMEs. The 2-day agenda and registration fees are also outlined. The event is limited to 16 banking and finance professionals.§¶§Ú§ß§Ñ§ß§ã§Ú§â§à§Ó§Ñ§ß§Ú§Ö §®§³§¢

§¶§Ú§ß§Ñ§ß§ã§Ú§â§à§Ó§Ñ§ß§Ú§Ö §®§³§¢SME Banking Club

?

§¶§à§â§å§Þ §á§à§ã§Ó§ñ§ë§Ö§ß §Ó§à§á§â§à§ã§Ñ§Þ §à§Ò§ã§Ý§å§Ø§Ú§Ó§Ñ§ß§Ú§ñ §Ü§Ý§Ú§Ö§ß§ä§à§Ó §Þ§Ñ§Ý§à§Ô§à §Ú §ã§â§Ö§Õ§ß§Ö§Ô§à §Ò§Ú§Ù§ß§Ö§ã§Ñ §Ú §Ó§Ü§Ý§ð§é§Ñ§Ö§ä §á§â§Ñ§Ü§ä§Ú§é§Ö§ã§Ü§Ú§Ö §á§â§Ö§Ù§Ö§ß§ä§Ñ§è§Ú§Ú §ï§Ü§ã§á§Ö§â§ä§à§Ó §Ú §Õ§Ú§ã§Ü§å§ã§ã§Ú§Ú §Õ§Ý§ñ §ä§à§á-§Þ§Ö§ß§Ö§Õ§Ø§Ö§â§à§Ó §Ò§Ñ§ß§Ü§à§Ó. §°§ã§ß§à§Ó§ß§í§Ö §ä§Ö§Þ§í §æ§à§â§å§Þ§Ñ §à§ç§Ó§Ñ§ä§í§Ó§Ñ§ð§ä §Ó§à§Ý§ß§å§ð§ë§Ú§Ö §Ñ§ã§á§Ö§Ü§ä§í §Ü§â§Ö§Õ§Ú§ä§à§Ó§Ñ§ß§Ú§ñ §Ú §Ñ§Ó§ä§à§Þ§Ñ§ä§Ú§Ù§Ñ§è§Ú§Ú §á§â§à§è§Ö§ã§ã§à§Ó §Õ§Ý§ñ §®§³§¢. §µ§é§Ñ§ã§ä§Ú§Ö §Ó§Ü§Ý§ð§é§Ñ§Ö§ä§ã§ñ §Ó §â§Ñ§Ù§ß§å§ð §è§Ö§ß§à§Ó§å§ð §Ü§Ñ§ä§Ö§Ô§à§â§Ú§ð §Ó §Ù§Ñ§Ó§Ú§ã§Ú§Þ§à§ã§ä§Ú §à§ä §ã§ä§Ñ§ä§å§ã§Ñ §å§é§Ñ§ã§ä§ß§Ú§Ü§à§Ó, §Þ§Ö§â§à§á§â§Ú§ñ§ä§Ú§Ö §á§â§à§Û§Õ§Ö§ä §Ó §¬§Ú§Ö§Ó§Ö.Bucharest18

Bucharest18SME Banking Club

?

The document is an invitation to the SME Finance Meeting taking place on November 28 in Bucharest, Romania. The meeting will discuss key digital trends and solutions for SME lending, factoring, and customer onboarding. The agenda includes presentations on digital strategies in SME banking in Central and Eastern Europe and the customer journey in the digital age, as well as a Q&A session and networking reception. Attendees must RSVP by November 23 to confirm attendance.CEE SME Banking Club Conference 2018

CEE SME Banking Club Conference 2018SME Banking Club

?

The SME Banking Club is hosting its IV Annual Conference from October 29-30, 2018, in Warsaw, Poland, focusing on digital transformation trends in SME banking and the roles of new financial players. The event will feature expert speakers from various financial institutions discussing cooperation between banks and fintechs, innovations in SME banking, and digital transformation strategies. Participants can register online and enjoy networking opportunities and presentations on the latest in SME financial services.CEE SME Banking Club Conference 2017

CEE SME Banking Club Conference 2017SME Banking Club

?

The SME Banking Club is organizing the III Annual SME Banking Club Conference in Krakow, Poland from November 23-24, 2017, focusing on digital transformation trends in micro-, small, and medium enterprises (SME) banking. Key speakers include industry leaders and experts who will discuss innovations, customer experiences, and financial services for SMEs. This conference aims to foster networking among business bankers and financial experts while showcasing advancements in SME banking.CEE SME Banking Club Conference 2016

CEE SME Banking Club Conference 2016SME Banking Club

?

The document provides information about the SME Banking Club's annual conference being held on October 23-24, 2016 in Warsaw, Poland. The conference will focus on best practices and innovations in small and medium business banking in Central and Eastern Europe. It will include sessions on trends in CEE banking markets, collaborating with startups, competing with global players, non-financial services, credit risk models, and more. Speakers will represent major banks like BNP Paribas, Nordea, and Sberbank as well as fintech companies. Participants include senior executives from commercial, SME, and business banking. Registration is required through the provided website.Caucasus SME Banking Club Conference 2017

Caucasus SME Banking Club Conference 2017SME Banking Club

?

The Caucasus SME Banking Club Conference 2017 will take place on May 24-25 in Tbilisi, Georgia, at the Biltmore Hotel and Georgia's Innovation Technology Park. This international event will explore topics like startup banking, innovations, and non-financial services for SMEs, featuring discussions and keynote speakers from influential banks and financial institutions in the region. Registration is available online, with various fees for attendees depending on their organizational affiliation.Caucasus SME Banking Club Conference 2016

Caucasus SME Banking Club Conference 2016SME Banking Club

?

The Caucasus SME Banking Conference, scheduled for May 18-19, 2016, in Tbilisi, Georgia, will gather top bank executives to discuss critical topics in SME banking. Key themes include crisis management, innovations in the SME segment, and the financing landscape for small and medium enterprises. The event offers networking opportunities and practical sessions aimed at enhancing operational efficiency and strategic planning in the banking sector.Almaty SME Banking Club Seminar 2018

Almaty SME Banking Club Seminar 2018SME Banking Club

?

13 §Þ§Ñ§â§ä§Ñ 2018 §Ô§à§Õ§Ñ §Ó §¡§Ý§Þ§Ñ§ä§í §á§â§à§Û§Õ§Ö§ä §ã§Ö§Þ§Ú§ß§Ñ§â SME Banking Club §ã§à§Ó§Þ§Ö§ã§ä§ß§à §ã §Ò§Ú§Ù§ß§Ö§ã- §Ú §æ§Ú§ß§Ñ§ß§ã§à§Ó§í§Þ §Ü§à§ß§ã§Ñ§Ý§ä§Ú§ß§Ô§à§Þ, §á§à§ã§Ó§ñ§ë§Ö§ß§ß§í§Û §Ó§à§á§â§à§ã§Ñ§Þ, §ã §Ü§à§ä§à§â§í§Þ§Ú §ã§ä§Ñ§Ý§Ü§Ú§Ó§Ñ§ð§ä§ã§ñ §Ò§Ñ§ß§Ü§Ú §á§â§Ú §â§Ñ§Ò§à§ä§Ö §ã §Þ§Ñ§Ý§í§Þ §Ú §ã§â§Ö§Õ§ß§Ú§Þ §Ò§Ú§Ù§ß§Ö§ã§à§Þ. §µ§é§Ñ§ã§ä§ß§Ú§Ü§Ú §ã§Þ§à§Ô§å§ä §á§à§Ý§å§é§Ú§ä§î §Ñ§Ü§ä§å§Ñ§Ý§î§ß§å§ð §Ú§ß§æ§à§â§Þ§Ñ§è§Ú§ð §à §ä§â§Ö§ß§Õ§Ñ§ç §Ú§ß§ä§Ö§â§ß§Ö§ä- §Ú §Þ§à§Ò§Ú§Ý§î§ß§à§Ô§à §Ò§Ñ§ß§Ü§Ú§ß§Ô§Ñ, §Ò§Ú§Ù§ß§Ö§ã-§ã§Ö§Ô§Þ§Ö§ß§ä§Ñ§è§Ú§Ú, §Ü§â§Ö§Õ§Ú§ä§ß§í§ç §á§â§à§è§Ö§ã§ã§Ñ§ç §Ú §á§à§ã§ä§â§à§Ö§ß§Ú§Ú §ï§æ§æ§Ö§Ü§ä§Ú§Ó§ß§à§Û §ã§ä§â§Ñ§ä§Ö§Ô§Ú§Ú collection. §µ§é§Ñ§ã§ä§Ú§Ö §Ò§Ö§ã§á§Ý§Ñ§ä§ß§à§Ö, §ß§Ö§à§Ò§ç§à§Õ§Ú§Þ§Ñ §á§â§Ö§Õ§Ó§Ñ§â§Ú§ä§Ö§Ý§î§ß§Ñ§ñ §â§Ö§Ô§Ú§ã§ä§â§Ñ§è§Ú§ñ.Almaty SME Banking Club Seminar 2017

Almaty SME Banking Club Seminar 2017SME Banking Club

?

5 §ã§Ö§ß§ä§ñ§Ò§â§ñ 2017 §Ô§à§Õ§Ñ §Ó §¡§Ý§Þ§Ñ§ä§í §á§â§à§ç§à§Õ§Ú§ä §ã§Ö§Þ§Ú§ß§Ñ§â, §à§â§Ô§Ñ§ß§Ú§Ù§à§Ó§Ñ§ß§ß§í§Û SME Banking Club §Ú Clear Junction, §á§à§ã§Ó§ñ§ë§×§ß§ß§í§Û §Ñ§Ü§ä§å§Ñ§Ý§î§ß§í§Þ §Ó§à§á§â§à§ã§Ñ§Þ §Ü§â§Ö§Õ§Ú§ä§à§Ó§Ñ§ß§Ú§ñ §Ú §è§Ú§æ§â§à§Ó§à§Ô§à §Ò§Ñ§ß§Ü§Ú§ß§Ô§Ñ §Õ§Ý§ñ §Þ§Ñ§Ý§à§Ô§à §Ú §ã§â§Ö§Õ§ß§Ö§Ô§à §Ò§Ú§Ù§ß§Ö§ã§Ñ. §µ§é§Ñ§ã§ä§Ú§Ö §Ó §ã§Ö§Þ§Ú§ß§Ñ§â§Ö §Ò§Ö§ã§á§Ý§Ñ§ä§ß§à, §á§â§Ö§Õ§Ó§Ñ§â§Ú§ä§Ö§Ý§î§ß§Ñ§ñ §â§Ö§Ô§Ú§ã§ä§â§Ñ§è§Ú§ñ §à§Ò§ñ§Ù§Ñ§ä§Ö§Ý§î§ß§Ñ. §±§â§à§Ô§â§Ñ§Þ§Þ§Ñ §Ó§Ü§Ý§ð§é§Ñ§Ö§ä §à§Ò§ã§å§Ø§Õ§Ö§ß§Ú§Ö §Þ§Ú§â§à§Ó§í§ç §ä§â§Ö§ß§Õ§à§Ó, §á§â§Ñ§Ü§ä§Ú§é§Ö§ã§Ü§Ú§ç §Ü§Ö§Û§ã§à§Ó §Ú §Ü§â§å§Ô§Ý§í§Û §ã§ä§à§Ý §ã §ï§Ü§ã§á§Ö§â§ä§Ñ§Þ§Ú §Ó §à§Ò§Ý§Ñ§ã§ä§Ú §®§³§¢.Central Asia SME Banking Club Conference 2018

Central Asia SME Banking Club Conference 2018SME Banking Club

?

The document details the agenda for the SME Banking Club Conference 2018 held on October 19, 2018, in Almaty, Kazakhstan, focusing on innovations in financial services for small and medium businesses. Key sessions included presentations on SME banking strategies, digital banking solutions, and the role of microfinance in SME financing, featuring various industry experts as speakers. The event was organized by the SME Banking Club and aimed to address regional issues and best practices in the sector.Recently uploaded (20)

Sustainable Muslim Community Development.pptx

Sustainable Muslim Community Development.pptxDr T AASIF AHMED

?

Dear Colleagues and Friends,

Community development is a powerful catalyst for national progress. When each community designs its own development model tailored to its unique needs, strengths, and values, transformative change unfolds at the grassroots¡ªlaying the foundation for a stronger, more resilient nation.

Inspired by this principle, I conducted a pilot study across global Muslim communities and formulated the ¡°Muslim Community Development: A?Centre?Approach¡± (MCD Model). This model builds on core community development concepts¡ªempowerment, asset-based planning, inclusivity, and local ownership ¡ªto mobilize community assets and encourage broad participation for sustainable social, economic, and cultural uplift.

I firmly believe the MCD Model offers a valuable framework not only for Muslim communities, but for any community worldwide. While it¡¯s currently in its pilot phase, I¡¯m committed to comparing its results with other community development models to evaluate effectiveness, scalability, and best practices.

Your suggestions, insights, and feedback are warmly welcomed. Please feel free to contact me for further discussion or clarification:

Dr.?T.?Aasif?Ahmed

? aasifahmed.t@gmail.comKeyman Training_ Edited Module_ver1.ppsx

Keyman Training_ Edited Module_ver1.ppsxfarooquidrfaisal

?

KeyMan Insurance Policy It's Benefits and Features Population aging DSGE OLG NK model Euro Zone

Population aging DSGE OLG NK model Euro Zonesradomska

?

Population aging through the lens of DSGE-OLG-NK model: implications for unemployment and monetary policy in the Euro areaAdrien Matray - A Prominent Macroeconomist

Adrien Matray - A Prominent MacroeconomistAdrien Matray

?

Adrien Matray is an applied macroeconomist whose research examines how finance shapes economic growth and economic inequality. Growing up in the less affluent suburbs of Paris, where economic disparities were stark, sparked his interest in understanding how financial systems affect well-being. His work addresses critical issues like income inequality and lack of access to formal financial institutions, aiming to inform policies that better regulate alternative financial services and promote equitable economic outcomes, especially for low-income communities.Seamless Integration of Digital Solutions for Pradhan Mantri Yojana with IPO ...

Seamless Integration of Digital Solutions for Pradhan Mantri Yojana with IPO ...winsofttech

?

Winsoft Technologies continues to lead the way, offering intelligent, adaptable solutions that help bridge the gap between social impact and capital participation. For banks, fintechs, and government agencies looking to stay ahead, partnering with Winsoft means stepping confidently into the future of finance.

https://winsoftech.com/

Chapter 3.pptx: Location decision of firms

Chapter 3.pptx: Location decision of firmsAtoshe Elmi

?

This chapter analysis the effect of the location decision of the firms and its impact on the development of cities OAT_RI_Ep31 WeighingTheRisks_Apr25_Financials.pptx

OAT_RI_Ep31 WeighingTheRisks_Apr25_Financials.pptxhiddenlevers

?

How will the tariffs and other economic noise affect capex and the markets during the trade wars?INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptx

INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptxAnkush Upadhyay

?

This presentation analyzes investment strategies for a 30-year-old risk-averse investor with ?50 lakhs. Based on a 35:65 equity-debt allocation, it recommends equity investments in HAL, BEL, and Bajaj Auto due to their strong financials and low debt, and debt investments in government and tax-free bonds with stable yields. The analysis balances risk and return for long-term portfolio growth in the defense sector and public sector bonds.chapter 5.pptx: Urban Poverty and Public Policy

chapter 5.pptx: Urban Poverty and Public PolicyAtoshe Elmi

?

This chapter analysis Urban Poverty and Public Policy Bringing data to life | Bricks, mortar and data: understanding house and rent...

Bringing data to life | Bricks, mortar and data: understanding house and rent...Office for National Statistics

?

For our ninth webinar, we explained how we create housing price statistics and the methodologies behind them. We explored how we identify an 'average' property, the changes observed in the market over time, and the tools you can use to answer these questions yourself. Buy Old Gmail Accounts form a USA Country

Buy Old Gmail Accounts form a USA CountryWhy You Should Buy Old Gmail Accounts for Your Business

?

Purchase Verified Gmail Accounts

Are you in search of a reliable Gmail account? Look no further! We offer the finest solution for your needs. Our Gmail accounts are active and each comes with a unique IP address to ensure maximum functionality and security. Purchasing an unverified Gmail account can hinder your access to essential features and may result in a loss of funds if the account is not legitimate.

Why Choose Our Service?

Verified Accounts: Every account we sell has passed thorough verification processes.

Secure Transactions: Ensure your investment is safe when acquiring a Gmail account.

Act Now! Secure a verified Gmail account from us today and experience seamless integration and performance. Choose wisely¡ªopt for accounts that guarantee verification.

Why Choose Us for Your Gmail Account Needs?

Buy Gmail Accounts

Buy Gmail Accounts

Are you ready to elevate your business to the next level? We specialize in providing bulk Gmail accounts, both new and old, tailored to your specific needs. Our accounts are not only active and phone verified, but each also boasts a unique IP address to ensure there are no conflicts between accounts.

Key Benefits of Our Service:

Diverse Accounts: Each account comes with a distinct login ID and IP address.

Proven Track Record: With years of experience in the market, we understand exactly what you need.

Reliability: Our accounts are guaranteed to meet your expectations and enhance your business operations.

Take Action Now! Visit our website to purchase your Gmail accounts today. Choose us for a reliable and effective solution to manage your business communications. With us, disappointment isn¡¯t an option.

Why Invest in a Gmail Account from Us?

Streamline Your Operations Buying bulk Gmail accounts can be time-consuming and complex due to the need for setup and verification. We provide a seamless solution that saves you time, allowing you to focus on other critical aspects of your business. When you purchase from us, you receive verified, ready-to-use Gmail accounts, delivered promptly to meet your business demands.

Affordable and Efficient Our services are designed to be cost-effective, providing you with a substantial return on investment. By choosing us, you¡¯re not just buying Gmail accounts; you¡¯re investing in a partnership that aims to boost your business¡¯s efficiency and success.

Why Gmail?

Universal Access: Gmail is one of the most popular email services globally, integrated with various Google services like Google Drive, Google+, and Google Wallet, enhancing productivity.

Robust Features: Each account offers 15 GB of storage, less spam, and easy access across all devices¡ªAndroid, iOS, and desktop. Gmail¡¯s intuitive design includes features like message threading, easy search, and built-in security.

Marketing and Outreach: Gmail accounts are essential for effective email marketing, allowing you to reach and engage customers directly. Our Phone Verified Accounts (PVAs) are ideal for robust email Reviving Heritage through the Abhay Bhutada Foundation¡¯s Support.pdf

Reviving Heritage through the Abhay Bhutada Foundation¡¯s Support.pdfRaj Kumble

?

This presentation unfolds over seven slides, beginning with an introduction to Shivsrushti¡¯s immersive design and historical focus. It then highlights the strategic nature of the Abhay Bhutada Foundation¡¯s support, emphasizing long-term maintenance and educational outreach. The deck explores how the park integrates modern technology to engage visitors, followed by its inclusive access programs for underprivileged students and rural communities. Hands-on learning experiences and community empowerment initiatives illustrate the park¡¯s commitment to active participation and local development. Finally, the presentation concludes by reflecting on the leadership lessons imparted through Shivsrushti and the enduring cultural impact of the Foundation¡¯s patronage.acca_f2_june_2014_specimen_exam_paper_full.pdf

acca_f2_june_2014_specimen_exam_paper_full.pdfnallaisa192

?

This document is the official specimen exam paper for the ACCA F2 (Management Accounting) exam, specifically released for the June 2014 examination session. It has been published by the Association of Chartered Certified Accountants (ACCA) to provide students with a reliable and representative example of what to expect in the actual F2 examination. The paper includes a complete set of sample multiple-choice and structured questions that reflect the actual exam format, covering key topics such as budgeting, costing techniques, variance analysis, performance measurement, management information systems, and decision-making processes. Each question is designed to assess the candidate¡¯s ability to apply management accounting principles in practical business contexts, and to think analytically and strategically. By working through this specimen paper, students can familiarize themselves with the standard of questions expected in the ACCA F2 exam and gain insight into effective time management and question interpretation strategies. This document is especially valuable for revision and exam practice, and can also serve as a benchmarking tool for evaluating a candidate¡¯s readiness before taking the official exam. It is recommended that students attempt the paper under timed conditions and review the official model answers to identify areas of strength and improvement.×îаæÃÀ¹úÍþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ±ÏÒµÖ¤£¨±«°Â²Ñ±ÏÒµÖ¤Ê飩԰涨ÖÆ

×îаæÃÀ¹úÍþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ±ÏÒµÖ¤£¨±«°Â²Ñ±ÏÒµÖ¤Ê飩԰涨ÖÆtaqyea

?

2025Ô°æÍþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ±ÏÒµÖ¤Êépdfµç×Ӱ桾qÞ±1954292140¡¿ÃÀ¹ú±ÏÒµÖ¤°ìÀíUWMÍþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ±ÏÒµÖ¤Êé¶àÉÙÇ®£¿¡¾qÞ±1954292140¡¿º£Íâ¸÷´óѧDiploma°æ±¾£¬ÒòΪÒßÇéѧУÍƳٷ¢·ÅÖ¤Êé¡¢Ö¤ÊéÔ¼þ¶ªÊ§²¹°ì¡¢Ã»ÓÐÕý³£±ÏҵδÄÜÈÏ֤ѧÀúÃæÁÙ¾ÍÒµÌṩ½â¾ö°ì·¨¡£µ±ÔâÓö¹Ò¿Æ¡¢¿õ¿Îµ¼ÖÂÎÞ·¨ÐÞÂúѧ·Ö£¬»òÕßÖ±½Ó±»Ñ§Ð£ÍËѧ£¬×îºóÎÞ·¨±ÏÒµÄò»µ½±ÏÒµÖ¤¡£´ËʱµÄÄãÒ»¶¨ÊÖ×ãÎ޴룬ÒòΪÁôѧһ³¡£¬Ã»ÓлñµÃ±ÏÒµÖ¤ÒÔ¼°Ñ§ÀúÖ¤Ã÷¿Ï¶¨ÊÇÎÞ·¨¸ø×Ô¼ººÍ¸¸Ä¸Ò»¸ö½»´úµÄ¡£

¡¾¸´¿ÌÍþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ³É¼¨µ¥ÐÅ·â,Buy University of Wisconsin-Milwaukee Transcripts¡¿

¹ºÂòÈÕº«³É¼¨µ¥¡¢Ó¢¹ú´óѧ³É¼¨µ¥¡¢ÃÀ¹ú´óѧ³É¼¨µ¥¡¢°ÄÖÞ´óѧ³É¼¨µ¥¡¢¼ÓÄôó´óѧ³É¼¨µ¥£¨q΢1954292140£©Ð¼ÓÆ´óѧ³É¼¨µ¥¡¢ÐÂÎ÷À¼´óѧ³É¼¨µ¥¡¢°®¶ûÀ¼³É¼¨µ¥¡¢Î÷°àÑÀ³É¼¨µ¥¡¢µÂ¹ú³É¼¨µ¥¡£³É¼¨µ¥µÄÒâÒåÖ÷ÒªÌåÏÖÔÚÖ¤Ã÷ѧϰÄÜÁ¦¡¢ÆÀ¹ÀѧÊõ±³¾°¡¢Õ¹Ê¾×ÛºÏËØÖÊ¡¢Ìá¸ß¼ȡÂÊ£¬ÒÔ¼°ÊÇ×÷ΪÁôÐÅÈÏÖ¤ÉêÇë²ÄÁϵÄÒ»²¿·Ö¡£

Íþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ³É¼¨µ¥Äܹ»ÌåÏÖÄúµÄµÄѧϰÄÜÁ¦£¬°üÀ¨Íþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ¿Î³Ì³É¼¨¡¢×¨ÒµÄÜÁ¦¡¢Ñо¿ÄÜÁ¦¡££¨q΢1954292140£©¾ßÌåÀ´Ëµ£¬³É¼¨±¨¸æµ¥Í¨³£°üº¬Ñ§ÉúµÄѧϰ¼¼ÄÜÓëÏ°¹ß¡¢¸÷¿Æ³É¼¨ÒÔ¼°ÀÏʦÆÀÓïµÈ²¿·Ö£¬Òò´Ë£¬³É¼¨µ¥²»½öÊÇѧÉúѧÊõÄÜÁ¦µÄÖ¤Ã÷£¬Ò²ÊÇÆÀ¹ÀѧÉúÊÇ·ñÊʺÏij¸ö½ÌÓýÏîÄ¿µÄÖØÒªÒÀ¾Ý£¡

ÎÒÃdzÐŵ²ÉÓõÄÊÇѧУ԰æÖ½ÕÅ£¨Ô°æÖ½ÖÊ¡¢µ×É«¡¢ÎÆ·£©ÎÒÃǹ¤³§ÓµÓÐÈ«Ì×½ø¿ÚÔ×°É豸£¬ÌØÊ⹤ÒÕ¶¼ÊDzÉÓò»Í¬»úÆ÷ÖÆ×÷£¬·ÂÕæ¶È»ù±¾¿ÉÒÔ´ïµ½100%£¬ËùÓгÉÆ·ÒÔ¼°¹¤ÒÕЧ¹û¶¼¿ÉÌáÇ°¸ø¿Í»§Õ¹Ê¾£¬²»ÂúÒâ¿ÉÒÔ¸ù¾Ý¿Í»§ÒªÇó½øÐе÷Õû£¬Ö±µ½ÂúÒâΪֹ£¡

¡¾Ö÷ÓªÏîÄ¿¡¿

Ò»¡¢¹¤×÷δȷ¶¨£¬»Ø¹úÐèÏȸø¸¸Ä¸¡¢Ç×ÆÝÅóÓÑ¿´ÏÂÎÄƾµÄÇé¿ö£¬°ìÀí±ÏÒµÖ¤|°ìÀíÎÄƾ: Âò´óѧ±ÏÒµÖ¤|Âò´óѧÎÄƾ¡¾qÞ±1954292140¡¿Íþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУѧλ֤Ã÷ÊéÈçºÎ°ìÀíÉêÇ룿

¶þ¡¢»Ø¹ú½ø˽Æó¡¢ÍâÆó¡¢×Ô¼º×öÉúÒâµÄÇé¿ö£¬ÕâЩµ¥Î»ÊDz»²éѯ±ÏÒµÖ¤ÕæαµÄ£¬¶øÇÒ¹úÄÚûÓÐÇþµÀÈ¥²éѯ¹úÍâÎÄƾµÄÕæ¼Ù£¬Ò²²»ÐèÒªÌṩÕæʵ½ÌÓý²¿ÈÏÖ¤¡£¼øÓÚ´Ë£¬°ìÀíÃÀ¹ú³É¼¨µ¥Íþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ±ÏÒµÖ¤¡¾qÞ±1954292140¡¿¹úÍâ´óѧ±ÏÒµÖ¤, ÎÄƾ°ìÀí, ¹úÍâÎÄƾ°ìÀí, ÁôÐÅÍøÈÏÖ¤Bringing data to life | Bricks, mortar and data: understanding house and rent...

Bringing data to life | Bricks, mortar and data: understanding house and rent...Office for National Statistics

?

Ad