Computerized payroll system

- 1. Computerized Payroll System for Derf’s Manpower and General Services Phils, Inc., DEVELOPERS : Dandamun, Raihana S. Fernandez, Apols V. Gicaro, Mark Francis G. Tancinco, Angelique M.

- 2. Introduction: • Derf’s Manpower and General Services, Phils., Inc. is a private corporation duly registered with the Securities and Exchange Commission (SEC), Bureau of Internal Revenue (BIR), and the Department of Labor and Employment (DOLE). • At present Derf’s have the following clients: SM Homeworld, Pollandre Manufacturing Corp., Blue Mountain Worldwide Distribution Inc., Green Light Recreative, Apollo Lightning Inc., and Enderun Colleges. • Derf’s Manpower and General Services, Phils., Inc. had been the priority of the developers in creating a computerized payroll system for the benefit of the company and its employees, as well as to provide a payroll system that offers fast transactions, generates reports and lessens the time consumed in preparing the payroll.

- 3. GENERAL PROBLEM: The Derf’s Manpower and General Services, Phils., Inc. is having a hard time in manually checking each daily time record of employee, monitoring of previous loans, cash advances and charges and preparing essential reports.

- 4. SPECIFIC PROBLEMS: • The Derf’s Manpower and General Services, Phils., Inc. consumes time and effort in manually checking each daily time record of the employee. • The Derf’s Manpower and General Services, Phils., Inc. is having difficulties in making reports because of the voluminous files stored and placed in the filing cabinets. • The Derf’s Manpower and General Services, Phils., Inc. is having a hard time in monitoring the previous loan, cash advances, and charges of the employee due to unorganized employee records, wherein the Staff has to find a specific employee record on a different folders.

- 5. GENERAL OBJECTIVE: To design and develop a Computerized Payroll System for Derf’s Manpower and General Services, Phils., Inc. that provides fast transactions, minimize the manual checking of employees daily time record, monitors previous employee loans, cash advances and charges, and can generate essential reports.

- 6. SPECIFIC OBJECTIVES: • To minimize the manual checking of each daily time records of the employee. • To develop a module that will generate essential reports. • To develop a module that will monitor the status of employee’s loan and other deductions such as cash advances and charges.

- 8. SCOPE: • It covers the time-in and time-out of employees through biometrics, specifically through a fingerprint scanner technology. • It also covers the process of preparing the pay slip of each employee, monitors loans, cash advances, charges, keeping the records and easily computes the basic pay, regular overtime pay, overtime with night differential pay, pay during day off, special and legal holiday pay, gross pay, SSS contributions, PhilHealth contributions, Pag-Ibig contributions, admin fee, cash bond, loans, cash advances, charges deductions and net pay.

- 9. LIMITATIONS: • The system cannot generate report of appraisals and evaluation reports of the employee because it was not included in the system. • The system will only be used for payroll transactions by the company specifically Derf’s Manpower and General Services, Phils., Inc. It will not be employed in any other company other than Derf’s Manpower

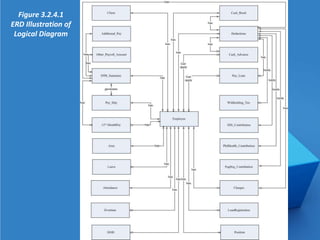

- 11. Figure 3.2.4.1 ERD Illustration of Logical Diagram

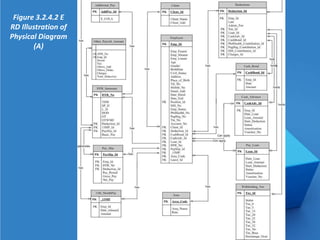

- 12. Figure 3.2.4.2 E RD Illustration of Physical Diagram (A)

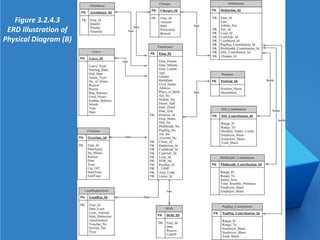

- 13. Figure 3.2.4.3 ERD Illustration of Physical Diagram (B)

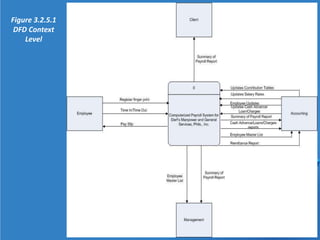

- 15. Figure 3.2.5.1 DFD Context Level

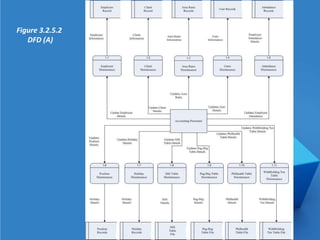

- 16. Figure 3.2.5.2 DFD (A)

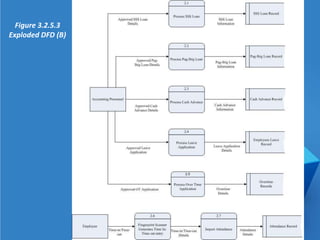

- 17. Figure 3.2.5.3 Exploded DFD (B)

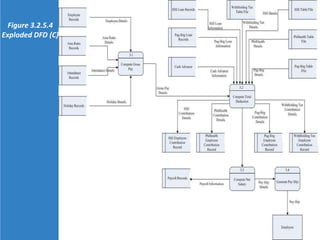

- 18. Figure 3.2.5.4 Exploded DFD (C)

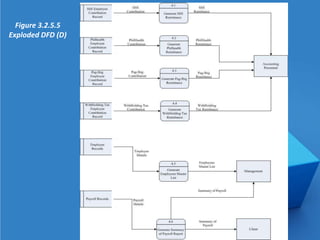

- 19. Figure 3.2.5.5 Exploded DFD (D)

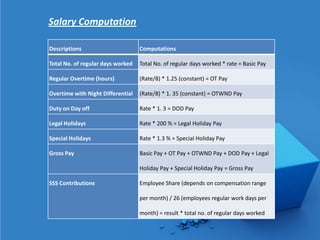

- 20. COMPUTATIONS

- 21. Salary Computation Descriptions Computations Total No. of regular days worked Total No. of regular days worked * rate = Basic Pay Regular Overtime (hours) (Rate/8) * 1.25 (constant) = OT Pay Overtime with Night Differential (Rate/8) * 1. 35 (constant) = OTWND Pay Duty on Day off Rate * 1. 3 = DOD Pay Legal Holidays Rate * 200 % = Legal Holiday Pay Special Holidays Rate * 1.3 % = Special Holiday Pay Gross Pay Basic Pay + OT Pay + OTWND Pay + DOD Pay + Legal Holiday Pay + Special Holiday Pay = Gross Pay SSS Contributions Employee Share (depends on compensation range per month) / 26 (employees regular work days per month) = result * total no. of regular days worked

- 22. PhilHealth Contributions Employee Share (depends on compensation range per month) / 26 (employees regular work days per month) = result * total no. of regular days worked Pag-Ibig Contributions Employee Share (depends on compensation range per month) / 26 (employees regular work days per month) = result * total no. of regular days worked Cash Bond Basic Pay * 5% = Cash Bond Admin Fee Basic Pay * 2% = Admin Fee Lates (Rate/8 hours) / 60 minutes = Late Other Deductions Cash Advance + Charges + Loans = Other Deductions Total Deductions SSS co + PhilHealth/Pag-Ibig Contributions + Cash Bond + Admin Fee + Late + Other Deductions = TotalDeductions Net Pay Gross Pay – Total Deductions = Net Pay

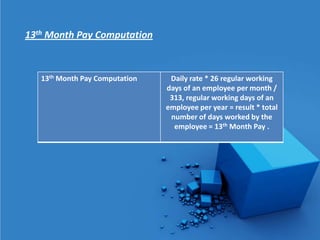

- 23. 13th Month Pay Computation 13th Month Pay Computation Daily rate * 26 regular working days of an employee per month / 313, regular working days of an employee per year = result * total number of days worked by the employee = 13th Month Pay .