1 of 1

Download to read offline

Recommended

10 tools of the trade insert (advisor present) 6 9-11

10 tools of the trade insert (advisor present) 6 9-11Weydert Wealth Management

Ã˝

Examples of the kinds of reports a fee-only wealth manager runs to render professional advice.Size and value effects for stocks thru 2009

Size and value effects for stocks thru 2009Weydert Wealth Management

Ã˝

Dimensional Fund Advisors' powerful slides on the small cap and value effect detail how small stocks and value stocks enhance portfolio returns and explain portfolio performance.The Power of Economic Science 2012

The Power of Economic Science 2012Weydert Wealth Management

Ã˝

This document discusses innovations in finance from the 1950s to today. It begins by outlining conventional wisdom from the 1930s that focused on picking individual winners and holding concentrated portfolios. It then summarizes several seminal works and developments that helped shift the field: James Tobin's separation theorem emphasized diversification; William Sharpe developed the single-factor capital asset pricing model relating risk and return; Eugene Fama developed the efficient market hypothesis asserting that markets accurately reflect information. This led to the development of index funds by John Bogle, providing low-cost, passive investment options. Overall, the document outlines major theoretical and practical innovations that professionalized the field of finance and emphasized diversification, risk-adjusted returns, and passive investing.The Power of Economic Science

The Power of Economic ScienceWeydert Wealth Management

Ã˝

The document discusses the performance of various model investment portfolios from 1973-2010. It provides the annualized compound returns and annualized standard deviations for 5 model portfolios over this period. The model portfolios had varying allocations to US and international stocks, bonds, and emerging markets. Model portfolio 5, which had the most diversified allocation, achieved the highest annualized return of 11.65% and relatively low standard deviation of 11.26% compared to the other portfolios.Multifactor investing dfa 7-2006

Multifactor investing dfa 7-2006Weydert Wealth Management

Ã˝

The three-factor model developed by Fama and French provides a framework for investment strategies that identifies sources of risk that compensate investors. It explains stock returns better than the single-factor CAPM model by including factors for firm size and book-to-market ratio in addition to market beta. While book-to-market ratio may not seem to directly describe risk, it serves as a proxy for a company's financial distress - high book-to-market stocks tend to be more risky with higher expected returns. The three-factor model allows advisors to construct portfolios targeting different risk exposures from size and value factors to outperform the market over the long run.Dfa basic slides 2013

Dfa basic slides 2013Weydert Wealth Management

Ã˝

The document discusses three dimensions of expected stock returns:

1) Company size - Small company stocks tend to have higher expected returns than large company stocks over time.

2) Company price - Lower-priced "value" stocks tend to have higher expected returns than higher-priced "growth" stocks over time.

3) Equity market - Stocks tend to have higher expected returns than fixed income investments like bonds over time.Dfa all slides 2013

Dfa all slides 2013Weydert Wealth Management

Ã˝

The document discusses diversification across different asset classes and geographic regions. It presents 5 model portfolios with varying allocations to US and international stocks and bonds. The most diversified portfolio (Portfolio 5) allocates 30% to international stocks, 7.5% to several US stock size and style factors, and 40% to bonds. Tables show the annual returns and volatility of returns for each model portfolio from 1998-2012. The most diversified portfolio had the highest annualized return of 7.02% and second highest standard deviation of returns of 13.68%.Dfa and the error term 12-2001

Dfa and the error term 12-2001Weydert Wealth Management

Ã˝

This document discusses the concept of error terms in investment returns and strategies. It makes three key points:

1) Even portfolios with identical exposures to risk factors like market, size, and value will experience random variation in returns over time due to residual error from differences in underlying security holdings. This error averages to zero over the long run.

2) Tax-managed investment strategies will differ in returns from benchmarks, but offer higher after-tax returns justifying the tracking error. Maximum annual deviations were 2.3% overperformance and 1.3% underperformance.

3) The Fama-French multifactor model helps investors manage systematic risk factors rather than focus on arbitrary benchmarks or short-term noise inFama french 5 factor working paper 11-2013

Fama french 5 factor working paper 11-2013Weydert Wealth Management

Ã˝

The document summarizes a five-factor asset pricing model that augments the Fama-French three-factor model by adding profitability and investment factors.

The five-factor model is tested using portfolios sorted on size, book-to-market equity ratio, profitability, and investment to produce spreads in average returns. The results show patterns in average returns related to size, value, profitability, and investment that the five-factor model seeks to capture. Specifically, small stocks and stocks with high book-to-market ratios, profitability, or low investment tend to have higher average returns. However, the model has difficulties explaining the low returns of some small, low-profitability stocks that invest heavily.Factor investing, andrew ang 12-17-2013

Factor investing, andrew ang 12-17-2013Weydert Wealth Management

Ã˝

The document summarizes factor investing using Norway's sovereign wealth fund as a case study. It finds that 99% of the variation in the fund's returns can be explained by its strategic asset allocation decisions between equities and bonds. This supports the finding that the most important investment decision is the top-down choice of asset allocation. The document also defines factors as classes of securities that have higher long-term returns than the broad market, such as value stocks, momentum stocks, illiquid securities, risky bonds, and options strategies. Adopting a factor investing approach allows investors to access these premiums in a cost-effective manner.Semmelweis reflex 12 5-2013

Semmelweis reflex 12 5-2013Weydert Wealth Management

Ã˝

We are all prone to cognitive biases that make it easy to fool ourselves, even more so than others. Confirmation bias and motivated reasoning cause us to only see evidence that supports our existing beliefs and interpretations. The bias blind spot further prevents us from recognizing our own cognitive biases. While the scientific method aims to reduce bias through rigorous testing of hypotheses, even scientists fall prey to these biases and often fail to replicate their own seminal studies. Overcoming cognitive biases requires acknowledging their existence and establishing processes like "adversarial collaboration" that encourage challenging existing ideas without fear of reprisal.Mutual fund landscape 10-22-2013

Mutual fund landscape 10-22-2013Weydert Wealth Management

Ã˝

1) The mutual fund landscape comprises thousands of funds competing to identify mispriced securities, making it difficult for most funds to consistently outperform their benchmarks over time.

2) Few funds survive for long periods, with about half of equity funds disappearing within 10 years, largely due to poor performance. Similarly, only about one in six funds delivers benchmark-beating returns over 10 years.

3) Past outperformance is not predictive of future success, as most "winning" funds fail to continue outperforming in subsequent periods. High costs also predict future underperformance, with funds in the lowest cost quartiles more likely to outperform over 5 and 10 year periods.Dfa matrix book us_2013 - copy

Dfa matrix book us_2013 - copyWeydert Wealth Management

Ã˝

This document provides historical return data for various investment indexes from 1926 to 2012. It discusses Dimensional Fund Advisors' evolution in response to advances in financial research. Key points include:

- Dimensional structures portfolios around dimensions of expected returns identified by research, such as market, size, value, and profitability factors.

- Recent research identified profitability as a new dimension with high profitability firms having higher average returns.

- Dimensional incorporates new research findings by evolving existing strategies and developing new ones.

- Dimensional's approach focuses on expected returns rather than attempting to time markets or capture short-term anomalies.

- Historical return data is provided for indexes spanning US and international equitiesDfa institutional review 2007q4

Dfa institutional review 2007q4Weydert Wealth Management

Ã˝

Dimensional investors are able to capture the value premium where others fail through an integrated investment process. Their process begins with clear investment principles of efficient markets and targeting dimensions of expected return like value and size. They design strategies for continuous exposure to these premium-generating factors. Their portfolio engineering, management, and trading are dynamically integrated to minimize costs from factors like momentum and provide liquidity. This allows Dimensional to reliably deliver excess returns to investors from targeting premiums.Qir 2013q2 us

Qir 2013q2 usWeydert Wealth Management

Ã˝

This research paper discusses enhancing value investment strategies by incorporating expected profitability.

For small cap value strategies, the paper proposes excluding stocks in each country with the lowest direct profitability, with the percentage excluded depending on the stock's price-to-book ratio.

For large cap value strategies, the paper suggests selecting stocks based on both low price-to-book ratios and high direct profitability. It also proposes overweighting stocks that have higher profitability, lower market capitalization, and lower relative price.

The goal is to structure portfolios to better capture the dimensions of expected returns related to company size, relative price, and expected profitability, while maintaining appropriate diversification and managing costs.Part-Time CFO Presentation

Part-Time CFO PresentationWeydert Wealth Management

Ã˝

This document describes the services of a part-time CFO service for small businesses. They help business owners understand their financial metrics through analysis of profitability, cash flow, ratios, and forecasting. They analyze key metrics, identify trends, and grade performance in areas like capital structure and profitability. They also help solve strategic problems by determining how to reach goals through actions like increasing prices or reducing expenses. The service aims to provide actionable financial insights and advice to small businesses without needing a full-time CFO.4 active vs passive advisor insert funds flows dfa (advisor present) p. 1-3, ...

4 active vs passive advisor insert funds flows dfa (advisor present) p. 1-3, ...Weydert Wealth Management

Ã˝

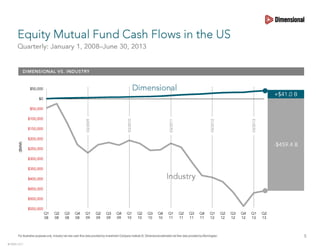

This excellent article contains three key graphics illustrating how average investors flow into and out of investments at the wrong times and contrasts this with the average DFA investor who remains much more consistent and disciplined.Dfa us matrix book 2011

Dfa us matrix book 2011Weydert Wealth Management

Ã˝

This document provides a summary of Dimensional Fund Advisors' 30 year history from 1981 to 2010. It discusses how Dimensional was founded on empirical financial research and introduced novel investment strategies like microcap investing. Over the decades, Dimensional expanded its offerings globally while maintaining its focus on translating academic theories into practical investment solutions. Key events include expanding client base, growing assets under management, moving headquarters, and continuing to work closely with leading financial academics.Economic Revitalization for Pakistan: An Overview

Economic Revitalization for Pakistan: An OverviewVaqar Ahmed

Ã˝

The "Draft Economic Agenda 2018" by SDPI outlined a framework for Pakistan's economic revitalisation, addressing deep-rooted structural issues.

The project work highlighted the country's persistent challenges: low productivity, inequitable distribution of wealth, environmental degradation, and a narrow tax base. It critiqued the prevailing growth model, which it argued has exacerbated inequalities and neglected human development.

The agenda advocated for a paradigm shift, emphasizing:

• Inclusive Growth: Prioritizing job creation, poverty reduction, and equitable access to resources, particularly for marginalized groups.

• Sustainable Development: Integrating environmental considerations into economic planning, promoting renewable energy, and addressing climate change impacts.

• Industrial Diversification: Moving away from reliance on traditional sectors, fostering innovation, and promoting value-added manufacturing.

• Human Capital Development: Investing in education, healthcare, and skills training to enhance productivity and competitiveness.

• Fiscal Reforms: Expanding the tax base, improving tax administration, and reducing reliance on external debt.

• Agricultural Transformation: Promoting sustainable agriculture, improving land management, and enhancing food security.

• Energy Security: Diversifying energy sources, promoting renewable energy, and improving energy efficiency.

• Regional Cooperation: Strengthening trade and economic ties with neighboring countries.

• Governance Reforms: Enhancing transparency, accountability, and citizen participation in economic decision-making.

The agenda proposed specific policy recommendations, including:

• Targeted investments in infrastructure, education, and healthcare.

• Incentives for small and medium enterprises (SMEs).

• Reforms to improve the ease of doing business.

• Measures to promote financial inclusion.

• Policies to address climate change and environmental degradation.Gender board diversity and firm performance

Gender board diversity and firm performanceGRAPE

Ã˝

We study the effects of gender board diversity on firm performance. We use novel and rich firm-level data covering over seven million private and public firms spanning the years 1995-2020 in Europe. We augment a standard TFP estimation with a shift-share instrument for gender board diversity. We find that increasing the share of women in the boardroom is conducive to better economic performance. The results prove robust in a variety of subsamples, and to a variety of sensitivity analyses. This outcome is driven primarily by firms from the service sector. The positive impact was stronger during the more recent years of our sample that is a period with relatively more board diversity. AP Automation: The Competitive Advantage Your Business Needs

AP Automation: The Competitive Advantage Your Business NeedsAggregage

Ã˝

https://www.accountantadvocate.com/frs/27799174/building-a-business-case-for-finance-automation

Struggling to get buy-in for finance automation? Learn how to build a compelling business case and streamline your purchase-to-pay process to drive efficiency, reduce costs, and stay ahead of the competition.Presentation for business plan sample m

Presentation for business plan sample mmsmiranda894

Ã˝

This sample business plan presentation #AgroculyrTYPES OF TAXATION IN INDIA: Direct, Indirect, and Their Economic Impact

TYPES OF TAXATION IN INDIA: Direct, Indirect, and Their Economic ImpactSunita C

Ã˝

This presentation explains the different types of taxation in India, including direct and indirect taxes, their structures, revenue significance, policy implications, and effects on individuals, businesses, and economic growth, with real-world examples and case studies.Farmer Producer Organizations (FPOs) in India: Strengthening Agricultural Val...

Farmer Producer Organizations (FPOs) in India: Strengthening Agricultural Val...Sunita C

Ã˝

This presentation explores the role of FPOs in empowering small and marginal farmers, improving market access, enhancing bargaining power, promoting sustainable agriculture, and addressing challenges in agricultural trade, financing, and policy support.Basic Mathematics For Economic Analysis DSC2.pdf

Basic Mathematics For Economic Analysis DSC2.pdfRoushanVishwakarma1

Ã˝

Basic Mathematics For Economic Analysis DSC2More Related Content

More from Weydert Wealth Management (11)

Fama french 5 factor working paper 11-2013

Fama french 5 factor working paper 11-2013Weydert Wealth Management

Ã˝

The document summarizes a five-factor asset pricing model that augments the Fama-French three-factor model by adding profitability and investment factors.

The five-factor model is tested using portfolios sorted on size, book-to-market equity ratio, profitability, and investment to produce spreads in average returns. The results show patterns in average returns related to size, value, profitability, and investment that the five-factor model seeks to capture. Specifically, small stocks and stocks with high book-to-market ratios, profitability, or low investment tend to have higher average returns. However, the model has difficulties explaining the low returns of some small, low-profitability stocks that invest heavily.Factor investing, andrew ang 12-17-2013

Factor investing, andrew ang 12-17-2013Weydert Wealth Management

Ã˝

The document summarizes factor investing using Norway's sovereign wealth fund as a case study. It finds that 99% of the variation in the fund's returns can be explained by its strategic asset allocation decisions between equities and bonds. This supports the finding that the most important investment decision is the top-down choice of asset allocation. The document also defines factors as classes of securities that have higher long-term returns than the broad market, such as value stocks, momentum stocks, illiquid securities, risky bonds, and options strategies. Adopting a factor investing approach allows investors to access these premiums in a cost-effective manner.Semmelweis reflex 12 5-2013

Semmelweis reflex 12 5-2013Weydert Wealth Management

Ã˝

We are all prone to cognitive biases that make it easy to fool ourselves, even more so than others. Confirmation bias and motivated reasoning cause us to only see evidence that supports our existing beliefs and interpretations. The bias blind spot further prevents us from recognizing our own cognitive biases. While the scientific method aims to reduce bias through rigorous testing of hypotheses, even scientists fall prey to these biases and often fail to replicate their own seminal studies. Overcoming cognitive biases requires acknowledging their existence and establishing processes like "adversarial collaboration" that encourage challenging existing ideas without fear of reprisal.Mutual fund landscape 10-22-2013

Mutual fund landscape 10-22-2013Weydert Wealth Management

Ã˝

1) The mutual fund landscape comprises thousands of funds competing to identify mispriced securities, making it difficult for most funds to consistently outperform their benchmarks over time.

2) Few funds survive for long periods, with about half of equity funds disappearing within 10 years, largely due to poor performance. Similarly, only about one in six funds delivers benchmark-beating returns over 10 years.

3) Past outperformance is not predictive of future success, as most "winning" funds fail to continue outperforming in subsequent periods. High costs also predict future underperformance, with funds in the lowest cost quartiles more likely to outperform over 5 and 10 year periods.Dfa matrix book us_2013 - copy

Dfa matrix book us_2013 - copyWeydert Wealth Management

Ã˝

This document provides historical return data for various investment indexes from 1926 to 2012. It discusses Dimensional Fund Advisors' evolution in response to advances in financial research. Key points include:

- Dimensional structures portfolios around dimensions of expected returns identified by research, such as market, size, value, and profitability factors.

- Recent research identified profitability as a new dimension with high profitability firms having higher average returns.

- Dimensional incorporates new research findings by evolving existing strategies and developing new ones.

- Dimensional's approach focuses on expected returns rather than attempting to time markets or capture short-term anomalies.

- Historical return data is provided for indexes spanning US and international equitiesDfa institutional review 2007q4

Dfa institutional review 2007q4Weydert Wealth Management

Ã˝

Dimensional investors are able to capture the value premium where others fail through an integrated investment process. Their process begins with clear investment principles of efficient markets and targeting dimensions of expected return like value and size. They design strategies for continuous exposure to these premium-generating factors. Their portfolio engineering, management, and trading are dynamically integrated to minimize costs from factors like momentum and provide liquidity. This allows Dimensional to reliably deliver excess returns to investors from targeting premiums.Qir 2013q2 us

Qir 2013q2 usWeydert Wealth Management

Ã˝

This research paper discusses enhancing value investment strategies by incorporating expected profitability.

For small cap value strategies, the paper proposes excluding stocks in each country with the lowest direct profitability, with the percentage excluded depending on the stock's price-to-book ratio.

For large cap value strategies, the paper suggests selecting stocks based on both low price-to-book ratios and high direct profitability. It also proposes overweighting stocks that have higher profitability, lower market capitalization, and lower relative price.

The goal is to structure portfolios to better capture the dimensions of expected returns related to company size, relative price, and expected profitability, while maintaining appropriate diversification and managing costs.Part-Time CFO Presentation

Part-Time CFO PresentationWeydert Wealth Management

Ã˝

This document describes the services of a part-time CFO service for small businesses. They help business owners understand their financial metrics through analysis of profitability, cash flow, ratios, and forecasting. They analyze key metrics, identify trends, and grade performance in areas like capital structure and profitability. They also help solve strategic problems by determining how to reach goals through actions like increasing prices or reducing expenses. The service aims to provide actionable financial insights and advice to small businesses without needing a full-time CFO.4 active vs passive advisor insert funds flows dfa (advisor present) p. 1-3, ...

4 active vs passive advisor insert funds flows dfa (advisor present) p. 1-3, ...Weydert Wealth Management

Ã˝

This excellent article contains three key graphics illustrating how average investors flow into and out of investments at the wrong times and contrasts this with the average DFA investor who remains much more consistent and disciplined.Dfa us matrix book 2011

Dfa us matrix book 2011Weydert Wealth Management

Ã˝

This document provides a summary of Dimensional Fund Advisors' 30 year history from 1981 to 2010. It discusses how Dimensional was founded on empirical financial research and introduced novel investment strategies like microcap investing. Over the decades, Dimensional expanded its offerings globally while maintaining its focus on translating academic theories into practical investment solutions. Key events include expanding client base, growing assets under management, moving headquarters, and continuing to work closely with leading financial academics.4 active vs passive advisor insert funds flows dfa (advisor present) p. 1-3, ...

4 active vs passive advisor insert funds flows dfa (advisor present) p. 1-3, ...Weydert Wealth Management

Ã˝

Recently uploaded (20)

Economic Revitalization for Pakistan: An Overview

Economic Revitalization for Pakistan: An OverviewVaqar Ahmed

Ã˝

The "Draft Economic Agenda 2018" by SDPI outlined a framework for Pakistan's economic revitalisation, addressing deep-rooted structural issues.

The project work highlighted the country's persistent challenges: low productivity, inequitable distribution of wealth, environmental degradation, and a narrow tax base. It critiqued the prevailing growth model, which it argued has exacerbated inequalities and neglected human development.

The agenda advocated for a paradigm shift, emphasizing:

• Inclusive Growth: Prioritizing job creation, poverty reduction, and equitable access to resources, particularly for marginalized groups.

• Sustainable Development: Integrating environmental considerations into economic planning, promoting renewable energy, and addressing climate change impacts.

• Industrial Diversification: Moving away from reliance on traditional sectors, fostering innovation, and promoting value-added manufacturing.

• Human Capital Development: Investing in education, healthcare, and skills training to enhance productivity and competitiveness.

• Fiscal Reforms: Expanding the tax base, improving tax administration, and reducing reliance on external debt.

• Agricultural Transformation: Promoting sustainable agriculture, improving land management, and enhancing food security.

• Energy Security: Diversifying energy sources, promoting renewable energy, and improving energy efficiency.

• Regional Cooperation: Strengthening trade and economic ties with neighboring countries.

• Governance Reforms: Enhancing transparency, accountability, and citizen participation in economic decision-making.

The agenda proposed specific policy recommendations, including:

• Targeted investments in infrastructure, education, and healthcare.

• Incentives for small and medium enterprises (SMEs).

• Reforms to improve the ease of doing business.

• Measures to promote financial inclusion.

• Policies to address climate change and environmental degradation.Gender board diversity and firm performance

Gender board diversity and firm performanceGRAPE

Ã˝

We study the effects of gender board diversity on firm performance. We use novel and rich firm-level data covering over seven million private and public firms spanning the years 1995-2020 in Europe. We augment a standard TFP estimation with a shift-share instrument for gender board diversity. We find that increasing the share of women in the boardroom is conducive to better economic performance. The results prove robust in a variety of subsamples, and to a variety of sensitivity analyses. This outcome is driven primarily by firms from the service sector. The positive impact was stronger during the more recent years of our sample that is a period with relatively more board diversity. AP Automation: The Competitive Advantage Your Business Needs

AP Automation: The Competitive Advantage Your Business NeedsAggregage

Ã˝

https://www.accountantadvocate.com/frs/27799174/building-a-business-case-for-finance-automation

Struggling to get buy-in for finance automation? Learn how to build a compelling business case and streamline your purchase-to-pay process to drive efficiency, reduce costs, and stay ahead of the competition.Presentation for business plan sample m

Presentation for business plan sample mmsmiranda894

Ã˝

This sample business plan presentation #AgroculyrTYPES OF TAXATION IN INDIA: Direct, Indirect, and Their Economic Impact

TYPES OF TAXATION IN INDIA: Direct, Indirect, and Their Economic ImpactSunita C

Ã˝

This presentation explains the different types of taxation in India, including direct and indirect taxes, their structures, revenue significance, policy implications, and effects on individuals, businesses, and economic growth, with real-world examples and case studies.Farmer Producer Organizations (FPOs) in India: Strengthening Agricultural Val...

Farmer Producer Organizations (FPOs) in India: Strengthening Agricultural Val...Sunita C

Ã˝

This presentation explores the role of FPOs in empowering small and marginal farmers, improving market access, enhancing bargaining power, promoting sustainable agriculture, and addressing challenges in agricultural trade, financing, and policy support.Basic Mathematics For Economic Analysis DSC2.pdf

Basic Mathematics For Economic Analysis DSC2.pdfRoushanVishwakarma1

Ã˝

Basic Mathematics For Economic Analysis DSC2PFMS Public Finance Management System Presentation Dr. Konka BAMU

PFMS Public Finance Management System Presentation Dr. Konka BAMUPrakash Konka

Ã˝

National Service Scheme Transaction on PFMS PortalSSON Report Webinar Recap - Auxis Webinar

SSON Report Webinar Recap - Auxis WebinarAuxis Consulting & Outsourcing

Ã˝

SSON Report Webinar Recap.pdfJP Morgan 2021 Outlook for Business Development

JP Morgan 2021 Outlook for Business DevelopmentDika Rinakuki

Ã˝

An economic and finance outlook for 2021 for the businessHIRE THE TOP CRYPTO RECOVERY EXPERT, HIRE iFORCE HACKER RECOVERY

HIRE THE TOP CRYPTO RECOVERY EXPERT, HIRE iFORCE HACKER RECOVERYraclawwysocki2

Ã˝

Ã˝Ã˝My name is Raclaw Wysocki, a real estate investor from Warszawa, Poland. Last year, I invested in cryptocurrency, hoping to double my investment by the start of the new year. However, I soon discovered that I had fallen victim to a scam. It was a devastating experience for me and my family, and without iFORCE HACKER RECOVERY, I wouldn‚Äôt have been able to recover my funds.Ã˝iFORCE HACKER RECOVERY is a leading cryptocurrency and data recovery company specializing in retrieving lost crypto assets from hackers and fraudulent investment brokers. Thanks to their expertise, I successfully recovered $950,000 worth of crypto. I highly recommend their services. They are trustworthy, reliable, and have a proven 100% success rate.

Website; www. iforcehackersrecovery. com

Email; contact@iforcehackersrecovery. comÃ˝

Call/whatsapp +1 240 (80) (33) 706Ã˝ Ã˝ Ã˝