1 of 1

Download to read offline

Ad

Recommended

Cost of College Education

Cost of College EducationDavid Lerner Associates

╠²

Student loan debt in the U.S. currently totals about $1 trillion, with the average outstanding debt being $27,000, and many families owing significantly more. The burden of these loans, exemplified by a case study of a graduate struggling to pay her monthly payments against low income, poses long-term challenges for financial stability and retirement savings. Alternatives to incurring debt include early savings, applying for grants and scholarships, and attending community colleges to reduce educational expenses.4 Financial Strategies for Young Adults

4 Financial Strategies for Young AdultsDavid Lerner Associates

╠²

As young people graduate and enter the workforce, they often find the reality of their financial situation differs significantly from the glamorous lifestyle depicted in media. John Koene emphasizes the importance of budgeting, building an emergency savings fund, contributing to retirement accounts, and being cautious with debt to help align expectations with reality. He warns that excessive debt can hinder long-term financial goals and encourages creating a debt payoff schedule.David Lerner Associates: Working During Retirement

David Lerner Associates: Working During RetirementDavid Lerner Associates

╠²

More Americans are planning to work during retirement, which can help extend their savings and provide social benefits. Working can impact social security and pension benefits, with various implications based on the amount earned and age. Additionally, health coverage options are an important consideration when planning to work part-time during retirement.Does it cost more to be a woman

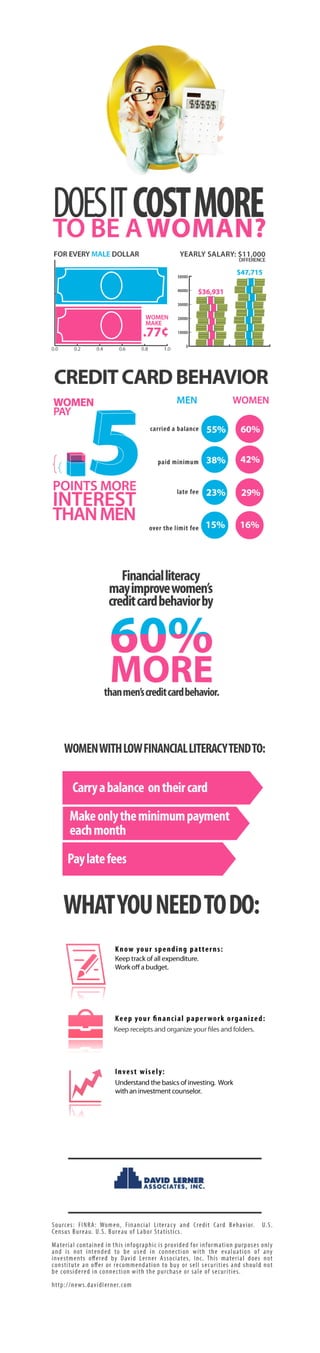

Does it cost more to be a womanDavid Lerner Associates

╠²

Does it cost more money to be a woman in the U.S. today than it does to be a man? A study conducted by the FINRA Education Institute suggests that in a couple of areas, at least, the answer may be yes.Yankee worldview

Yankee worldviewtippetts01

╠²

The document summarizes the development of Yankee Republicanism and the Northern worldview between 1815-1860. Key aspects included westward expansion, the rise of industrialization versus agricultural boom, and the growth of abolitionist sentiment. The market revolution transformed the North through consumerism, technological changes, and the shift from subsistence to cash crops. Transcendentalism philosophy emphasized self-reliance and individualism. Abolitionism grew in response to the intractable issue of slavery and the realization that the South was committed to defending the institution.Merger of Apple REIT Six into BRE Select Hotels

Merger of Apple REIT Six into BRE Select HotelsDavid Lerner Associates

╠²

David Lerner Associates facilitated the merger of Apple REIT Six into BRE Select Hotels Corp, an affiliate of Blackstone Real Estate Partners VII, completing a $1.2 billion transaction in May 2013. The merger included multiple hotel properties such as SpringHill Suites and Residence Inn, located in various states including Florida and New Jersey. This consolidation of assets marks a significant development in the hospitality investment sector.How Stay-at-home Moms Can Prepare for Retirement

How Stay-at-home Moms Can Prepare for RetirementDavid Lerner Associates

╠²

This document discusses retirement planning options for stay-at-home mothers. It notes that while they give up earning potential to raise children, stay-at-home mothers should still plan for retirement. It recommends rolling over any 401(k) from a previous job into an IRA. A husband can contribute up to $5,500/$6,500 annually to a spousal IRA. It also discusses the maximum annual contributions to IRAs and 401(k)s and notes that funds in the husband's retirement accounts may not be accessible in case of divorce.Money Lessons for Women

Money Lessons for WomenDavid Lerner Associates

╠²

The gap between men and women is still evident - partly due to the fact that a large proportion of women work shorter hours or stop working altogether once they become mothers.╠²

Here are some lessons women can learn that will help them become even more independent and financially stable.

Womens' Entrepreneurship -

Womens' Entrepreneurship - David Lerner Associates

╠²

Hats off to the successful women business owners in the US and around the world. Women entrepreneurs are creating successful companies faster than men and young women - millenipreneurs - are doing best of all. Where women business owners fall behind is planning for retirement.5 Personal Finance Tips for Women

5 Personal Finance Tips for WomenDavid Lerner Associates

╠²

The document discusses five essential personal finance tips specifically for women, emphasizing the importance of financial literacy, consulting professionals, smart investing, planning for retirement, and taking immediate action. It highlights that many women will eventually manage their finances alone and encourages building confidence in making financial decisions. Additionally, it includes a disclaimer that the material is for informational purposes only and does not constitute financial advice.Women & Money: the Financial Gender Gap

Women & Money: the Financial Gender GapDavid Lerner Associates

╠²

International Women's Week s a good time to take another look at the financial gender gap; Women pay more in interest rates, earn less and pay more for many products than men do.Elder Financial Abuse Checklist

Elder Financial Abuse ChecklistDavid Lerner Associates

╠²

The document outlines signs of financial abuse in seniors, such as large withdrawals, confusion, and changes in financial management. It provides next steps for victims, including contacting the eldercare locator and tips for protecting personal information. Additionally, it offers advice on dealing with telemarketing fraud and educating others about prevention strategies.The American Retirement Crisis

The American Retirement Crisis David Lerner Associates

╠²

The document discusses the American retirement crisis, highlighting an increase in the aging population and the inadequacy of retirement savings among those over 55. It offers five steps for better retirement planning, including early saving, prioritizing retirement contributions, and assessing expected expenses and potential income sources. Additionally, it includes disclaimers regarding the information provided and its intended use.The College Application Process

The College Application ProcessDavid Lerner Associates

╠²

As summer ends, families face the often stressful college application process with various requirements including biographical information, extracurricular activities, reference letters, and personal essays. Emphasis is placed on the quality of recommendation letters and personal essays to help an applicant stand out, while focusing on a few key extracurricular pursuits rather than numerous superficial ones is advised. Different application timelines exist, notably early action and early decision, and careful organization is crucial in managing deadlines and documentation.How Divorce Affects Social Security Benefits

How Divorce Affects Social Security BenefitsDavid Lerner Associates

╠²

Divorce can affect a person's Social Security retirement benefits if they were counting on their spouse's benefits. Even if divorced, a person may still collect benefits from their ex-spouse if the marriage lasted 10+ years, they are at least 62 years old, their ex-spouse receives Social Security benefits, and their own benefit is less. The spousal benefit is 50% of the ex-spouse's benefit at full retirement age, but the amount can be affected by when benefits are claimed, earnings, and pension benefits from non-covered work. Remarriage does not impact benefits from an ex-spouse unless the new marriage lasts until the death of the ex-spouse.Executive Bonus Plans Boost Employee Retention

Executive Bonus Plans Boost Employee RetentionDavid Lerner Associates

╠²

Executive bonus plans can boost employee retention by incentivizing key employees to stay. Offering a Section 162 executive bonus plan allows businesses to reward top performers without providing the same benefits to all employees. The business can pay life insurance premiums for executives and deduct the cost, while the income is taxable to the employee. To offset the tax burden, the bonus can be increased or the business can loan money for taxes. This system of "golden handcuffs" encourages executives to remain for long periods like retirement. The plans provide benefits like cash value that executives can use for retirement income or exchange for annuities.Older Americans Month: Health Care Considerations

Older Americans Month: Health Care ConsiderationsDavid Lerner Associates

╠²

Health care becomes increasingly important as individuals approach retirement, with a focus on preventive care and potential health declines necessitating additional medical support. Medicare plays a critical role for those 65 and older, but early retirees may need alternative health insurance options, and many opt for Medigap policies to cover non-Medicare expenses. Long-term care insurance and understanding Medicaid eligibility are essential considerations for managing potential nursing home costs, and individuals should seek professional guidance regarding these matters.David Lerner Associates: The US Economic Rebound

David Lerner Associates: The US Economic ReboundDavid Lerner Associates

╠²

The document discusses the positive economic indicators in the U.S., highlighting significant job creation, improved unemployment rates, and increased consumer confidence as signs of recovery since the Great Recession. It mentions that consumer spending grew at the fastest pace in over eight years and housing starts rose year-over-year, although still below pre-recession levels. Caution is advised, as economic growth can be influenced by multiple factors, and the information provided is not a recommendation for investment.Primary Financing Sources for a Business Loans

Primary Financing Sources for a Business LoansDavid Lerner Associates

╠²

The document outlines various financing sources available to business owners, including personal loans, credit cards, home equity financing, and loans from family and friends, each with its own advantages and disadvantages. It also discusses institutional sources such as banks, the Small Business Administration (SBA), Small Business Investment Companies (SBICs), Economic Development Administration (EDA), and credit unions. The advice emphasizes careful consideration of all options and stresses the importance of understanding the implications of each financing source.David Lerner Associates: Charitable deduction

David Lerner Associates: Charitable deductionDavid Lerner Associates

╠²

The document explains charitable deductions, which allow individuals to deduct the value of property donated to qualified charities, potentially lowering federal gift and estate taxes. It provides conditions for qualifying gifts, types of charities that qualify, and implications for estate planning, alongside examples of charitable giving and IRA rollover gifts for donors over 70 1/2. Important disclosures clarify that the material is for informational purposes only and does not constitute tax or legal advice.Taking Care of Aging Parents

Taking Care of Aging ParentsDavid Lerner Associates

╠²

Taking care of aging parents involves preparing for their future needs by having crucial conversations about their wishes, gathering personal data records, and seeking professional advice for financial, legal, and health matters. Caregivers are encouraged to utilize local support groups, community services, and resources like the eldercare locator for assistance. Financial planning is essential both for parents and caregivers, including understanding available tax benefits, to ensure that both parties can manage their responsibilities and needs effectively.Financially speaking women and men are different

Financially speaking women and men are differentDavid Lerner Associates

╠²

Women today are in a stronger position to achieve financial security compared to men, yet they face unique challenges such as longer life expectancies and wage gaps that affect their savings and retirement. To navigate their financial futures, women should educate themselves about investments, advocate for equal pay, and create comprehensive financial and estate plans. Collaborating with financial professionals can also be beneficial in developing strategies for financial security.A Primer: Understanding Life Insurance

A Primer: Understanding Life InsuranceDavid Lerner Associates

╠²

Term life insurance provides a death benefit for a specific period at a set premium, while permanent life insurance has a portion of premiums go into a cash value that accumulates. Annuities allow investment now with payouts in the future, either as a lump sum or periodic payments, and can provide guaranteed lifetime income in retirement. The document discusses different types of life insurance and annuities to help the reader understand their options for protecting loved ones or saving for retirement.Life Insurance Generator

Life Insurance GeneratorDavid Lerner Associates

╠²

The document compares life insurance to a generator that can provide essential support during difficult times, like the aftermath of Hurricane Sandy. It outlines five key benefits of life insurance: family protection, supplemental retirement income, mortgage protection, college funding, and long-term care, emphasizing the importance of these policies for financial stability. The author encourages families to consider the advantages of life insurance despite concerns about premium costs.David Lerner Associates: 401k Primer

David Lerner Associates: 401k PrimerDavid Lerner Associates

╠²

The document provides an overview of common questions regarding 401(k) retirement plans, including contribution limits, participation requirements, and differences between traditional and Roth 401(k) plans. It also addresses employer matching contributions, options available when changing jobs, and the requirement to start withdrawals at age 70┬Į, highlighting potential penalties for missing withdrawals. This informational guide aims to clarify the workings of 401(k) plans for participants.David Lerner Associates Apple REIT Merger

David Lerner Associates Apple REIT MergerDavid Lerner Associates

╠²

David Lerner Associates welcomed the merger of Apple REIT Six into BRE Select Hotels Corp in May 2013. BRE Select Hotels is an affiliate of Blackstone Real Estate Partners VII. The document lists 10 hotels that were previously part of Apple REIT Six, providing the name and number of rooms for each hotel, and noting that each was merged into BRE Select Hotels Corp in May 2013.4 Important Facts About the Affordable Care Act

4 Important Facts About the Affordable Care ActDavid Lerner Associates

╠²

The Affordable Care Act still remains in force despite changes made to the law. Under the ACA, individuals must have qualifying health insurance by April 1, 2014 or pay a penalty. The 2014 penalty is 1% of taxable income or $95 per adult, up to $285 per family. Exceptions apply for financial hardship, religious objections, or if insurance costs more than 8% of income. Insurers can no longer deny coverage or increase premiums due to pre-existing conditions under the ACA.More Related Content

More from David Lerner Associates (20)

Money Lessons for Women

Money Lessons for WomenDavid Lerner Associates

╠²

The gap between men and women is still evident - partly due to the fact that a large proportion of women work shorter hours or stop working altogether once they become mothers.╠²

Here are some lessons women can learn that will help them become even more independent and financially stable.

Womens' Entrepreneurship -

Womens' Entrepreneurship - David Lerner Associates

╠²

Hats off to the successful women business owners in the US and around the world. Women entrepreneurs are creating successful companies faster than men and young women - millenipreneurs - are doing best of all. Where women business owners fall behind is planning for retirement.5 Personal Finance Tips for Women

5 Personal Finance Tips for WomenDavid Lerner Associates

╠²

The document discusses five essential personal finance tips specifically for women, emphasizing the importance of financial literacy, consulting professionals, smart investing, planning for retirement, and taking immediate action. It highlights that many women will eventually manage their finances alone and encourages building confidence in making financial decisions. Additionally, it includes a disclaimer that the material is for informational purposes only and does not constitute financial advice.Women & Money: the Financial Gender Gap

Women & Money: the Financial Gender GapDavid Lerner Associates

╠²

International Women's Week s a good time to take another look at the financial gender gap; Women pay more in interest rates, earn less and pay more for many products than men do.Elder Financial Abuse Checklist

Elder Financial Abuse ChecklistDavid Lerner Associates

╠²

The document outlines signs of financial abuse in seniors, such as large withdrawals, confusion, and changes in financial management. It provides next steps for victims, including contacting the eldercare locator and tips for protecting personal information. Additionally, it offers advice on dealing with telemarketing fraud and educating others about prevention strategies.The American Retirement Crisis

The American Retirement Crisis David Lerner Associates

╠²

The document discusses the American retirement crisis, highlighting an increase in the aging population and the inadequacy of retirement savings among those over 55. It offers five steps for better retirement planning, including early saving, prioritizing retirement contributions, and assessing expected expenses and potential income sources. Additionally, it includes disclaimers regarding the information provided and its intended use.The College Application Process

The College Application ProcessDavid Lerner Associates

╠²

As summer ends, families face the often stressful college application process with various requirements including biographical information, extracurricular activities, reference letters, and personal essays. Emphasis is placed on the quality of recommendation letters and personal essays to help an applicant stand out, while focusing on a few key extracurricular pursuits rather than numerous superficial ones is advised. Different application timelines exist, notably early action and early decision, and careful organization is crucial in managing deadlines and documentation.How Divorce Affects Social Security Benefits

How Divorce Affects Social Security BenefitsDavid Lerner Associates

╠²

Divorce can affect a person's Social Security retirement benefits if they were counting on their spouse's benefits. Even if divorced, a person may still collect benefits from their ex-spouse if the marriage lasted 10+ years, they are at least 62 years old, their ex-spouse receives Social Security benefits, and their own benefit is less. The spousal benefit is 50% of the ex-spouse's benefit at full retirement age, but the amount can be affected by when benefits are claimed, earnings, and pension benefits from non-covered work. Remarriage does not impact benefits from an ex-spouse unless the new marriage lasts until the death of the ex-spouse.Executive Bonus Plans Boost Employee Retention

Executive Bonus Plans Boost Employee RetentionDavid Lerner Associates

╠²

Executive bonus plans can boost employee retention by incentivizing key employees to stay. Offering a Section 162 executive bonus plan allows businesses to reward top performers without providing the same benefits to all employees. The business can pay life insurance premiums for executives and deduct the cost, while the income is taxable to the employee. To offset the tax burden, the bonus can be increased or the business can loan money for taxes. This system of "golden handcuffs" encourages executives to remain for long periods like retirement. The plans provide benefits like cash value that executives can use for retirement income or exchange for annuities.Older Americans Month: Health Care Considerations

Older Americans Month: Health Care ConsiderationsDavid Lerner Associates

╠²

Health care becomes increasingly important as individuals approach retirement, with a focus on preventive care and potential health declines necessitating additional medical support. Medicare plays a critical role for those 65 and older, but early retirees may need alternative health insurance options, and many opt for Medigap policies to cover non-Medicare expenses. Long-term care insurance and understanding Medicaid eligibility are essential considerations for managing potential nursing home costs, and individuals should seek professional guidance regarding these matters.David Lerner Associates: The US Economic Rebound

David Lerner Associates: The US Economic ReboundDavid Lerner Associates

╠²

The document discusses the positive economic indicators in the U.S., highlighting significant job creation, improved unemployment rates, and increased consumer confidence as signs of recovery since the Great Recession. It mentions that consumer spending grew at the fastest pace in over eight years and housing starts rose year-over-year, although still below pre-recession levels. Caution is advised, as economic growth can be influenced by multiple factors, and the information provided is not a recommendation for investment.Primary Financing Sources for a Business Loans

Primary Financing Sources for a Business LoansDavid Lerner Associates

╠²

The document outlines various financing sources available to business owners, including personal loans, credit cards, home equity financing, and loans from family and friends, each with its own advantages and disadvantages. It also discusses institutional sources such as banks, the Small Business Administration (SBA), Small Business Investment Companies (SBICs), Economic Development Administration (EDA), and credit unions. The advice emphasizes careful consideration of all options and stresses the importance of understanding the implications of each financing source.David Lerner Associates: Charitable deduction

David Lerner Associates: Charitable deductionDavid Lerner Associates

╠²

The document explains charitable deductions, which allow individuals to deduct the value of property donated to qualified charities, potentially lowering federal gift and estate taxes. It provides conditions for qualifying gifts, types of charities that qualify, and implications for estate planning, alongside examples of charitable giving and IRA rollover gifts for donors over 70 1/2. Important disclosures clarify that the material is for informational purposes only and does not constitute tax or legal advice.Taking Care of Aging Parents

Taking Care of Aging ParentsDavid Lerner Associates

╠²

Taking care of aging parents involves preparing for their future needs by having crucial conversations about their wishes, gathering personal data records, and seeking professional advice for financial, legal, and health matters. Caregivers are encouraged to utilize local support groups, community services, and resources like the eldercare locator for assistance. Financial planning is essential both for parents and caregivers, including understanding available tax benefits, to ensure that both parties can manage their responsibilities and needs effectively.Financially speaking women and men are different

Financially speaking women and men are differentDavid Lerner Associates

╠²

Women today are in a stronger position to achieve financial security compared to men, yet they face unique challenges such as longer life expectancies and wage gaps that affect their savings and retirement. To navigate their financial futures, women should educate themselves about investments, advocate for equal pay, and create comprehensive financial and estate plans. Collaborating with financial professionals can also be beneficial in developing strategies for financial security.A Primer: Understanding Life Insurance

A Primer: Understanding Life InsuranceDavid Lerner Associates

╠²

Term life insurance provides a death benefit for a specific period at a set premium, while permanent life insurance has a portion of premiums go into a cash value that accumulates. Annuities allow investment now with payouts in the future, either as a lump sum or periodic payments, and can provide guaranteed lifetime income in retirement. The document discusses different types of life insurance and annuities to help the reader understand their options for protecting loved ones or saving for retirement.Life Insurance Generator

Life Insurance GeneratorDavid Lerner Associates

╠²

The document compares life insurance to a generator that can provide essential support during difficult times, like the aftermath of Hurricane Sandy. It outlines five key benefits of life insurance: family protection, supplemental retirement income, mortgage protection, college funding, and long-term care, emphasizing the importance of these policies for financial stability. The author encourages families to consider the advantages of life insurance despite concerns about premium costs.David Lerner Associates: 401k Primer

David Lerner Associates: 401k PrimerDavid Lerner Associates

╠²

The document provides an overview of common questions regarding 401(k) retirement plans, including contribution limits, participation requirements, and differences between traditional and Roth 401(k) plans. It also addresses employer matching contributions, options available when changing jobs, and the requirement to start withdrawals at age 70┬Į, highlighting potential penalties for missing withdrawals. This informational guide aims to clarify the workings of 401(k) plans for participants.David Lerner Associates Apple REIT Merger

David Lerner Associates Apple REIT MergerDavid Lerner Associates

╠²

David Lerner Associates welcomed the merger of Apple REIT Six into BRE Select Hotels Corp in May 2013. BRE Select Hotels is an affiliate of Blackstone Real Estate Partners VII. The document lists 10 hotels that were previously part of Apple REIT Six, providing the name and number of rooms for each hotel, and noting that each was merged into BRE Select Hotels Corp in May 2013.4 Important Facts About the Affordable Care Act

4 Important Facts About the Affordable Care ActDavid Lerner Associates

╠²

The Affordable Care Act still remains in force despite changes made to the law. Under the ACA, individuals must have qualifying health insurance by April 1, 2014 or pay a penalty. The 2014 penalty is 1% of taxable income or $95 per adult, up to $285 per family. Exceptions apply for financial hardship, religious objections, or if insurance costs more than 8% of income. Insurers can no longer deny coverage or increase premiums due to pre-existing conditions under the ACA.