financial statements part1

- 1. Preparation

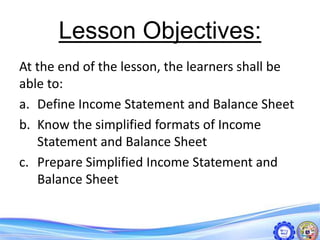

- 2. Lesson Objectives: At the end of the lesson, the learners shall be able to: a. Define Income Statement and Balance Sheet b. Know the simplified formats of Income Statement and Balance Sheet c. Prepare Simplified Income Statement and Balance Sheet

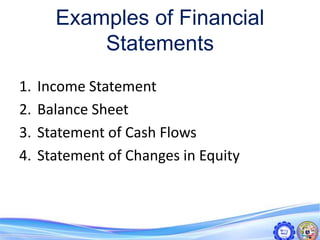

- 3. Examples of Financial Statements 1. Income Statement 2. Balance Sheet 3. Statement of Cash Flows 4. Statement of Changes in Equity

- 4. INCOME STATEMENT - other term for Comprehensive Statement of Income - Periodic financial income summary - a financial statement showing the profit or loss sustained by a company during a particular period, including all items of income and expenditure - basically contains all the nominal accounts, except the drawing accounts and the income summary accounts

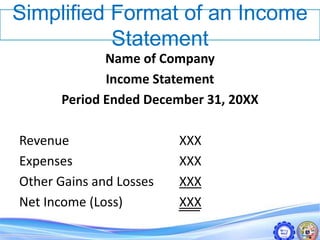

- 5. Simplified Format of an Income Statement Name of Company Income Statement Period Ended December 31, 20XX Revenue XXX Expenses XXX Other Gains and Losses XXX Net Income (Loss) XXX

- 6. BALANCE SHEET - also known as the statement of financial position - it provides the amounts for the various assets, liabilities, and owner’s capital accounts. - it contains real accounts

- 7. Name of Company Balance Sheet As of December 31, 20XX Asset 1 Liability 1 Asset 2 Liability 2 Asset 3 Total Liabilities Asset 4 Asset 5 Owner’s Capital Total Assets Total Liabilities and Owner’s Capital Simplified format of a Balance Sheet

- 8. Owner’s Capital is determined as follows: Owner’s Capital Balance (ATB) P 100,000.00 Net Income from the Income Statement 78,932.58 Owner’s Drawings (ATB) ( ) Owner’s Capital, Dec. 31, 2015 P 178,932.58

Editor's Notes

- IN YOUR OWN WORDS, WHAT IS A FINANCIAL STATEMENTS Can you site some examples of FS that you know?

- But for this subject, we will be only focusing on the first two FS

- For the period report/ for the year ended Nominal accounts are accounts that are being close to income summary every year-end reporting

- Give example Using our adjusted trial balance in our activity, can we now make an income statement?

- As of report Real accounts – accounts that are being forwarded to the next accounting period.

- For assets that has contra-asset account like FFE, AR, deduct this CAA to the asset Can we now prepare the balance sheet of Jeremias company? Let’s compute first for the owner’s capital How to compute for owners capital?

- So can we now prepare our balance sheet? Group yourselves