Fraud Detection Engine

- 1. Features Transactional Fraud Pre Txn Validation Post Txn Validation Lending Eligibility Check Merchant Fraud Pre-Onboarding Post-Onboarding Version 1.0

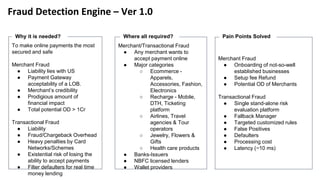

- 2. Fraud Detection Engine – Ver 1.0 To make online payments the most secured and safe Merchant Fraud ● Liability lies with US ● Payment Gateway acceptability of a LOB. ● Merchant’s credibility ● Prodigious amount of financial impact ● Total potential OD > 1Cr Transactional Fraud ● Liability ● Fraud/Chargeback Overhead ● Heavy penalties by Card Networks/Schemes ● Existential risk of losing the ability to accept payments ● Filter defaulters for real time money lending Why it is needed? Merchant/Transactional Fraud ● Any merchant wants to accept payment online ● Major categories ○ Ecommerce - Apparels, Accessories, Fashion, Electronics ○ Recharge - Mobile, DTH, Ticketing platform ○ Airlines, Travel agencies & Tour operators ○ Jewelry, Flowers & Gifts ○ Health care products ● Banks-Issuers ● NBFC licensed lenders ● Wallet providers Where all required? Merchant Fraud ● Onboarding of not-so-well established businesses ● Setup fee Refund ● Potential OD of Merchants Transactional Fraud ● Single stand-alone risk evaluation platform ● Fallback Manager ● Targeted customized rules ● False Positives ● Defaulters ● Processing cost ● Latency (~10 ms) Pain Points Solved