Local government; Financing and Fiscal management

- 1. LOCAL GOVERNMENT; FINANCING AND FISCAL MANAGEMENT Prepared by: DAISY JANE D. BONGGO MPA-2

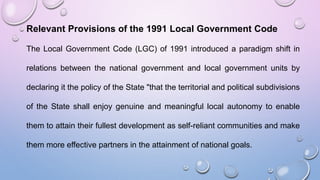

- 2. Relevant Provisions of the 1991 Local Government Code The Local Government Code (LGC) of 1991 introduced a paradigm shift in relations between the national government and local government units by declaring it the policy of the State "that the territorial and political subdivisions of the State shall enjoy genuine and meaningful local autonomy to enable them to attain their fullest development as self-reliant communities and make them more effective partners in the attainment of national goals.

- 3. INTERNAL REVENUE ALLOTMENT (IRA) • Internal revenue allotment is the annual share of local governments out of the proceeds from national revenue taxes. • It is estimated at forty percent (40%) of the actual collections of national internal revenue taxes during the third fiscal year preceding the current year (Section 284 of RA No. 7160)

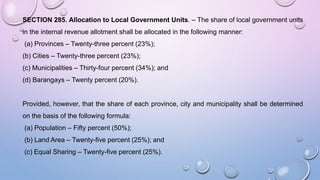

- 4. SECTION 285. Allocation to Local Government Units. – The share of local government units in the internal revenue allotment shall be allocated in the following manner: (a) Provinces – Twenty-three percent (23%); (b) Cities – Twenty-three percent (23%); (c) Municipalities – Thirty-four percent (34%); and (d) Barangays – Twenty percent (20%). Provided, however, that the share of each province, city and municipality shall be determined on the basis of the following formula: (a) Population – Fifty percent (50%); (b) Land Area – Twenty-five percent (25%); and (c) Equal Sharing – Twenty-five percent (25%).

- 5. • The share of each LGU shall be released, without need of any further action, directly to the provincial, city, municipal or barangay treasurer, as the case may be, on a quarterly basis within five days after the end of each quarter, and which shall not be imposed by the National Government for whatever purpose (Sec. 286 Automatic Release of Shares) • Each local government unit shall appropriate in its annual budget no less than twenty percent (20%) of its annual internal revenue allotment for development plans of local government units shall be furnished by the DILG (Sec. 287 Local Development Projects)

- 6. LOCAL TAXES AND NON-TAX REVENUES • LGUs are given authority to levy their own taxes, fees and other sources of revenues, consistent with the basic policies in the Code. • Local taxes includes real property tax; the business of printing and publication; sand, gravel and other quarry resources; delivery trucks of manufacturers and dealers; and the franchise tax, professional tax, amusement tax. • Non-tax revenues are generated from the operation of economic enterprises, namely, market and slaughterhouses, waterworks, bus terminal, cemetery and gymnasium or sports center.

- 7. GRANTS, LOANS • Under the Local Government Code, LGUs in the Philippines were also authorized to seek grants and contract loans, credits, and other forms of indebtedness with any domestic private bank and other lending institutions. Borrowed funds can be used to finance the construction, installation, improvement, expansion, operation, or maintenance of public facilities, infrastructure facilities, housing projects, the acquisition of real property, and the implementation of other capital investment projects.

- 8. • Loans, deferred payment and other financial schemes • Bonds and other long-term securities • Inter-local government loans, grants, and subsidies. • Loans from funds secured by NG from foreign sources • Build-Operate-Transfer/Joint Ventures: financing, construction, maintenance, operation, and management of infrastructure projects by the private sector FORMS OF INDEBTEDNESS/CREDIT FACILITIES: