PointNine_Company_Overview.v1.9

- 1. Point Nine 1 Strictly private and confidential Post Trade Excellency

- 2. Point Nine Introducing Point Nine 2 w w w . p 9 f t . c o m 2 • Founded in 2002, Point Nine is one of the industry leaders in post trade execution, operation, processing and reporting. • We collaborate with both buy and sell side financial firms and corporates to help them meet the ever-expanding challenges of post-trade processing. • Circle, our in-house proprietary technology, provides a real-time solution to all our customers and their trading relationships

- 3. Point Nine Circle Network - Financial Service Providers 3 w w w . p 9 f t . c o m 3

- 4. Point Nine Circle Network - Independent Software Vendors 4 w w w . p 9 f t . c o m 4 investone AXYSGeneva

- 5. Point Nine Point Nine Overview 5 w w w . p 9 f t . c o m 5 Circle has been operational since 2004 Real-time, end-to-end automation of post trade execution work- flow Integrated, web-delivered, reporting platform Scalable solution Fast implementation Cross-asset coverage Reduces Operational Risk, Cost and Time On hand operations professionals for managed solutions

- 6. Point Nine 6 Circle - Solution for all market participants w w w . p 9 f t . c o m 6 Equity FX Indices Commodity Credit Fixed Income Depository Custodians Prime Brokers Execution Brokers und Administrators “Circle” Fund/Asset Manager Buy Side Banks Corporates Retail FX Cash Regulators Trade Repositories Alternative Assets RealAssets

- 7. Point Nine Service Summary 7 w w w . p 9 f t . c o m 7 Trade & Corporate Action capturing Settlements of cash and assets Matching Affirmation Corporate Action Processing Dissemination of trade/corporate action activity to third parties Reconciliations Reporting Operation Regulatory Reporting

- 8. Point Nine Service Summary 8 w w w . p 9 f t . c o m 8 Proprietary Technology Web Based Centralized Solution Full Audit Trail Customized User Access Circle Connectivity Range Fast Implementation 0 Technology

- 9. Point Nine Industry Challenges 9 w w w . p 9 f t . c o m 9 • Automated reconciliations • Specialisation in data translation and transformation for regulatory reporting • Trade Repository and CCP connectivity • Constant updating and implementation of state of art proprietary software • Fully automated and scalable solution • Centralised operation / achieves economies of scale • No requirement for opaque spreadsheet functionality • STP real-time connectivity with multiple market participants • Tailored made, comprehensive reporting • Automated reconciliations with clients and all their third parties • No manual procedures (other than break resolution) • Industry renowned experience Increased Market Regulation Cost Efficiency Operational Risk

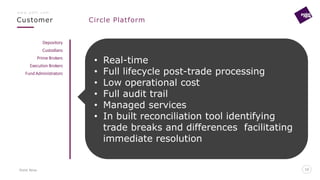

- 10. Point Nine Customer Circle Platform 10 w w w . p 9 f t . c o m 10 Depository Custodians Prime Brokers Execution Brokers Fund Administrators • Real-time • Full lifecycle post-trade processing • Low operational cost • Full audit trail • Managed services • In built reconciliation tool identifying trade breaks and differences facilitating immediate resolution

- 11. Point Nine Customer Circle Platform 11 w w w . p 9 f t . c o m 11 Fund/Asset Manager Buy Side Banks Corporates Retail FX • Real-time connectivity to all market participants • Seamless setup and integration • Reduction of operational risk • Full life cycle trade support • Customer view access • Full audit trail

- 12. Point Nine Circle Dashboard 12 w w w . p 9 f t . c o m 12

- 13. Point Nine Get In Touch 13 w w w . p 9 f t . c o m 13 E info@p9ft.com +44 20 7193 5298 We are here to help you Working days 9am to 7pm BSG Valentine, Lynton House 7-12 Tavistock Square, WC1H 9BQ UK, London Chrysorrogiatissis 11, 3032 Cyprus, Limassol Sedyh 38-14, 220103 Belarus, Minsk Sales Office Head Office R&D Office P