1 of 12

Download to read offline

Ad

Recommended

Macro Synopsis by Anric Blatt

Macro Synopsis by Anric BlattAnric Blatt

╠²

The document outlines the urgent global resource crisis driven by unprecedented population growth and increasing demands for food, water, energy, and metals, which have become limited and valuable commodities. It emphasizes the geopolitical shifts as emerging nations seek to access these resources, while also presenting a significant investment opportunity for visionary investors through Global Fund Exchange, which focuses on dedicated multi-manager portfolios in these key areas. The report warns of severe consequences resulting from resource scarcity and emphasizes the critical need for investment in sustainable infrastructure to address future challenges.Terra Prima Partners - Investing in Sustainable Solutions that WILL change th...

Terra Prima Partners - Investing in Sustainable Solutions that WILL change th...Anric Blatt

╠²

Terra Prima Partners is a private equity firm focused on sustainable innovations across various sectors such as energy, water, and agriculture, addressing the urgent global demand for these resources driven by population growth. The firm aims to capitalize on this opportunity by supporting entrepreneurs with expertise and investments in groundbreaking technologies that promise both financial returns and environmental benefits. Their portfolio includes projects that seek to improve efficiency, reduce costs, and tackle pressing challenges such as water scarcity and energy consumption.Terra Prima Partners LLC - Vision Statement

Terra Prima Partners LLC - Vision StatementAnric Blatt

╠²

Terra Prima is a venture capital and private equity firm focused on investing in breakthrough technologies within renewable and sustainable sectors such as clean power, water conservation, and sustainable agriculture. The firm aims to support passionate entrepreneurs and transformative innovations while targeting massive markets to generate significant returns. With a network of industry leaders and a global perspective, Terra Prima aims to drive positive change in the face of increasing demand for sustainable solutions.Vital assets-overview

Vital assets-overviewAnric Blatt

╠²

Global Fund Exchange focuses on purpose-driven investments that address pressing environmental needs in energy, agriculture, water, and scarce resources. With significant growth opportunities in clean energy and agriculture driven by rising global demand, the fund appeals to investors aiming to make a positive impact while seeking profits. The management team, with extensive experience in finance and investment across various asset classes, emphasizes strategic diversification and a commitment to long-term sustainability.Anric Blatt Sustainability as an asset class

Anric Blatt Sustainability as an asset classAnric Blatt

╠²

The document discusses the growing global challenges of food, water and energy security due to rising population, climate change impacts, and unsustainable resource use. It argues that these issues represent both risks and investment opportunities. Specific opportunities mentioned include investments in agriculture, water, clean/renewable energy, and related natural resources and commodities. The document promotes treating sustainability issues as a critical asset class and taking action to address problems before it is too late.The 5 key V's of Big Data

The 5 key V's of Big DataAnric Blatt

╠²

The document explains the concept of big data through the five Vs: volume, velocity, variety, veracity, and value. It highlights how vast and rapidly changing data types challenge traditional database technologies, necessitating new tools for analysis and storage. Additionally, it emphasizes the importance of turning big data into valuable insights for businesses to stay competitive in the evolving big data economy.10 Insightful Quotes On Designing A Better Customer Experience

10 Insightful Quotes On Designing A Better Customer ExperienceYuan Wang

╠²

The document discusses the importance of customer experience design and emphasizes the need for collaboration, diversity, and emotional engagement in crafting effective interactions. It outlines strategies for understanding user expectations, innovating through research, and creating memorable brand storytelling to foster customer loyalty. Key points include designing for context, consulting directly with customers, and measuring the right metrics for success.Crushing it on Linkedin Table of contents

Crushing it on Linkedin Table of contentsAnric Blatt

╠²

Here is a Table of Contents of #anricb 's #CrushingitonLinkedin programFinding Your WHY

Finding Your WHYAnric Blatt

╠²

The document emphasizes the importance of communicating one's 'why' in discussions about business, especially when seeking capital or investment. It suggests that while others may tolerate explanations about 'what' and 'how', they ultimately care more about the underlying motivation and purpose. The message is framed within the context of raising capital and leveraging social media platforms like LinkedIn.The energy-report-2011

The energy-report-2011Anric Blatt

╠²

This document summarizes the key reasons why a transition to 100% renewable energy is necessary by 2050:

1) Fossil fuels like oil, coal and gas are finite resources that are being depleted, while energy demand continues to rise globally. Over 1 billion people still lack access to reliable electricity.

2) Unconventional fossil fuel sources that are being increasingly tapped, like tar sands and shale gas, produce more greenhouse gases and pollution and put unsustainable demands on water resources.

3) If current consumption patterns continue globally, the world's oil reserves would be depleted in less than 10 years. Renewable energy is the only option that can provide sustainable energy access for all.Macro overview by Global Fund Exchange

Macro overview by Global Fund ExchangeAnric Blatt

╠²

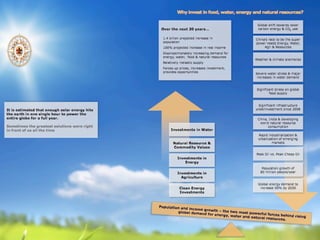

The document discusses the significant investment opportunities in energy and water due to rapid population and income growth, projecting a 40% increase in global primary energy use by 2030, primarily from non-OECD economies. It highlights the growing importance of clean energy investments, which are expected to reach $1.6 trillion by 2050, alongside the urgent need for water resource management amidst rising demand and environmental concerns. Additionally, agricultural challenges and the necessity for increased investment in natural resources are mentioned, emphasizing the interconnectedness of energy, water, and food security issues.Global Fund Exchange - Corporate Profile

Global Fund Exchange - Corporate ProfileAnric Blatt

╠²

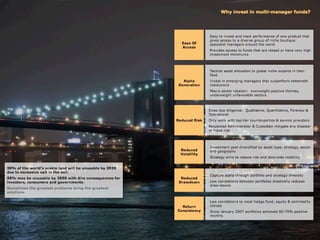

This document provides information about an investment fund called the Earth Wind & Fire Fund, which invests across various sectors related to energy, natural resources, water, and agriculture. It utilizes a multi-manager, multi-strategy approach to diversify across geographies, sectors, asset classes, and themes. The fund aims to provide investors opportunities from mega macro trends while reducing volatility normally associated with these markets. It highlights why multi-manager funds and investing in energy and natural resources can provide benefits such as ease of access, alpha generation, and risk reduction. Brief biographies are provided for the key people involved in the fund.Q&a

Q&aAnric Blatt

╠²

The document provides an overview of an investment manager's macro strategy and portfolio management process. It discusses:

1. The manager focuses on long-term profit opportunities brought about by an ever-increasing energy and commodity demand fueled by increasing population and accelerated industrialization.

2. They manage portfolios through dedicated sub-strategies including clean energy, water, agriculture, traditional energy, carbon and emissions trading, commodities and natural resources, and other hedge sectors.

3. The current timing is ideal for an experienced and diligent group of investors like themselves, as the cash flow rich integrated energy companies, sovereign wealth funds, utilities and technology companies around the world are spending vast amounts of money on these sectors.More Related Content

More from Anric Blatt (7)

Crushing it on Linkedin Table of contents

Crushing it on Linkedin Table of contentsAnric Blatt

╠²

Here is a Table of Contents of #anricb 's #CrushingitonLinkedin programFinding Your WHY

Finding Your WHYAnric Blatt

╠²

The document emphasizes the importance of communicating one's 'why' in discussions about business, especially when seeking capital or investment. It suggests that while others may tolerate explanations about 'what' and 'how', they ultimately care more about the underlying motivation and purpose. The message is framed within the context of raising capital and leveraging social media platforms like LinkedIn.The energy-report-2011

The energy-report-2011Anric Blatt

╠²

This document summarizes the key reasons why a transition to 100% renewable energy is necessary by 2050:

1) Fossil fuels like oil, coal and gas are finite resources that are being depleted, while energy demand continues to rise globally. Over 1 billion people still lack access to reliable electricity.

2) Unconventional fossil fuel sources that are being increasingly tapped, like tar sands and shale gas, produce more greenhouse gases and pollution and put unsustainable demands on water resources.

3) If current consumption patterns continue globally, the world's oil reserves would be depleted in less than 10 years. Renewable energy is the only option that can provide sustainable energy access for all.Macro overview by Global Fund Exchange

Macro overview by Global Fund ExchangeAnric Blatt

╠²

The document discusses the significant investment opportunities in energy and water due to rapid population and income growth, projecting a 40% increase in global primary energy use by 2030, primarily from non-OECD economies. It highlights the growing importance of clean energy investments, which are expected to reach $1.6 trillion by 2050, alongside the urgent need for water resource management amidst rising demand and environmental concerns. Additionally, agricultural challenges and the necessity for increased investment in natural resources are mentioned, emphasizing the interconnectedness of energy, water, and food security issues.Global Fund Exchange - Corporate Profile

Global Fund Exchange - Corporate ProfileAnric Blatt

╠²

This document provides information about an investment fund called the Earth Wind & Fire Fund, which invests across various sectors related to energy, natural resources, water, and agriculture. It utilizes a multi-manager, multi-strategy approach to diversify across geographies, sectors, asset classes, and themes. The fund aims to provide investors opportunities from mega macro trends while reducing volatility normally associated with these markets. It highlights why multi-manager funds and investing in energy and natural resources can provide benefits such as ease of access, alpha generation, and risk reduction. Brief biographies are provided for the key people involved in the fund.Q&a

Q&aAnric Blatt

╠²

The document provides an overview of an investment manager's macro strategy and portfolio management process. It discusses:

1. The manager focuses on long-term profit opportunities brought about by an ever-increasing energy and commodity demand fueled by increasing population and accelerated industrialization.

2. They manage portfolios through dedicated sub-strategies including clean energy, water, agriculture, traditional energy, carbon and emissions trading, commodities and natural resources, and other hedge sectors.

3. The current timing is ideal for an experienced and diligent group of investors like themselves, as the cash flow rich integrated energy companies, sovereign wealth funds, utilities and technology companies around the world are spending vast amounts of money on these sectors.