VEROCY KVK Rotterdam

- 1. Iran Conference KvK /RVO Rotterdam, 24-03-2014 Geopolitics and Risks Investments Dr Cyril Widdershoven Cyril.widdershoven@verocy.co m/cw@mea-risk.com Mob: 0031-6-53819265 Skype: Cyril.widdershoven

- 2. VEROCY.COM MANAGING VALUE OF CRITICAL Company Info 2

- 3. VEROCY.COM MANAGING VALUE OF CRITICAL Company Info 3

- 4. VEROCY.COM MANAGING VALUE OF CRITICAL THE ISSUE Oil & Gas Assets Center of Instability 4

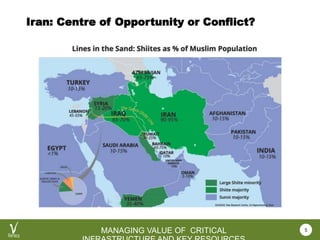

- 5. VEROCY.COM MANAGING VALUE OF CRITICAL Iran: Centre of Opportunity or Conflict? 5

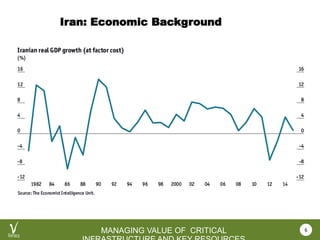

- 6. VEROCY.COM MANAGING VALUE OF CRITICAL Iran: Economic Background 6

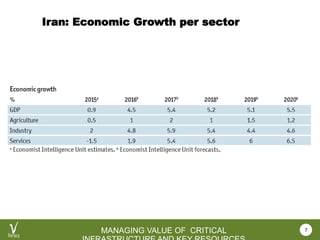

- 7. VEROCY.COM MANAGING VALUE OF CRITICAL Iran: Economic Growth per sector 7

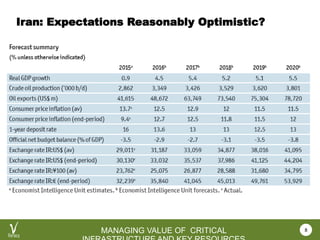

- 8. VEROCY.COM MANAGING VALUE OF CRITICAL Iran: Expectations Reasonably Optimistic? 8

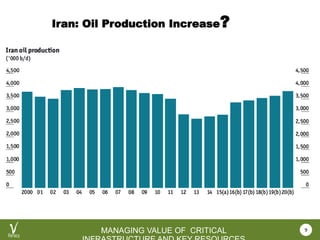

- 9. VEROCY.COM MANAGING VALUE OF CRITICAL Iran: Oil Production Increase? 9

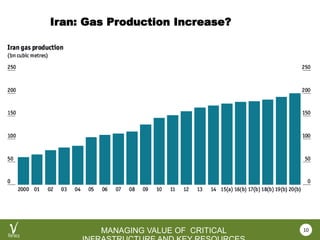

- 10. VEROCY.COM MANAGING VALUE OF CRITICAL Iran: Gas Production Increase? 10

- 11. VEROCY.COM MANAGING VALUE OF CRITICAL Iran: Opportunities 11

- 12. VEROCY.COM MANAGING VALUE OF CRITICAL Iran: What¨s on Offer? 12

- 13. VEROCY.COM MANAGING VALUE OF CRITICAL Iran Risks I ? Several sanctions will be in place for prolonged period ? Third party risk continues ? Continued conflict with Iranian Revolutionary Guard Corps (IRGC) ? Financial transactions continue to be hampered (US-listing or operations) ? IRGC holds vast stakes oil/gas/energy/finance/telecoms and infrastructure ? Slow economic opening of other sectors than energy-related sectors 13

- 14. VEROCY.COM MANAGING VALUE OF CRITICAL ? Iranian elections NOT showing full support `liberals ̄ ? Position of Iranian political hardliners weakened BUT still ruling ? Ongoing interference Iran in Arab world (Syria-Iraq-Yemen- Lebanon) ? Hardliners/IRGC is testing commitment of Western sanctions relieve ? Western investments will threaten Iranian business elite powers ? Possibility of being confronted by increased domestic demand requirements oil/gas production, leading to lower domestic price settings Iran Risks II 14

- 15. VEROCY.COM MANAGING VALUE OF CRITICAL Iran: Risks? 15

- 16. VEROCY.COM MANAGING VALUE OF CRITICAL Iran: Risk For Other Operations GCC? ? Investors-Suppliers-Operators-Banks should be taking into account in all their operations and possible discussions with and within Iran that GCC-North Africa- Turkish clients could be not amused! ? Ongoing strive between Sunni-Shi¨a regions not to be underestimated in your own commercial activities ? American politics will have an influence in 2016-2017 on Iranian opportunities! ? Too high optimism about potential Iran at present, due to oil-gas market issues ? Very strict in geopolitical alliances ? IPC contracts are still NOT applicable, as they could be seen as interfering in Iran¨s nationalistic oil policies 16

- 17. VEROCY.COM MANAGING VALUE OF CRITICAL Going to Iran: Integrated Risk Analysis needed ? The opportunities in Iran are theoretically staggering. Full scope of projects and openings will bring Iran to the centre of attention ? Political-economic and geopolitical environment however still to be assessed continuously ? Investment analysis and commercial cooperation needs to be based on in-depth analysis of power players and political-religious links inside and between companies and organisations ? Full need of export and political risk insurance ? Watch out for growing amount of new agents/consultants focussing on Iran ? Assessments/economic advise/geopolitical risks integral part of your Iranian approach ? VEROCY has direct link to Iranian Governor Kuzhestan/NIOC ? Can be followed up from NL(HQ)-US (Risk)-Turkey (Energy)-Dubai (Investment Iran) 17

- 18. VEROCY.COM MANAGING VALUE OF CRITICAL Background Speaker ? Dr. Cyril Widdershoven is currently SVP Research of US-based consultancy MEA-Risk.com and Dutch critical risk (defense/security/energy MENA) consultancy VEROCY. He also is Fellow of IAGS US (www.IAGS.org) and Senior Fellow of Turkish strategic thinktank HAZAR.. ? Dr. Widdershoven is a long-time observer of the global energy market with focus on geopolitical risk, terrorism, fundamentalism and military/defense related issues in the MENA region. Presently, he holds several advisory positions with international think tanks in the Middle East and energy sectors in the Netherlands, the United Kingdom, and the United States. In earlier career assignments, he held positions at Capgemini Consulting, Deloitte Financial Advisory Services, and as Senior Financial Analyst Oil & Gas Sector FDA, where he managed and advised the oil and gas department on equity and bond markets, with the main targets being Shell, BP, Total, Eni, BG, Heerema, Fugro, DSM, Dow Chemicals, BASF, Statoil, Schlumberger, Halliburton, PSG, and Repsol. ? Dr. Widdershoven held several senior publishing positions in leading energy publications such as Afroil, Middle East Oil and Gas, and North Africa Oil and Gas Magazine Cairo, and he continues to oversee the Mediterranean Energy Political Risk Consultancy. Dr. Widdershoven worked on M&A operations in Egypt, Libya, Sudan, and Iran, he studied the pipeline operations in Libya, Algeria, Nigeria and Turkey, and he assessed risk for institutional investors and banks in Libya, Egypt, Saudi Arabia, Oman and Iraq, all while advising international organizations on related issues. ? Dr. Widdershoven has throughout his career lived and worked in numerous Middle East countries, with a home base in Egypt, where he was Head of Investment and Research at ARTOC Group for Investment and Development in Cairo. He has lived in GCC, Iran, Egypt, Lebanon, Jordan, and Turkye. 18

- 19. THANK YOU! CRITICAL INFRASTRUCTURE & KEY RESOURCES PROTECTIONINQUIRIES@VEROCY.COM