Market Report 2015-Retail Q4

- 1. Wisinski of West Michigan Office âĒ Industrial âĒ Retail âĒ Multi-Family 100 Grandville Ave SW Suite 100 Grand Rapids, MI 49503 616. 776. 0100 www.naiwwm.com *Also serving the Kalamazoo & Southwest Michigan areas from our new Kalamazoo office* Retail Market Report West Michigan Q4 - Year End 2015

- 2. LookingAheadattheRetail MarketinSixteen. For Retailers, Brands and Consumers. * The information contained herein has been given to us by sources we deem reliable. We have no reason to doubt its accuracy, however, we do not make any guarantees. All information should be verified before relying thereon. * Source: NAIWisinskiofWestMI, CoStar PropertyÂŪ , U.S. Bureau of Labor Statistics GRAND RAPIDS, MI The Market 2015 was an EXCITING year for retail real estate in West Michigan. The market continues to absorb vacancy and significant new projects have come on line. The most notable and largest project is the 75 store Tanger Outlet center in Byron Center. This was a long awaited dream for the throngs of outlet mall shoppers. Look for continued development around Tanger especially some food related brands. In Holland, de-malling began on the now named Shops at West Shore along with outlot construction. Kalamazoo saw a major new development off Stadium Dr at US 131 with the opening of Costco and the regions first Field Stream scheduled to open in the first quarter of 2016. Here are a few others who chose to locate in Grand Rapids in 2015: Trader Joes, Fresh Market, West Elm, Wolfgang Puck, Slows BBQ, Orvis, Jersey Mikeâs Subs, Bravo, Pieology, Menchies Yogurt and more. As we look forward to 2016 the pace for retail doesnât show any signs of slowing down. There is significant new construction happening at Knapp East Beltline with several new names to be announced soon. The long awaited arrival of Chick-fil-A is projected to occur this year and our areaâs first Freddyâs Frozen Custard Steakburgers is under construction on Plainfield NE. If youâre already a retailer in Grand Rapids, please contact our NAI Retail Team to learn how we can assist you with mapping out and securing your new or next location. If youâre wondering if your company should open a store in West MichiganâĶthe time is now! Anyone on our Retail Team would be happy to discuss the West Michigan marketplace in further detail. Please contact us. Have a great 2016! -Rod Alderink, Principal | NAI Member âOur West Michigan economy continues to receive accolades as one of the fastest growing in the country ranked in similar company with Houston and Denver. Our unemployment continues to be the lowest in the state and below the national average. Grand Rapids is no longer seen as an in-fill location after retailers have ventured to Chicago and Detroit. Wisconsin based Kessler Jewlery chose Grand Rapids for its first out-state location.â

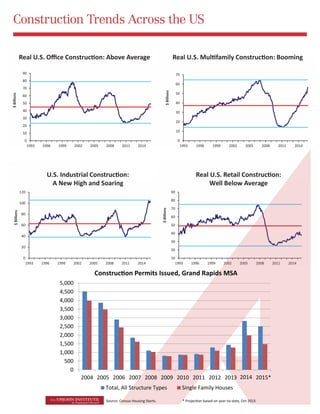

- 3. Construction Trends Across the US 0 10 20 30 40 50 60 70 80 90 1993 1996 1999 2002 2005 2008 2011 2014 $Billions 0 10 20 30 40 50 60 70 1993 1996 1999 2002 2005 2008 2011 2014 $Billions 0 20 40 60 80 100 120 1993 1996 1999 2002 2005 2008 2011 2014 $Billions A New High and Soaring 10 20 30 40 50 60 70 80 90 1993 1996 1999 2002 2005 2008 2011 2014 $Billions Well Below Average 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Total, All Structure Types Single Family Houses Source: Census Housing Starts. -to-date, Oct 2015 2014 2015*

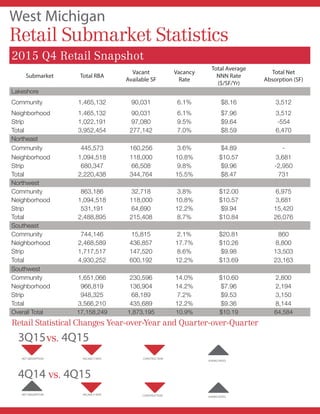

- 4. West Michigan Retail Submarket Statistics Retail Statistical Changes Year-over-Year and Quarter-over-Quarter CONSTRUCTION CONSTRUCTION ASKING RATES ASKING RATES VACANCY RATE VACANCY RATE NET ABSORPTION NET ABSORPTION 3Q15vs. 4Q15 4Q14 vs. 4Q15 2015 Q4 Retail Snapshot Submarket Total RBA Vacant Available SF Vacancy Rate Total Average NNN Rate ($/SF/Yr) Total Net Absorption (SF) Lakeshore Community 1,465,132 90,031 6.1% $8.16 3,512 Neighborhood 1,465,132 90,031 6.1% $7.96 3,512 Strip 1,022,191 97,080 9.5% $9.64 -554 Total 3,952,454 277,142 7.0% $8.59 6,470 Northeast Community 445,573 160,256 3.6% $4.89 - Neighborhood 1,094,518 118,000 10.8% $10.57 3,681 Strip 680,347 66,508 9.8% $9.96 -2,950 Total 2,220,438 344,764 15.5% $8.47 731 Northwest Community 863,186 32,718 3.8% $12.00 6,975 Neighborhood 1,094,518 118,000 10.8% $10.57 3,681 Strip 531,191 64,690 12.2% $9.94 15,420 Total 2,488,895 215,408 8.7% $10.84 26,076 Southeast Community 744,146 15,815 2.1% $20.81 860 Neighborhood 2,468,589 436,857 17.7% $10.26 8,800 Strip 1,717,517 147,520 8.6% $9.98 13,503 Total 4,930,252 600,192 12.2% $13.69 23,163 Southwest Community 1,651,066 230,596 14.0% $10.60 2,800 Neighborhood 966,819 136,904 14.2% $7.96 2,194 Strip 948,325 68,189 7.2% $9.53 3,150 Total 3,566,210 435,689 12.2% $9.36 8,144 Overall Total 17,158,249 1,873,195 10.9% $10.19 64,584

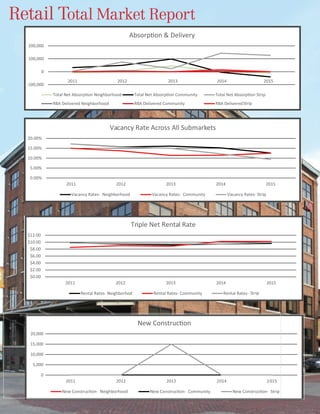

- 5. Retail Total Market Report 0.00% 5.00% 10.00% 15.00% 20.00% 2011 2012 2013 2014 2015 Vacancy Rate Across All Submarkets Vacancy Rates- Neighborhood Vacancy Rates- Community Vacancy Rates- Strip $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 2011 2012 2013 2014 2015 Triple Net Rental Rate Rental Rates- Neighborhod Rental Rates- Community Rental Rates- Strip 0 5000 10000 15000 20000 2011 2012 20132 0142 015 -100,000 0 100,000 200,000 2011 2012 20132 014 2015 RBA Delivered Neighborhood RBA Delivered Community RBA Delivered Strip 2 2 2 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 2011 2012 2013 2014 2015 Triple Net Rental Rate Rental Rates- Neighborhod Rental Rates- Community Rental Rates- Strip $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 2011 2012 2013 2014 2015 Triple Net Rental Rate Rental Rates- Neighborhod Rental Rates- Community Rental Rates- Strip $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 2011 2012 2013 2014 2015 Triple Net Rental Rate Rental Rates- Neighborhod Rental Rates- Community Rental Rates- Strip 0 5,000 10,000 15,000 20,000

- 6. Methodology | Definitions | Submarket Map Community Center A shopping center development that has a total square footage between 10,000 - 350,000 SF. Generally will have 2-3 large anchored tenants, but not department store anchors. Community Center typically offers a wider range of apparel and other soft goofs than the Neighborhood Center. Among the more common anchors are supermarkets and super drugstores. Strip Center A strip center is an attached row of stores or service outlets managed as a coherent retail entity, with on-site parking usually located in front of the stores. Open canopies may connect the storefronts, but a strip center does not have enclosed walkways linking the stores. Neighborhood Center Provides for the sale of convenience goods (food, drugs, etc) and personal services (laundry, dry cleaning, etc.) Absorption (Net) The change in occupied space in a given time period. Available Square Footage Net rentable area considered available for lease; excludes sublease space. Average Asking Rental Rate Rental rate as quoted from each buildingâs owner/management company. For retail, a triple net rate is requested. RBA The total square footage of a building that can be occupied by, or assigned to a tenant for the purpose of determining a tenantâs rental obligation. Deliveries Buildings that have their certificate of occupancy and are allowed to be moved into by the tenant/purchaser. Vacancy Rate All physically unoccupied lease space, either direct or sublease. SF/PSF Square foot/per square foot, used as a unit of measurement. Southwest Northeast Southeast Northwest Lakeshore Methodology:The retail market report includes community, neighborhood, and strip retail buildings within each of the defined submarkets. For definition of product type, please see below.

- 7. Through our affiliation with NAI Global, we can also assist you with your needs throughout the US globally right here from West Michigan. Doug Taatjes, CCIM, SIOR 616 292 1828 dougt@naiwwm.com Hillary Taatjes-Woznick 616 242 1113 hillaryt@naiwwm.com Tim Platt 616 575 7031 timp@naiwwm.com Gary Steere 616 575 7008 garys@naiwwm.com Russ Bono 616 242 1115 russb@naiwwm.com Jeremy Veenstra 616 242 1105 jeremyv@naiwwm.com Marc Tourangeau 269 207 3072 markt@naiwwm.com Stanley Wisinski III, SIOR, CCIM 616 575 7015 sjw@naiwwm.com Bill Tyson 616 242 1103 billt@naiwwm.com Meet Our Team Retail Specialists Rod Alderink 616 242 1104 roda@naiwwm.com Dane Davis 269 459 0434 daned@naiwwm.com Dick Jasinski 616 575 7003 dickj@naiwwm.com Scott Nurski 616 242 1106 scottn@naiwwm.com In the spring of 2011, two successful and reputable companies, The Wisinski Group and NAI West Michigan merged. The merger represents collaboration, rich traditions, innovative technologies, unique cultures and diversity of skills and specialties which ultimately benefit our clients. Weâre going back to our fundamentals, strengthening our core, and becoming stronger in the services we provide our clients. Our focus is simple, building client relationships for life by offering market appropriate advice and then executing. Our success is a direct result of its unwavering commitment to providing the best possible service to each and every client. Our Brokers, with their 562 plus years of combined experience (20.1 years average), possess the knowledge and expertise to manage the most complex transactions in industrial, office, retail, and multifamily specialities throughout West Michigan. NAI Wisinski of West Michigan At a Glance Achieve More. Local Knowledge. Global Reach.

- 8. 100 Grandville Ave SW Suite 100 Grand Rapids, MI 49503 616. 776. 0100 www.naiwwm.com facebook.com/naiwwm @naiwwm nai-wisinski-of-west-michigan Wisinski of West Michigan Office âĒ Industrial âĒ Retail âĒ Multi-Family