Fire Insurance

- 1. INSURANCE AND RISK MANAGEMENT GROUP ¨C 11 AAYUSH GARG 20DM004 AYSUH PRATAP 20DM052 BHANU PATHAK 20DM0058 CHIRAG JASWAL 20DM066 DEEPANSHU PAL SINGH 20DM071 DISHA BHATIA 20DM074

- 2. QUESTION - WHAT IS MEANT BY EARTHQUAKE AND SHOCKS? WHAT COMPONENTS ARE COVERED OR NOT COVERED IN FIRE INSURANCE? IF NOT, THEN HOW WILL IT BE COVERED (SUGGESTIONS) ? An earthquake is the shaking of the surface of the Earth resulting from a sudden release of energy in the Earth's lithosphere that creates seismic waves. ? The mainshock is the largest earthquake in a sequence which is sometimes preceded by few foreshocks and can be followed by many aftershocks.

- 3. FIRE INSURANCE ? As per the Insurance Act 1938, under Section 2 (6A), Fire Insurance is defined as ˇ°the business of effecting, otherwise than independently to some other class of business, contracts of insurance against loss by or incidental to fire or other occurrence customarily included among the risks insured against in fire insurance policies.ˇ± ? Fire insurance is an agreement whereby one party (the insurer), in return, for a consideration undertakes to the indemnify the other party (the insured) against financial loss which he may sustain by reason of certain defined subject matter being damaged by the destroyed by fire or other defined perils up to an agreed amount.

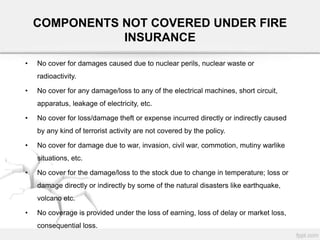

- 4. COMPONENTS NOT COVERED UNDER FIRE INSURANCE ? No cover for damages caused due to nuclear perils, nuclear waste or radioactivity. ? No cover for any damage/loss to any of the electrical machines, short circuit, apparatus, leakage of electricity, etc. ? No cover for loss/damage theft or expense incurred directly or indirectly caused by any kind of terrorist activity are not covered by the policy. ? No cover for damage due to war, invasion, civil war, commotion, mutiny warlike situations, etc. ? No cover for the damage/loss to the stock due to change in temperature; loss or damage directly or indirectly by some of the natural disasters like earthquake, volcano etc. ? No coverage is provided under the loss of earning, loss of delay or market loss, consequential loss.

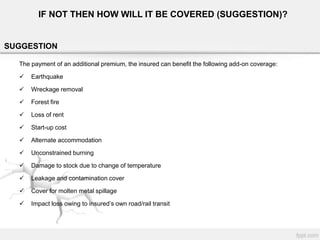

- 5. IF NOT THEN HOW WILL IT BE COVERED (SUGGESTION)? The payment of an additional premium, the insured can benefit the following add-on coverage: ? Earthquake ? Wreckage removal ? Forest fire ? Loss of rent ? Start-up cost ? Alternate accommodation ? Unconstrained burning ? Damage to stock due to change of temperature ? Leakage and contamination cover ? Cover for molten metal spillage ? Impact loss owing to insuredˇŻs own road/rail transit SUGGESTION