Star Health Comprehensive Policy

- 2. No cap on room rent and treatment cost. Covers medical expenses incurred on Bariatric surgical procedures and its complications. Air ambulance assistance, Second medical opinion are covered. Cost of health check up for every block of 3 claim free years. Cover for maternity (normal and caesarean delivery) and New born baby. Automatic restoration of entire Sum insured by 100%.

- 3. Dental / ophthalmic cover on OPD basis. Hospital cash benefit. Cover for over 400 day care procedures. Personal accident cover against Death and Permanent total disablement (equal to the Health Insurance cover) at no additional cost. 100% Increase in Sum Insured upon a claim free renewal

- 4. Section 1: Hospitalization cover protects the insured for in patient hospitalization expenses for a minimum period of 24 hrs. These expenses include room rent (Single Standard A/C room), nursing and boarding charges, Surgeon, Anesthetist, Medical Practitioner, Consultants, Specialist fees, Cost of Medicines and Drugs. Ambulance charges for emergency transportation to hospital as per specified limits. Air Ambulance Benefit: Permitted up to 10% of the Sum Insured opted, during one policy period, applicable for sum insured of Rs.7.5 lakhs and above only. Pre hospitalization expenses up to 30 days prior to admission in the hospital Post hospitalization expenses up to 60 days after discharge from the hospital Out-patient consultation (other than dental and ophthal) expenses up to limits mentioned in the table of benefits Coverage for Domiciliary hospitalization for a period exceeding three days.

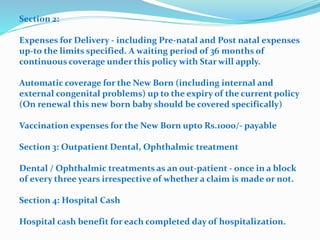

- 5. Section 2: Expenses for Delivery - including Pre-natal and Post natal expenses up-to the limits specified. A waiting period of 36 months of continuous coverage under this policy with Star will apply. Automatic coverage for the New Born (including internal and external congenital problems) up to the expiry of the current policy (On renewal this new born baby should be covered specifically) Vaccination expenses for the New Born upto Rs.1000/- payable Section 3: Outpatient Dental, Ophthalmic treatment Dental / Ophthalmic treatments as an out-patient - once in a block of every three years irrespective of whether a claim is made or not. Section 4: Hospital Cash Hospital cash benefit for each completed day of hospitalization.

- 6. Section 5: Health Check up Cost of Health Check-up once after a block of every three claim-free years Section 6: Bariatric Surgery Expenses incurred on hospitalization for bariatric surgical procedure and its complications thereof are payable subject to a maximum of Rs.2,50,000/- during the policy period. This maximum limit of Rs.2,50,000/- is inclusive of pre- hospitalization and post hospitalization expenses. Claim under this section shall be processed only on cashless basis. Coverage under this section is subject to a waiting period of 36 months and payable only while the policy is in force

- 7. Section 7: Accidental Death and Permanent Total Disablement Cover against Accidental Death The person chosen by the Proposer at the time of payment of premium as mentioned in the schedule herein is covered for Personal Accident The sum insured for this section is equal to the sum insured opted for the Health insurance. Section 8: Option for Second Medical Opinion The Insured Person is given the facility of obtaining a Second Medical Opinion in electronic mode from a Doctor in the Company's network of Medical Practitioners Medical records can be sent to the mail id e_medicalopinion@starhealth.in

- 8. Automatic Restoration of Sum Insured (Applicable for Section 1 Only) Upon exhaustion of Basic sum insured and the Bonus, sum insured will be automatically restored by 100% once policy period. Such restored Sum Insured can be utilized only for illness / disease unrelated to the illness / diseases for which claim/s was / were made. Such restoration will be available for section 1 other than Section 1G. Bonus: Following a claim free year bonus at 50% of the basic sum insured (max.100%) would be allowed. Where there is a claim the Bonus would be reversed in the same order in which it was given.

- 9. STAR ADVANTAGE No third Party Administrator, direct in-house claim settlement. Faster & hassle-free claim settlement. Cashless hospitalization wherever possible. Network of more than 8400+ hospitals across India. 24x7 Toll Free Helpline. Information on health through free health magazine. Facility for maintaining personal health records in electronic format.