Mobile Enterprise, the coming explosion

- 1. Mobile Enterprise“The coming explosion”Paul van DoornFounder Eikenzande BV Serves clients who want to accelerate their business with advanced Mobile Data solutions and Social Media process integration. Over 25 years IT & Mobile Industry experienceContact for more information: paul@eikenzande.comLinkedin: http://nl.linkedin.com/in/paulvandoornLicensed under Creative Commons Attribution 3.0 Unported License (http://www.creativecommons.org/licenses/by/3.0) You are free to Share or Remix any part of this work as long as you attribute this work to Paul van Doorn / Eikenzande BV (http://nl.linkedin.com/in/paulvandoorn) Caesar v9.0.pptx

- 2. Key MessagesThe mobile ecosystem is undergoing seismic shifts which are affecting network providers and over the top content providers. New companies emerge…… Smartphone explosion has created a new paradigm: “Information for Everyone, Anytime, Anywhere”

- 3. Mobile data traffic overtakes voice in volume and completely floods the mobile network. Voice and SMS are Apps. Traditional voice and SMS are dead as a source of revenue

- 4. The introduction of LTE, the extremely fast mobile network technology purely aimed at data devices, will only reinforce and accelerate the trends

- 5. Mobile and fixed telcos have completely lost control over Value Added Services to over the top content providers, such as Apple, Google and Facebook. Mobile companies have no way to go, other than to cut costs and transform into efficient utilities

- 6. The Cloud, specifically Platforms as a Service that are driving fundamental changes, such as the rise of social media. But next Big Thing will be in B2B: “Mobilisation of the Enterprise”. Or the “appification” of everything

- 7. It is still early days for Mobile Enterprise Platform companies, although consolidation and acquisitions by established players seem logicalMobilisation of the Enterprise: Extraordinary opportunities for new or innovative players 2

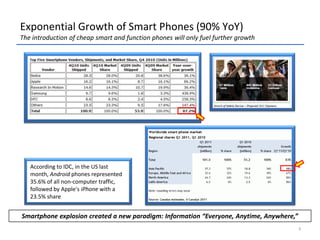

- 8. ExponentialGrowth of Smart Phones (90% YoY) The introduction of cheap smart and functionphoneswillonlyfuelfurthergrowth3According to IDC, in the US last month, Android phones represented 35.6% of all non-computer traffic, followed by Apple's iPhone with a 23.5% shareSmartphone explosion created a new paradigm: Information “Everyone, Anytime, Anywhere,”

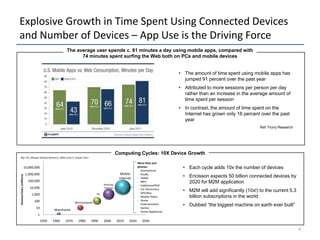

- 9. Explosive Growth in Time Spent Using Connected Devices and Number of Devices – App Use is the Driving Force4More than just phones:Smartphone

- 10. Kindle

- 11. Tablet

- 12. MP3

- 13. Cellphone/PDA

- 14. Car Electronics

- 15. GPS/Nav

- 16. Mobile Video

- 18. Games

- 19. Home AppliancesTheaverage user spends c. 81 minutes a day using mobile apps, compared with 74 minutes spent surfing the Web both on PCs and mobile devicesComputing Cycles: 10X Device GrowthExRef: ITU, Morgan Stanley Research, 2009;Scott A. Snyder 2011The amount of time spent using mobile apps has jumped 91 percent over the past year

- 20. Attributed to more sessions per person per day rather than an increase in the average amount of time spent per session

- 21. In contrast, the amount of time spent on the Internet has grown only 16 percent over the past yearRef: Flurry ResearchEach cycle adds 10x the number of devices

- 22. Ericisson expects 50 billion connected devices by 2020 for M2M application

- 23. M2M will add significantly (10x!) to the current 5.3 billion subscriptions in the world

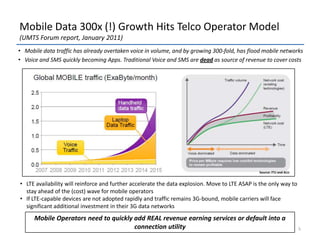

- 24. Dubbed “the biggest machine on earth ever built”Mobile Data 300x (!) Growth Hits Telco Operator Model(UMTS Forum report, January 2011)Mobile data traffic has already overtaken voice in volume, and by growing 300-fold, has flood mobile networks

- 25. Voice and SMS quickly becoming Apps. Traditional Voice and SMS are dead as source of revenue to cover costs5Source: ITU and ALULTE availability will reinforce and further accelerate the data explosion. Move to LTE ASAP is the only way to stay ahead of the (cost) wave for mobile operators

- 26. If LTE-capable devices are not adopted rapidly and traffic remains 3G-bound, mobile carriers will face significant additional investment in their 3G data networksMobile Operators need to quickly add REAL revenue earning services or default into a connection utility

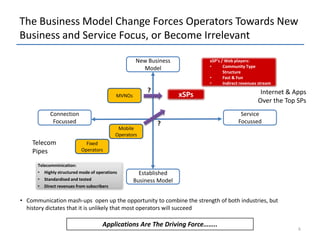

- 27. The Business Model ChangeForces Operators Towards New Business and Service Focus, orBecome Irrelevant6xSP’s / Web players:Community Type Structure

- 28. Fast & Fun

- 29. Indirect revenuesstreamNew Business Model?Internet & AppsOver the Top SPsxSPsMVNOsConnectionFocussedServiceFocussed?Mobile OperatorsTelecom PipesFixed OperatorsTelecomminication:Highly structured mode of operations

- 31. Direct revenues from subscribers

- 32. Communicationmash-ups open up the opportunity to combine the strength of both industries, buthistorydictatesthatit is unlikelythat most operators willsucceedEstablished Business ModelApplications Are The DrivingForce……..

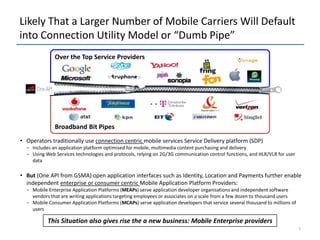

- 33. Likely That a Larger Number of Mobile Carriers Will Default into Connection Utility Model or “Dumb Pipe”7Over the Top Service ProvidersBroadband Bit PipesOperators traditionally use connection centric mobile services Service Delivery platform(SDP)

- 34. Includes an application platform optimised for mobile, multimedia content purchasing and delivery

- 35. Using Web Services technologies and protocols, relying on 2G/3G communication control functions, and HLR/VLR for user data

- 36. But (One API from GSMA) open application interfaces such as Identity, Location and Payments further enable independent enterprise or consumer centric Mobile Application Platform Providers:

- 37. Mobile Enterprise Application Platforms (MEAPs) serve application developer organisations and independent software vendors that are writing applications targeting employees or associates on a scale from a few dozen to thousand users

- 38. Mobile Consumer Application Platforms (MCAPs) serve application developers that service several thousand to millions of usersThis Situation also gives rise the a new business: Mobile Enterprise providers

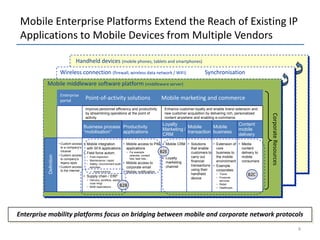

- 39. Enterprise portalPoint-of-activity solutionsMobile marketing and commerceImprove personnel efficiency and productivity by streamlining operations at the point of activityEnhance customer loyalty and enable brand extension and new customer acquisition by delivering rich, personalized content anywhere and enabling e-commerceBusiness process “mobilisation”Productivity applicationsLoyalty Marketing / CRMMobile transactionMobile businessContent mobile deliveryDefinitionCustom access to a company’s intranet

- 40. Custom access to company’s legacy apps

- 41. Custom access to the internet

- 42. Mobile access to PIM applications

- 43. For example calendar, contact lists, task lists,..

- 44. Mobile access to corporate email

- 46. Mobile CRM

- 48. Solutions that enable customers to carry out financial transactions using their handheld device

- 49. Extension of core business to the mobile environment

- 51. Travel

- 53. Retail

- 54. Healthcare

- 55. Media content delivery to mobile consumers

- 56. Mobile integration with SFA applications

- 58. Field inspection

- 60. Safety / environment audit activities

- 61. Asset tracking

- 62. Supply chain / ERP

- 63. Delivery, workflow, warehouse mngt

- 64. M2M ApplicationsB2EB2CB2BMobile Enterprise Platforms Extend the Reach of Existing IP Applications to Mobile Devices from Multiple VendorsHandheld devices (mobile phones, tablets and smartphones)Wireless connection (firewall, wireless data network / WiFi)SynchronisationMobile middleware software platform(middleware server)Corporate Resources Enterprise mobility platforms focus on bridging between mobile and corporate network protocols8

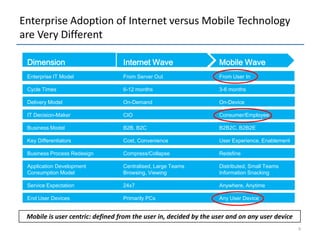

- 65. Enterprise Adoption of Internet versus Mobile Technology are Very Different9Dimension Internet Wave Mobile Wave Enterprise IT Model From Server Out From User InCycle Times 6-12 months 3-6 monthsDelivery Model On-Demand On-DeviceIT Decision-Maker CIO Consumer/EmployeeBusiness Model B2B, B2C B2B2C, B2B2EKey Differentiators Cost, Convenience User Experience, EnablementBusiness Process Redesign Compress/Collapse RedefineApplication Development Centralised, Large Teams Distributed, Small Teams Consumption Model Browsing, ViewingInformationSnackingService Expectation 24x7 Anywhere, AnytimeEnd User Devices Primarily PCs Any User DeviceGeographic Growth Developed Markets Emerging MarketsMobile is user centric: defined from the user in, decided by the user and on any user device

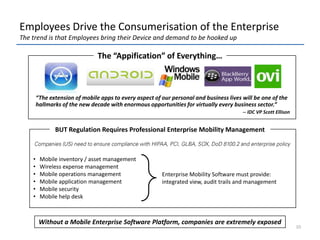

- 66. Employees Drive the Consumerisation of the EnterpriseThe trend is that Employees bring their Device and demand to be hooked upThe “Appification” of Everything…“The extension of mobile apps to every aspect of our personal and business lives will be one of the hallmarks of the new decade with enormous opportunities for virtually every business sector.” -- IDC VP Scott EllisonBUT Regulation Requires Professional Enterprise Mobility ManagementCompanies (US) need to ensure compliance with HIPAA, PCI, GLBA, SOX, DoD 8100.2 and enterprise policy Mobile inventory / asset management

- 70. Mobile security

- 71. Mobile help deskEnterprise Mobility Software must provide: integrated view, audit trails and managementWithout a Mobile Enterprise Software Platform, companies are extremely exposed10

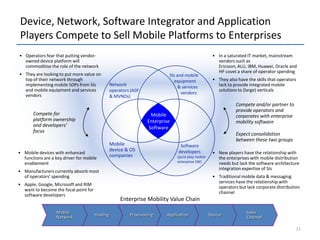

- 72. HostingProvisioningApplicationDeviceMobileNetworkSales ChannelDevice, Network, Software Integrator and Application Players Compete to Sell Mobile Platforms to Enterprises Operators fear that putting vendor-owned device platform will commoditise the role of the network

- 73. They are looking to put more value on top of their network through implementing mobile SDPs from SIs and mobile equipment and services vendors

- 74. In a saturated IT market, mainstream vendors such as Ericsson, ALU, IBM, Huawei, Oracle and HP covet a share of operator spending

- 75. They also have the skills that operators lack to provide integrated mobile solutions to (large) verticalsSIs and mobile equipment& servicesvendorsNetwork operators (ASP & MVNOs)Compete and/or partner to provide operators and corporates with enterprise mobility softwareExpect consolidation between these two groupsCompete for platform ownership and developers’ focusMobile EnterpriseSoftwareMobile device & OS companies Software developers(pure play mobile enterprise SW)Mobile devices with enhanced functions are a key driver for mobile enablement

- 76. Manufacturers currently absorb most of operators’ spending

- 77. Apple, Google, Microsoft and RIM want to become the focal point for software developers

- 78. New playershave the relationship with the enterprises with mobile distribution needs but lack the software architecture integration expertise of SIs

- 79. Traditional mobile data & messaging services have the relationship with operators but lack corporate distribution channelEnterprise Mobility Value Chain11

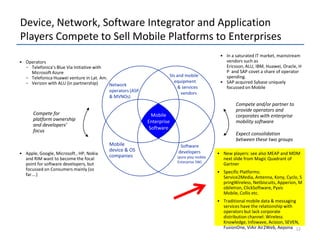

- 80. Device, Network, Software Integrator and Application Players Compete to Sell Mobile Platforms to Enterprises In a saturated IT market, mainstream vendors such as Ericsson, ALU, IBM, Huawei, Oracle, HP and SAP covet a share of operator spending.

- 81. SAP acquired Sybase uniquely focussed on Mobile

- 82. Operators

- 83. Telefonica’s Blue Via Initiative with Microsoft Azure

- 84. Telefonica Huawei venture in Lat. Am.

- 85. Verizon with ALU (in partnership)SIs and mobile equipment& servicesvendorsNetwork operators (ASP & MVNOs)Compete and/or partner to provide operators and corporates with enterprise mobility softwareExpect consolidation between these two groupsCompete for platform ownership and developers’ focusMobile EnterpriseSoftwareMobile device & OS companies Software developers(pure play mobile Enterprise SW)Apple, Google, Microsoft , HP, Nokia and RIM want to become the focal point for software developers, but focussed on Consumers mainly (so far….)

- 86. New players: see also MEAP and MDM next slide from Magic Quadrant of Gartner

- 87. Specific Platforms: Service2Media, Antenna, Kony, Cyclo, SpringWireless, Netbiscuits, Apperion, MobileIron, ClickSoftware, Pyxis Mobile, Collis etc.

- 88. Traditional mobile data & messaging services have the relationship with operators but lack corporate distribution channel: Wireless Knowledge, Infowave, Acision, SEVEN, FusionOne, ViAir Air2Web, Aepona12

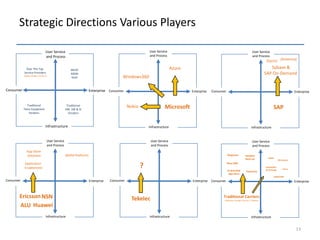

- 89. Strategic Directions Various Players13User Serviceand ProcessUser Serviceand ProcessUser Serviceand ProcessUser Serviceand ProcessUser Serviceand ProcessUser Service and Process(Antenna)(Syclo)Sybase &SAP On-Demand AzureOver The Top Service Providers(Apple, Google, Amazon)MEAPMDMXaaSWindows360ConsumerConsumerConsumerConsumerConsumerConsumerEnterpriseEnterpriseEnterpriseEnterpriseEnterpriseSAPEnterpriseMicrosoftNokiaTraditionalTelco EquipmentVendorsTraditionalHW, SW & SIVendorsInfrastructureInfrastructureInfrastructureInfrastructureInfrastructureInfrastructureApp Store Solutions(M2M Platform)RingtonesHandSetBack-UpM2MM-Centrex?Application EnablementMass SMSHosted BES& ExchangeTetra Co-Branded App StorePaymentsGlobal SIM EricssonNSNTraditional CarriersVodafone, Orange, Verizon, T-MobileTekelecHuaweiALU

- 90. Where are the Opportunities -Strategic Direction 14User Serviceand ProcessConsumerEnterpriseInfrastructure

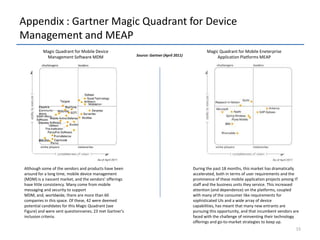

- 91. Appendix : Gartner Magic Quadrant for Device Management and MEAP15Magic Quadrant for Mobile Device Management Software MDMMagic Quadrant for Mobile Eneterprise Application Platforms MEAPSource: Gartner (April 2011)Although some of the vendors and products have been around for a long time, mobile device management (MDM) is a nascent market, and the vendors' offerings have little consistency. Many come from mobile messaging and security to support MDM, and, worldwide, there are more than 60 companies in this space. Of these, 42 were deemed potential candidates for this Magic Quadrant (see Figure) and were sent questionnaires; 23 met Gartner's inclusion criteria.During the past 18 months, this market has dramatically accelerated, both in terms of user requirements and theprominence of these mobile application projects among IT staff and the business units they service. This increasedattention (and dependence) on the platforms, coupled with many of the consumer like requirements for sophisticated UIs and a wide array of device capabilities, has meant that many new entrants are pursuing this opportunity, and that incumbent vendors are faced with the challenge of reinventing their technology offerings and go-to-market strategies to keep up.