ImpliedVolatility-Analysis Ford-vs.-GM_Dec-2013

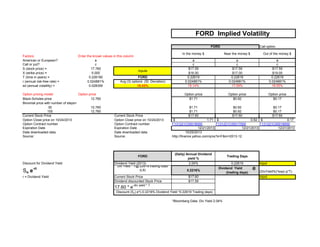

- 1. Call option Factors Enter the known values in this column In the money $ Near the money $ Out of the money $ American or European? a a a a Call or put? c c c c S (stock price) = 17.760 $17.59 $17.59 $17.59 X (strike price) = 5.000 $16.00 $17.00 $19.00 T (time in years) = 0.226190 FORD 0.22619 0.22619 0.22619 r (annual risk-free rate) = 0.024881% Avg (3) options (St. Deviation) 0.024881% 0.024881% 0.024881% sd (annual volatility) = 0.028359 18.43% 19.14% 17.59% 18.55% Option pricing model Option price Option price Option price Option price Black-Scholes price 12.760 $1.71 $0.92 $0.17 Binomial price with number of steps= 30 12.760 $1.71 $0.92 $0.17 100 12.760 $1.71 $0.92 $0.17 Current Stock Price Current Stock Price $17.60 $17.60 $17.60 Option Close price on 10/24/2013 Option Close price on 10/24/2013 1.71$ 0.92$ 0.17$ Option Contract number Option Contract number F131221C00016000 F131221C00017000 F131221C00019000 Expiration Date Expiration Date 12/21/2013 12/21/2013 12/21/2013 Date downloaded data Date downloaded data 10/25/2013 Source: Source: http://finance.yahoo.com/q/os?s=F&m=2013-12 FORD (Daily) Annual Dividend yield % Trading Days Discount for Dividend Yield Dividend Yield (2013) 2.04% 0.22619 Input So e -rt Div Yield * T@.22619 trading days (L9) 0.2216% Dividend Yield @ (trading days) (DivYield%)*exp(-q*T) r = Dividend Yield Current Stock Price $17.60 Input Dividend discounted Stock Price $17.59 17.60 * e-div yield * T *Bloomberg Data: Div Yield 2.04% FORD Implied Volatility FORD Discount (So) e^(-0.2216% Dividend Yield *0.22619 Trading days) Inputs

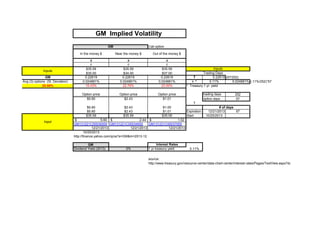

- 2. Call option In the money $ Near the money $ Out of the money $ a a a c c c $35.59 $35.59 $35.59 $30.00 $34.00 $37.00 Trading Days GM 0.22619 0.22619 0.22619 T 0.22619 (57/252) Avg (3) options (St. Deviation) 0.024881% 0.024881% 0.024881% r * 0.11% 0.024881% (.11%/252)*57 20.56% 15.43% 22.76% 23.50% * Treasury 1 yr. yield Option price Option price Option price trading days 252 $5.60 $2.43 $1.01 option days 57 T $5.60 $2.43 $1.00 $5.60 $2.43 $1.01 Expiration 12/21/2013 57 $35.59 $35.59 $35.59 Start 10/25/2013 5.60$ 2.44$ 1.02$ GM131221C00030000 GM131221C00034000 GM131221C00037000 12/21/2013 12/21/2013 12/21/2013 10/25/2013 http://finance.yahoo.com/q/os?s=GM&m=2013-12 GM Interest Rates Dividend Yield (2013) 0% 1 yr treasury yield 0.11% source: http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=billrates GM Implied Volatility # of days GM Inputs Inputs Input