5Cs of Credit Deck

- 1. Accessing Capital: 5Cs of Credit Richard Gianni Market President, Houston Regional President, East Texas Region 888.215.2373 houston@liftfund.com LiftFund.com

- 2. AGENDA â Who we Are â What We Offer â Who We Serve â Our Clients â Preparing for a Business Loan: Preparing, Lenderâs View, and Financial Hurdles â 5Cs of Credit â Our Process â Our Commitment

- 4. WHATĖýWEĖýOFFER âĒ $500ĖýtoĖý$250,000ĖýforĖýbusinessĖýloansĖý âĒ Terms:Ėý6ĖýtoĖý120ĖýmonthĖýterms âĒ 7.25%ĖýtoĖý18%ĖýfixedĖýrates âĒ NoĖýpreâpaymentĖýpenalty âĒ OnlineĖýbusinessĖýeducation âĒ FinancialĖý&ĖýbusinessĖýmanagementĖýconsultations

- 5. OURĖýVALUE âĒ WeĖýfundĖýSTARTUPS âĒ LOWERĖýRATESĖýthanĖýcreditĖýcardsĖýandĖýpaydayĖýlenders âĒ WeĖýworkĖýwithĖýLOWERĖýCREDITĖýSCORES âĒ WeĖýhaveĖýaĖý20ĖýyearĖýPROVEN trackĖýrecordĖýofĖýworkingĖýwithĖýsmallĖý businessĖýclients âĒ WeĖýareĖýFLEXIBLE onĖýcollateralĖýrequirements âĒ WeĖýconnectĖýclientsĖýtoĖýOTHERĖýSMALLĖýBUSINESSĖýRESOURCESĖýavailableĖý inĖýourĖýcommunity âĒ WeĖýhaveĖýONLINE BusinessĖýResources

- 6. OURĖýCLIENTS Our clients reflect the diverse communities we serve

- 8. âĒ WeĖýaskĖý ïž âHowĖýwillĖýtheĖýloanĖýbeĖýpaidĖýback?â FromĖýtheĖýbusinessĖýorĖýpersonalĖýincome? ïž WhatĖýwillĖýsecureĖýtheĖýloan? UnsecuredĖýlendingĖýisĖýpracticallyĖýextinct! ïž WhatĖýisĖýtheĖýrisk? ïž WillĖýtheĖýbusinessĖýsucceed? ïž AreĖýyouĖýaĖýgoodĖýBorrower?Ėý ïž WhatĖýisĖýyourĖýcontribution? Would you Lend to Yourself?

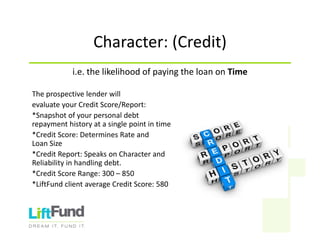

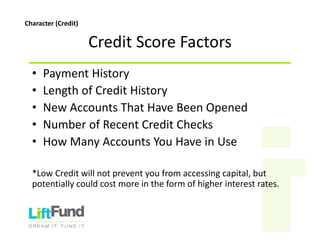

- 11. CreditĖýScoreĖýFactors âĒ PaymentĖýHistory âĒ LengthĖýofĖýCreditĖýHistory âĒ NewĖýAccountsĖýThatĖýHaveĖýBeenĖýOpened âĒ NumberĖýofĖýRecentĖýCreditĖýChecks âĒ HowĖýManyĖýAccountsĖýYouĖýHaveĖýinĖýUse *LowĖýCreditĖýwillĖýnotĖýpreventĖýyouĖýfromĖýaccessingĖýcapital,ĖýbutĖý potentiallyĖýcouldĖýcostĖýmoreĖýinĖýtheĖýformĖýofĖýhigherĖýinterestĖýrates.Ėý CharacterĖý(Credit)

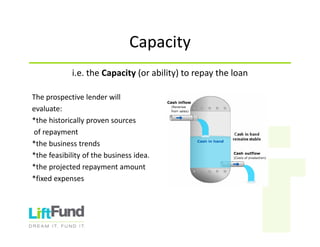

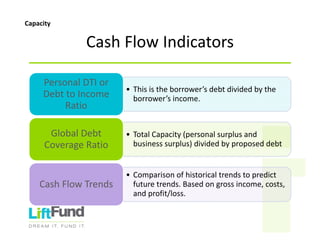

- 13. âĒ ThisĖýisĖýtheĖýborrowerâsĖýdebtĖýdividedĖýbyĖýtheĖý borrowerâsĖýincome.Ėý PersonalĖýDTIĖýorĖý DebtĖýtoĖýIncomeĖý Ratio âĒ TotalĖýCapacityĖý(personalĖýsurplusĖýandĖý businessĖýsurplus)ĖýdividedĖýbyĖýproposedĖýdebt GlobalĖýDebtĖý CoverageĖýRatio âĒ ComparisonĖýofĖýhistoricalĖýtrendsĖýtoĖýpredictĖý futureĖýtrends.ĖýBasedĖýonĖýgrossĖýincome,Ėýcosts,Ėý andĖýprofit/loss.Ėý CashĖýFlowĖýTrends CashĖýFlowĖýIndicators Capacity

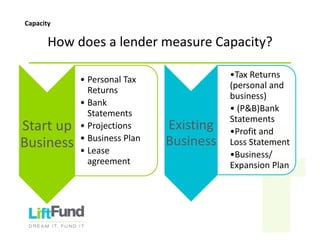

- 14. HowĖýdoesĖýaĖýlenderĖýmeasureĖýCapacity? ExistingĖý Business âĒTaxĖýReturnsĖý (personalĖýandĖý business) âĒ (P&B)BankĖý Statements âĒProfitĖýandĖý LossĖýStatement âĒBusiness/Ėý ExpansionĖýPlan StartĖýupĖý Business âĒ PersonalĖýTaxĖý Returns âĒ BankĖý Statements âĒ Projections âĒ BusinessĖýPlan âĒ LeaseĖý agreement Capacity

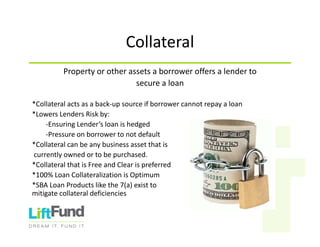

- 17. TypesĖýofĖýCollateral âĒ TangibleĖýBusinessĖýAssets âĒ ToĖýbeĖýPurchasedĖýBusinessĖýAssetsĖý(WithĖýLoanĖý Proceeds) âĒ Vehicles âĒ RealĖýEstate âĒ Contracts âĒ StocksĖý&ĖýBonds âĒ CashĖý âĒ CashĖýValueĖýonĖýaĖýLifeĖýInsuranceĖýPolicy Collateral

- 20. WEĖýHAVEĖýRESOURCESâĶONLINE âĒ TakeĖýourĖýIndexĖýtoĖýknowĖýwhereĖýyouĖýare âĒ VisitĖýourĖýonlineĖýlibraryĖýthatĖýhas: â businessĖýplanĖýtemplatesĖý â startupĖýbudgetĖý â ourĖýloanĖýapplicationĖýbudgets â projectionsĖý â personalĖýfinancialĖýstatement âĒ VisitĖýourĖýblog âĒ VisitĖýusĖýonĖýFacebookĖýforĖýtipsĖýandĖýarticles âĒ VisitĖýourĖýwebsite,ĖýweĖýhaveĖýliveĖýchatĖýandĖýaĖý businesscenter@liftfund.org emailĖýsoĖýaĖýteamĖýmemberĖýcanĖý supportĖýyou.

- 21. DETERMINEĖýWHATĖýTHEĖýLOANĖýISĖýFOR âĒ What Type of Funding Do You Need? Be Specific! ï§ Equipment ï§ Working Capital ï§ Start Up ï§ Expansion ï§ Inventory ï§ Asset Purchases ï§ Improvements âĒ What Is Your Contribution? ï§ Business loans are leveraged with equity and ownerâs capital. Be prepared to put your own money into your business.

- 22. PREPAREĖýYOURSELF ïž KnowĖýhowĖýmuchĖýyouĖýneedĖý ïž PersonalĖýandĖýbusinessĖýtaxĖýreturnsĖý(2â3Ėýyears) ïž CurrentĖýbusinessĖýandĖýpersonalĖýfinancialĖýstatements ïž BankĖýstatementsĖý(3Ėýmonths)ĖýĖý ïž ReviewĖýyourĖýcreditĖýreportĖý (www.annualcreditreport.com) ïž DBAĖýorĖýCorporationĖýDocuments ïž BusinessĖýplanĖýwithĖýfinancialĖýprojections

- 23. STARTâUPSĖýAREĖýSPECIAL âĒ 10â20%ĖýPersonalĖýInvestment âĒ BusinessĖýPlanĖý&ĖýFinancialĖýProjections âĒ SecondaryĖýSourceĖýofĖýIncome* *ifĖýnot,ĖýweĖýdoĖýhaveĖýspecialĖýloanĖýprograms

- 24. FINANCIALĖýHURDLES âĒ InĖýorderĖýtoĖýbetterĖýserveĖýyou,ĖýitsĖýimportantĖýthatĖý youĖýknowĖýtheĖýstatusĖýofĖýtheĖýfollowingĖýissues:Ėý â Bankruptcies â WriteâoffsĖýandĖýcollectionsĖýissues â RecentĖýSlowĖýpayments â CivilĖýjudgmentsĖýandĖýtaxĖýliens â TaxesĖýowedĖý(stateĖýandĖýfederal) âĒ WeĖýmayĖýnotĖýbeĖýableĖýtoĖýprovideĖýcapitalĖýatĖýthisĖýtimeĖý dueĖýtoĖýyourĖýcapacity,ĖýbutĖýweâllĖýconnectĖýyouĖýtoĖý resourcesĖýtoĖýgetĖýyourĖýfinancialsĖýinĖýorder.

- 25. Like Us on Facebook and Follow Us on Twitter ThankĖýYou! LiftFund.com Houston@liftfund.com 888.215.2373