Haunted by the Housing Market (2000 vs 2002)

- 1. Halloween 2002 Haunted by the Housing Market? Perspectives on the Real Estate Bubble Bill Wendel The Real Estate Caf├® Cambridge, Massachusetts bwendel77@aol.com 617-661-0878

- 2. Cover stories & special reports ŌĆó Consumer Reports, Nov, 2002 ŌĆó Fortune Magazine, Nov. 2002 ŌĆó The Wall Street Journal / Realestatejournal.com ŌĆó KiplingerŌĆÖs Magazine / Kiplinger.com ŌĆó Inman News

- 3. Presentation Overview ŌĆó Macro Environment ŌĆó Wealth effect ŌĆó Demand factors ŌĆó Public policy ŌĆó Demographics ŌĆó Limited supply of housing ŌĆó Broker tricks ŌĆó Underlying fundamentals ŌĆó Warnings from experts

- 4. Macro environment ŌĆó Overall economy ŌĆó Consumer con’¼üdence ŌĆó Interest rates ŌĆó Internet bubble ŌĆó Global economy

- 5. Overall Economy ŌĆó Jan. 2000: 8th year of economic boom has resulted in best economy in 50 years

- 6. Overall Economy ŌĆó Jan. 2000: 8th year of ŌĆó Oct 2002: Economy economic boom has trying to emerge from resulted in best mild recession, which economy in 50 years began 1st quarter 2001, but double dip recession looks increasingly likely

- 7. Consumer Con’¼üdence ŌĆó Jan. 2000: Consumer con’¼üdence is at near record highs

- 8. Consumer Con’¼üdence ŌĆó Jan. 2000: Consumer ŌĆó Oct. 2002: Consumer con’¼üdence is at near con’¼üdence index fell record highs to the lowest point in 9 years, plunging from 93.7 in September to 79.4 in October (Boston Globe, 10/30/02)

- 9. Interest Rates ŌĆó Jan. 2000: Lowest interest rates in 30 years

- 10. Interest Rates ŌĆó Jan. 2000: Lowest ŌĆó Oct. 2002: Until interest rates in 30 recently, interest rates years were under 6%, a 40 year low. Since Oct. 9th, rates have risen to highest point in three months.

- 11. Internet bubble? ŌĆó Jan. 2000: $1 BILLION in venture capital invested in Massachusetts in 1997 alone (’¼ünd subsequent years)

- 12. Internet bubble? ŌĆó Jan. 2000: $1 ŌĆó Oct. 2002: Venture BILLION in venture capital investment in capital invested in Massachusetts way Massachusetts in 1997 down, although exact alone (’¼ünd subsequent ’¼ügure unknown years)

- 13. Global economy ŌĆó Jan. 2000: Predictions range from 25% to 70% chance of worldwide recession because of Y2K (Yardeni)

- 14. Global economy ŌĆó Jan. 2000: Predictions ŌĆó Oct. 2002: Fears of a range from 25% to Y2K recession have 70% chance of been replaced by the worldwide recession reality of war against because of Y2K Iraq, a worldwide (Yardeni) recession, and talk of a Japan-style de’¼éation in the US (link to white paper on Fed's site)

- 15. Wealth effect ŌĆó Stock market ŌĆó Local jobs ŌĆó Inheritances

- 16. Stock market ŌĆó Jan. 2000: Stock market spinning off record pro’¼üts (20 to 30% per year) creating $8 trillion in wealth (con’¼ürm stat)

- 17. Stock market ŌĆó Jan. 2000: Stock ŌĆó Oct. 2002: Stock market spinning off market has lost $7 record pro’¼üts (20 to trillion in value 30% per year) creating (con’¼ürm), NASDAQ $8 trillion in wealth down 75% from peak (con’¼ürm stat) in March 2000

- 18. Local jobs ŌĆó Jan. 2000: Boston emerged as the 2nd leading ’¼ünancial center in the nation

- 19. Local jobs ŌĆó Jan. 2000: Boston ŌĆó Oct. 2002: Recession emerged as the 2nd & corporate scandals leading ’¼ünancial causing layoffs in the center in the nation ’¼ünancial sector, including XXX at Fidelity investments in Greater Boston

- 20. Inheritances ŌĆó Jan. 2000: $10 trillion in baby boomer inheritance between 1994 and 2000 pouring money into the high end of the housing market.

- 21. Inheritances ŌĆó Jan. 2000: $10 trillion ŌĆó Oct. 2002: Once in baby boomer projected to continue inheritance between at $1 trillion per year, 1994 and 2000 inherited wealth is pouring money into shrinking with stock the high end of the wealth and millions of housing market. baby boomers are now worried about their own retirement nest eggs

- 22. Demand factors ŌĆó Unemployment ŌĆó Job creation ŌĆó Rent control ŌĆó Rising rents ŌĆó Doubling up ŌĆó Substitution effect ŌĆó New factors

- 23. Unemployment ŌĆó Jan. 2000: Unemployment is at a record low, locally and nationally.housing market.

- 24. Unemployment ŌĆó Jan. 2000: ŌĆó Oct. 2002: Unemployment is at a Massachusetts has lost record low, locally and 134,000 jobs since the nationally peak of the late 1990ŌĆÖs boom (Boston Globe, 10/30/02)

- 25. Job creation ŌĆó Jan. 2000: 2,000 new jobs created in Cambridge each year from 1995-1997 (3 years) versus 500 to 700 condos available for sale each year.

- 26. Job creation ŌĆó Jan. 2000: 2,000 new ŌĆó Oct. 2002: Cambridge jobs created in still generating jobs, Cambridge each year including high paying from 1995-1997 (3 jobs in biotech, but years) versus 500 to of’¼üce market is now 700 condos available softer than it has been for sale each year. in years (con’¼ürm?)

- 27. Rent control ŌĆó Jan. 2000: End of rent control in 1995 affected 100,000 households (one year demand statewide, 7 years worth of sales in Greater Boston)

- 28. Rent control ŌĆó Jan. 2000: End of rent ŌĆó Oct. 2002: Excess control in 1995 demand created by the affected 100,000 end of rent control has households (one year now passed. Even so, demand statewide, 7 Boston's Mayor years worth of sales in Menino is leading Greater Boston) campaign to bring back rent control which would protect 70,000 households

- 29. Rising rents ŌĆó Jan. 2000: Rents are rising faster than housing prices (55% in last 4 years, vs 45% in last 5 years)

- 30. Rising rents ŌĆó Jan. 2000: Rents are ŌĆó Oct. 2002: Housing rising faster than price appreciation now housing prices (55% double rent increase in last 4 years, vs 45% (con’¼ürm in Wall Street in last 5 years) Journal, or other recent articles), and asking prices on high end apartments are falling across Greater Boston

- 31. Doubling up ŌĆó Jan. 2000: Students and other roommates doubling up pushing room rents to new heights: $600-$750 per bedroom

- 32. Doubling up ŌĆó Jan. 2000: Students ŌĆó Oct. 2002: and other roommates Willingness of doubling up pushing roommates to pay room rents to new unlimited rent seems heights: $600-$750 to have peaked, and per bedroom vacancy rate has risen

- 33. Substitution effect ŌĆó Jan. 2000: Now cheaper to buy than rent ($1,500 on a 2 bedroom apartment buys a $200,000 condominium)

- 34. Substitution effect ŌĆó Jan. 2000: Now ŌĆó Oct. 2002: Even more cheaper to buy than true than before rent ($1,500 on a 2 (Current market rent bedroom apartment of $1,600 for a 2 buys a $200,000 bedroom now buys a condominium) $400,000 condo because interest rates are so low-con’¼ürm.)

- 35. New factors ŌĆó Oct. 2002: Amateur investors pulling money out of stock market to buy real estate, driving up prices on homes, while creating increasingly soft rental market (link to article in WSJ)

- 36. Public policy ŌĆó Affordable housing ŌĆó Low / no down ŌĆó Capital gains

- 37. Affordable housing ŌĆó Jan. 2000: Innovative affordable housing programs, creating record new homeownership rates--70%-- nationwide

- 38. Affordable housing ŌĆó Jan. 2000: Innovative ŌĆó Oct. 2002: Many, affordable housing including economist programs, creating Karl Case, worried record new that relaxed standards homeownership have contributed to rates--70%-- new record foreclosure nationwide rate (get date)

- 39. Low / no down payment loans ŌĆó Jan. 2000: 97% loan products now require less money down than renting, which often require four months of upfront payments: ’¼ürst and last month's rent, security deposit, and rental fee.

- 40. Low / no down payment loans ŌĆó Jan. 2000: 97% loan ŌĆó Oct. 2002: No money products now require down and interest only less money down than mortgages have renting, which often reduced the barriers to require four months of home ownership even upfront payments: ’¼ürst more for people who and last month's rent, would otherwise rent. security deposit, and rental fee.

- 41. Capital gains ŌĆó Jan. 2000: Changes in capital gains tax treatment has generated more demand at high end of the market as empty nesters are trading up, too.

- 42. Capital gains ŌĆó Jan. 2000: Changes in ŌĆó Oct. 2002: Additional capital gains tax capital from change in treatment has tax laws, magni’¼üed by generated more low interest rates, have demand at high end of pushed housing prices the market as empty up, making it more nesters are trading up, dif’¼ücult of 1st time too. buyers to ’¼ünd the ’¼ürst rung on the housing ladder

- 43. Demographics ŌĆó Baby boomers ŌĆó Singles ŌĆó Two income households

- 44. Baby boomers ŌĆó Jan. 2000: Baby boomers reaching peak purchasing power (one turns 50 every 7 to 9 seconds?) are trading up.

- 45. Baby boomers ŌĆó Jan. 2000: Baby ŌĆó Oct. 2002: First wave boomers reaching of baby boomers has peak purchasing passed through and by power (one turns 50 2006 some of them every 7 to 9 seconds?) will begin trading are trading up. down.

- 46. Singles ŌĆó Jan. 2000: Single person households are the most rapidly growing market segment.

- 47. Singles ŌĆó Jan. 2000: Single ŌĆó Oct. 2002: Most person households are single person the most rapidly households now priced growing market out of the market in segment. Greater Boston?

- 48. Two income households ŌĆó Jan. 2000: Massachusetts has highest percentage of two income home buyers in the nation: 83%

- 49. Two income households ŌĆó Jan. 2000: ŌĆó Oct. 2002: Rising Massachusetts has prices mean that two highest percentage of incomes needed more two income home than ever in MA. Two buyers in the nation: income households 83% more vulnerable to foreclosure is one loses their job.

- 50. Limited supply of housing ŌĆó Little land ŌĆó Longer life expectancy ŌĆó Lower turnover ŌĆó Negative equity ŌĆó New signs ŌĆó New factors

- 51. Little land ŌĆó Jan. 2000: Limited land and prolonged permitting process slows production of new units, limiting the housing supply in Greater Boston

- 52. Little land ŌĆó Jan. 2000: Limited ŌĆó Oct. 2002: This land and prolonged ’¼ünding was repeated permitting process in the Housing Report slows production of Card (link to article), new units, limiting the and is the reason some housing supply in argue Boston will not Greater Boston experience a sharp decline in prices despite the real estate bubble

- 53. Longer life expectancy ŌĆó Jan. 2000: People living longer and 80% of elderly in need of health care would prefer to have it at home

- 54. Longer life expectancy ŌĆó Jan. 2000: People ŌĆó Oct. 2002: Still true, living longer and 80% and arguably even of elderly in need of more elderly not health care would moving now because prefer to have it at stock market losses home have eaten retirement savings

- 55. Lower turnover ŌĆó Jan. 2000: Low turnover of desirable properties in desirable areas

- 56. Lower turnover ŌĆó Jan. 2000: Low ŌĆó Oct. 2002: No longer turnover of desirable true? It appears that properties in desirable Lincoln has many areas more properties for sale than it has in recent years. 33 out of 100 properties on the market in Lexington are over $1 million.

- 57. Negative equity ŌĆó Jan. 2000: Not everyone has recovered from the decline in values in the late 1980's.

- 58. Negative equity ŌĆó Jan. 2000: Not ŌĆó Oct. 2002: Market everyone has recovered, but high recovered from the end buyers, buyers decline in values in the paying unprecedented late 1980's. prices in outlying areas or putting little or no money down are in danger of sliding into negative equity if prices go ’¼éat or fall.

- 59. New signs ŌĆó Oct. 2002: Executives at publicly-traded housing companies began selling stock in September (link to lead story in Investors Daily)

- 60. New factors ŌĆó Oct. 2002: Lowest interest rates in 40 years, generated 1.8 million new housing starts nationwide which could result in an oversupply of new housing and falling prices at some point in the future.

- 61. Broker Tricks ŌĆó Pocket listings ŌĆó Bidding wars ŌĆó FSBOs

- 62. Pocket Listings ŌĆó Jan. 2000: Brokers doing more pocket listings, making it appear that fewer properties are on the market. Overeager buyers engaged in bidding wars routinely paying more than

- 63. Pocket Listings ŌĆó Jan. 2000: Brokers ŌĆó Oct. 2002: As market doing more pocket shifts from sellers to listings, making it buyers market, pocket appear that fewer listings could fall. properties are on the However, Coldwell market. Overeager Banker's purchase of buyers engaged in DeWolfe could mean bidding wars routinely even more pocket paying more than listings & in-house sales.

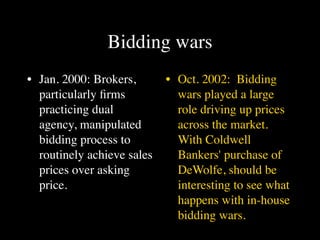

- 64. Bidding wars ŌĆó Jan. 2000: Brokers, particularly ’¼ürms practicing dual agency, manipulated bidding process to routinely achieve sales prices over asking price.

- 65. Bidding wars ŌĆó Jan. 2000: Brokers, ŌĆó Oct. 2002: Bidding particularly ’¼ürms wars played a large practicing dual role driving up prices agency, manipulated across the market. bidding process to With Coldwell routinely achieve sales Bankers' purchase of prices over asking DeWolfe, should be price. interesting to see what happens with in-house bidding wars.

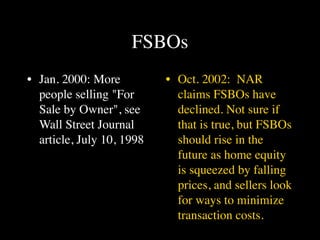

- 66. FSBOs ŌĆó Jan. 2000: More people selling "For Sale by Owner", see Wall Street Journal article, July 10, 1998

- 67. FSBOs ŌĆó Jan. 2000: More ŌĆó Oct. 2002: NAR people selling "For claims FSBOs have Sale by Owner", see declined. Not sure if Wall Street Journal that is true, but FSBOs article, July 10, 1998 should rise in the future as home equity is squeezed by falling prices, and sellers look for ways to minimize transaction costs.

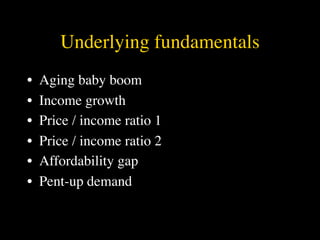

- 68. Underlying fundamentals ŌĆó Aging baby boom ŌĆó Income growth ŌĆó Price / income ratio 1 ŌĆó Price / income ratio 2 ŌĆó Affordability gap ŌĆó Pent-up demand

- 69. Aging baby boom ŌĆó Jan. 2000: Housing market slump when baby boomers hit retirement age (2010)

- 70. Aging baby boom ŌĆó Jan. 2000: Housing ŌĆó Oct. 2002: Loss of market slump when retirement savings baby boomers hit may delay downsizing, retirement age (2010) particularly if selling means losing money. That could result in a gridlock in certain segments of the housing market.

- 71. Income growth ŌĆó Jan. 2000: Household income increased 5% per year from 1995 to 2000 in New England.

- 72. Income growth ŌĆó Jan. 2000: Household ŌĆó Oct. 2002: Growth of income increased 5% household income per year from 1995 to predicted at just 1% 2000 in New England. for the next ’¼üve years. That means it will take ’¼üve years to equal the income growth of just one of the ’¼üve previous years.

- 73. Price / income ratio 1 ŌĆó Oct. 2002: Boston highest on the housing Richter scale with rating over 9

- 74. Price / income ratio 2 ŌĆó Oct. 2002: Housing prices up by 85% but income only up by 20% in last ’¼üve years. In contrast, during the last real estate cycle, price rose by 78% while incomes rose by 28% (con’¼ürm and link to article in WSJ.)

- 75. Affordability gap ŌĆó Oct. 2002: Gap between seller expectations and buyer purchasing power at record high (HomeGain.com monthly stats)

- 76. Pent-up demand ŌĆó Jan. 2000: Housing market still absorbing pent-up demand post rent control.

- 77. Pent-up demand ŌĆó Jan. 2000: Housing ŌĆó Oct. 2002: Oct. 2002: market still absorbing Record low interest pent-up demand post rates have brought rent control. "future demand" into the marketplace to compete with existing buyers, increasing prices & vulnerability when interest rates rise to traditional levels.

- 78. Warnings by Industry experts ŌĆó Consumer Reports ŌĆó Federal Reserve ŌĆó Mark Zandi, Economy.com ŌĆó Nick Retsinas ŌĆó University president (con’¼üdential)

- 79. Consumer Reports ŌĆó Oct. 2002: Boston overpriced by 31% to 48%

- 80. Federal Reserve ŌĆó Oct. 2002: "Housing markets can and do change abruptly."-- July 2001

- 81. Mark Zandi, Economy.com ŌĆó Oct. 2002: ŌĆ£Areas that have seen big run-ups in value recently might see home prices fall as much as 30 percent if and when the Federal Reserve raises rates.ŌĆØ (Boston Globe, 10/30/02)

- 82. Nick Retsinas ŌĆó Oct. 2002: "Boston housing market continues to defy the underlying fundamentals."-- Boston Globe

- 83. University President ŌĆó Oct. 2002: Fannie Mae & Freddie Mac could be in trouble at some point in the future