Trading update Q3/2011

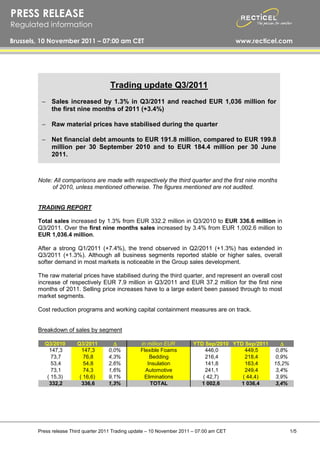

- 1. PRESS RELEASE Regulated information Brussels, 10 November 2011 â 07:00 am CET www.recticel.com Trading update Q3/2011 â Sales increased by 1.3% in Q3/2011 and reached EUR 1,036 million for the first nine months of 2011 (+3.4%) â Raw material prices have stabilised during the quarter â Net financial debt amounts to EUR 191.8 million, compared to EUR 199.8 million per 30 September 2010 and to EUR 184.4 million per 30 June 2011. Note: All comparisons are made with respectively the third quarter and the first nine months of 2010, unless mentioned otherwise. The figures mentioned are not audited. TRADING REPORT Total sales increased by 1.3% from EUR 332.2 million in Q3/2010 to EUR 336.6 million in Q3/2011. Over the first nine months sales increased by 3.4% from EUR 1,002.6 million to EUR 1,036.4 million. After a strong Q1/2011 (+7.4%), the trend observed in Q2/2011 (+1.3%) has extended in Q3/2011 (+1.3%). Although all business segments reported stable or higher sales, overall softer demand in most markets is noticeable in the Group sales development. The raw material prices have stabilised during the third quarter, and represent an overall cost increase of respectively EUR 7.9 million in Q3/2011 and EUR 37.2 million for the first nine months of 2011. Selling price increases have to a large extent been passed through to most market segments. Cost reduction programs and working capital containment measures are on track. Breakdown of sales by segment Q3/2010 Q3/2011 â in million EUR YTD Sep/2010 YTD Sep/2011 â 147,3 147,3 0,0% Flexible Foams 446,0 449,5 0,8% 73,7 76,8 4,3% Bedding 216,4 218,4 0,9% 53,4 54,8 2,6% Insulation 141,8 163,4 15,2% 73,1 74,3 1,6% Automotive 241,1 249,4 3,4% ( 15,3) ( 16,6) 9,1% Eliminations ( 42,7) ( 44,4) 3,9% 332,2 336,6 1,3% TOTAL 1 002,6 1 036,4 3,4% Press release Third quarter 2011 Trading update â 10 November 2011 â 07:00 am CET 1/5

- 2. TREND PER MARKET SEGMENT A. Flexible Foams Over the first nine months, sales in the Flexible Foams segment increased by 0.8% to EUR 449.5 million, primarily as a result of higher sales in the âTechnical foamsâ sub-segment. For the third quarter 2011 overall sales (EUR 147.3 million) were stable. The âComfortâ sub-segment reported lower sales (9M/2011: -3.7%; 3Q/2011: -2.6%) as a result of the deteriorating demand in Scandinavia and Spain. In the other countries the overall sales level stabilized in a very competitive market. The âTechnical foamsâ sub-segment (9M/2011: +11.8%; 3Q/2011: +8.0%) continued to benefit from improving demand, although at a slower rate, in the industrial and automotive markets. The âComposite foamsâ sub-segment (9M/2011: -12.5%; 3Q/2011: -16.7%) sales continued to suffer from poor world market prices for trim foam and from lower than expected volumes for bonded foam products. In line with its strategic plan, the Group completed the restructuring of several production sites in Spain and announced the closure of the Carobel converting plant in the UK by the end of 2011. The Group also decided to buy out the 50% joint venture partners in the holding company Enipur bv (The Netherlands), which controls the operations in Greece (Teknofoam Hellas) and in Turkey (Teknofoam Turkey). This transaction will enable the Group to implement its strategy in the region. The modernisation of the plant in Langeac (France), where a new foaming machine has been installed, is now completed. B. Bedding Over the first nine months, sales in the Bedding segment increased by 0.9% to EUR 218.4 million. For the third quarter 2011 overall sales (EUR 76.8 million) increased by 4.3%. Sales of the âBrandsâ sub-segment (9M/2011: -1.6%; 3Q/2011: -0.6%) were slightly lower; as a result of a lower shop visit rate driven by weakening consumer confidence. The Groupâs business performance remained under pressure in Austria and Switzerland, where the export activity (mainly SwissflexÂŪ) suffered from the strong Swiss Franc. Sales in the âNon-brandsâ sub-segment (9M/2011: +4.1%; 3Q/2011: +10.2%) have performed better. Press release Third quarter 2011 Trading update â 10 November 2011 â 07:00 am CET 2/5

- 3. C. Insulation Over the first nine months, sales in the Insulation segment increased by 15.2% to EUR 163.4 million. For the third quarter 2011, overall sales (EUR 54.8 million) increased by 2.6%, but to compare with a very strong Q3/2010 sales (+18.0% versus 2009). Sales in the âBuilding insulationâ sub-segment were the driver (9M/2011: +17.1%; 3Q/2011: +3.6%). Despite a softer European construction market, structural demand for high performing polyurethane building insulation products remains high as a result of stricter insulation standards and regulations, higher energy prices and growing awareness of the need for more and better insulation. Sales in the âIndustrial insulationâ sub-segment (9M/2011: -4.5%; 3Q/2011: -7.9%) remained slightly under expectations as a result of a lack of large LNG export projects. D. Automotive Over the first nine months, sales in Automotive increased by 3.4% to EUR 249.4 million. For the third quarter 2011, overall sales (EUR 74.3 million) increased by 1.6%. Sales in âInteriorsâ decreased slightly (9M/2011: +0.2%; 3Q/2011: -4.5%). The premium car market segment remained strong in Europe, the USA and in China. The Group won two new contracts for Porsche (Cajun), to be started in 2013 and Mercedes (E-class in China), to be started in 2012. Sales in âProseatâ, the 51%/49% seating Recticel/Woodbridge joint venture , (9M/2011: +10.7%; 3Q/2011: +12.7%) increased as a result of improving market share and the launch of the EPP (Expanded PolyPropylene) project in its French site of Trilport. FINANCIAL SITUATION On 30 September 2011, the Groupâs net financial debt (excluding non-recourse factoring/forfeiting programs) amounted to EUR 191.8 million compared to EUR 199.8 million on 30 September 2010; and EUR 184.4 million on 30 June 2011. Press release Third quarter 2011 Trading update â 10 November 2011 â 07:00 am CET 3/5

- 4. INSPECTION BY DIRECTORATE FOR COMPETITION OF THE EUROPEAN COMMISSION AND INSPECTION BY THE GERMAN FEDERAL CARTEL OFFICE (âBUNDESKARTELLAMTâ) Concerning the ongoing European Commission and Bundeskartellamt investigations, there are currently no additional elements to be announced than those made public by the Group in its press release of 30 August 2011 (First half-year results 2011). OUTLOOK Given the continuing uncertainty over the growth forecasts made by national and international competent institutions in the economies in which Recticel is active, the Board of Directors is not in a position to assess growth potential for the second half of 2011. °°° Press release Third quarter 2011 Trading update â 10 November 2011 â 07:00 am CET 4/5

- 5. UNCERTAINTY RISKS CONCERNING THE FORECASTS MADE This press report contains forecasts which entail risks and uncertainties, including with regard to statements concerning plans, objectives, expectations and/or intentions of the Recticel Group and its subsidiaries. Readers are informed that such forecasts entail known and unknown risks and/or may be subject to considerable business, macroeconomic and competition uncertainties and unforeseen circumstances which largely lie outside the control of the Recticel Group. Should one or more of these risks, uncertainties or unforeseen or unexpected circumstances arise or if the underlying assumptions were to prove to be incorrect, the final financial results of the Group may possibly differ significantly from the assumed, expected, estimated or extrapolated results. Consequently, neither Recticel nor any other person assumes any responsibility for the accuracy of these forecasts. FINANCIAL CALENDAR Third quarter trading update 2011 10.11.2011 (before opening of the stock exchange) Annual results 2011 02.03.2012 (before opening of the stock exchange) First quarter trading update 2012 08.05.2012 (before opening of the stock exchange) Annual General Meeting 29.05.2012 (at 10:00 AM CET) First half-year results 2012 30.08.2012 (before opening of the stock exchange) Third quarter trading update 2012 09.11.2012 (before opening of the stock exchange) FOR ADDITIONAL INFORMATION RECTICEL - Olympiadenlaan 2, B-1140 Brussels (Evere) PRESS & INVESTOR RELATIONS Mr Michel De Smedt Mobile: +32 479 91 11 38 desmedt.michel@recticel.com RECTICEL IN A NUTSHELL Recticel is a Belgian Group with a strong European dimension, but also operates in the rest of the world. Recticel has 110 establishments in 27 countries. Recticel contributes to daily comfort with foam filling for seats, mattresses and slat bases of top brands, insulation material, interior comfort for cars and an extensive range of other industrial and domestic applications. Recticel is the Group behind well-known bedding brands (BekaÂŪ, LattoflexÂŪ, Literie BultexÂŪ, SchlaraffiaÂŪ, SembellaÂŪ, SwissflexÂŪ, SuperbaÂŪ, UbicaÂŪ, etc.). Within the Insulation division high-quality thermal insulation products are marketed under the well-known brands EurowallÂŪ, PowerroofÂŪ, PowerdeckÂŪ and PowerwallÂŪ. Recticel is driven by technological progress and innovation, which has led to a revolutionary breakthrough at the biggest names in the car industry. Recticel achieved sales of EUR 1.35 billion in 2010. Recticel (NYSE Euronext: REC â Reuters: RECTt.BR â Bloomberg: REC:BB) is listed on NYSE Euronext in Brussels. The press release is available in English, Dutch and French on the website www.recticel.com Press release Third quarter 2011 Trading update â 10 November 2011 â 07:00 am CET 5/5