goods ans services tax,act - pros & cons

Download as pptx, pdf3 likes117 views

This document discusses the Goods and Services Tax (GST) implemented in India. It provides information on the structure of GST including CGST, SGST, UTGST and IGST. It outlines the benefits of GST such as reduction in cascading taxes, overall reduction in prices, and creation of a common national market. The limitations of GST are also noted, such as the increase in compliance costs and the exclusion of petroleum and liquor from the tax regime. In conclusion, GST is presented as an important step towards comprehensive indirect tax reform and economic integration in India.

1 of 16

Download to read offline

Ad

Recommended

Income tax slabs 2018 19

Income tax slabs 2018 19Rupeeiq Online

╠²

The document outlines income tax slabs for individuals and other entities for the financial year 2018-19 and assessment year 2019-20, detailing different thresholds based on age categories: below 60 years, between 60 and 80 years, and above 80 years. It specifies tax rates ranging from nil to 30% based on income brackets, along with applicable surcharges. Additionally, there are conditions limiting the surcharge based on total income exceeding specified thresholds.GST I The Framework

GST I The FrameworkCA Gaurav Gupta

╠²

The document provides an overview of the proposed GST framework in India, including:

- The origin and development of GST over time from 2006-2016.

- Key aspects of the proposed GST framework such as the types of taxes (CGST, SGST, IGST), the GST council and committees established, registration process, payment methods, and anticipated benefits.

- Details on the registration process including obtaining registration, approval process, surrender and cancellation of registration.

- An explanation of the various payment methods under GST particularly internet banking and over the counter payments.Gst

Gst Mayank Agrawal

╠²

The document provides an overview of the Goods and Services Tax (GST) implemented in India. Some key points covered include:

- GST is an indirect tax regime launched on July 1, 2017 that unified multiple taxes into a single tax.

- It applies uniformly across India to the manufacture, sale, and consumption of goods and services.

- GST is composed of the Central GST (CGST) and State GST (SGST) and subsumed many existing taxes like VAT.

- The GST rates and tax structure were designed after extensive consultation and 12 meetings of the GST Council. Exemptions and categories with different rates were established for various goods and services.Gst

GstSAHILKUMAR566

╠²

The Kelkar-Shah Committee made recommendations for implementing GST in India in four stages:

1) Establishing IT systems to handle GST processes

2) Building the Central GST system

3) Obtaining agreement from states through political negotiations on a "Grand Bargain"

4) Interacting with states to bring them on board with the GST system

The Committee also recommended reducing customs duties gradually and replacing other indirect taxes such as excise duty and service tax with the GST over time.Startup Tax Strategies

Startup Tax StrategiesNational Association of Pakistani Entrepreneurs

╠²

This document summarizes key tax considerations for startups in Pakistan. It outlines the various tax filings and compliance requirements under income tax laws and sales tax laws, including entity registration, tax number acquisition, income tax returns, withholding requirements, tax rates, and penalties. Specifically, it notes that startups must first register their legal entity with tax authorities, understand applicable tax obligations based on entity type, and ensure compliance with monthly, annual, and other tax filing deadlines.Short Term course on GST-Registration under GST

Short Term course on GST-Registration under GSTSandeep Gupta

╠²

The document discusses registration requirements under the Goods and Services Tax (GST) law in India. It states that mandatory registration is required if aggregate turnover exceeds Rs. 20 lakhs for most states or Rs. 10 lakhs for special category states, or if the person holds a license under existing law or is engaged in reverse charge transactions. It outlines the registration process which involves filing Form REG-01 along with required documents like PAN and address proof. Upon approval, the GST Identification Number (GSTIN) is issued with a 15-digit format. The next session topic will be on input tax credit under GST.basic of taxes

basic of taxesUddeshya Bora

╠²

This document outlines the various types of taxes in India including direct and indirect taxes. Direct taxes include income tax and wealth tax, with income tax rates varying based on taxpayer type (individual, HUF, firm, local authority, or company). Indirect taxes include excise duty, custom duty, central sales tax, value added tax, and service tax. The document also provides details on income tax slabs and rates for individuals of different ages, sources of income, special features of income tax law, recent amendments, and income computation and disclosure standards.Gs tseminarppt

Gs tseminarpptabdul280288

╠²

The document provides information about GST awareness campaigns and updates regarding the GST system in India. Some key points:

1) GST aims to replace existing indirect tax system with a single, unified tax to reduce cascading of taxes and make India a common market.

2) GST will subsume many central and state taxes into a single tax applicable on supply of goods and services.

3) Taxpayers will need to file regular returns providing details of outward supplies, input tax credits, and tax liabilities to allow for matching and compliance verification by tax authorities.Gst ppt

Gst pptAyush Gupta

╠²

GST is a comprehensive indirect tax on the supply of goods and services throughout India that replaces multiple taxes levied by the central and state governments. It aims to create a single, unified Indian market to make India a common economic market. When implemented, GST will eliminate tax cascading and provide seamless tax credits, thereby reducing the overall tax burden on goods. It is expected to simplify and rationalize indirect tax structure in India and improve economic growth.(34) gst overview hari master piece

(34) gst overview hari master piecehariharanmasterpiece

╠²

The document provides an overview of the Goods and Services Tax (GST) system implemented in India in 2017. It discusses the existing indirect tax structure that GST replaced, including various central and state taxes. It then explains key aspects of GST including the tax structure of CGST, SGST and IGST, constitutional amendments enabling GST, the role of the GST Council, and the GST Network (GSTN) for IT infrastructure. The benefits of GST are listed as reducing tax cascading, creating a common national market, increasing tax base and ease of doing business. Exempted items under GST are also outlined.GST

GSTSoumya Nichani

╠²

Goods & Services Tax is an indirect tax that will replace multiple taxes in India. It will create a single, unified Indian market to make business easier. GST is expected to benefit the government through a wider tax base and increased revenue. It will benefit industry by removing cascading taxes and reducing compliance costs. Consumers should see lower prices as manufacturing costs decrease without multiple taxes being applied.Gst for Nov 2017

Gst for Nov 2017Aashish Moktan

╠²

This document provides an overview of the Goods and Services Tax (GST) in India. It discusses the genesis and need for GST, the key benefits, and the constitutional amendment process. It also covers the core concepts of GST including the dual GST model and relevant definitions such as goods, services, consideration, reverse charge, and taxable person. The overview contains several tables and charts to illustrate the topics in a clear and visual manner.Introduction of GST

Introduction of GSTTanviSharda1

╠²

The document provides an overview of the Goods and Services Tax (GST) in India. It discusses that GST is a comprehensive indirect tax replacing multiple taxes. The key points covered are the constitutional amendment for GST, the legislative framework establishing central, state and integrated GST, features of GST including the tax structure and benefits of GST such as creating a unified market, removing cascading effects of taxes, and boosting the 'Make in India' initiative.Introduction to GST

Introduction to GSTmmdaga

╠²

The document provides an overview of the Goods and Services Tax (GST) in India, highlighting its need for indirect tax reform and the transition from a complex multi-tax structure to a single GST regime. Key features include the introduction of a unified tax rate, the establishment of the GST Council for governance, and provisions for revenue compensation to states. It also outlines benefits such as simplified tax processes, reduction in tax cascading, and enhanced compliance through technology.Gst (Goods And Services Tax).pptx

Gst (Goods And Services Tax).pptxAbhiArora31

╠²

GST (Goods and Services Tax) is a comprehensive indirect tax that will be levied on manufacture, sale and consumption of goods as well as services at the national level. It is proposed to be a dual GST with taxation powers vested concurrently in the Centre and States. GST aims to create a unified common national market by replacing existing multiple taxes and levies, and overcome the cascading effect of taxes. Its implementation would greatly simplify and rationalize India's indirect tax system and boost economic growth.Goods & Services tax - GST

Goods & Services tax - GSTRajkumar P

╠²

The document discusses the Goods and Services Tax (GST) in India, which is an indirect tax that replaced various other taxes and became effective on July 1, 2017. It includes Central Goods and Service Tax (CGST), State Goods and Service Tax (SGST), and Integrated Goods and Service Tax (IGST) while simplifying the tax structure and aiming for economic growth. The document also outlines the advantages and disadvantages of GST, emphasizing its potential to streamline taxation, enhance revenue, and create a more competitive market.Goods & services tax

Goods & services taxRajkumar P

╠²

GST is a new indirect tax regime in India that combines multiple taxes into one. It is levied on the supply of goods and services. GST helps eliminate cascading of taxes and reduces the overall tax burden. It includes CGST for the central government, SGST for state governments, and IGST for inter-state transactions. The implementation of GST is expected to simplify indirect taxation in India and boost economic growth by reducing costs and improving ease of doing business. While it offers various benefits, there are also challenges to its implementation regarding tax credits, impact on certain sectors, and operational complexities.(34) gst overview ah authors

(34) gst overview ah authorsHariharanAmutha1

╠²

The document provides an overview of the Goods and Services Tax (GST) implemented in India in 2017. It discusses the existing indirect tax structure that GST replaced, including multiple central and state taxes. GST is a dual model with CGST collected by the central government and SGST/UTGST collected by state governments. For inter-state transactions, IGST is collected and subsequently distributed between the states. The objectives, benefits, and key features of GST are outlined including a unified market, reduced compliance costs, and a broader tax base.UNIT II GST.pptx

UNIT II GST.pptxvidhya balasubramanian

╠²

GST (Goods and Services Tax) is proposed as a comprehensive indirect tax on manufacture, sale and consumption of goods and services at the national level in India. It will replace multiple taxes levied by the central and state governments. The key advantages of GST include eliminating the cascading effect of taxes, improving ease of doing business by simplifying taxation structure, and expanding the tax base. However, implementing such a large reform will be challenging and requires strong coordination between the central and state governments.(34) gst overview hari master piece

(34) gst overview hari master pieceHariMasterpiece

╠²

The document provides an overview of the Goods and Services Tax (GST) system implemented in India in 2017. It discusses the existing indirect tax structure that GST replaced, including various central taxes and state taxes. The key features of GST are outlined, such as a dual GST with CGST and SGST/UTGST, and IGST for inter-state transactions. The objectives and benefits of GST are highlighted, including a unified market, reduced compliance costs, and increased tax revenues. The constitution of the GST Council and its role in administering GST are also summarized.GST vs previous tax FOR BBA AND MBA STUDENTS PPT

GST vs previous tax FOR BBA AND MBA STUDENTS PPTpankajka85

╠²

GOODS AND SERVICES TAX (GST) IN INDIA

Concept of GST

When was GST Launched in India?

Why was GST Introduced in India?

Existing Tax structure in India

Proposed Tax Structure in India

Model of GST

GST vs Previous Taxes

Impact of GST on Indian EconomyGst ppt.

Gst ppt.Parth Shah

╠²

The Goods and Services Tax (GST) is a comprehensive national tax reform in India aimed at consolidating multiple indirect taxes into a single value-added tax on goods and services. It addresses issues like tax cascading, complexity, and evasion by implementing a dual tax structure administered by both central and state governments. While GST promises transparency and efficiency in the tax system, it faces challenges such as administrative coordination and the need for sophisticated IT infrastructure.Goods and Services Tax (India)

Goods and Services Tax (India)Ajith Albi

╠²

The document discusses the tax structure in India, highlighting the distinction between direct taxes, like income tax, and indirect taxes, such as Goods and Services Tax (GST). It outlines the introduction and implementation timeline of GST, its structure consisting of CGST, SGST, and IGST, and the tax slabs. It also lists the items that will become cheaper or costlier under GST and mentions potential benefits and hurdles in its implementation.GST in India

GST in India Dr. Mohmed Amin Mir

╠²

The document provides an overview of Goods & Services Tax (GST) implemented in India in 2017. It discusses the deficiencies of the previous indirect tax system that GST aimed to address, such as dual levy and multiple registrations. Key aspects of GST covered include the four-tier tax rate structure, input tax credit mechanism, treatment of inter-state supplies, and the major constitutional amendments and legislations passed between 2014-2017 to enable its rollout. Special features of GST highlighted are the single and destination-based tax, subsuming of various central and state taxes, and easier compliance through e-filing of common returns.Research report on gst

Research report on gstmanish kumar

╠²

The document is a research report analyzing the impact of Goods and Services Tax (GST) on various sectors and product prices in India. It highlights that GST is a significant indirect tax reform aimed at unifying multiple existing taxes and addressing the cascading tax effect, while also providing statistical analyses of its effects on different industries. Key findings indicate that GST reduces the tax burden on consumers but may decrease government revenues and affect purchasing behavior.Research paper GST

Research paper GSTSIDDHARTH YADAV

╠²

The document summarizes a research paper on India's Goods and Services Tax (GST). It discusses how GST simplifies India's complex indirect tax system by consolidating multiple taxes into a single tax applied to goods and services. GST aims to reduce tax cascading, promote a unified market, and support economic growth. While GST addresses some issues, challenges remain in fully implementing an ideal harmonized tax system across India.A Presentation on GST

A Presentation on GSTNarayan Lodha

╠²

The presentation by CA Narayan Lodha outlines the Goods and Services Tax (GST) framework in India, emphasizing its structure, features, benefits, and implications for businesses. It discusses the dual GST system, the classifications of goods and services, and the significance of input tax credit (ITC) for businesses. Additionally, it highlights the advantages of GST, such as simplification of tax administration and competitiveness in both domestic and international markets.Japan's Media and Telecom Markets: Evolution, Global Competition, and NTT Law...

Japan's Media and Telecom Markets: Evolution, Global Competition, and NTT Law...Toshiya Jitsuzumi

╠²

Presentation at ICA2025 in Denver, CO. on June 16, 2025.2025-06-22 Abraham 04 (shared slides).pptx

2025-06-22 Abraham 04 (shared slides).pptxDale Wells

╠²

Lesson 4 of 9 in a Heritage Bible Master Class study of "Abraham: The Man God Called 'My Friend'"

Heritage Bible Master Class is a non-denominational Bible Class/Worship service that meets every Sunday morning at 10:15 at Heritage Palms Country Club, south of Fred Waring and east of Jefferson. Please join us.More Related Content

Similar to goods ans services tax,act - pros & cons (20)

Gst ppt

Gst pptAyush Gupta

╠²

GST is a comprehensive indirect tax on the supply of goods and services throughout India that replaces multiple taxes levied by the central and state governments. It aims to create a single, unified Indian market to make India a common economic market. When implemented, GST will eliminate tax cascading and provide seamless tax credits, thereby reducing the overall tax burden on goods. It is expected to simplify and rationalize indirect tax structure in India and improve economic growth.(34) gst overview hari master piece

(34) gst overview hari master piecehariharanmasterpiece

╠²

The document provides an overview of the Goods and Services Tax (GST) system implemented in India in 2017. It discusses the existing indirect tax structure that GST replaced, including various central and state taxes. It then explains key aspects of GST including the tax structure of CGST, SGST and IGST, constitutional amendments enabling GST, the role of the GST Council, and the GST Network (GSTN) for IT infrastructure. The benefits of GST are listed as reducing tax cascading, creating a common national market, increasing tax base and ease of doing business. Exempted items under GST are also outlined.GST

GSTSoumya Nichani

╠²

Goods & Services Tax is an indirect tax that will replace multiple taxes in India. It will create a single, unified Indian market to make business easier. GST is expected to benefit the government through a wider tax base and increased revenue. It will benefit industry by removing cascading taxes and reducing compliance costs. Consumers should see lower prices as manufacturing costs decrease without multiple taxes being applied.Gst for Nov 2017

Gst for Nov 2017Aashish Moktan

╠²

This document provides an overview of the Goods and Services Tax (GST) in India. It discusses the genesis and need for GST, the key benefits, and the constitutional amendment process. It also covers the core concepts of GST including the dual GST model and relevant definitions such as goods, services, consideration, reverse charge, and taxable person. The overview contains several tables and charts to illustrate the topics in a clear and visual manner.Introduction of GST

Introduction of GSTTanviSharda1

╠²

The document provides an overview of the Goods and Services Tax (GST) in India. It discusses that GST is a comprehensive indirect tax replacing multiple taxes. The key points covered are the constitutional amendment for GST, the legislative framework establishing central, state and integrated GST, features of GST including the tax structure and benefits of GST such as creating a unified market, removing cascading effects of taxes, and boosting the 'Make in India' initiative.Introduction to GST

Introduction to GSTmmdaga

╠²

The document provides an overview of the Goods and Services Tax (GST) in India, highlighting its need for indirect tax reform and the transition from a complex multi-tax structure to a single GST regime. Key features include the introduction of a unified tax rate, the establishment of the GST Council for governance, and provisions for revenue compensation to states. It also outlines benefits such as simplified tax processes, reduction in tax cascading, and enhanced compliance through technology.Gst (Goods And Services Tax).pptx

Gst (Goods And Services Tax).pptxAbhiArora31

╠²

GST (Goods and Services Tax) is a comprehensive indirect tax that will be levied on manufacture, sale and consumption of goods as well as services at the national level. It is proposed to be a dual GST with taxation powers vested concurrently in the Centre and States. GST aims to create a unified common national market by replacing existing multiple taxes and levies, and overcome the cascading effect of taxes. Its implementation would greatly simplify and rationalize India's indirect tax system and boost economic growth.Goods & Services tax - GST

Goods & Services tax - GSTRajkumar P

╠²

The document discusses the Goods and Services Tax (GST) in India, which is an indirect tax that replaced various other taxes and became effective on July 1, 2017. It includes Central Goods and Service Tax (CGST), State Goods and Service Tax (SGST), and Integrated Goods and Service Tax (IGST) while simplifying the tax structure and aiming for economic growth. The document also outlines the advantages and disadvantages of GST, emphasizing its potential to streamline taxation, enhance revenue, and create a more competitive market.Goods & services tax

Goods & services taxRajkumar P

╠²

GST is a new indirect tax regime in India that combines multiple taxes into one. It is levied on the supply of goods and services. GST helps eliminate cascading of taxes and reduces the overall tax burden. It includes CGST for the central government, SGST for state governments, and IGST for inter-state transactions. The implementation of GST is expected to simplify indirect taxation in India and boost economic growth by reducing costs and improving ease of doing business. While it offers various benefits, there are also challenges to its implementation regarding tax credits, impact on certain sectors, and operational complexities.(34) gst overview ah authors

(34) gst overview ah authorsHariharanAmutha1

╠²

The document provides an overview of the Goods and Services Tax (GST) implemented in India in 2017. It discusses the existing indirect tax structure that GST replaced, including multiple central and state taxes. GST is a dual model with CGST collected by the central government and SGST/UTGST collected by state governments. For inter-state transactions, IGST is collected and subsequently distributed between the states. The objectives, benefits, and key features of GST are outlined including a unified market, reduced compliance costs, and a broader tax base.UNIT II GST.pptx

UNIT II GST.pptxvidhya balasubramanian

╠²

GST (Goods and Services Tax) is proposed as a comprehensive indirect tax on manufacture, sale and consumption of goods and services at the national level in India. It will replace multiple taxes levied by the central and state governments. The key advantages of GST include eliminating the cascading effect of taxes, improving ease of doing business by simplifying taxation structure, and expanding the tax base. However, implementing such a large reform will be challenging and requires strong coordination between the central and state governments.(34) gst overview hari master piece

(34) gst overview hari master pieceHariMasterpiece

╠²

The document provides an overview of the Goods and Services Tax (GST) system implemented in India in 2017. It discusses the existing indirect tax structure that GST replaced, including various central taxes and state taxes. The key features of GST are outlined, such as a dual GST with CGST and SGST/UTGST, and IGST for inter-state transactions. The objectives and benefits of GST are highlighted, including a unified market, reduced compliance costs, and increased tax revenues. The constitution of the GST Council and its role in administering GST are also summarized.GST vs previous tax FOR BBA AND MBA STUDENTS PPT

GST vs previous tax FOR BBA AND MBA STUDENTS PPTpankajka85

╠²

GOODS AND SERVICES TAX (GST) IN INDIA

Concept of GST

When was GST Launched in India?

Why was GST Introduced in India?

Existing Tax structure in India

Proposed Tax Structure in India

Model of GST

GST vs Previous Taxes

Impact of GST on Indian EconomyGst ppt.

Gst ppt.Parth Shah

╠²

The Goods and Services Tax (GST) is a comprehensive national tax reform in India aimed at consolidating multiple indirect taxes into a single value-added tax on goods and services. It addresses issues like tax cascading, complexity, and evasion by implementing a dual tax structure administered by both central and state governments. While GST promises transparency and efficiency in the tax system, it faces challenges such as administrative coordination and the need for sophisticated IT infrastructure.Goods and Services Tax (India)

Goods and Services Tax (India)Ajith Albi

╠²

The document discusses the tax structure in India, highlighting the distinction between direct taxes, like income tax, and indirect taxes, such as Goods and Services Tax (GST). It outlines the introduction and implementation timeline of GST, its structure consisting of CGST, SGST, and IGST, and the tax slabs. It also lists the items that will become cheaper or costlier under GST and mentions potential benefits and hurdles in its implementation.GST in India

GST in India Dr. Mohmed Amin Mir

╠²

The document provides an overview of Goods & Services Tax (GST) implemented in India in 2017. It discusses the deficiencies of the previous indirect tax system that GST aimed to address, such as dual levy and multiple registrations. Key aspects of GST covered include the four-tier tax rate structure, input tax credit mechanism, treatment of inter-state supplies, and the major constitutional amendments and legislations passed between 2014-2017 to enable its rollout. Special features of GST highlighted are the single and destination-based tax, subsuming of various central and state taxes, and easier compliance through e-filing of common returns.Research report on gst

Research report on gstmanish kumar

╠²

The document is a research report analyzing the impact of Goods and Services Tax (GST) on various sectors and product prices in India. It highlights that GST is a significant indirect tax reform aimed at unifying multiple existing taxes and addressing the cascading tax effect, while also providing statistical analyses of its effects on different industries. Key findings indicate that GST reduces the tax burden on consumers but may decrease government revenues and affect purchasing behavior.Research paper GST

Research paper GSTSIDDHARTH YADAV

╠²

The document summarizes a research paper on India's Goods and Services Tax (GST). It discusses how GST simplifies India's complex indirect tax system by consolidating multiple taxes into a single tax applied to goods and services. GST aims to reduce tax cascading, promote a unified market, and support economic growth. While GST addresses some issues, challenges remain in fully implementing an ideal harmonized tax system across India.A Presentation on GST

A Presentation on GSTNarayan Lodha

╠²

The presentation by CA Narayan Lodha outlines the Goods and Services Tax (GST) framework in India, emphasizing its structure, features, benefits, and implications for businesses. It discusses the dual GST system, the classifications of goods and services, and the significance of input tax credit (ITC) for businesses. Additionally, it highlights the advantages of GST, such as simplification of tax administration and competitiveness in both domestic and international markets.Recently uploaded (19)

Japan's Media and Telecom Markets: Evolution, Global Competition, and NTT Law...

Japan's Media and Telecom Markets: Evolution, Global Competition, and NTT Law...Toshiya Jitsuzumi

╠²

Presentation at ICA2025 in Denver, CO. on June 16, 2025.2025-06-22 Abraham 04 (shared slides).pptx

2025-06-22 Abraham 04 (shared slides).pptxDale Wells

╠²

Lesson 4 of 9 in a Heritage Bible Master Class study of "Abraham: The Man God Called 'My Friend'"

Heritage Bible Master Class is a non-denominational Bible Class/Worship service that meets every Sunday morning at 10:15 at Heritage Palms Country Club, south of Fred Waring and east of Jefferson. Please join us.Types of Information Sources (Primary, Secondary, and Tertiary Sources)

Types of Information Sources (Primary, Secondary, and Tertiary Sources)jenicahmendoza1

╠²

Sources of information come in various forms and serve different educational purposes. Personal letter personal letter personal letter.pptx

Personal letter personal letter personal letter.pptxGedeJuliana2

╠²

Personal letter personal letter personal letterPersonal letter personal letter personal letterBriefing on the upcoming UNFSS +4 Stocktake

Briefing on the upcoming UNFSS +4 StocktakeFrancois Stepman

╠²

2 June 2025. Online network briefing session from the Netherlands Food Partnership about the upcoming UNFSS +4 Stocktake for the Dutch partner network

The global UN FSS+4 Stocktaking Moment (July 27ŌĆō29, 2025, in Addis Ababa, Ethiopia, co-hosted by Ethiopia and Italy) aims to discuss progress made since the UN Food Systems Summit of 2021.

With just five years remaining until the 2030 Agenda for Sustainable Development horizon line, the UNFSS+4 will provide an opportunity to document progress, strengthen accountability, and unlock investments for transformative action.

The event spotlighted:

successful country-level transformations,

innovative practices,

challenges faced in fragile and conflict-affected settings,

and be part of broader efforts to shape a coherent global narrative on sustainable development and accelerate synergies between key SDG transitions.

This is the presentation of Mr. Khaled Eltaweel of the Food Systems Coordination Hub.

Josaya - Abstract for the research of the youth development.pdf

Josaya - Abstract for the research of the youth development.pdfJosaya Injesi

╠²

This is my abstract. My first idea on the youFL Studio Crack Full Version [Latest 2025]

FL Studio Crack Full Version [Latest 2025]Jackson lithms

╠²

¤æēØŚĪØŚóØŚ¦ØŚś:ØŚ¢ØŚóØŚŻØŚ¼ ØŚ¤ØŚ£ØŚĪØŚ× & ØŚŻØŚöØŚ”ØŚ¦ ØŚČØŚ╗ØÉōØŚ╝ ØŚÜØŚ╝ØŚ╝ØŚ┤ØŚ╣ØŚ▓ ØŚĪØŚśØŚ¬ ØŚ¦ØŚ«ØŚ»> https://pcprocore.com/ ¤æłŌŚĆ

FL Studio is a powerful digital audio workstation (DAW) used for music production. It's a complete software package that allows users to compose, arrange, record, edit, mix, and master music. Known for its intuitive design, especially for pattern-based music creation, FL Studio is popular among beginners and experienced producers alike.

Analysis of Tausog Language English.pptx

Analysis of Tausog Language English.pptxMervieJadeBabao

╠²

Analysis of Tausog Language English

Analysis of Tausog Language English

Analysis of Tausog Language English

Analysis of Tausog Language English

Analysis of Tausog Language English

Analysis of Tausog Language English

Analysis of Tausog Language English

Analysis of Tausog Language English

Analysis of Tausog Language EnglishGoogle Algorithm Updates ŌĆō A Complete Guide for Digital Marketing Students.pdf

Google Algorithm Updates ŌĆō A Complete Guide for Digital Marketing Students.pdfNithinks37

╠²

Explore the most important Google algorithm updates that shaped the SEO landscape from Panda to Helpful Content. This presentation is designed for students and beginners in digital marketing to help them understand how Google's algorithms affect search rankings and how to stay updated with best practices.

¤öŹ WhatŌĆÖs inside:

Overview of key algorithm updates (Panda, Penguin, Hummingbird, BERT, etc.)

Real-life examples of algorithm impacts

SEO tips to align with GoogleŌĆÖs evolving standards

Easy-to-understand explanations for beginners

¤ōÜ Learn more about SEO and digital marketing at ¤æē https://nithinksofficial.com

Whether you're preparing for a course, training session, or just want to improve your SEO skills, this guide will help you build a solid foundation.

#GoogleAlgorithmUpdates #DigitalMarketing #SEOforBeginners #GoogleSEO #LearnSEO #nithinksofficial. https://nithinksofficial.com/Ad

goods ans services tax,act - pros & cons

- 1. GOODS & SERVICES TAX ACT

- 2. PROJECT GUIDE- DR. SHUBHAM MISHRA PRESENTED BY- ANKITA SALNI TOPPO (08) NIDHI TIGGA (40) NISHA CHHAVI KINDO (43) PRIYAM VISHWAKARMA (50) RIYA GUPTA (58)

- 3. TOPIC- ’ā╝STRUCTURE OF GST ŌĆó SGST ŌĆó UTGST ŌĆó CGST ŌĆó IGST ’ā╝BENEFITS OF GST ’ā╝LIMITATIONS OF GST

- 4. PRE-GST INDIRECT TAX STRUCTURE IN INDIA ’āśCentral excise duty ’āśAdditional duties of excise ’āśExcise duty levied under medicinal & toiletries preparation act ’āśAdditional duties of customs(SAD & CVD) ’āśService tax ’āśSurcharges & cesses ’āśState VAT / sales tax ’āśPurchase tax ’āśEntertainment tax ’āśLuxury tax ’āśEntry tax ’āśTaxes on lottery, betting & gambling ’āśSurcharges and cesses CENTRAL TAXEX STATE TAXEX GST

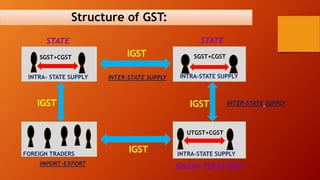

- 5. GST IGST SGST/UT GST CGST GST STRUCTURE IN INDIA

- 6. Structure of GST: INTRA- STATE SUPPLY SGST+CGST SGST+CGST INTRA-STATE SUPPLY UTGST+CGST INTRA-STATE SUPPLYFOREIGN TRADERS INTER-STATE SUPPLY INTER-STATE SUPPLY IGST IGST IMPORT-EXPORT IGST IGST STATE STATE UNION TERRITORY

- 8. BENEFITS OF GST ’āśReduction in cascading of taxes ’āśOverall reduction in prices ’āśCommon national market ’āśBenefits to small taxpayers ’āśSelf-regulating tax system ’āśNon-intrusive electronic tax system

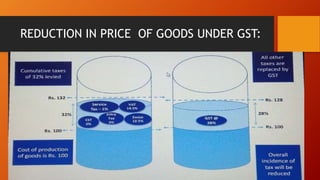

- 9. REDUCTION IN PRICE OF GOODS UNDER GST:

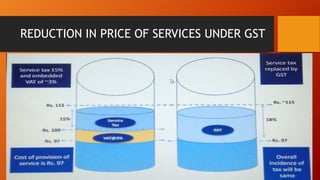

- 10. REDUCTION IN PRICE OF SERVICES UNDER GST

- 11. BENEFITS OF GST ’āśSimplified tax regime ’āśReduction in multiplicity of taxes ’āśConsumption based tax ’āśAbolition of CST ’āśExports to be zero rated ’āśProtection of domestic industries-IGST

- 12. BENEFITS OF GST ’āśDECREASE IN INFLATION ’āśEASE OF DOING BUSINESS ’āśDECREASE IN BLACK TRANSACTION ’āśMORE INFORMED CONSUMER ’āśPOORER STATES TO GAIN ’āśMAKE IN INDIA

- 13. LIMITATIONS OF GST ’āśIncrease cost due to software purchase ’āśHardship in GST compliance ’āśIncrease in operational cost ’āśEffective in the middle of the financial year ’āśAn online taxation system ’āśSMEŌĆÖs will have higher tax burden

- 14. LIMITATIONS OF GST ’āśPetroleum & liquor are not at tax regime ’āśNo anti inflationary ’āśCostlier services ’āśAdministration complexities ’āśRegistration in each state ’āśStamp duty is also out of tax regime

- 15. CONCLUSION: GST is the most logical steps towards the comprehensive indirect tax reforms in our country. GST is levied on all supply of goods & services, it is destination based taxation system. GST is all set to integrate state economies and boost Overall growth. GST will create a single, unified Indian market to make the economy stronger.

- 16. THANK YOU...