Mobile Monday Toronto - Feb 2012 Talk

- 1. Canadian Mobile Steeplechase Mobile Monday Toronto Event - February 2012 Ronald Gruia Principal Analyst & Program Leader, Emerging Telecoms ┬® 2012 Frost & Sullivan. All rights reserved.

- 2. CanadaŌĆÖs Mobile ScorecardŌĆ” Competition has increased mobile penetration and brought down service pricing from earlier quasi de-facto oligopolistic levels, but how can we ensure that competition continues going forward? History tends to repeat itselfŌĆ” How do we ensure Industry Canada and the CRTC decisions are coherent (i.e. cannot have one allow a participant to be in a spectrum auction only to have the other not award that participant an operator license) Anachronistic foreign ownership rules (why belong on a list with Burma, Chad, etc.) instead of looking to regions such as Scandinavia as a proxy for how things should be over hereŌĆ” or even better: Japan and/or South Korea ŌĆō in other words, instead of being happy not to be near the bottom (more like in the middle pack)ŌĆ” why not aspire for the TOP ??? Reasons to be optimistic: innovation is part of our DNA, wind of change at the CRTC, Canadians among the most loyal customers in the world (provided they receive good service) Potential game changers this year: upcoming decisions on 700 MHz spectrum auction and foreign ownership issue Mobile Monday Toronto - Feb. 2012

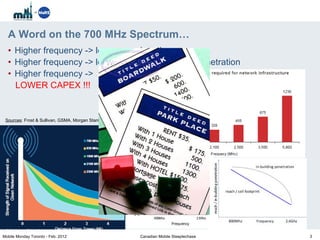

- 3. A Word on the 700 MHz SpectrumŌĆ” Higher frequency -> lower wavelength Higher frequency -> lower reach & in-building penetration Higher frequency -> LOWER CAPEX !!! Mobile Monday Toronto - Feb. 2012 Sources : Frost & Sullivan, GSMA, Morgan Stanley, UBS

- 4. Network Sharing Among New Entrants: Missed Opportunity? Mobile Monday Toronto - Feb. 2012

- 5. Future Snapshot of the Wireless Landscape? Even before relaxation of foreign ownership decision takes place: VimpelCom acquiring OTH & Weather (inc. Wind) from Naguib Sawiris Carlos Slim manifested in the past interest in the Canadian market AT&T and BT originally helped Rogers launch its wireless business (Cantel) Mobile Monday Toronto - Feb. 2012

- 6. Q & A Session Ronald F. Gruia Principal Analyst & Program Leader, Emerging Telecoms rgruia@frost.com ’Ć© +1-416-490-0493 Twitter: rgruia Thank You