Investment Module Risk Assessment And Market Research

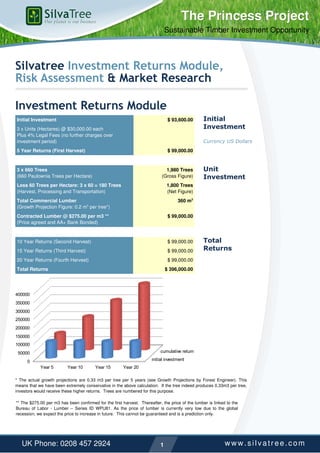

- 1. The Princess Project Sustainable Timber Investment Opportunity Silvatree Investment Returns Module, Risk Assessment & Market Research Investment Returns Module Initial Investment $ 93,600.00 Initial 3 x Units (Hectares) @ $30,000.00 each Investment Plus 4% Legal Fees (no further charges over investment period) Currency US Dollars 5 Year Returns (First Harvest) $ 99,000.00 3 x 660 Trees 1,980 Trees Unit (660 Paulownia Trees per Hectare) (Gross Figure) Investment Less 60 Trees per Hectare: 3 x 60 = 180 Trees 1,800 Trees (Harvest, Processing and Transportation) (Net Figure) Total Commercial Lumber 360 m3 (Growth Projection Figure: 0.2 m3 per tree*) Contracted Lumber @ $275.00 per m3 ** $ 99,000.00 (Price agreed and AA+ Bank Bonded) 10 Year Returns (Second Harvest) $ 99,000.00 Total 15 Year Returns (Third Harvest) $ 99,000.00 Returns 20 Year Returns (Fourth Harvest) $ 99,000.00 Total Returns $ 396,000.00 400000 350000 300000 250000 200000 150000 100000 50000 cumulative return 0 initial investment Year 5 Year 10 Year 15 Year 20 * The actual growth projections are 0.33 m3 per tree per 5 years (see Growth Projections by Forest Engineer). This means that we have been extremely conservative in the above calculation. If the tree indeed produces 0.33m3 per tree, investors would receive these higher returns. Trees are numbered for this purpose. ** The $275.00 per m3 has been confirmed for the first harvest. Thereafter, the price of the lumber is linked to the Bureau of Labor - Lumber ŌĆō Series ID WPU81. As the price of lumber is currently very low due to the global recession, we expect the price to increase in future. This cannot be guaranteed and is a prediction only. UK Phone: 0208 457 2924 1 www.silvatree.com

- 2. The Princess Project Sustainable Timber Investment Opportunity Project Risks Assessment Silva Tree conducted extensive research before embarking on the Princess Project. We looked at a variety of trees and crops, as well as alternative investment opportunities. Our decision to grow Paulownia was dependent upon a number of factors, many of which were environmental, and during the decision making process we amassed a great deal of product comparison information. As the main investors in the Princess Project, Silva Tree have also undergone a rigorous risk assessment procedure before going ahead with the project and we have compiled a basic summary of our findings here for your perusal. According to our research, the main risks to established timber plantations are fire, disease, illegal logging and the plantation owners falling into financial difficulties. The main risks to new timber plantations were found to be poor quality seeds or seedlings, insufficient irrigation, poor soil preparation, unsuitable soil type and badly managed plantations, including soil preparation, lack of fertilization and overcrowding. Through careful planning, Silva Tree have overcome all of these risks. As Panama is not in a hurricane or volcanic zone, we have not included extreme weather conditions in the assessment. Fire The most obvious risk to a timber plantation is that of fire, a natural force which can wipe out whole forests in a matter of hours. Contrary to popular belief, however, fire and other disasters damage less than 0.5% of privately owned forests every year. Moreover, unlike some other trees, Paulownia has an unusually high ignition temperature of approximately 425 degrees centigrade (compare to teak with an ignition point of 100 degrees centigrade)[1]. It is so fire resistant that it actually functions as a natural fire breaker and has been credited with saving vast areas of forests, farms and homes from devastation. PanamaŌĆÖs humid climate is another factor which eliminates the probability of fire, especially in rural areas away from major roads and factories. Natural fires are extremely rare in Panama and the country boasted just a handful of forest fires in 2008 (please see graph on next page in which forest fires are marked by the yellow bar).[2] UK Phone: 0208 457 2924 2 www.silvatree.com

- 3. The Princess Project Sustainable Timber Investment Opportunity This map shows PanamaŌĆÖs total fire outbreaks in 2008, correlated around the main highway and away from rural areas. [2] UK Phone: 0208 457 2924 3 www.silvatree.com

- 4. The Princess Project Sustainable Timber Investment Opportunity Disease The only known disease to have affected Paulownia is called Witches Broom. A significant problem for the species in the 1960`s, it has since been eliminated. Research conducted in the late 1980ŌĆÖs has led to the development of Paulownia seedlings which are resistant to the disease and it currently has no known threats.[3][4][5] Logging Illegal logging can be a major threat to forests, particularly in countries with low political stability. Unlike many Central and South American countries, PanamaŌĆÖs legal and environmental departments possess high levels of power and the country is increasingly active in the crackdown on illegal logging practices.[6] Illegal logging generally poses a significant problem in natural forests where poachers can set up sawmill operations unnoticed. In order for theft from a private plantation to occur, a great deal of equipment would have to be transported unnoticed through rough terrain. Moreover, the Princess Project is very much a community effort, with permanent staff working and living onsite. Similarly, the local villages and towns support the project wholeheartedly and benefit from the employment it provides as well as the humanitarian efforts that form a part of it, thus the project benefits from the protection of the local community as a whole. Financial difficulties In the unlikely event that Silva Tree should fall into financial difficulties, safety nets have been put into place to ensure that individual investorsŌĆÖ property would not be affected. All the land sold to investors is held in a UK trust, ensuring that each investorŌĆÖs plot would remain in their ownership regardless of the future of Silva Tree. Similarly, the funds required for the management and harvest of each timber cycle are held in escrow to ensure that the project would continue to progress regardless of Silva TreeŌĆÖs success as a company. Seedling quality Silva Tree have sourced their seedlings from the worldŌĆÖs leading Paulownia authority who have been cloning the species for over 30 years. A seedling survival rate of 95% is guaranteed by the supplier, and any tree which does not survive is replanted within 6 weeks, not affecting its overall growth. Irrigation & soil Paulownia only requires water in its first few weeks of growth and, in most cases, PanamaŌĆÖs tropical climate provides sufficient rain for this. The Princess Project site also contains a natural stream which can be used as a water supply during dry seasons without affecting the local communityŌĆÖs drinking water. UK Phone: 0208 457 2924 4 www.silvatree.com

- 5. The Princess Project Sustainable Timber Investment Opportunity The project location has been chosen carefully to meet the requirements of the Princess Tree. Paulownia does not require particularly fertile soil as it draws nutrients from deep within the ground so, unlike other trees, it is not at risk of dying due to malnutrition. Additional safety nets Although every care has been taken to ensure the success of the Princess Project, we take the responsibility of private investment very seriously and additional project buffers of 30-40% have been set up as an extra precaution. It is also significant that just 5371 ha of reforestation occurred in the entire country of Panama in 2008, so the Princess Project represents nearly 10% of national reforestation over the last year, and over 25% of the reforestation of 2004.[6] Not surprisingly, the project receives a great deal of government and community support which helps all involved to maintain the highest standards of security and care. Market Research Timber as an investment Aside from its obvious environmental benefits, Timber is a low risk, high return asset which has outperformed stocks, bonds and other ŌĆ£╠²During╠²the╠²Great╠² commodities for the last 30 years. The track record of early investors Depression,╠²timber╠² and a surge in modern academic research have shown that timber is a was╠²up╠²233%╠²while╠²the╠² near-perfect asset. [8] As the main investors in the Princess Project, price╠²of╠²stocks╠²fell╠² these factors were taken into account by Silva Tree when we decided to more╠²than╠²70%.╠²In╠² take on this large-scale timberland project. fact,╠²during╠²the╠²three╠² worst╠²market╠² downturns╠²of╠²the╠²20th╠² century╠²(1911┬Ł20,╠²1929┬Ł 41╠²and╠²1966┬Ł81),╠² timber╠²outperformed╠² the╠²S&P╠²500╠²by╠²a╠²wide╠² margin.╠²The╠²fact╠²is,╠² managed╠²timber╠²has╠² actually╠²beaten╠²the╠² stock╠²market╠²ŌĆō╠²with╠² less╠²risk╠²ŌĆō╠²over╠²the╠² long╠²run.╠²ŌĆØ Stewart Miller [7] Timber beats every other asset class Timber has consistently beaten all major asset classes over the last 30 years, performing better than stocks, bonds and commodities. TimberŌĆÖs total compound gain from 1987 to 2002 was approximately 15%. [9] Although timber prices fluctuate, research indicates that market prices for timber have risen steadily for over 100 years, performing better than any other commodity. UK Phone: 0208 457 2924 5 www.silvatree.com

- 6. The Princess Project Sustainable Timber Investment Opportunity The reason is that timber is not sensitive to world events, politics or new discoveries that expand supply (like oil). Moreover, despite possible timber substitutes such as steel, plastic and Aluminium, people still want wood and paper, and an emerging bio-fuel market increases demand even further. Timber vs. stocks Not only does timber beat all other major asset classes, but it also does If╠²╠²you╠²had╠² so with lower volatility. Timber has had just three ŌĆ£down yearsŌĆØ in the last 45 years whilst stocks, comparatively, have had 12 ŌĆ£down yearsŌĆØ invested╠²just╠² over the same period. The last great bear market in stocks began in $10,000╠²in╠²timber╠² the late 1960s and lasted until about 1980. An investor in stocks during in╠²1972,╠²you╠²would╠² that period lost money due to inflation alone. A timber investor, be╠²sitting╠²on╠² however, has never had a losing year. Moreover, the returns were in most cases in the double-digits with a whopping 55% return in 1973 nearly╠²a╠²million╠² and a 47% return in 1977. [9] dollars╠²todayŌĆ” Figure 1. US capital market line, showing the returns and volatility Ashish Kellar [9] among asset classes. Timberland returns are represented by NCREIF Timberland Index (1990-2008). Source: NCREIF, Ibbotson Associates Hedging inflation Historically, timberland investments have demonstrated significant correlation with inflation.[8] According to legendary investor Jeremy Grantham, timber prices have risen at 3.3% above the rate of inflation over the last century: Grantham himself keeps 20% of his personal portfolio in timber. [8] UK Phone: 0208 457 2924 6 www.silvatree.com

- 7. The Princess Project Sustainable Timber Investment Opportunity Investing in timber Until recently, all the advantages of investing in timber have been restricted to highly wealthy industrial investors. For smaller investors, timber has been prohibitively costly until late. Over the last few decades, however, primarily US institutional investors have purchased large areas of timberland, increasing the level of institutional investment in timberland from $4 billion in 1981 to over $18 billion by the end of 2005. [8] Species Selection Convinced that timber is a good investment, Silva Tree took the task of choosing a tree species to grow. Costing, practicality, land availability and environmental factors were all considered. We cannot include all the facts or tree species which constitute months of research, so just a small selection has been included here. Gmelina A relatively fast growing tree with high rates of Carbon absorption, Gmelina represented a very attractive option. Its weaknesses are that it requires very fertile soil, regular irrigation and temperatures no higher than 26 degrees centigrade to grow well. [10] It may die from age 10 onwards and it does not regenerate from its roots. These factors made Gmelina an impractical and extremely costly tree to grow, requiring highly specific conditions and premium priced land which could arguably be better used to grow food crops. Palm One of the best known trees in the world, the Palm tree is grown for its oil and fruit across the Tropics. Although relatively easy to grow, the Palm tree is sensitive to insect damage and disease and its lumber is practically worthless. Eucalyptus This tree is fast growing, robust and abundant in Australia and North America. It grows in the Tropics and is resilient to difficult weather and soil conditions. The main problem with Eucalyptus is that, because it is so rich in oil, it is extremely flammable and highly sensitive to forest fire (it has even been known to spontaneously explode). It is only harvestable in years 12-25 and its wood is mostly used for pulpwood & simple fuel production, which are Carbon releasing products and therefore not in line with our green ethic.[11] [12] Teak Teak was the strongest contender for the project aside from Paulownia and remains our projectŌĆÖs biggest rival. Known as ŌĆ£the king of treesŌĆØ, Teak is reputed to have a high market value, weather resistant timber properties and tough, durable lumber. HereŌĆÖs why we chose Paulownia: UK Phone: 0208 457 2924 7 www.silvatree.com

- 8. The Princess Project Sustainable Timber Investment Opportunity Despite its popularity, little is publically known about TeakŌĆÖs Paulownia Teak negative effects on the environment and the saturation of the Achievable 50 GBP 50 GBP Teak timber market. Travelling through Central America today, price per tree one will see a landscape littered with thousands of hectares of Supply Minimal High abandoned Teak plantations, some of which are more than twenty years old. If Teak is really the valuable asset it is advertised to Demand Growing Saturated be, one is inclined to wonder why so much of it remains Year of 5 25 abandoned and unsold. harvest Carbon 38 CO2e 26 CO2e A slow growing hardwood, Teak requires good quality topsoil and absorption considerable maintenance, including regular thinning and pruning, (ha) which incurs ongoing costs. In addition, financial returns are not Soil High None achieved for several years, with top grade Teak only harvestable fertilisation in its 25th year. Paulownia, in contrast, is first harvested in year value 5 and requires little maintenance, thus costs to grow it are very Ignition point 425 ┬║C 100 ┬║C low and returns can be made in record time. Weight 280 kg 875 kg Environmentally, fallen Teak leaves are one of the main causes of Water High High soil erosion and forest fires in Panamanian plantations; their high resistance oil content means they act as tinder for fires during the dry seasons. Moreover, when the leaves fall to the ground they serve no useful function either as a natural fertilizer or as feed for Information taken from A comparative analysis of the advantages of growing animals. Paulownia leaves in contrast are used in many parts of paulownia vs. teak, David Morris, Enoch the world as animal feed due to their high nutritional value. Olinga College (ENOCIS). Panama and Indigenous Education Fund. Paulownia also increases land fertility due to its rapidly decomposing leaves which feed natural grasses, and in turn prevent the erosion of top soil. By far the most significant factor, however, is simply that too much Teak has been planted in recent years. Globally, there are more offers to sell teak than to buy it. The market is flooded, with a negative effect on prices and, although the demand for timber is growing, high priced Teak is no longer a competitive product. Paulownia is a product with cultural significance as well as versatility. Demand for it is so high that a buyer was found for the entire plantationŌĆśs timber before the project had even begun. There are few Paulownia growers in the world as well as an emerging biofuel market and, by becoming one of the worldŌĆÖs first large-scale Paulownia producers, Silva Tree is securing its position in the global market, a position which is not available in the Teak industry. References 1: MORRIS, David, A Comparative Analysis of the Advantages of Growing Paulownia vs. Teak, 2005. 2: ANAM, Compendio Estad├Łstico Ambiental, 2004-2008. 3: CAF, IDRC, Agroforestry Systems in China, 1991. 4: Chinese Academy of Forestry, Paulownia in China: Cultivation and Utilization, 1986. 5: XIONG, Yao Guo, Final Technical Report of Paulownia Project (Phase II), 1990. 6: ANAM, Autoridad Nacional del Ambiente, 2009. 7: MILLER, Stewart, Investment U White Paper Report, 2009. 8: STURM, Paul, SmartMoney Magazine, . 9: KELKAR, Ashish, Timber stocks should outperform in an inflationary market, . 10: DEHRADUN SANTOS, Robert L., GAMHAR (Gmelina Arborea), 1997. 11: CALSTATE, The Eucalyptus of California, 1997. 12: R.L. Dickson, C.A. Raymond, W. Joe and C.A. Wilkinson, Forest Ecology and Management, Volume 179, July 2003. UK Phone: 0208 457 2924 8 www.silvatree.com

![The Princess Project

Sustainable Timber Investment Opportunity

Project Risks Assessment

Silva Tree conducted extensive research before embarking on the Princess

Project. We looked at a variety of trees and crops, as well as alternative

investment opportunities.

Our decision to grow Paulownia was dependent upon a number of factors,

many of which were environmental, and during the decision making process

we amassed a great deal of product comparison information.

As the main investors in the Princess Project, Silva Tree have also undergone

a rigorous risk assessment procedure before going ahead with the project

and we have compiled a basic summary of our findings here for your perusal.

According to our research, the main risks to established timber plantations

are fire, disease, illegal logging and the plantation owners falling into

financial difficulties.

The main risks to new timber plantations were found to be poor quality seeds

or seedlings, insufficient irrigation, poor soil preparation, unsuitable soil type

and badly managed plantations, including soil preparation, lack of

fertilization and overcrowding.

Through careful planning, Silva Tree have overcome all of these risks. As

Panama is not in a hurricane or volcanic zone, we have not included extreme

weather conditions in the assessment.

Fire

The most obvious risk to a timber plantation is that of fire, a natural force

which can wipe out whole forests in a matter of hours. Contrary to popular

belief, however, fire and other disasters damage less than 0.5% of privately

owned forests every year. Moreover, unlike some other trees, Paulownia has

an unusually high ignition temperature of approximately 425 degrees

centigrade (compare to teak with an ignition point of 100 degrees

centigrade)[1].

It is so fire resistant that it actually functions as a natural fire breaker and

has been credited with saving vast areas of forests, farms and homes from

devastation. PanamaŌĆÖs humid climate is another factor which eliminates the

probability of fire, especially in rural areas away from major roads and

factories.

Natural fires are extremely rare in Panama and the country boasted just a

handful of forest fires in 2008 (please see graph on next page in which forest

fires are marked by the yellow bar).[2]

UK Phone: 0208 457 2924 2 www.silvatree.com](https://image.slidesharecdn.com/investmentmoduleriskassessmentandmarketresearch-12538626499491-phpapp01/85/Investment-Module-Risk-Assessment-And-Market-Research-2-320.jpg)

![The Princess Project

Sustainable Timber Investment Opportunity

This map shows PanamaŌĆÖs total fire outbreaks in 2008, correlated around the

main highway and away from rural areas. [2]

UK Phone: 0208 457 2924 3 www.silvatree.com](https://image.slidesharecdn.com/investmentmoduleriskassessmentandmarketresearch-12538626499491-phpapp01/85/Investment-Module-Risk-Assessment-And-Market-Research-3-320.jpg)

![The Princess Project

Sustainable Timber Investment Opportunity

Disease

The only known disease to have affected Paulownia is called Witches Broom.

A significant problem for the species in the 1960`s, it has since been

eliminated. Research conducted in the late 1980ŌĆÖs has led to the

development of Paulownia seedlings which are resistant to the disease and it

currently has no known threats.[3][4][5]

Logging

Illegal logging can be a major threat to forests, particularly in countries with

low political stability. Unlike many Central and South American countries,

PanamaŌĆÖs legal and environmental departments possess high levels of power

and the country is increasingly active in the crackdown on illegal logging

practices.[6]

Illegal logging generally poses a significant problem in natural forests where

poachers can set up sawmill operations unnoticed. In order for theft from a

private plantation to occur, a great deal of equipment would have to be

transported unnoticed through rough terrain.

Moreover, the Princess Project is very much a community effort, with

permanent staff working and living onsite. Similarly, the local villages and

towns support the project wholeheartedly and benefit from the employment

it provides as well as the humanitarian efforts that form a part of it, thus the

project benefits from the protection of the local community as a whole.

Financial difficulties

In the unlikely event that Silva Tree should fall into financial difficulties,

safety nets have been put into place to ensure that individual investorsŌĆÖ

property would not be affected. All the land sold to investors is held in a UK

trust, ensuring that each investorŌĆÖs plot would remain in their ownership

regardless of the future of Silva Tree.

Similarly, the funds required for the management and harvest of each timber

cycle are held in escrow to ensure that the project would continue to

progress regardless of Silva TreeŌĆÖs success as a company.

Seedling quality

Silva Tree have sourced their seedlings from the worldŌĆÖs leading Paulownia

authority who have been cloning the species for over 30 years. A seedling

survival rate of 95% is guaranteed by the supplier, and any tree which does

not survive is replanted within 6 weeks, not affecting its overall growth.

Irrigation & soil

Paulownia only requires water in its first few weeks of growth and, in most

cases, PanamaŌĆÖs tropical climate provides sufficient rain for this. The

Princess Project site also contains a natural stream which can be used as a

water supply during dry seasons without affecting the local communityŌĆÖs

drinking water.

UK Phone: 0208 457 2924 4 www.silvatree.com](https://image.slidesharecdn.com/investmentmoduleriskassessmentandmarketresearch-12538626499491-phpapp01/85/Investment-Module-Risk-Assessment-And-Market-Research-4-320.jpg)

![The Princess Project

Sustainable Timber Investment Opportunity

The project location has been chosen carefully to meet the requirements of

the Princess Tree. Paulownia does not require particularly fertile soil as it

draws nutrients from deep within the ground so, unlike other trees, it is not

at risk of dying due to malnutrition.

Additional safety nets

Although every care has been taken to ensure the success of the Princess

Project, we take the responsibility of private investment very seriously and

additional project buffers of 30-40% have been set up as an extra

precaution. It is also significant that just 5371 ha of reforestation occurred

in the entire country of Panama in 2008, so the Princess Project represents

nearly 10% of national reforestation over the last year, and over 25% of the

reforestation of 2004.[6] Not surprisingly, the project receives a great deal

of government and community support which helps all involved to maintain

the highest standards of security and care.

Market Research

Timber as an investment

Aside from its obvious environmental benefits, Timber is a low risk, high

return asset which has outperformed stocks, bonds and other

ŌĆ£╠²During╠²the╠²Great╠²

commodities for the last 30 years. The track record of early investors

Depression,╠²timber╠²

and a surge in modern academic research have shown that timber is a

was╠²up╠²233%╠²while╠²the╠²

near-perfect asset. [8] As the main investors in the Princess Project,

price╠²of╠²stocks╠²fell╠²

these factors were taken into account by Silva Tree when we decided to

more╠²than╠²70%.╠²In╠²

take on this large-scale timberland project.

fact,╠²during╠²the╠²three╠²

worst╠²market╠²

downturns╠²of╠²the╠²20th╠²

century╠²(1911┬Ł20,╠²1929┬Ł

41╠²and╠²1966┬Ł81),╠²

timber╠²outperformed╠²

the╠²S&P╠²500╠²by╠²a╠²wide╠²

margin.╠²The╠²fact╠²is,╠²

managed╠²timber╠²has╠²

actually╠²beaten╠²the╠²

stock╠²market╠²ŌĆō╠²with╠²

less╠²risk╠²ŌĆō╠²over╠²the╠²

long╠²run.╠²ŌĆØ

Stewart Miller [7]

Timber beats every other asset class

Timber has consistently beaten all major asset classes over the last 30 years,

performing better than stocks, bonds and commodities. TimberŌĆÖs total

compound gain from 1987 to 2002 was approximately 15%. [9] Although

timber prices fluctuate, research indicates that market prices for timber have

risen steadily for over 100 years, performing better than any other

commodity.

UK Phone: 0208 457 2924 5 www.silvatree.com](https://image.slidesharecdn.com/investmentmoduleriskassessmentandmarketresearch-12538626499491-phpapp01/85/Investment-Module-Risk-Assessment-And-Market-Research-5-320.jpg)

![The Princess Project

Sustainable Timber Investment Opportunity

The reason is that timber is not sensitive to world events, politics or new

discoveries that expand supply (like oil). Moreover, despite possible timber

substitutes such as steel, plastic and Aluminium, people still want wood and

paper, and an emerging bio-fuel market increases demand even further.

Timber vs. stocks

Not only does timber beat all other major asset classes, but it also does If╠²╠²you╠²had╠²

so with lower volatility. Timber has had just three ŌĆ£down yearsŌĆØ in the

last 45 years whilst stocks, comparatively, have had 12 ŌĆ£down yearsŌĆØ invested╠²just╠²

over the same period. The last great bear market in stocks began in $10,000╠²in╠²timber╠²

the late 1960s and lasted until about 1980. An investor in stocks during in╠²1972,╠²you╠²would╠²

that period lost money due to inflation alone. A timber investor, be╠²sitting╠²on╠²

however, has never had a losing year. Moreover, the returns were in

most cases in the double-digits with a whopping 55% return in 1973

nearly╠²a╠²million╠²

and a 47% return in 1977. [9] dollars╠²todayŌĆ”

Figure 1. US capital market line, showing the returns and volatility Ashish Kellar [9]

among asset classes. Timberland returns are represented by NCREIF

Timberland Index (1990-2008).

Source: NCREIF, Ibbotson Associates

Hedging inflation

Historically, timberland investments have demonstrated significant

correlation with inflation.[8] According to legendary investor Jeremy

Grantham, timber prices have risen at 3.3% above the rate of inflation over

the last century: Grantham himself keeps 20% of his personal portfolio in

timber. [8]

UK Phone: 0208 457 2924 6 www.silvatree.com](https://image.slidesharecdn.com/investmentmoduleriskassessmentandmarketresearch-12538626499491-phpapp01/85/Investment-Module-Risk-Assessment-And-Market-Research-6-320.jpg)

![The Princess Project

Sustainable Timber Investment Opportunity

Investing in timber

Until recently, all the advantages of investing in timber have been restricted

to highly wealthy industrial investors. For smaller investors, timber has been

prohibitively costly until late. Over the last few decades, however, primarily

US institutional investors have purchased large areas of timberland,

increasing the level of institutional investment in timberland from $4 billion

in 1981 to over $18 billion by the end of 2005. [8]

Species Selection

Convinced that timber is a good investment, Silva Tree took the task of

choosing a tree species to grow. Costing, practicality, land availability and

environmental factors were all considered. We cannot include all the facts or

tree species which constitute months of research, so just a small selection

has been included here.

Gmelina

A relatively fast growing tree with high rates of Carbon absorption, Gmelina

represented a very attractive option. Its weaknesses are that it requires

very fertile soil, regular irrigation and temperatures no higher than 26

degrees centigrade to grow well. [10] It may die from age 10 onwards and it

does not regenerate from its roots. These factors made Gmelina an

impractical and extremely costly tree to grow, requiring highly specific

conditions and premium priced land which could arguably be better used to

grow food crops.

Palm

One of the best known trees in the world, the Palm tree is grown for its oil

and fruit across the Tropics. Although relatively easy to grow, the Palm tree

is sensitive to insect damage and disease and its lumber is practically

worthless.

Eucalyptus

This tree is fast growing, robust and abundant in Australia and North

America. It grows in the Tropics and is resilient to difficult weather and soil

conditions. The main problem with Eucalyptus is that, because it is so rich in

oil, it is extremely flammable and highly sensitive to forest fire (it has even

been known to spontaneously explode). It is only harvestable in years 12-25

and its wood is mostly used for pulpwood & simple fuel production, which are

Carbon releasing products and therefore not in line with our green ethic.[11]

[12]

Teak

Teak was the strongest contender for the project aside from Paulownia and

remains our projectŌĆÖs biggest rival. Known as ŌĆ£the king of treesŌĆØ, Teak is

reputed to have a high market value, weather resistant timber properties

and tough, durable lumber. HereŌĆÖs why we chose Paulownia:

UK Phone: 0208 457 2924 7 www.silvatree.com](https://image.slidesharecdn.com/investmentmoduleriskassessmentandmarketresearch-12538626499491-phpapp01/85/Investment-Module-Risk-Assessment-And-Market-Research-7-320.jpg)