Aba april 5 pitch_book_adley_exits deck

- 1. Exits All Jammed Up ABA Business Law Spring Meeting Try the PitchBook Platform: Adley Bowden Email: demo@pitchbook.com Director of Research, PitchBook Phone: 1-877-267-5593 adley@pitchbook.com

- 2. -The Exit Backlog -The Current State of Exits -Outlook for Exits and PE Source:PitchBook By Pudelek (Marcin Szala) (Own work) [CC-BY-SA-3.0 (http://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons

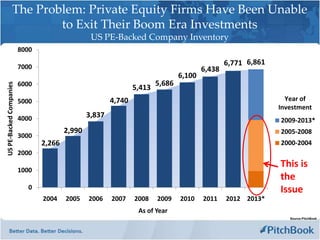

- 3. The Problem: Private Equity Firms Have Been Unable to Exit Their Boom Era Investments US PE-Backed Company Inventory 8000 7000 6,771 6,861 6,438 6,100 6000 5,686 US PE-Backed Companies 5,413 5000 4,740 Year of Investment 4000 3,837 2009-2013* 2,990 2005-2008 3000 2,266 2000-2004 2000 This is 1000 the 0 Issue 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013* As of Year Source:PitchBook

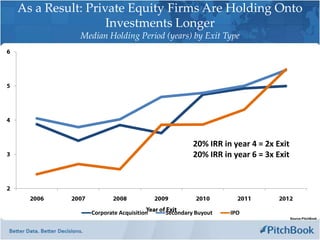

- 4. As a Result: Private Equity Firms Are Holding Onto Investments Longer Median Holding Period (years) by Exit Type 20% IRR in year 4 = 2x Exit 20% IRR in year 6 = 3x Exit Corporate Acquisition Secondary Buyout IPO Source:PitchBook

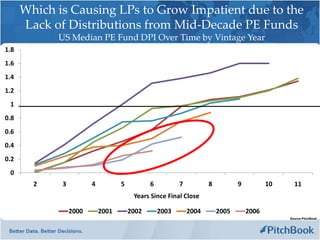

- 5. Which is Causing LPs to Grow Impatient due to the Lack of Distributions from Mid-Decade PE Funds US Median PE Fund DPI Over Time by Vintage Year 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 2 3 4 5 6 7 8 9 10 11 Years Since Final Close 2000 2001 2002 2003 2004 2005 2006 Source:PitchBook

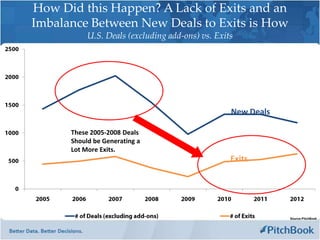

- 6. How Did this Happen? A Lack of Exits and an Imbalance Between New Deals to Exits is How U.S. Deals (excluding add-ons) vs. Exits New Deals These 2005-2008 Deals Should be Generating a Lot More Exits. Exits Source:PitchBook

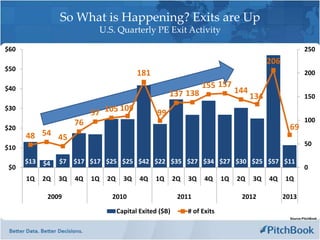

- 7. So What is Happening? Exits are Up U.S. Quarterly PE Exit Activity $60 250 206 $50 181 200 $40 155 157 137 138 144 134 150 109 97 105 $30 99 76 100 $20 69 48 54 45 50 $10 $13 $4 $7 $17 $17 $25 $25 $42 $22 $35 $27 $34 $27 $30 $25 $57 $11 $0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2009 2010 2011 2012 2013 Capital Exited ($B) # of Exits Source:PitchBook

- 8. • “Emphasize selling portfolio companies while being highly selective with regards to new investments.” – Madison Dearborn Source:PitchBook

- 9. Secondary Buyouts Gaining Momentum as a Legitimate Buy/Sell Option Private Equity Secondary Buyout Activity 120 108 100 79 80 72 65 68 60 55 54 55 40 32 33 31 31 31 18 20 13 13 12 - 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2009 2010 2011 2012 2013 Source:PitchBook

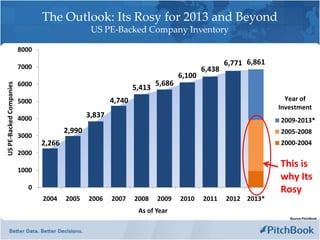

- 10. The Outlook: Its Rosy for 2013 and Beyond US PE-Backed Company Inventory 8000 7000 6,771 6,861 6,438 6,100 6000 5,686 US PE-Backed Companies 5,413 5000 4,740 Year of Investment 4000 3,837 2009-2013* 2,990 2005-2008 3000 2,266 2000-2004 2000 This is 1000 why Its 0 Rosy 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013* As of Year Source:PitchBook

- 11. Side Affect #1: Lots of Deal Opportunities for Lawyers Source:PitchBook

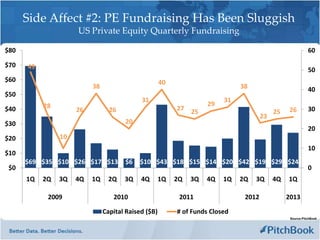

- 12. Side Affect #2: PE Fundraising Has Been Sluggish US Private Equity Quarterly Fundraising $80 60 $70 49 50 $60 40 38 38 40 $50 31 31 28 29 $40 26 26 27 25 25 26 30 23 $30 20 20 $20 10 10 $10 $69 $35 $10 $26 $17 $13 $6 $10 $43 $18 $15 $14 $20 $42 $19 $29 $24 $0 0 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2009 2010 2011 2012 2013 Capital Raised ($B) # of Funds Closed Source:PitchBook

- 13. şÝşÝߣ Affect #3: A Slow Moving Shakeout? PE Investors that have not raised a fund since 2009 140 125 119 120 100 86 80 PE Firms 71 71 60 38 40 31 24 20 16 17 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Year of Last Closed Fund Source:PitchBook

- 14. Exits All Jammed Up ABA Business Law Spring Meeting Try the PitchBook Platform: Adley Bowden Email: demo@pitchbook.com Director of Research, PitchBook Phone: 1-877-267-5593 adley@pitchbook.com

![-The Exit Backlog

-The Current State of Exits

-Outlook for Exits and PE

Source:PitchBook

By Pudelek (Marcin Szala) (Own work) [CC-BY-SA-3.0

(http://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons](https://image.slidesharecdn.com/abaapril5pitchbookadleyexitsdeck-130405072938-phpapp02/85/Aba-april-5-pitch_book_adley_exits-deck-2-320.jpg)