Estonian Tax System

- 1. Andra Larin Estonian Tax System 15 December 2020 Tech Open Air Skill Exchange with Estonian eResidency Programme Priolaunch

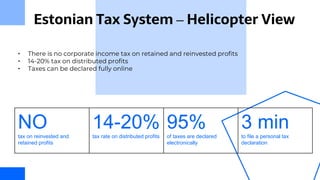

- 2. âĒ There is no corporate income tax on retained and reinvested profits âĒ 14-20% tax on distributed profits âĒ Taxes can be declared fully online Estonian Tax System â Helicopter View NOtax on reinvested and retained profits 14-20%tax rate on distributed profits 95%of taxes are declared electronically 3 minto file a personal tax declaration

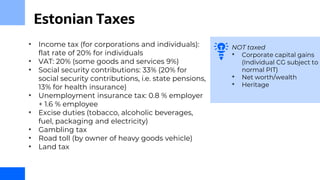

- 3. âĒ Income tax (for corporations and individuals): flat rate of 20% for individuals âĒ VAT: 20% (some goods and services 9%) âĒ Social security contributions: 33% (20% for social security contributions, i.e. state pensions, 13% for health insurance) âĒ Unemployment insurance tax: 0.8 % employer + 1.6 % employee âĒ Excise duties (tobacco, alcoholic beverages, fuel, packaging and electricity) âĒ Gambling tax âĒ Road toll (by owner of heavy goods vehicle) âĒ Land tax Estonian Taxes NOT taxed âĒ Corporate capital gains (Individual CG subject to normal PIT) âĒ Net worth/wealth âĒ Heritage

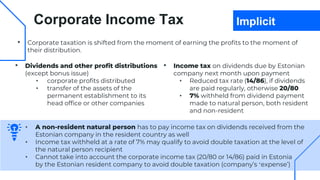

- 4. âĒ Corporate taxation is shifted from the moment of earning the profits to the moment of their distribution. Corporate Income Tax Implicit âĒ Income tax on dividends due by Estonian company next month upon payment âĒ Reduced tax rate (14/86), if dividends are paid regularly, otherwise 20/80 âĒ 7% withheld from dividend payment made to natural person, both resident and non-resident âĒ Dividends and other profit distributions (except bonus issue) âĒ corporate profits distributed âĒ transfer of the assets of the permanent establishment to its head office or other companies âĒ A non-resident natural person has to pay income tax on dividends received from the Estonian company in the resident country as well âĒ Income tax withheld at a rate of 7% may qualify to avoid double taxation at the level of the natural person recipient âĒ Cannot take into account the corporate income tax (20/80 or 14/86) paid in Estonia by the Estonian resident company to avoid double taxation (companyâs âexpenseâ)

- 5. Corporate Income Tax Explicit âĒ Taxes due by an Estonian company next month upon payment âĒ Income tax: 20/80 of the (net) taxable amount âĒ Social contribution: 33 % (on fringe benefit and calculated income tax) âĒ Fringe benefits âĒ gifts, donations, and representation expenses âĒ expenses and payments not related to business âĒ No obligation to submit a tax return annually, regardless of profits or losses âĒ Income tax is assessed monthly (Form TSD with Annexes) âĒ TSD to be submitted by 10th day of the month following the payment of dividends, taxable expenses or other profit distributions

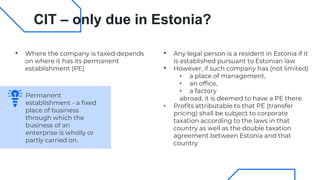

- 6. CIT â only due in Estonia? âĒ Any legal person is a resident in Estonia if it is established pursuant to Estonian law âĒ However, if such company has (not limited) âĒ a place of management, âĒ an office, âĒ a factory abroad, it is deemed to have a PE there âĒ Profits attributable to that PE (transfer pricing) shall be subject to corporate taxation according to the laws in that country as well as the double taxation agreement between Estonia and that country âĒ Where the company is taxed depends on where it has its permanent establishment (PE) Permanent establishment - a fixed place of business through which the business of an enterprise is wholly or partly carried on.

- 7. âĒ 20 % Standard rate âĒ 9 % Reduced rate (e.g. books, accomodation) âĒ 0% e.g. Supply of goods exported to another EU countryâs VAT payer; Services not rendered in Estonia (reverse charge) âĒ VAT returns to be submitted by 20th day of each month for the previous month Value Added Tax (VAT) 40.000 EUR A threshold (sales revenue) for registering an Estonian company as a VAT payer GERMANY âĒ The foreign companies selling goods and services across EU borders do not normally have to be registered for VAT there âĒ But exceptions requiring registration for VAT in Germany, e.g. - Organising live events (conferences, art, education) in Germany - Distance selling of goods to individual persons (e.g. internet retailing, Amazon traders) and exceeds the German delivery threshold of 100,000 EUR per annum

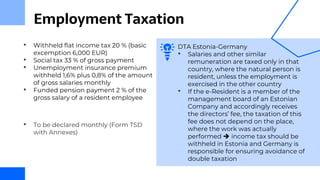

- 8. âĒ Withheld flat income tax 20 % (basic excemption 6,000 EUR) âĒ Social tax 33 % of gross payment âĒ Unemployment insurance premium withheld 1,6% plus 0,8% of the amount of gross salaries monthly âĒ Funded pension payment 2 % of the gross salary of a resident employee Employment Taxation DTA Estonia-Germany âĒ Salaries and other similar remuneration are taxed only in that country, where the natural person is resident, unless the employment is exercised in the other country âĒ If the e-Resident is a member of the management board of an Estonian Company and accordingly receives the directorsâ fee, the taxation of this fee does not depend on the place, where the work was actually performed ïĻ income tax should be withheld in Estonia and Germany is responsible for ensuring avoidance of double taxation âĒ To be declared monthly (Form TSD with Annexes)

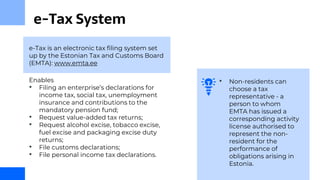

- 9. e-Tax is an electronic tax filing system set up by the Estonian Tax and Customs Board (EMTA): www.emta.ee e-Tax System Enables âĒ Filing an enterpriseâs declarations for income tax, social tax, unemployment insurance and contributions to the mandatory pension fund; âĒ Request value-added tax returns; âĒ Request alcohol excise, tobacco excise, fuel excise and packaging excise duty returns; âĒ File customs declarations; âĒ File personal income tax declarations. âĒ Non-residents can choose a tax representative - a person to whom EMTA has issued a corresponding activity license authorised to represent the non- resident for the performance of obligations arising in Estonia.

- 10. âĒ Companies (incl. holdings) that have substance in Estonia âĒ Digital nomads âĒ Companies active worldwide âĒ Companies with owners / management board from various countries Who could benefit from e-Residency?

- 11. Priolaunch is an e-Residency Marketplace Member Priolaunch Legal Oà MÞnchen, Germany andra[at]priolaunch.com +49 172 3456 185 https://marketplace.e-resident.gov.ee/company/priolaunch

![Priolaunch is an e-Residency Marketplace Member

Priolaunch Legal OÃ

MÞnchen, Germany

andra[at]priolaunch.com

+49 172 3456 185

https://marketplace.e-resident.gov.ee/company/priolaunch](https://image.slidesharecdn.com/toaeresidencyestoniantax-210107090237/85/Estonian-Tax-System-11-320.jpg)