tp-one-brochure

0 likes244 views

True Potential OneTM is a new financial planning tool that consolidates all of a user's savings and investments into one place for easy management. It allows users to see their pension, ISAs, GIAs and other investments together, and create a single financial masterplan to work towards their goals. The tool provides flexibility to adjust plans over time as needs change.

1 of 12

Download to read offline

Ad

Recommended

Clear Money March & April 2015 Edition.PDF

Clear Money March & April 2015 Edition.PDFKathryn Tomlinson

╠²

The document summarizes key information from a financial magazine published by Fairstone Financial Management Ltd. It discusses upcoming pension reforms in the UK that will take effect on April 6, 2015, including the ability to withdraw up to 25% of pension funds as tax-free cash from age 55. It outlines options for withdrawing funds, such as lump sums, income drawdown, or purchasing an annuity. It also discusses tax implications of withdrawals and limits on future pension contributions. The magazine provides information on financial planning areas like savings, investments, pensions, insurance and mortgages.2016 New Year Star Forecast by Clarice Georgia Victoria Chan

2016 New Year Star Forecast by Clarice Georgia Victoria ChanCGVC Living Inspirations

╠²

The document provides predictions and advice for the new year from Clarice Georgia Victoria Chan. It encourages optimism and focus in pursuing goals and opportunities in 2016. Chan emphasizes looking inward and believing in oneself to achieve abundance. Several passages predict career advances, business opportunities, and positive changes for the new year.Smart money november december_2013 issue_singles_per

Smart money november december_2013 issue_singles_perOliver Taylor

╠²

This document is a magazine that provides financial advice to help readers make more of their money. The main articles discuss:

1) Giving grandchildren pensions as gifts that provide tax benefits and set them up for retirement.

2) The importance of reviewing one's long-term pension investment strategy and considering different options like income drawdown to maximize funds for retirement.

3) Writing a will as a new year's resolution to ensure one's estate goes to loved ones and avoids unnecessary taxes.Jeff Dragon Berthel Fisher - About investment for your retirement

Jeff Dragon Berthel Fisher - About investment for your retirementJeff Dragon Berthel Fisher

╠²

The document emphasizes the importance of investing in oneself and pursuing new passions for a fulfilling retirement. It discusses how a retirement advisor can help create a personalized plan that takes into account potential new vocations to supplement retirement income. Following a well-structured plan can lead to a more enjoyable and financially secure retirement experience.8 Steps to Financial Success

8 Steps to Financial SuccessBobby Cherry

╠²

The document outlines 8 steps to financial success: 1) Set goals; 2) Understand risk; 3) Leverage the power of compound returns over time; 4) Invest early and often; 5) Increase savings when income increases; 6) Stay focused on long-term investing rather than trying to time the market; 7) Have adequate life insurance; 8) Use a professional wealth manager for their expertise, resources, and help achieving financial goals. It provides examples and formulas to illustrate concepts like compound returns and how much to save monthly to reach savings targets. The document encourages long-term investing for growth and using a wealth management firm for guidance.Tp art-of-investing 1013

Tp art-of-investing 1013coussey

╠²

The document outlines a philosophy on personal saving and investment, emphasizing the importance of setting clear financial goals and understanding the impact of inflation on future needs. It stresses the need for individuals to take responsibility for their savings while considering their risk tolerance and the suitability of various investment vehicles, including ISAs and pensions. The narrative advocates for simplicity, clarity, and regular monitoring of investments, encouraging individuals to adopt good saving habits and prioritize their financial objectives.Middleincome

Middleincomeatul baride

╠²

This document provides an overview of financial education topics for middle-income investors, including the importance of learning about money, financial planning, goal setting, understanding net worth, budgeting, investing, and protection of wealth. It discusses defining SMART goals, calculating one's current net worth by listing assets and liabilities, the importance of budgeting to manage expenses and generate surplus to invest, and investment mantras like understanding compounding and diversification. The power of compounding over long periods of time is demonstrated through an example of investing 1,000 rupees annually over 10 and 20 years at 8% interest. Overall, the document outlines basic concepts for middle-income investors to effectively manage their finances through planning, saving, andFinancial management

Financial managementHaotian Gong

╠²

The document discusses the importance of financial planning and budgeting. It explains key financial concepts like compound interest and how money can accumulate over time through wise investing. It emphasizes that budgeting is key to smart financing, as a budget allows you to plan your future income and expenditures. The document then provides steps for creating a budget, including adding up income sources, estimating expenses, and figuring out the difference between income and expenses. For teenagers, it notes the focus should be on saving and preparing financially for the future.Investment planning at early 30s

Investment planning at early 30sGeetashreeGogoi1

╠²

Investment planning in one's early 30s is important as goals like buying a house, retirement planning, and children's education will start to become priorities. The key steps involve identifying financial goals, learning about investment options and risk appetite, creating an investment plan, and allocating assets accordingly. By the 30s, income is more stable but risk tolerance may decrease as responsibilities increase. Investing regularly in instruments like the National Pension System, Public Provident Fund, government bonds, equity shares, and fixed deposits while increasing contributions over time can help achieve multiple long-term goals.Things to Do After You Pay Off Debt

Things to Do After You Pay Off DebtGlobal Client Solutions

╠²

Global Client Solutions is a payment processor established in 2003 that aids consumers in settling debts. After paying off debt, it is essential to reassess your budget, create an emergency fund by avoiding credit cards, and set new financial goals to maintain good spending habits. These steps help ensure that individuals do not fall back into debt and can effectively manage their finances in the future.CL_Scotiabank_Feb_2015_FINAL

CL_Scotiabank_Feb_2015_FINALVictoria DiPlacido

╠²

This document provides advice for creating a personalized retirement investment plan in a three-part series. It recommends meeting with a Scotiabank advisor to develop a plan to reach retirement goals. It also advises to invest early and regularly through an RRSP or TFSA, using tools like Scotiabank's Retirement Savings Reality Check to explore scenarios. Finally, it suggests staying invested despite market volatility and reviewing plans annually.Preparing for the New Financial Year

Preparing for the New Financial YearNikhil Kumar

╠²

Young adults are encouraged to take financial planning seriously, starting with setting a budget and establishing savings goals. Investing in suitable instruments, purchasing insurance, and managing dues are essential steps for managing finances effectively. Adopting an asset-light lifestyle and maximizing tax savings can also contribute to better financial health for millennials.The Success of Financial Freedom

The Success of Financial FreedomRachel Olsen

╠²

The document provides tips for achieving financial freedom and success. It discusses taking time each day for yourself (the Golden Hour), setting goals both long-term and short-term, spending less than you earn to avoid debt, giving to others without expectation of return to guarantee financial success, and investing in knowledge, health, family, and business relationships which allow you to achieve more.A Powerful Tax Strategy For Locum Tenens

A Powerful Tax Strategy For Locum TenensPeter Thoms, CFA

╠²

The document outlines the financial benefits of defined benefit plans for self-employed individuals, particularly locum tenens physicians, highlighting their capacity to significantly reduce taxes and rapidly build retirement savings. It provides examples of substantial potential tax savings and retirement growth, emphasizing suitability criteria for these plans. The document also promotes a specific financial advisory firm, Orion Capital Management, that specializes in assisting clients with these retirement planning strategies.Why You Should Ditch the Way YouŌĆÖve Been Doing Strategic Planning

Why You Should Ditch the Way YouŌĆÖve Been Doing Strategic PlanningBloomerang

╠²

The document argues for a change in strategic planning approaches for nonprofits to enhance effectiveness and reduce stress. It critiques traditional beliefs that hinder growth, emphasizing the need for new strategies to achieve clarity, funding, and a thriving team. The author, Sarah Olivieri, suggests that adopting a fresh perspective and the 'impact method' can lead to better goal-setting and organizational success.Againsuccess

AgainsuccessMumtaz Siddiquee

╠²

The document discusses a home business opportunity with Success Worldwide that can provide financial freedom and additional income for retirement without interfering with other jobs. It notes that the opportunity allows savings on taxes, potential travel, and unlimited earnings through network marketing with only a small initial investment. Building the business is described as easy and flexible to incorporate into one's life.Budgeting Stratgy

Budgeting Stratgy Kimmie Champlin

╠²

The document provides guidance on creating an effective budget in 4 parts:

1) Estimate revenue streams conservatively and current cash.

2) Determine priorities and allocate funds across expenses like recruitment, events based on priorities.

3) Ensure the budget is balanced each month and cuts can be made if needed.

4) Track actual revenues and expenses monthly to evaluate performance against the budget and make adjustments.SixKeyAreas (2)

SixKeyAreas (2)Daniel Mallozzi

╠²

The document outlines the six key areas of a comprehensive financial plan: current snapshot, manage risk, accumulate wealth, control taxes, plan for retirement, and leave a legacy. It provides details on what each area involves, such as creating a clear picture of goals, capturing current income and expenses, protecting against financial risks, leveraging investments to support goals, evaluating tax strategies, planning for how retirement will look, and distributing an estate effectively. The overall scope is to develop a plan that addresses all of these essential areas and fits an individual's unique financial situation and priorities.Retiring early

Retiring earlyRighthorizon

╠²

Rahul dreams of retiring early at age 50 and needs to determine how to save and invest enough to achieve a retirement corpus of Rs. 3,00,00,000. There is a two step method - first ascertain the corpus required considering inflation, and second determine how much to save and invest each month starting early to take advantage of compounding returns. An analysis shows Rahul would need to invest Rs. 1,64,952 annually or Rs. 11,128 monthly to reach his goal if earning 14% annually on his investments.EDUCATION SOLUTIONS

EDUCATION SOLUTIONSChantal Reichel

╠²

This document provides information on different education savings and investment plans from Old Mutual Invest and Max Investments (SmartMAX). It summarizes the key features of two plans from each - the Old Mutual Invest Tax Free Plan and Flexible Plan, and the SmartMAX Focussed Plan and Flexible Plan. It also briefly introduces a third SmartMAX Flexible Plan (Xtra) and encourages readers to speak to an advisor or visit the company websites for more details on choosing the most appropriate plan.Saving for Retirement

Saving for RetirementJessica Thomson

╠²

This document emphasizes the importance of early retirement savings, detailing the benefits and differences between RRSPs and TFSAs. It highlights strategies for maximizing savings, such as contributing to employer-matched RRSPs and building an emergency fund while prioritizing debt repayment. The key takeaway is that starting to save now, even in small amounts, can significantly impact retirement funds due to compound growth over time.Session 1 Preparation Printversion

Session 1 Preparation PrintversionVenkatachalam Vaidhiyanathan

╠²

The document outlines three steps to financial success: 1) Save money by setting goals and creating a budget to control spending; 2) Invest saved money to generate positive cash flow; 3) Protect assets and income by managing taxes and paying down debt. It provides information on concepts like assets, liabilities, income and expenses to understand personal finances and develop a net worth chart and cash flow plan.Generic fixed

Generic fixedlsorrentino1

╠²

This document compares a fixed annuity to certificate of deposits (CDs) and money markets. It notes that a fixed annuity offers tax deferral, avoidance of probate, guaranteed interest rates including a minimum 1% renewal rate for years 2-5, ability to withdraw funds penalty-free, and turning the investment into guaranteed lifetime income. CD rates are shown to be lower, with interest taxed annually, not avoiding probate, and greater bank failure risk. A chart also shows that a fixed annuity would accumulate more value over time compared to a CD.Innovations AUVMs

Innovations AUVMsSupriyo Guha

╠²

This document proposes installing automated urea vending machines (AUVMs) in rural villages to improve access and availability of urea for farmers. Key points:

1) AUVMs would be located within a 5-7 km radius catchment area of villages with high urea demand to provide 24/7 access for farmers.

2) The machines would automatically reorder urea from supply hubs when stocks drop below a threshold.

3) AUVMs could save costs compared to traditional distribution and increase brand visibility, creating a differentiated customer experience.Dunya turu

Dunya turuM├┤...Moema Anita Concei├¦├Żo

╠²

This document lists various locations around the world including countries, cities, and regions such as South Africa, Alaska, Virginia, Austria, Bangladesh, China, Australia, Bora Bora, Burma, England, California, Ecuador, Egypt, Italy, England, Blackpool, Florida Keys, India, Naples, Japan, Russia, Jordan, Mauritania, Portofino, Moscow, Spain, Thailand, Utah, West Virginia, Croatia, and Zambia. It credits National Geographic as the source of photographs and lists the song "Wild Child" by Enya as the music.V. Le cercle de lŌĆÖExpiationPierrot Caron

╠²

Le chapitre 14 explore le th├©me de l'enseignement de l'innocence et de la r├®demption ├Ā travers le cercle de l'expiation, soulignant que chaque individu est li├® ├Ā Dieu et que la culpabilit├® est une illusion. Il insiste sur l'importance d'enseigner la paix et de partager l'innocence, en encourageant chacun ├Ā surmonter la douleur et ├Ā reconna├«tre leur h├®ritage divin. En unissant nos efforts dans l'amour et la compr├®hension, nous pouvons gu├®rir et restaurer la communication entre le p├©re et le fils.First-Year Living-Learning Communities

First-Year Living-Learning CommunitiesBrandon Schwartz

╠²

The document discusses first-year living-learning communities at Babson College. It describes two communities - Living Social Change and Living Entrepreneurship. Both communities are connected to a first-year seminar course and encourage exploration of a specific interest. The communities help residents develop a sense of belonging, experience academic achievement through unique learning opportunities, and immerse themselves in entrepreneurship or social change. Students are encouraged to apply by the June 6th deadline and may only be placed in one community.Scaling empathy with personas

Scaling empathy with personasCoryndon Luxmoore

╠²

The document discusses the concept of personas in user experience design, emphasizing their role in enhancing empathy and understanding of customer needs across an organization. It outlines the benefits of persona creation, including better decision-making and improved product design, as well as the process of developing and utilizing personas based on user research and segmentation. Additionally, it highlights the importance of integrating personas into broader company operations to improve customer interactions and support.Presentation of CONTENTdm Digital Library Project (April 2015)

Presentation of CONTENTdm Digital Library Project (April 2015)Marina Georgieva

╠²

The document outlines the creation of a digital collection focused on Bulgaria's picturesque church and monastery buildings, aiming to promote cultural heritage and attract tourists. Key features include resource gathering, metadata development, and user-friendly browsing and searching functionalities to enhance accessibility. The collection prioritizes aesthetic appeal and user engagement through feedback and support sections.More Related Content

What's hot (15)

Investment planning at early 30s

Investment planning at early 30sGeetashreeGogoi1

╠²

Investment planning in one's early 30s is important as goals like buying a house, retirement planning, and children's education will start to become priorities. The key steps involve identifying financial goals, learning about investment options and risk appetite, creating an investment plan, and allocating assets accordingly. By the 30s, income is more stable but risk tolerance may decrease as responsibilities increase. Investing regularly in instruments like the National Pension System, Public Provident Fund, government bonds, equity shares, and fixed deposits while increasing contributions over time can help achieve multiple long-term goals.Things to Do After You Pay Off Debt

Things to Do After You Pay Off DebtGlobal Client Solutions

╠²

Global Client Solutions is a payment processor established in 2003 that aids consumers in settling debts. After paying off debt, it is essential to reassess your budget, create an emergency fund by avoiding credit cards, and set new financial goals to maintain good spending habits. These steps help ensure that individuals do not fall back into debt and can effectively manage their finances in the future.CL_Scotiabank_Feb_2015_FINAL

CL_Scotiabank_Feb_2015_FINALVictoria DiPlacido

╠²

This document provides advice for creating a personalized retirement investment plan in a three-part series. It recommends meeting with a Scotiabank advisor to develop a plan to reach retirement goals. It also advises to invest early and regularly through an RRSP or TFSA, using tools like Scotiabank's Retirement Savings Reality Check to explore scenarios. Finally, it suggests staying invested despite market volatility and reviewing plans annually.Preparing for the New Financial Year

Preparing for the New Financial YearNikhil Kumar

╠²

Young adults are encouraged to take financial planning seriously, starting with setting a budget and establishing savings goals. Investing in suitable instruments, purchasing insurance, and managing dues are essential steps for managing finances effectively. Adopting an asset-light lifestyle and maximizing tax savings can also contribute to better financial health for millennials.The Success of Financial Freedom

The Success of Financial FreedomRachel Olsen

╠²

The document provides tips for achieving financial freedom and success. It discusses taking time each day for yourself (the Golden Hour), setting goals both long-term and short-term, spending less than you earn to avoid debt, giving to others without expectation of return to guarantee financial success, and investing in knowledge, health, family, and business relationships which allow you to achieve more.A Powerful Tax Strategy For Locum Tenens

A Powerful Tax Strategy For Locum TenensPeter Thoms, CFA

╠²

The document outlines the financial benefits of defined benefit plans for self-employed individuals, particularly locum tenens physicians, highlighting their capacity to significantly reduce taxes and rapidly build retirement savings. It provides examples of substantial potential tax savings and retirement growth, emphasizing suitability criteria for these plans. The document also promotes a specific financial advisory firm, Orion Capital Management, that specializes in assisting clients with these retirement planning strategies.Why You Should Ditch the Way YouŌĆÖve Been Doing Strategic Planning

Why You Should Ditch the Way YouŌĆÖve Been Doing Strategic PlanningBloomerang

╠²

The document argues for a change in strategic planning approaches for nonprofits to enhance effectiveness and reduce stress. It critiques traditional beliefs that hinder growth, emphasizing the need for new strategies to achieve clarity, funding, and a thriving team. The author, Sarah Olivieri, suggests that adopting a fresh perspective and the 'impact method' can lead to better goal-setting and organizational success.Againsuccess

AgainsuccessMumtaz Siddiquee

╠²

The document discusses a home business opportunity with Success Worldwide that can provide financial freedom and additional income for retirement without interfering with other jobs. It notes that the opportunity allows savings on taxes, potential travel, and unlimited earnings through network marketing with only a small initial investment. Building the business is described as easy and flexible to incorporate into one's life.Budgeting Stratgy

Budgeting Stratgy Kimmie Champlin

╠²

The document provides guidance on creating an effective budget in 4 parts:

1) Estimate revenue streams conservatively and current cash.

2) Determine priorities and allocate funds across expenses like recruitment, events based on priorities.

3) Ensure the budget is balanced each month and cuts can be made if needed.

4) Track actual revenues and expenses monthly to evaluate performance against the budget and make adjustments.SixKeyAreas (2)

SixKeyAreas (2)Daniel Mallozzi

╠²

The document outlines the six key areas of a comprehensive financial plan: current snapshot, manage risk, accumulate wealth, control taxes, plan for retirement, and leave a legacy. It provides details on what each area involves, such as creating a clear picture of goals, capturing current income and expenses, protecting against financial risks, leveraging investments to support goals, evaluating tax strategies, planning for how retirement will look, and distributing an estate effectively. The overall scope is to develop a plan that addresses all of these essential areas and fits an individual's unique financial situation and priorities.Retiring early

Retiring earlyRighthorizon

╠²

Rahul dreams of retiring early at age 50 and needs to determine how to save and invest enough to achieve a retirement corpus of Rs. 3,00,00,000. There is a two step method - first ascertain the corpus required considering inflation, and second determine how much to save and invest each month starting early to take advantage of compounding returns. An analysis shows Rahul would need to invest Rs. 1,64,952 annually or Rs. 11,128 monthly to reach his goal if earning 14% annually on his investments.EDUCATION SOLUTIONS

EDUCATION SOLUTIONSChantal Reichel

╠²

This document provides information on different education savings and investment plans from Old Mutual Invest and Max Investments (SmartMAX). It summarizes the key features of two plans from each - the Old Mutual Invest Tax Free Plan and Flexible Plan, and the SmartMAX Focussed Plan and Flexible Plan. It also briefly introduces a third SmartMAX Flexible Plan (Xtra) and encourages readers to speak to an advisor or visit the company websites for more details on choosing the most appropriate plan.Saving for Retirement

Saving for RetirementJessica Thomson

╠²

This document emphasizes the importance of early retirement savings, detailing the benefits and differences between RRSPs and TFSAs. It highlights strategies for maximizing savings, such as contributing to employer-matched RRSPs and building an emergency fund while prioritizing debt repayment. The key takeaway is that starting to save now, even in small amounts, can significantly impact retirement funds due to compound growth over time.Session 1 Preparation Printversion

Session 1 Preparation PrintversionVenkatachalam Vaidhiyanathan

╠²

The document outlines three steps to financial success: 1) Save money by setting goals and creating a budget to control spending; 2) Invest saved money to generate positive cash flow; 3) Protect assets and income by managing taxes and paying down debt. It provides information on concepts like assets, liabilities, income and expenses to understand personal finances and develop a net worth chart and cash flow plan.Generic fixed

Generic fixedlsorrentino1

╠²

This document compares a fixed annuity to certificate of deposits (CDs) and money markets. It notes that a fixed annuity offers tax deferral, avoidance of probate, guaranteed interest rates including a minimum 1% renewal rate for years 2-5, ability to withdraw funds penalty-free, and turning the investment into guaranteed lifetime income. CD rates are shown to be lower, with interest taxed annually, not avoiding probate, and greater bank failure risk. A chart also shows that a fixed annuity would accumulate more value over time compared to a CD.Viewers also liked (12)

Innovations AUVMs

Innovations AUVMsSupriyo Guha

╠²

This document proposes installing automated urea vending machines (AUVMs) in rural villages to improve access and availability of urea for farmers. Key points:

1) AUVMs would be located within a 5-7 km radius catchment area of villages with high urea demand to provide 24/7 access for farmers.

2) The machines would automatically reorder urea from supply hubs when stocks drop below a threshold.

3) AUVMs could save costs compared to traditional distribution and increase brand visibility, creating a differentiated customer experience.Dunya turu

Dunya turuM├┤...Moema Anita Concei├¦├Żo

╠²

This document lists various locations around the world including countries, cities, and regions such as South Africa, Alaska, Virginia, Austria, Bangladesh, China, Australia, Bora Bora, Burma, England, California, Ecuador, Egypt, Italy, England, Blackpool, Florida Keys, India, Naples, Japan, Russia, Jordan, Mauritania, Portofino, Moscow, Spain, Thailand, Utah, West Virginia, Croatia, and Zambia. It credits National Geographic as the source of photographs and lists the song "Wild Child" by Enya as the music.V. Le cercle de lŌĆÖExpiationPierrot Caron

╠²

Le chapitre 14 explore le th├©me de l'enseignement de l'innocence et de la r├®demption ├Ā travers le cercle de l'expiation, soulignant que chaque individu est li├® ├Ā Dieu et que la culpabilit├® est une illusion. Il insiste sur l'importance d'enseigner la paix et de partager l'innocence, en encourageant chacun ├Ā surmonter la douleur et ├Ā reconna├«tre leur h├®ritage divin. En unissant nos efforts dans l'amour et la compr├®hension, nous pouvons gu├®rir et restaurer la communication entre le p├©re et le fils.First-Year Living-Learning Communities

First-Year Living-Learning CommunitiesBrandon Schwartz

╠²

The document discusses first-year living-learning communities at Babson College. It describes two communities - Living Social Change and Living Entrepreneurship. Both communities are connected to a first-year seminar course and encourage exploration of a specific interest. The communities help residents develop a sense of belonging, experience academic achievement through unique learning opportunities, and immerse themselves in entrepreneurship or social change. Students are encouraged to apply by the June 6th deadline and may only be placed in one community.Scaling empathy with personas

Scaling empathy with personasCoryndon Luxmoore

╠²

The document discusses the concept of personas in user experience design, emphasizing their role in enhancing empathy and understanding of customer needs across an organization. It outlines the benefits of persona creation, including better decision-making and improved product design, as well as the process of developing and utilizing personas based on user research and segmentation. Additionally, it highlights the importance of integrating personas into broader company operations to improve customer interactions and support.Presentation of CONTENTdm Digital Library Project (April 2015)

Presentation of CONTENTdm Digital Library Project (April 2015)Marina Georgieva

╠²

The document outlines the creation of a digital collection focused on Bulgaria's picturesque church and monastery buildings, aiming to promote cultural heritage and attract tourists. Key features include resource gathering, metadata development, and user-friendly browsing and searching functionalities to enhance accessibility. The collection prioritizes aesthetic appeal and user engagement through feedback and support sections.The G 35x Type Astronomical Telescope Updated

The G 35x Type Astronomical Telescope Updatedgalileotelescope

╠²

This document provides contact information for Sun East Asia Corporation, including their address, telephone numbers, fax number, and email address. Sun East Asia Corporation is located in Manila, Philippines and can be contacted regarding do-it-yourself astronomical telescopes.20141112 125019 po├©me toi, plurielleabdelmalek aghzaf

╠²

Le po├©me c├®l├©bre la beaut├® plurielle d'une personne, posant des questions sur son lien avec le monde qui l'entoure. Il ├®voque des images et des m├®taphores pour illustrer la fa├¦on dont cette beaut├® s'inspire et refl├©te celle des autres. L'auteur souligne que cette beaut├® collective est une richesse, b├®n├®fique pour elle et pour toutes les autres femmes.Choosing a Husband is a Critical Career Decision

Choosing a Husband is a Critical Career DecisionKiran Shaw

╠²

Bangalore Mirror

Choosing a Husband is a Critical Career Decision

22July2015Volute pumps

Volute pumpsgalileotelescope

╠²

This document provides contact information for Ebara Volute Pumps Sun East Asia Corporation, including their address, telephone numbers, fax number, and email address. The company is located in Manila, Philippines at the 11th floor of the Ramon Magsaysay Center building at 1680 Roxas Boulevard in Malate, Manila.Teori Ramona T. Mercer.

Teori Ramona T. Mercer.Ririn Saputri

╠²

Ramona T. Mercer adalah perawat yang mengembangkan teori tentang stres antepartum dan pencapaian peran ibu. Teori ini menekankan pentingnya dukungan sosial dan faktor-faktor yang memengaruhi kesehatan mental ibu selama kehamilan untuk mencapai peran sebagai ibu. Mercer juga menetapkan empat tahap pencapaian peran ibu yang mencakup anticipatory, formal, informal, dan personal.Ad

Similar to tp-one-brochure (20)

The Magic Of Lifetime Cash Flow Forecsats

The Magic Of Lifetime Cash Flow Forecsatsbributcher

╠²

The document discusses lifetime cash flow forecasts and financial planning. It explains that cash flow forecasts can show a client's future income and expenses over their lifetime to determine if they will have enough money to support their desired lifestyle and retirement. The financial planner uses software to build forecasts that help clients understand how their financial decisions today will impact their future and determine if adjustments are needed. The planner aims to empower clients by helping them "see" their financial future and make informed decisions to achieve their goals and ensure their money lasts as long as possible.Pension review checklist

Pension review checklistAvantis Wealth

╠²

The document provides information about conducting a pension review and creating an action plan for a richer retirement. It outlines key questions to consider as part of the pension review, such as contributions, financial needs, investment performance, and options at retirement. The action plan section then guides the reader through assessing their current financial situation, retirement goals, any gaps, and potential actions to close gaps and achieve retirement goals, such as changing investments or pension arrangements. The overall document aims to help readers evaluate if their current pension and savings are on track to meet their retirement income needs and identify actions to improve their prospects for a "richer retirement".Pension review checklist

Pension review checklistAvantis Wealth

╠²

The document provides information on conducting a pension review and creating an action plan for a richer retirement. It outlines key questions to consider in the review, such as whether contributions are sufficient, financial needs, investment performance, and fees. The action plan section recommends assessing one's current situation, retirement goals, any gaps, and steps to take. Conducting regular reviews can help ensure a pension is on track to meet retirement income needs.Your Future Direction

Your Future Direction IFS (Professional Connections) Ltd

╠²

Independent Financial Services provides a "Your Future Direction Programme" to help clients achieve financial goals and peace of mind. They work with clients through a multi-step process: discovering clients' needs and situation; evaluating their current financial position; designing customized solutions; presenting recommendations; implementing plans; and reviewing plans periodically. The company charges fixed fees based on the value of the work rather than hourly rates. They have offices in Essington and Leamington Spa and serve a diverse range of clients.Hamptons July-August 2016 Newsletter

Hamptons July-August 2016 NewsletterColin Hart Dip PFA, AIFP, Cert PFS

╠²

The document discusses various topics related to retirement planning and pensions. It provides advice on assessing whether you will be able to afford your desired retirement lifestyle, consolidating separate pension pots into one for simplicity, and having more choice over how you can access your pension savings following rule changes. The articles aim to help readers make informed decisions about funding their retirement and taking advantage of new freedoms over pension income options.Choppy Waters, Not Full-On Gale

Choppy Waters, Not Full-On GaleTudor Franklin Independent Financial Advice

╠²

The document discusses various aspects of financial planning and investment strategies, particularly focusing on wealth transfer, pension options, and tax efficiency. It emphasizes the importance of planning for retirement and offers insights on whether to invest in pensions or ISAs, along with managing inflation risks. The publication serves as a guide for readers to prepare for a financially secure future through professional advice and informed decision-making.Top Tips To Plan A Smarter Retirement

Top Tips To Plan A Smarter RetirementPravesh Vasudeva

╠²

The document provides essential tips for planning a successful retirement, emphasizing the importance of starting early, understanding personal goals, and being mindful of expenses. Key strategies include saving in RRSPs, making realistic budgets, and prioritizing debt repayment. Engaging with financial advisors can help tailor a retirement plan that suits individual needs.Retirement Planning Guide by IBB Wealth

Retirement Planning Guide by IBB WealthIBB Law

╠²

This document serves as a comprehensive guide to retirement planning, emphasizing the importance of early and informed financial preparation for retirement to ensure a comfortable lifestyle. It outlines key aspects such as tax relief on pension contributions, variations in pension schemes, and the implications of pension freedoms introduced in 2015 that allow greater access and control over pension savings. The guide also highlights the significance of regularly reviewing retirement arrangements in the context of an aging population and potential state pension inadequacies.Retirement Planning

Retirement PlanningTudor Franklin Independent Financial Advice

╠²

The document serves as a comprehensive guide on retirement planning, emphasizing the importance of starting to plan early to ensure financial security in later years. It explains the various types of pension schemes, the implications of pension freedoms introduced in 2015, and the tax benefits associated with pension contributions. Additionally, it highlights the significance of understanding one's pension value to achieve desired retirement outcomes.cfp-e book (1)

cfp-e book (1)JoydeepSarkar19

╠²

The document discusses creating an income and expense statement and cashflow statement to assess financial position over time. It explains that an income statement shows income and expenditures over a period, while a cashflow statement only includes actual cash inflows and outflows. The key steps are to list all sources of income, expenditures, and determine the surplus or deficit. Creating these statements makes it easy to see where money is being spent and how earnings and expenses impact net worth over time.Shaping Your Future To Create The Life You Want

Shaping Your Future To Create The Life You WantTudor Franklin Independent Financial Advice

╠²

The document serves as a guide for creating a personalized financial plan to achieve desired lifestyle goals and ensure financial security. It emphasizes the importance of setting specific, measurable, and actionable financial and lifestyle goals while preparing for unexpected challenges. The guide also outlines strategies for effective wealth management through understanding liquidity needs, diversifying investments, and planning for future generations.Investor update april 2015

Investor update april 2015Columbia Threadneedle Investments

╠²

Columbia Threadneedle Investments announced a rebranding of the business as Columbia Threadneedle Investments through the combining of Threadneedle Investments and Columbia Management. The experienced portfolio managers, strong product range, and robust processes remain unchanged, with no changes to fund names, account numbers, phone numbers, or the investor center address. The new brand represents the combined capabilities and resources of the two companies that are now both owned by Ameriprise Financial. Together they manage over $500 billion in assets with over 450 investment professionals located across 18 countries.A guide to retirement planning

A guide to retirement planningScott Moreton

╠²

This document provides a summary of retirement planning strategies. It discusses how much individuals need to save for retirement given increasing lifespans. Proper planning is important as delaying can significantly increase costs. The document outlines pension rules and options for investing in retirement plans. Taking professional advice is recommended to make informed decisions about securing adequate retirement income.ppt- Financial planning.pptx

ppt- Financial planning.pptxrajitharevanna

╠²

1. Financial planning involves evaluating one's current financial situation, setting goals, and developing recommendations to achieve those goals. It includes areas like investing, taxes, savings, and insurance.

2. The document discusses the meaning and benefits of financial planning. It outlines the basic steps of financial planning as evaluating one's current finances, writing down financial objectives, exploring investment opportunities, and developing the right plan.

3. Maintaining and monitoring the financial plan is emphasized as important for adapting to changes in one's circumstances over time. Various tips are provided around managing expenses, savings, debt, and investments.Magazine Sample 2

Magazine Sample 2Kristine Bell

╠²

The document is a multi-product brochure from Manulife aimed at consumers transitioning to retirement. It provides an overview of retirement products and highlights key things for readers to consider when planning for retirement, such as when to retire, estimating expenses, understanding sources of income, and reviewing insurance needs. The brochure uses a magazine format with different sections to make the large amount of information easier for readers to navigate and find what interests them most. This format was well-received by clients and marketing teams.Client BrochureLife + Investing

Client BrochureLife + InvestingRussell Reinhart, CFP ®

╠²

The document discusses a goals-based wealth management process that aligns investments with clients' life goals. It focuses on helping clients achieve their dreams through tailored financial guidance. Key aspects include identifying clients' ideal and acceptable scenarios for each goal, designing investment plans within a "comfort zone", and making ongoing adjustments as clients' lives and priorities change over time. The process aims to minimize risk while avoiding unnecessary sacrifices to clients' lifestyles.Personal Financial Statements and Budgeting

Personal Financial Statements and BudgetingARAVINDR951741

╠²

This document provides information about personal financial statements, budgeting, taxes, and savings. It discusses creating a personal balance sheet listing assets and liabilities to determine net worth. It also covers creating a personal budget that tracks income versus expenses and a cash flow statement showing cash inflows and outflows. Common budgeting methods like the 50/30/20 rule and envelope system are explained. The document also discusses investment management, different types of savings accounts and investments, direct and indirect taxes, and ways to reduce tax liability through deductions specified in the Indian Income Tax Act.esm69_singles FULL

esm69_singles FULLPaul Murray

╠²

This document discusses various topics related to pensions and retirement planning. It includes the following articles:

1. Getting your pension in shape to enjoy the kind of lifestyle you want in later life. It discusses factors to consider like income needs, assessing pension pot size needed, and annual contribution limits.

2. The investment company growth story of the decade. It notes that investment companies were some of the earliest collective investment vehicles, and over a third of the sector now invests in alternative assets like infrastructure funds.

3. What are the income options for your pension? It outlines the increased flexibility and choice individuals now have in how and when they can access pension savings following rule changes in 2015.7 Big Mistakes eGuide

7 Big Mistakes eGuideRyan Isaac

╠²

Dentists commonly make mistakes that can jeopardize their retirement. The top three mistakes are: not tracking spending, paying off debts without a strategy, and not automating investment programs. To fix these, dentists should use apps to track spending, develop a debt repayment plan that considers factors like refinancing and borrowing against assets, and automate monthly investments into retirement accounts from practice earnings. Automating investments is key to building wealth for a secure retirement.PV Feb 2015 WEB

PV Feb 2015 WEBEm Eato

╠²

This document provides information to intermediaries about how LifeQuote can help grow their protection business. It highlights the benefits of LifeQuote's online quoting and application system, including quick multi-benefit quotes, pre-underwriting, and full post-sale administration support. It also shares the story of one adviser who used LifeQuote and saw growth in both his mortgage and protection business. The document encourages intermediaries to contact LifeQuote to learn more about how its services can help focus on clients' full protection needs and allow advisers to grow their protection sales.Ad

tp-one-brochure

- 1. The financial planner that makes life easy.

- 2. Introducing our latest innovation that consolidates all of your savings and investments into one convenient location. True Potential OneŌäó is the new financial planner that makes life easy. 1

- 3. Creating new technology that simplifies and enhances life is something we firmly believe in. So, for people with investments here, there and everywhere, and an unclear view of their finances, we wanted to offer a better alternative. What we needed was a lifetime financial planner that groups your Pension, ISAs, GIAs, and any other investments you have, into one place, with just one provider. A bit like having one big bank account with smaller ones inside for every financial eventuality in life. Exclusively available to clients of True Potential powered financial advisers, True Potential OneŌäó is a system that works with your lifestyle. We like to think of it as ŌĆśa place for everything and everything in its place.ŌĆÖ The big idea GIA with Provider B Stocks and Shares ISA with Provider D SIPP with Provider A Stocks and Shares ISA with Bank A GIA with Bank B Personal Pension with Provider C 2

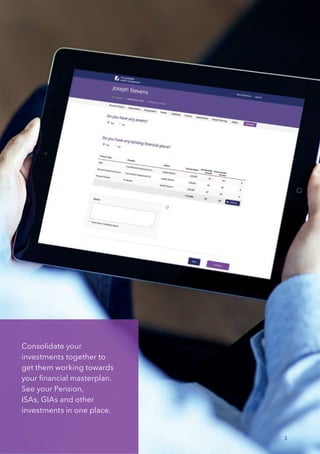

- 4. Consolidate your investments together to get them working towards your financial masterplan. See your Pension, ISAs, GIAs and other investments in one place. 3

- 5. Why True Potential OneŌäó One financial life plan Plan your retirement spending in detail to set a realistic goal Flexible planning you can adjust when life changes Consolidate your investments Makes it easier to take advantage of new pension freedoms Top-up investments with impulseSave┬« to reach your goal 4

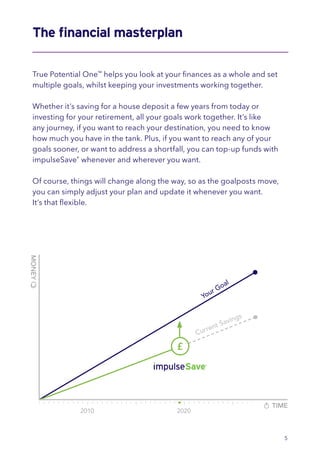

- 6. The financial masterplan True Potential OneŌäó helps you look at your finances as a whole and set multiple goals, whilst keeping your investments working together. Whether itŌĆÖs saving for a house deposit a few years from today or investing for your retirement, all your goals work together. ItŌĆÖs like any journey, if you want to reach your destination, you need to know how much you have in the tank. Plus, if you want to reach any of your goals sooner, or want to address a shortfall, you can top-up funds with impulseSave┬« whenever and wherever you want. Of course, things will change along the way, so as the goalposts move, you can simply adjust your plan and update it whenever you want. ItŌĆÖs that flexible. 2010 2020 5

- 7. Track your masterplan 24/7 using our award-winning Wealth Platform. Adjust your saving and spending plan yourself or contact your financial adviser. 6

- 8. Life doesnŌĆÖt stop at retirement, neither should your financial plan. 7

- 9. A life planner and a retirement planner Most financial planning for the future involves picking a figure out of thin air - one that you THINK will see you through your twilight years. But what if you live a lot longer than you think you will, or you want to see and do so much more than your initial plan allows for? Tricky isnŌĆÖt it. ThatŌĆÖs why we think itŌĆÖs far better to be able to plan your future spending in great detail, as well as have the flexibility to adjust your plan when things change. Once youŌĆÖve thought about your future spending, itŌĆÖs so much easier to work backwards to the present and devise a financial plan that helps deliver the lifestyle you want in your retirement. ThatŌĆÖs why our unique life planner looks at your life as a whole. True Potential OneŌäó makes your spending plan more realistic by breaking down your retirement into phases. Maybe you want to go travelling in your 60s, take lots of city breaks in your 70s and slow down in your 80s. YouŌĆÖll spend more money early on and less as you get older. This kind of planning builds a much more accurate picture of what youŌĆÖll spend in retirement and how much money youŌĆÖll need to make it a reality. Life Planner Retirement Planner 8

- 10. How pension reforms affect you From April 2015, it all changed for pension savers just like you - and it changed for the better. The new retirement reforms give you much more flexible ways of spending your retirement fund. So letŌĆÖs explain what those changes are just to put you in the picture. More financial flexibility In the past, most people upon their retirement have been allowed to take a 25% tax-free lump sum and generally have bought an annuity with the rest. Since April 2015, if youŌĆÖre a saver over the age of 55, you have the option of taking smaller sums from your pension pot as you need, instead of one single big lump sum, and in each case, 25% of the sum you take out will be tax-free. Because this effectively means you can use your pension like a bank account, making withdrawals whenever you want, a need for better money management and professional financial advice becomes essential. ThatŌĆÖs where True Potential OneŌäó becomes invaluable to help you budget throughout your retirement years. Three ways to take money out: Take the whole amount with 25% tax-free and the rest taxed as income Take 25% tax-free lump sum and draw the rest as an income, taxed at marginal rate Take no lump sum, but a regular income with 25% tax-free and the rest taxed at marginal rate 9

- 11. New retirement reforms mean a new retirement strategy WeŌĆÖve already talked about how you can use True Potential OneŌäó to plan for your retirement, but it offers much more than pension flexibility. You can consolidate multiple investments under your retirement goal and plan for life events where you might withdraw lump sums - maybe a new car or a childŌĆÖs wedding. So, you can have your Pension, ISA, GIA and any other investment working together for your future as one financial masterplan. 10

- 12. Registered Head Office: Newburn House, Gateway West, Newburn Riverside, Newcastle upon Tyne, NE15 8NX London Office: 42-44 Grosvenor Gardens, Belgravia, London, SW1W 0EB T: 0871 700 0007 E: platform@tpllp.com True Potential Investments LLP is authorised and regulated by the Financial Conduct Authority, FSR No. 527444. Registered in England and Wales, No. OC356027. impulseSave® is a registered trademark of True Potential Investments LLP Your capital is at risk. Investments can fluctuate in value and you may not get back the amount you invest. Past performance is not a guide to future performance. Tax rules can change at any time. www.tpllp.com