1 of 1

Downloaded 56 times

Ad

Recommended

Social, Digital & Mobile in APAC

Social, Digital & Mobile in APACWe Are Social Singapore

╠²

The We Are Social 2014 Asia-Pacific Digital Overview report provides key statistics on the digital landscape across 30 countries in the Asia-Pacific region. Key findings include a total population of approximately 3.88 billion, with 1.26 billion internet users and 969 million active social network users, reflecting a 32% internet penetration and 25% social networking penetration. The report highlights significant mobile subscription growth, with 3.35 billion active mobile subscriptions across the region.Taiwan digital landscape by L'atelier BNP Paribas

Taiwan digital landscape by L'atelier BNP ParibasL'Atelier BNP Paribas

╠²

The document provides a comprehensive overview of Taiwan's digital landscape in 2013, detailing statistics on internet and mobile internet users, social media engagement, and e-commerce behaviors. Key findings include that 75.44% of Taiwan's population are internet users, with Facebook, Yahoo, and YouTube as the top online sites. The e-commerce market was valued at Ōé¼2.82 billion, with various online purchasing trends and motivations highlighted.Asia-Pacific Social Media Influence - Zaheer Nooruddin

Asia-Pacific Social Media Influence - Zaheer NooruddinBurson-Marsteller Asia-Pacific

╠²

This infographic from Asia-Pacific colourfully visualizes data about the top social networks and preferred social media channel types and by market in the Asia-Pacific Region by Zaheer Nooruddin Asia-Pacific China Social Media Strategy WEIBO Zaheer Nooruddin

Asia-Pacific China Social Media Strategy WEIBO Zaheer NooruddinBurson-Marsteller Asia-Pacific

╠²

The document presents a framework for improving corporate reputation and crisis preparedness through effective digital communications, specifically utilizing Weibo in China. It outlines seven strategic steps for organizations to optimize their Weibo presence, including defining objectives, understanding audiences, and leveraging insights for better engagement. The approach emphasizes the importance of a systematic strategy to enhance brand reputation and marketing effectiveness in the rapidly evolving social media landscape in China.Asian Media Landscape Series - Hong Kong, Taiwan, Singapore and Malaysia

Asian Media Landscape Series - Hong Kong, Taiwan, Singapore and MalaysiaPR Newswire APAC

╠²

The document provides a comprehensive overview of the media landscape in Hong Kong, highlighting its diverse mass media forms, including newspapers, television, radio, and an evolving digital presence. It emphasizes the region's freedom of expression, competitive newspaper market, and the significant role of international media outlets. Additionally, it touches on the rising popularity of social media and the shifting media consumption habits among the population, indicating a blend of traditional and new media influences.We Are Social's Guide to Social, Digital and Mobile Around the World (Feb 2013)

We Are Social's Guide to Social, Digital and Mobile Around the World (Feb 2013)We Are Social Singapore

╠²

The document provides key global statistics on social, digital, and mobile usage as of February 2013, including a total population of approximately 7 billion, with 33% being internet users and 24% using social networks. It highlights various penetration rates across regions for internet and social media, as well as details of the top social networks by active users. Additionally, it mentions mobile subscriptions, revealing a 91% penetration rate worldwide.Vietnam Digital landscape update 2013 Sep_2013_Mindshare

Vietnam Digital landscape update 2013 Sep_2013_MindsharePhŲ░ŲĪng Bi

╠²

This document provides a summary of Vietnam's digital landscape as of 2013. Some of the key points include:

- Vietnam had over 31 million internet subscribers as of November 2012, representing a penetration rate of 35.6%, one of the highest in Southeast Asia.

- The average time spent online had increased from 97 minutes in 2008 to 133 minutes in 2012. Popular online activities for Vietnamese internet users included social networking, listening to music, watching videos, playing games, and searching for news and information.

- Top websites included Facebook, YouTube, and online portals providing news, music, movies and games. Social networking sites like Facebook were the most visited destinations online.

- Vietnam's population was young, with over halfHong Kong - Social Media & Internet Facts

Hong Kong - Social Media & Internet FactsReach China Holdings Limited

╠²

As of August 2012, Hong Kong has a population of approximately 7.1 million, with a significant internet penetration rate of 68.5% and a high fixed broadband rate. Social media usage is evolving, with Facebook being the leading platform, but users primarily utilize it for maintaining relationships rather than networking. Despite a growing online presence, online shopping remains low compared to other developed markets due to the convenience of physical retail.We Are SocialŌĆÖs Guide to Social, Digital and Mobile in China (2nd Edition, Ja...

We Are SocialŌĆÖs Guide to Social, Digital and Mobile in China (2nd Edition, Ja...We Are Social Singapore

╠²

As of January 2013, China has a population of approximately 1.34 billion, with 42% being internet users and 44% active on social media. The report highlights significant growth in mobile internet usage, where mobile subscribers outnumber PC users, and notes that 91% of netizens engage with social media platforms. Key social networks in China, including Qzone and Weibo, have millions of active users, indicating a strong preference for social networking and digital communication among the population.Social, Digital & Mobile Around The World (January 2014)

Social, Digital & Mobile Around The World (January 2014)We Are Social Singapore

╠²

The document presents a global digital statistics overview for 2014, including internet users, social network users, and mobile subscriptions across various countries and regions. It highlights key data such as internet penetration rates, social media usage, and mobile connectivity, providing insights into digital trends worldwide. The statistics reflect significant disparities in digital access and usage between different regions.Digital, Social & Mobile in APAC in 2015

Digital, Social & Mobile in APAC in 2015We Are Social Singapore

╠²

The document is a report from We Are Social and IAB Singapore detailing digital, social, and mobile statistics in the Asia-Pacific region as of March 2015. It presents data on internet users, social media penetration, and mobile connections across various countries, highlighting trends in digital growth and usage. Key figures include the total number of active internet users, active social media users, and mobile connections, alongside demographic and urbanization statistics.2016 Digital Yearbook

2016 Digital YearbookWe Are Social Singapore

╠²

The 2016 Digital Yearbook by We Are Social compiles key digital statistics for 232 countries worldwide, serving as a part of a broader report on digital trends. It provides detailed profiles including metrics like active internet users, social media users, and mobile connections, offering insights into global digital penetration rates. This year's analysis also includes forecasts and general trends observed for the upcoming twelve months.Digital in 2016

Digital in 2016We Are Social Singapore

╠²

We Are SocialŌĆÖs 2016 report provides an in-depth analysis of global digital, social, and mobile trends across 30 leading economies, with additional data on 232 countries. The document includes statistics on internet users, social media engagement, and mobile usage, illustrating significant growth trends in user demographics and media consumption. The report is structured into three sections: a comprehensive overview, a yearbook, and an executive summary, all aimed at helping organizations understand and leverage emerging digital trends.Digital Reporting_Please Like Me_Zaheer Nooruddin _2011

Digital Reporting_Please Like Me_Zaheer Nooruddin _2011Burson-Marsteller Asia-Pacific

╠²

1. The document discusses ways to measure social media in public relations, from basic metrics like impressions and reach to more advanced metrics that establish causation between communications activities and business outcomes.

2. It addresses common myths around digital ROI and the misconception that activity equals value. The key is to establish clear objectives and define success in measurable terms from the outset.

3. A framework is presented that distinguishes between measuring output, impact and outcomes. Output looks at engagement, impact looks at passive and active engagement, while outcomes demonstrate value through metrics like revenue, customer satisfaction and thought leadership.Social Responsibility > Social Marketing > Social Media

Social Responsibility > Social Marketing > Social Media Burson-Marsteller Asia-Pacific

╠²

The document discusses the evolving landscape of corporate social responsibility (CSR) and the importance of social marketing within the context of globalization and digitalization. It emphasizes the need for companies to engage transparently with stakeholders and adapt to potential crises, particularly in the digital space. Additionally, it highlights the growing expectation from consumers and executives for corporations to play a significant role in addressing societal challenges.Burson-Marsteller Asia-Pacific Corporate Social Media Study 2011

Burson-Marsteller Asia-Pacific Corporate Social Media Study 2011Burson-Marsteller Asia-Pacific

╠²

The 2011 Asia-Pacific Corporate Social Media Study by Burson-Marsteller reveals that while top Asian companies are gradually increasing their use of social media for corporate marketing and communications, they predominantly focus on pushing content rather than engaging stakeholders in dialogue. The study indicates that South Korean and Chinese firms lead in social media activity, yet a conservative business culture across the region discourages two-way communication, resulting in many companies underutilizing these platforms. As companies struggle to manage online reputation and engagement, the need for a strategic and transparent approach to social media is emphasized.Corporate Communications in the Age of Social Technology

Corporate Communications in the Age of Social TechnologyBurson-Marsteller Asia-Pacific

╠²

This document outlines 12 truths about modern public relations and corporate communications in the age of social technology. It discusses how people consume content selfishly, attention spans are collapsing, digital storytelling is key, and PR and customer service are merging. It also notes that communication is becoming more female-focused on listening, Asian companies are increasingly going digital at a faster rate than Western companies, and complexity is making PR more difficult to manage.Modern corporate communications

Modern corporate communicationsBurson-Marsteller Asia-Pacific

╠²

The document discusses trends in financial communications for companies in Asia Pacific. It notes the rise of Asia Pacific as a center for capital raising and mergers and acquisitions. Transparency and real-time communication across multiple channels are increasingly important. The document then provides guidance on developing a financial communications plan, including defining objectives, identifying stakeholders, crafting messages, and planning communications channels and issue monitoring. It also offers two case studies showing how companies effectively responded to crises through coordinated communications with investors and other stakeholders.social business from the inside-out

social business from the inside-outBurson-Marsteller Asia-Pacific

╠²

The document discusses the challenges that organizations face with social media. While some organizations have found success, many are struggling as social media requires a sustained approach and unclear ways to measure value. It demands a different mindset of being truly customer-centric. Few organizations are set up in a way that allows their culture, leadership, governance, and people to effectively engage across the multiplicity of social media touchpoints in a way that impacts the whole organization. The document raises questions about how fit organizations are to meet these challenges across their leadership, culture, management of risk, ownership models, and tools/skills.B-M Asia-Pacific Social Media Infographics Booklet_Aug2011

B-M Asia-Pacific Social Media Infographics Booklet_Aug2011Burson-Marsteller Asia-Pacific

╠²

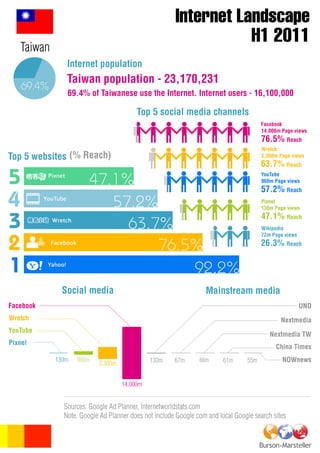

This document is from Burson-Marsteller Asia-Pacific and contains social media and digital media infographics for various Asia-Pacific markets from H1 2011. It introduces Burson-Marsteller's presence and digital/social media capabilities in Asia-Pacific and provides statistics on internet, social media, and mobile usage in 14 Asia-Pacific countries. Contact information is provided for those seeking further information.B-M Philippines digital landscape INFOGRAPHIC Asia H1 2011

B-M Philippines digital landscape INFOGRAPHIC Asia H1 2011Burson-Marsteller Asia-Pacific

╠²

This document is from Burson-Marsteller Asia-Pacific and contains information about social media and digital landscapes across 14 Asia-Pacific countries and regions. It includes infographics on social media penetration and platforms in each country/region. The introduction discusses the rapid growth of digital media in Asia-Pacific and how identifying digital influencers has become important. The conclusion encourages the reader to enjoy the insights from the infographics compilation.Burson-Marsteller Digital Crisis Communications Study

Burson-Marsteller Digital Crisis Communications StudyBurson-Marsteller Asia-Pacific

╠²

The document discusses the findings of a study on digital crisis communications. It finds that 59% of business leaders have experienced a crisis, and crises are now seen as an ordinary part of business. Product safety issues and online security failures are viewed as having the highest impact on reputation. While half of companies have a crisis plan, digital communications are seen as making crisis management more difficult due to the need to respond quickly. The rise of social media is believed to have increased companies' vulnerability to crises.More Related Content

Viewers also liked (7)

Vietnam Digital landscape update 2013 Sep_2013_Mindshare

Vietnam Digital landscape update 2013 Sep_2013_MindsharePhŲ░ŲĪng Bi

╠²

This document provides a summary of Vietnam's digital landscape as of 2013. Some of the key points include:

- Vietnam had over 31 million internet subscribers as of November 2012, representing a penetration rate of 35.6%, one of the highest in Southeast Asia.

- The average time spent online had increased from 97 minutes in 2008 to 133 minutes in 2012. Popular online activities for Vietnamese internet users included social networking, listening to music, watching videos, playing games, and searching for news and information.

- Top websites included Facebook, YouTube, and online portals providing news, music, movies and games. Social networking sites like Facebook were the most visited destinations online.

- Vietnam's population was young, with over halfHong Kong - Social Media & Internet Facts

Hong Kong - Social Media & Internet FactsReach China Holdings Limited

╠²

As of August 2012, Hong Kong has a population of approximately 7.1 million, with a significant internet penetration rate of 68.5% and a high fixed broadband rate. Social media usage is evolving, with Facebook being the leading platform, but users primarily utilize it for maintaining relationships rather than networking. Despite a growing online presence, online shopping remains low compared to other developed markets due to the convenience of physical retail.We Are SocialŌĆÖs Guide to Social, Digital and Mobile in China (2nd Edition, Ja...

We Are SocialŌĆÖs Guide to Social, Digital and Mobile in China (2nd Edition, Ja...We Are Social Singapore

╠²

As of January 2013, China has a population of approximately 1.34 billion, with 42% being internet users and 44% active on social media. The report highlights significant growth in mobile internet usage, where mobile subscribers outnumber PC users, and notes that 91% of netizens engage with social media platforms. Key social networks in China, including Qzone and Weibo, have millions of active users, indicating a strong preference for social networking and digital communication among the population.Social, Digital & Mobile Around The World (January 2014)

Social, Digital & Mobile Around The World (January 2014)We Are Social Singapore

╠²

The document presents a global digital statistics overview for 2014, including internet users, social network users, and mobile subscriptions across various countries and regions. It highlights key data such as internet penetration rates, social media usage, and mobile connectivity, providing insights into digital trends worldwide. The statistics reflect significant disparities in digital access and usage between different regions.Digital, Social & Mobile in APAC in 2015

Digital, Social & Mobile in APAC in 2015We Are Social Singapore

╠²

The document is a report from We Are Social and IAB Singapore detailing digital, social, and mobile statistics in the Asia-Pacific region as of March 2015. It presents data on internet users, social media penetration, and mobile connections across various countries, highlighting trends in digital growth and usage. Key figures include the total number of active internet users, active social media users, and mobile connections, alongside demographic and urbanization statistics.2016 Digital Yearbook

2016 Digital YearbookWe Are Social Singapore

╠²

The 2016 Digital Yearbook by We Are Social compiles key digital statistics for 232 countries worldwide, serving as a part of a broader report on digital trends. It provides detailed profiles including metrics like active internet users, social media users, and mobile connections, offering insights into global digital penetration rates. This year's analysis also includes forecasts and general trends observed for the upcoming twelve months.Digital in 2016

Digital in 2016We Are Social Singapore

╠²

We Are SocialŌĆÖs 2016 report provides an in-depth analysis of global digital, social, and mobile trends across 30 leading economies, with additional data on 232 countries. The document includes statistics on internet users, social media engagement, and mobile usage, illustrating significant growth trends in user demographics and media consumption. The report is structured into three sections: a comprehensive overview, a yearbook, and an executive summary, all aimed at helping organizations understand and leverage emerging digital trends.We Are SocialŌĆÖs Guide to Social, Digital and Mobile in China (2nd Edition, Ja...

We Are SocialŌĆÖs Guide to Social, Digital and Mobile in China (2nd Edition, Ja...We Are Social Singapore

╠²

More from Burson-Marsteller Asia-Pacific (20)

Digital Reporting_Please Like Me_Zaheer Nooruddin _2011

Digital Reporting_Please Like Me_Zaheer Nooruddin _2011Burson-Marsteller Asia-Pacific

╠²

1. The document discusses ways to measure social media in public relations, from basic metrics like impressions and reach to more advanced metrics that establish causation between communications activities and business outcomes.

2. It addresses common myths around digital ROI and the misconception that activity equals value. The key is to establish clear objectives and define success in measurable terms from the outset.

3. A framework is presented that distinguishes between measuring output, impact and outcomes. Output looks at engagement, impact looks at passive and active engagement, while outcomes demonstrate value through metrics like revenue, customer satisfaction and thought leadership.Social Responsibility > Social Marketing > Social Media

Social Responsibility > Social Marketing > Social Media Burson-Marsteller Asia-Pacific

╠²

The document discusses the evolving landscape of corporate social responsibility (CSR) and the importance of social marketing within the context of globalization and digitalization. It emphasizes the need for companies to engage transparently with stakeholders and adapt to potential crises, particularly in the digital space. Additionally, it highlights the growing expectation from consumers and executives for corporations to play a significant role in addressing societal challenges.Burson-Marsteller Asia-Pacific Corporate Social Media Study 2011

Burson-Marsteller Asia-Pacific Corporate Social Media Study 2011Burson-Marsteller Asia-Pacific

╠²

The 2011 Asia-Pacific Corporate Social Media Study by Burson-Marsteller reveals that while top Asian companies are gradually increasing their use of social media for corporate marketing and communications, they predominantly focus on pushing content rather than engaging stakeholders in dialogue. The study indicates that South Korean and Chinese firms lead in social media activity, yet a conservative business culture across the region discourages two-way communication, resulting in many companies underutilizing these platforms. As companies struggle to manage online reputation and engagement, the need for a strategic and transparent approach to social media is emphasized.Corporate Communications in the Age of Social Technology

Corporate Communications in the Age of Social TechnologyBurson-Marsteller Asia-Pacific

╠²

This document outlines 12 truths about modern public relations and corporate communications in the age of social technology. It discusses how people consume content selfishly, attention spans are collapsing, digital storytelling is key, and PR and customer service are merging. It also notes that communication is becoming more female-focused on listening, Asian companies are increasingly going digital at a faster rate than Western companies, and complexity is making PR more difficult to manage.Modern corporate communications

Modern corporate communicationsBurson-Marsteller Asia-Pacific

╠²

The document discusses trends in financial communications for companies in Asia Pacific. It notes the rise of Asia Pacific as a center for capital raising and mergers and acquisitions. Transparency and real-time communication across multiple channels are increasingly important. The document then provides guidance on developing a financial communications plan, including defining objectives, identifying stakeholders, crafting messages, and planning communications channels and issue monitoring. It also offers two case studies showing how companies effectively responded to crises through coordinated communications with investors and other stakeholders.social business from the inside-out

social business from the inside-outBurson-Marsteller Asia-Pacific

╠²

The document discusses the challenges that organizations face with social media. While some organizations have found success, many are struggling as social media requires a sustained approach and unclear ways to measure value. It demands a different mindset of being truly customer-centric. Few organizations are set up in a way that allows their culture, leadership, governance, and people to effectively engage across the multiplicity of social media touchpoints in a way that impacts the whole organization. The document raises questions about how fit organizations are to meet these challenges across their leadership, culture, management of risk, ownership models, and tools/skills.B-M Asia-Pacific Social Media Infographics Booklet_Aug2011

B-M Asia-Pacific Social Media Infographics Booklet_Aug2011Burson-Marsteller Asia-Pacific

╠²

This document is from Burson-Marsteller Asia-Pacific and contains social media and digital media infographics for various Asia-Pacific markets from H1 2011. It introduces Burson-Marsteller's presence and digital/social media capabilities in Asia-Pacific and provides statistics on internet, social media, and mobile usage in 14 Asia-Pacific countries. Contact information is provided for those seeking further information.B-M Philippines digital landscape INFOGRAPHIC Asia H1 2011

B-M Philippines digital landscape INFOGRAPHIC Asia H1 2011Burson-Marsteller Asia-Pacific

╠²

This document is from Burson-Marsteller Asia-Pacific and contains information about social media and digital landscapes across 14 Asia-Pacific countries and regions. It includes infographics on social media penetration and platforms in each country/region. The introduction discusses the rapid growth of digital media in Asia-Pacific and how identifying digital influencers has become important. The conclusion encourages the reader to enjoy the insights from the infographics compilation.Burson-Marsteller Digital Crisis Communications Study

Burson-Marsteller Digital Crisis Communications StudyBurson-Marsteller Asia-Pacific

╠²

The document discusses the findings of a study on digital crisis communications. It finds that 59% of business leaders have experienced a crisis, and crises are now seen as an ordinary part of business. Product safety issues and online security failures are viewed as having the highest impact on reputation. While half of companies have a crisis plan, digital communications are seen as making crisis management more difficult due to the need to respond quickly. The rise of social media is believed to have increased companies' vulnerability to crises.China Healthcare & Wellness Consumer Survey

China Healthcare & Wellness Consumer SurveyBurson-Marsteller Asia-Pacific

╠²

The survey found that healthcare is the top spending priority for Chinese families. Nearly 70% ranked it as the most important expenditure area. Consumers are empowered and proactive in managing their health, with over 80% researching online before doctor visits. News websites are a key information source on health topics. The internet and online peer communities are trusted platforms for sensitive health issues. Women play a large role in healthcare decisions and spending, which is increasing on preventative care and wellness.Integrating Social Media into Reputation Management

Integrating Social Media into Reputation ManagementBurson-Marsteller Asia-Pacific

╠²

The document discusses 10 laws for integrating social media into reputation management. The laws include setting measurable objectives, listening before joining conversations, communicating authentically as a human being, making audiences feel included, responding to comments factually and in a timely manner, being transparent about affiliations, sometimes not responding to criticism, that lawyers cannot defend in the court of public opinion, measuring only meaningful metrics, and proportionate responses are often best to online criticism. The document provides examples and data to support each of the 10 laws.Ad