Competative structure of industries ..

ŌĆóDownload as PPTX, PDFŌĆó

0 likesŌĆó364 views

threats to your business by these factors i.e suppliers, buyes, subsitutes, potential entries (new entrants in the firm)

1 of 7

Download to read offline

Recommended

Group 2 case studies susie rachel jessica

Group 2 case studies susie rachel jessicadottuta

╠²

Susie, Rachel and Jessica's Case Study: Adopting Porter's 5 Forces with Reference to the Farming Industry5 forces model

5 forces modelkavish dani

╠²

Porter's 5 Forces model analyzes competitive forces in an industry including the threat of new entrants, power of suppliers and buyers, and threat of substitute products. The model outlines factors that influence barriers to entry like economies of scale, product differentiation, and capital requirements. It also describes how concentrated and high-volume buying groups gain bargaining power over sellers, and how connected suppliers of important inputs gain power if substitutes are unavailable.Porter's 3 framework model

Porter's 3 framework modelCherith Rachabattuni

╠²

Porter models are important as a way to evaluate

competitive environment and/or internal

processes.

PorterŌĆÖs concepts form a common language business

professionals use to talk about strategy

Use Porter strategy terminology in discussing how

an industry and companies in the industry

compete.

Three Porter Models:

1) Five forces model

2) Generic Strategies

3) Value ChainVaibhav PurwarPorter's5 forces

Vaibhav PurwarPorter's5 forcesneerajsingh

╠²

This document provides an overview of Porter's Five Forces model for assessing the competitive landscape of an industry. It discusses the five forces: threat of new entrants, threat of substitution, supplier power, buyer power, and rivalry among existing competitors. The document also provides examples of each force and how it can impact an industry. It analyzes factors like barriers to entry, switching costs, concentration of buyers/suppliers, and product differentiation. The objective of Porter's model is to help analyze the external influences and competitive environment within a market.Porter 5 forces model value chain

Porter 5 forces model value chainyusmazy

╠²

This document provides an overview of Porter's 5 Forces model and value chain analysis as planning techniques for analyzing competition. It first explains the 5 forces model and its analysis of competitive rivalry, threat of new entry, bargaining power of suppliers, bargaining power of buyers, and threat of substitute products. It then discusses Porter's value chain analysis and its examination of primary activities like operations, marketing and sales, and support activities like procurement, technology development, and human resource management. The document aims to outline these strategic analytical frameworks for understanding an industry's structure and a company's competitive strengths and weaknesses.Michael porter 5 force model

Michael porter 5 force modelNarsee Monjee Institute of Management Studies

╠²

This document summarizes Michael Porter's Five Forces model of competition. It was developed by Michael Porter to analyze industry structure and competition. The five competitive forces are: the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, the threat of substitute products, and competitive rivalry between existing competitors. The document explains each of these forces and factors that influence the degree of each force within an industry.Porter

PorterSahil Grover

╠²

The document discusses Michael Porter's five forces model for analyzing industry competition and profitability. It outlines the five competitive forces as the threat of new entrants, the bargaining power of suppliers and buyers, the threat of substitute products, and rivalry among existing competitors. It then provides more details on analyzing industry concentration, barriers to entry, and the bargaining power within a industry's supply chain.External analysis

External analysisYasir Sheikh

╠²

The document discusses external analysis for understanding an industry's competitive environment. It defines key concepts like industry, sector, strategic groups. It also explains Porter's five forces model for analyzing competitive forces that shape an industry - threat of new entry, rivalry among existing firms, bargaining power of buyers and suppliers, threat of substitutes. Finally, it discusses how the general environment/macro factors like political, economic, social and technological aspects (PEST analysis) can impact Porter's five forces.Porter's 5 Forces Model

Porter's 5 Forces ModelBrainware University

╠²

Porter's 5 Forces model analyzes five competitive forces that shape an industry: the bargaining power of suppliers and customers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. The document provides an overview of Porter's model and describes the five forces and factors that determine the level of competition within each force.Five force.pptx

Five force.pptxKevalModi10

╠²

The document discusses Porter's five forces model of competition. It analyzes the five competitive forces that determine an industry's profitability: 1) threat of new entry, 2) power of suppliers, 3) power of buyers, 4) threat of substitute products, and 5) rivalry among existing competitors. For each force, it identifies factors that influence the intensity of competition from that force. For example, for the threat of entry it discusses barriers like economies of scale, switching costs, and access to distribution channels that make entry more difficult.The Five Forces Model by Michael E. Porter

The Five Forces Model by Michael E. PorterJeffery Chong

╠²

This document summarizes Michael Porter's five forces model for analyzing competition within an industry. The five competitive forces are: the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, the threat of substitute products or services, and the rivalry among existing competitors. For each force, the document provides a brief explanation of how it is assessed and when it presents a high or low threat within an industry.Porter's Five Forces Model - Analysing Competiton

Porter's Five Forces Model - Analysing Competitontutor2u

╠²

Porter's Five Forces model is a popular analytical framework for assessing the nature of competition in a market. This presentation provides an overview of the model.Mba case analysis pestel 5 forces 2015

Mba case analysis pestel 5 forces 2015Stephen Ong

╠²

This document provides an overview of methods for assessing the external business environment, including PESTEL analysis and Porter's Five Forces model. It discusses using these tools to discover threats and opportunities, understand industry competition, and make informed strategic choices. Porter's Five Forces model analyzes five competitive forces that shape industry competition: the threat of new entrants, power of suppliers and buyers, threat of substitutes, and industry rivalry. It also discusses a sixth force of complementors. The document provides examples and outlines factors that influence the competitive forces.Michael Porter's 5 forces model

Michael Porter's 5 forces modelMC Tubera

╠²

Michael Porter developed the Five Forces model for analyzing industry competition and profitability. The five competitive forces are: 1) rivalry among existing competitors, 2) threat of new entry, 3) threat of substitute products, 4) bargaining power of suppliers, and 5) bargaining power of buyers. The model helps evaluate an industry's attractiveness by examining the strength of each force and impact on profitability. Determinants that influence the competitive forces are also identified such as barriers to entry, supplier/buyer concentration, and product differentiation.Porter's 5 forces model

Porter's 5 forces modelShiva Suryavanshi

╠²

Michael Porter developed the Five Forces model in the 1970s to analyze industry profitability. The model examines five competitive forces: threat of new entry, power of suppliers, power of buyers, threat of substitutes, and rivalry among existing competitors. Porter argued that by understanding these forces, companies can identify whether industries are attractive to compete in and determine appropriate strategies for improving profitability. The model helps explain why some industries are more profitable than others due to barriers that protect them from competition.Porter's five forces

Porter's five forcesDrMunishTiwari

╠²

Michael Porter's Five Forces model analyzes competitive rivalry and industry profitability. The model examines five forces: the threat of new entrants, the power of suppliers and buyers, the threat of substitute products, and the intensity of rivalry among existing competitors. The model suggests that the collective strength of these forces determines the ultimate profit potential of an industry.5 forces

5 forcesWahab Tanha

╠²

Michael Porter's Five Forces model analyzes competitive rivalry and its intensity within an industry. The model identifies five forces that determine the competitive intensity and attractiveness of an industry: the threat of new entrants, the threat of substitute products or services, the bargaining power of buyers, the bargaining power of suppliers, and the intensity of rivalry among existing competitors. Porter's framework suggests that by understanding these forces, companies can identify existing strengths and weaknesses and potential opportunities and threats in an industry.5 forces of model Michael proter

5 forces of model Michael proterVipin Sharma

╠²

force is very important so b careful about ur life and force ur dream, what u want and wat u want to achive... life alwayz in diffrent trackTopic2 Str Analysis

Topic2 Str Analysisguest8fdbdd

╠²

This document summarizes key aspects of analyzing a company's external environment, including the macroenvironment, industry environment, and competitive forces. It discusses Porter's five forces model and how to assess the competitive intensity and attractiveness of an industry based on factors like rivalry, threat of new entry and substitution, and bargaining powers of suppliers and buyers. Key drivers of change and their impact on competitive dynamics are also addressed.External and internal enviornment (management)

External and internal enviornment (management)TouQeer Ali Abbasi

╠²

This document discusses the external and internal factors that influence managers and organizations. It describes Porter's five forces model of competition and introduces the general environment that organizations operate within, including technological, sociocultural, demographic, macroeconomic, political/legal, and international forces. The internal environment of an organization includes its culture, human capital, resources, and organizational structure. Managers must understand these external and internal factors to effectively lead their organizations.5 forces

5 forcesbhaveshm

╠²

Michael Porter developed the Five Forces model in the 1970s to analyze industry profitability and competitive intensity. The model examines five forces: the threat of new entrants, the power of suppliers and buyers, the threat of substitute products, and the intensity of rivalry among existing competitors. Porter argued that understanding these forces could help determine an industry's weaknesses and identify potential opportunities for competitive advantage. The model helps explain why some industries are more profitable than others and allows companies to assess the attractiveness of an industry.Five force

Five forceUlsah T N

╠²

According to Michael Porter, the competitiveness of an industry is determined by five forces: the threat of new entrants, the power of suppliers and buyers, the threat of substitutes, and the intensity of rivalry among existing competitors. Porter identified these five forces that shape every industry and market. A company's corporate strategy should aim to modify these competitive forces to improve the company's position within the industry.Porters 5 force model

Porters 5 force model karangoyal972

╠²

Michael Porter developed the Five Forces model for analyzing industry competition and profitability. The five competitive forces are the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, the threat of substitute products, and the intensity of rivalry among existing competitors. The model helps understand an industry's structure and weaknesses to develop strategies. It was applied to analyze Coca-Cola, identifying traditional competitors, potential new entrants, substitute drinks, supplier power over ingredients, and buyers' combined purchase power as key competitive forces.607f4627e883654ac4ea0199_Porters 5 Forces.pdf

607f4627e883654ac4ea0199_Porters 5 Forces.pdfKiran Dubb

╠²

This document provides an overview of Porter's Five Forces model for analyzing industry competition and profitability. It describes the five competitive forces as the bargaining power of suppliers and customers, the threat of new entrants and substitutes, and the intensity of rivalry between existing competitors. Factors that influence each force are also outlined. The document explains how the model can be used for static industry analysis, dynamic analysis accounting for changes over time, and identifying options for improving a company's position within an industry by influencing the competitive forces.607f4627e883654ac4ea0199_Porters 5 Forces.pdf

607f4627e883654ac4ea0199_Porters 5 Forces.pdfKiran Dubb

╠²

This document provides an overview of Porter's Five Forces model for analyzing industry competition and profitability. It describes the five competitive forces as the bargaining power of suppliers and customers, the threat of new entrants and substitutes, and the intensity of rivalry between existing competitors. Factors that influence each force are also outlined. The document explains how the model can be used for static industry analysis, dynamic analysis accounting for changes over time, and identifying options for improving a company's position within an industry by influencing the competitive forces.Sm ii

Sm iisiva kumar

╠²

The document discusses analyzing a firm's environment and competitors. It covers analyzing a firm's mega, micro, and relevant environments. It also discusses SWOT analysis, Porter's five forces model, and competitor analysis. The purpose is to understand opportunities/threats in the external environment, industry competition, and competitors' strategies to develop an effective strategy.PorterŌĆÖs five forces model.pptx

PorterŌĆÖs five forces model.pptxAdityaMishra105898

╠²

Porter's five forces model analyzes the competitive intensity and profitability of an industry by examining five forces: the threat of substitute products or services, the threat of established rivals, the threat of new entrants, the bargaining power of suppliers, and the bargaining power of customers. These forces determine the microenvironment that affects a company's ability to serve its customers and earn profits. The five forces framework is used to analyze factors like competitive rivalry, suppliers' and customers' negotiating power, and the threat of substitutes and new competitors entering the market.Porte's Five Forces Model

Porte's Five Forces ModelMariamKhan120

╠²

Porte's Five Forces Model analysis is an important tool for understanding the forces that shape competition within an industry.DellŌĆÖs move final ppt b2 b

DellŌĆÖs move final ppt b2 bdivyanshi dayalani

╠²

Dell transitioned from a business-to-consumer (B2C) model to a business-to-business (B2B) model. Some key factors in Dell's transition included adopting a direct sales model to build customized PCs according to customer needs using a just-in-time pull system. This allowed Dell to reduce inventory costs and move components out of warehouses quickly. While B2B transactions involve more complex decision making and information exchange than B2C, Dell was able to simplify the B2B purchasing process by connecting to customers' ERP systems. To succeed in the B2B market, Dell focused on maximizing customer relationships, providing highly detailed content, managing longer sales cycles, and establishing brandCrm

Crm divyanshi dayalani

╠²

This presentation compares the customer relationship management practices of Pantaloons and Shoppers Stop, two leading Indian retailers. Both companies use CRM software tools like SAP and JDA to track customer purchases and implement loyalty programs. Pantaloons utilizes strategies like Fashion Friday discounts and instant rewards to encourage repeat visits. Shoppers Stop focuses on customer convenience and their exclusive First Citizen membership for privileged customers. The presentation evaluates the CRM strategies of both companies and provides suggestions to further enhance customer relationship management.More Related Content

Similar to Competative structure of industries .. (20)

Porter's 5 Forces Model

Porter's 5 Forces ModelBrainware University

╠²

Porter's 5 Forces model analyzes five competitive forces that shape an industry: the bargaining power of suppliers and customers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. The document provides an overview of Porter's model and describes the five forces and factors that determine the level of competition within each force.Five force.pptx

Five force.pptxKevalModi10

╠²

The document discusses Porter's five forces model of competition. It analyzes the five competitive forces that determine an industry's profitability: 1) threat of new entry, 2) power of suppliers, 3) power of buyers, 4) threat of substitute products, and 5) rivalry among existing competitors. For each force, it identifies factors that influence the intensity of competition from that force. For example, for the threat of entry it discusses barriers like economies of scale, switching costs, and access to distribution channels that make entry more difficult.The Five Forces Model by Michael E. Porter

The Five Forces Model by Michael E. PorterJeffery Chong

╠²

This document summarizes Michael Porter's five forces model for analyzing competition within an industry. The five competitive forces are: the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, the threat of substitute products or services, and the rivalry among existing competitors. For each force, the document provides a brief explanation of how it is assessed and when it presents a high or low threat within an industry.Porter's Five Forces Model - Analysing Competiton

Porter's Five Forces Model - Analysing Competitontutor2u

╠²

Porter's Five Forces model is a popular analytical framework for assessing the nature of competition in a market. This presentation provides an overview of the model.Mba case analysis pestel 5 forces 2015

Mba case analysis pestel 5 forces 2015Stephen Ong

╠²

This document provides an overview of methods for assessing the external business environment, including PESTEL analysis and Porter's Five Forces model. It discusses using these tools to discover threats and opportunities, understand industry competition, and make informed strategic choices. Porter's Five Forces model analyzes five competitive forces that shape industry competition: the threat of new entrants, power of suppliers and buyers, threat of substitutes, and industry rivalry. It also discusses a sixth force of complementors. The document provides examples and outlines factors that influence the competitive forces.Michael Porter's 5 forces model

Michael Porter's 5 forces modelMC Tubera

╠²

Michael Porter developed the Five Forces model for analyzing industry competition and profitability. The five competitive forces are: 1) rivalry among existing competitors, 2) threat of new entry, 3) threat of substitute products, 4) bargaining power of suppliers, and 5) bargaining power of buyers. The model helps evaluate an industry's attractiveness by examining the strength of each force and impact on profitability. Determinants that influence the competitive forces are also identified such as barriers to entry, supplier/buyer concentration, and product differentiation.Porter's 5 forces model

Porter's 5 forces modelShiva Suryavanshi

╠²

Michael Porter developed the Five Forces model in the 1970s to analyze industry profitability. The model examines five competitive forces: threat of new entry, power of suppliers, power of buyers, threat of substitutes, and rivalry among existing competitors. Porter argued that by understanding these forces, companies can identify whether industries are attractive to compete in and determine appropriate strategies for improving profitability. The model helps explain why some industries are more profitable than others due to barriers that protect them from competition.Porter's five forces

Porter's five forcesDrMunishTiwari

╠²

Michael Porter's Five Forces model analyzes competitive rivalry and industry profitability. The model examines five forces: the threat of new entrants, the power of suppliers and buyers, the threat of substitute products, and the intensity of rivalry among existing competitors. The model suggests that the collective strength of these forces determines the ultimate profit potential of an industry.5 forces

5 forcesWahab Tanha

╠²

Michael Porter's Five Forces model analyzes competitive rivalry and its intensity within an industry. The model identifies five forces that determine the competitive intensity and attractiveness of an industry: the threat of new entrants, the threat of substitute products or services, the bargaining power of buyers, the bargaining power of suppliers, and the intensity of rivalry among existing competitors. Porter's framework suggests that by understanding these forces, companies can identify existing strengths and weaknesses and potential opportunities and threats in an industry.5 forces of model Michael proter

5 forces of model Michael proterVipin Sharma

╠²

force is very important so b careful about ur life and force ur dream, what u want and wat u want to achive... life alwayz in diffrent trackTopic2 Str Analysis

Topic2 Str Analysisguest8fdbdd

╠²

This document summarizes key aspects of analyzing a company's external environment, including the macroenvironment, industry environment, and competitive forces. It discusses Porter's five forces model and how to assess the competitive intensity and attractiveness of an industry based on factors like rivalry, threat of new entry and substitution, and bargaining powers of suppliers and buyers. Key drivers of change and their impact on competitive dynamics are also addressed.External and internal enviornment (management)

External and internal enviornment (management)TouQeer Ali Abbasi

╠²

This document discusses the external and internal factors that influence managers and organizations. It describes Porter's five forces model of competition and introduces the general environment that organizations operate within, including technological, sociocultural, demographic, macroeconomic, political/legal, and international forces. The internal environment of an organization includes its culture, human capital, resources, and organizational structure. Managers must understand these external and internal factors to effectively lead their organizations.5 forces

5 forcesbhaveshm

╠²

Michael Porter developed the Five Forces model in the 1970s to analyze industry profitability and competitive intensity. The model examines five forces: the threat of new entrants, the power of suppliers and buyers, the threat of substitute products, and the intensity of rivalry among existing competitors. Porter argued that understanding these forces could help determine an industry's weaknesses and identify potential opportunities for competitive advantage. The model helps explain why some industries are more profitable than others and allows companies to assess the attractiveness of an industry.Five force

Five forceUlsah T N

╠²

According to Michael Porter, the competitiveness of an industry is determined by five forces: the threat of new entrants, the power of suppliers and buyers, the threat of substitutes, and the intensity of rivalry among existing competitors. Porter identified these five forces that shape every industry and market. A company's corporate strategy should aim to modify these competitive forces to improve the company's position within the industry.Porters 5 force model

Porters 5 force model karangoyal972

╠²

Michael Porter developed the Five Forces model for analyzing industry competition and profitability. The five competitive forces are the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, the threat of substitute products, and the intensity of rivalry among existing competitors. The model helps understand an industry's structure and weaknesses to develop strategies. It was applied to analyze Coca-Cola, identifying traditional competitors, potential new entrants, substitute drinks, supplier power over ingredients, and buyers' combined purchase power as key competitive forces.607f4627e883654ac4ea0199_Porters 5 Forces.pdf

607f4627e883654ac4ea0199_Porters 5 Forces.pdfKiran Dubb

╠²

This document provides an overview of Porter's Five Forces model for analyzing industry competition and profitability. It describes the five competitive forces as the bargaining power of suppliers and customers, the threat of new entrants and substitutes, and the intensity of rivalry between existing competitors. Factors that influence each force are also outlined. The document explains how the model can be used for static industry analysis, dynamic analysis accounting for changes over time, and identifying options for improving a company's position within an industry by influencing the competitive forces.607f4627e883654ac4ea0199_Porters 5 Forces.pdf

607f4627e883654ac4ea0199_Porters 5 Forces.pdfKiran Dubb

╠²

This document provides an overview of Porter's Five Forces model for analyzing industry competition and profitability. It describes the five competitive forces as the bargaining power of suppliers and customers, the threat of new entrants and substitutes, and the intensity of rivalry between existing competitors. Factors that influence each force are also outlined. The document explains how the model can be used for static industry analysis, dynamic analysis accounting for changes over time, and identifying options for improving a company's position within an industry by influencing the competitive forces.Sm ii

Sm iisiva kumar

╠²

The document discusses analyzing a firm's environment and competitors. It covers analyzing a firm's mega, micro, and relevant environments. It also discusses SWOT analysis, Porter's five forces model, and competitor analysis. The purpose is to understand opportunities/threats in the external environment, industry competition, and competitors' strategies to develop an effective strategy.PorterŌĆÖs five forces model.pptx

PorterŌĆÖs five forces model.pptxAdityaMishra105898

╠²

Porter's five forces model analyzes the competitive intensity and profitability of an industry by examining five forces: the threat of substitute products or services, the threat of established rivals, the threat of new entrants, the bargaining power of suppliers, and the bargaining power of customers. These forces determine the microenvironment that affects a company's ability to serve its customers and earn profits. The five forces framework is used to analyze factors like competitive rivalry, suppliers' and customers' negotiating power, and the threat of substitutes and new competitors entering the market.Porte's Five Forces Model

Porte's Five Forces ModelMariamKhan120

╠²

Porte's Five Forces Model analysis is an important tool for understanding the forces that shape competition within an industry.More from divyanshi dayalani (12)

DellŌĆÖs move final ppt b2 b

DellŌĆÖs move final ppt b2 bdivyanshi dayalani

╠²

Dell transitioned from a business-to-consumer (B2C) model to a business-to-business (B2B) model. Some key factors in Dell's transition included adopting a direct sales model to build customized PCs according to customer needs using a just-in-time pull system. This allowed Dell to reduce inventory costs and move components out of warehouses quickly. While B2B transactions involve more complex decision making and information exchange than B2C, Dell was able to simplify the B2B purchasing process by connecting to customers' ERP systems. To succeed in the B2B market, Dell focused on maximizing customer relationships, providing highly detailed content, managing longer sales cycles, and establishing brandCrm

Crm divyanshi dayalani

╠²

This presentation compares the customer relationship management practices of Pantaloons and Shoppers Stop, two leading Indian retailers. Both companies use CRM software tools like SAP and JDA to track customer purchases and implement loyalty programs. Pantaloons utilizes strategies like Fashion Friday discounts and instant rewards to encourage repeat visits. Shoppers Stop focuses on customer convenience and their exclusive First Citizen membership for privileged customers. The presentation evaluates the CRM strategies of both companies and provides suggestions to further enhance customer relationship management.Dcm

Dcmdivyanshi dayalani

╠²

This document provides information on Samsung and LG, two major electronics companies in India. It outlines their histories, product portfolios, financial details, and distribution channel strategies. Key findings from a survey of 40 consumers in Delhi on satisfaction with Samsung and LG are also presented. The document concludes with recommendations for both companies, such as LG reversing its product strategy and Samsung focusing on fewer product lines.Group 7 (sm makemytrip)

Group 7 (sm makemytrip)divyanshi dayalani

╠²

The document discusses service marketing in the Indian travel and tourism industry. It provides an overview of the large and growing industry in India, as well as details about Make My Trip, a leading online travel company. It then discusses trends, problems faced by the industry, key customer touchpoints, the marketing mix, and opportunities for improvement based on a SERVQUAL analysis. The recommendations focus on improving the digital experience, empowering employees, enhancing tangibility and accuracy to increase reliability.Financial analysis

Financial analysisdivyanshi dayalani

╠²

This document analyzes the financial statements of Balaji Telefilms. It discusses key ratios such as DOL, DFL, debt-equity ratio, and interest coverage ratio. It finds that Balaji Telefilms has a high DOL of 9.01% indicating volatile earnings, but nil debt-equity and low interest coverage ratios showing the company relies mainly on equity financing and has little debt. The document also analyzes the company's working capital, profit margins, and dividend declared.Britannia group- 11

Britannia group- 11divyanshi dayalani

╠²

This document provides an overview of Britannia Industries, a leading Indian FMCG company. It discusses Britannia's product portfolio including biscuits, bread and dairy products. The marketing mix of 4Ps - Product, Price, Place and Promotion strategies are described. Segmentation, targeting and positioning approaches are outlined focusing on demographic and behavioral segments. A BCG matrix shows the cash cow and star products. Finally, a SWOT analysis is presented and recommendations are made to focus on new product categories, pricing and international expansion.Introduction of domino pdf

Introduction of domino pdfdivyanshi dayalani

╠²

An organizational behavior of domino's & pizza hut. it includes leadership, culture, and structure followed by both organizationsPantaloons 2016

Pantaloons 2016divyanshi dayalani

╠²

Pantaloons is a leading Indian retail brand owned by Aditya Birla Group. It has over 168 stores across India selling apparel, footwear, accessories and other products. Pantaloons targets the growing middle income segment in India. It uses segmentation strategies like demography, income, lifestyle to target different customer groups. The company aims to increase its market share through variety of products, affordable prices and proper promotion. culture of domino's and pizza hut

culture of domino's and pizza hutdivyanshi dayalani

╠²

Domino's and Pizza Hut are two large pizza chains. Domino's was founded in 1960 in Michigan and now operates globally. It is a public company led by CEO J. Patrick Doyle. Pizza Hut was founded in 1958 in Kansas and is now a subsidiary of Yum! Brands. It has over 13,000 locations worldwide excluding China and India. Both companies emphasize cultural values like teamwork, communication, and customer service while striving to provide quality food products.Pantaloons final 2016

Pantaloons final 2016divyanshi dayalani

╠²

Pantaloons is a leading Indian retail brand that deals in lifestyle apparel and accessories. It has over 168 stores across India and targets the middle income demographic with quality products at affordable prices. The document outlines Pantaloons' company description, market analysis, marketing strategies around segmentation, targeting, positioning, and the marketing mix, as well as budgets, controls, and action plans to increase market share.Financial analysis

Financial analysisdivyanshi dayalani

╠²

The document discusses financial analysis and key financial statements. Financial analysis involves evaluating businesses and projects to assess their suitability for investment. It entails examining a company's income statement, balance sheet, and cash flow statement to analyze past and future performance. The balance sheet lists assets, liabilities, and equity. The income statement shows revenues, expenses, and profits. The cash flow statement breaks cash flows into operating, investing, and financing activities. Financial ratios are used to analyze the information in financial statements and measure profitability, asset utilization, and liquidity.cheques

chequesdivyanshi dayalani

╠²

This document defines a cheque and describes its key parts and types. A cheque is a written order from a depositor to their bank requiring the bank to pay a specified sum to the payee or bearer. The key parts of a cheque are the drawer, drawee, payee, and amount. Cheques can be either bearer cheques, which are payable to whoever holds the cheque, or order cheques, which are payable only to the specified payee. Cheques can also be crossed, with a general crossing preventing counter payment and requiring deposit only, or a special crossing specifying payment to a particular bank.Recently uploaded (20)

Comments on Franchise and License Parts I and II.pdf

Comments on Franchise and License Parts I and II.pdfBrij Consulting, LLC

╠²

Overview: Carried forward from the ŌĆ£Licensing for Car and Home Parts I&IIŌĆØ document discusses the financial performance, licensing, and innovative engineering of glass cars and home applications with glass and steel combined at the granular level of topology. This document ŌĆ£Franchise and Licenses Parts 1&IIŌĆØ discusses licensing, franchise costs, and the development of glass homes and vehicles through innovative engineering, with extensive reporting and analysis.Securiport Gambia - Border Solutions Security Group

Securiport Gambia - Border Solutions Security GroupSecuriport Gambia

╠²

Securiport╠²Gambia is a civil aviation and intelligent immigration solutions provider founded in 2001. The company was created to address security needs unique to todayŌĆÖs age of advanced technology and security threats. Lessons Learnt - reach for the gold stars!.pptx

Lessons Learnt - reach for the gold stars!.pptxJon Stephenson

╠²

Embarking on a new change initiative without checking earlier lessons learnt is like going into an exam without practising past papers or doing any revision. You might occasionally get away with it but youŌĆÖre more likely to concede that youŌĆÖve made a schoolboy error!

I've summarised my thoughts on a slide - I hope you find it useful as a cheat sheet!

Please use the following link to check out my full LinkedIn article:

https://www.linkedin.com/pulse/lessons-learnt-reach-gold-stars-jon-stephenson-wf62eHOW TO HIRE A GENUINE CRYPTO RECOVERY SERVICE CONTACT SPARTAN TECH GROUP RETR...

HOW TO HIRE A GENUINE CRYPTO RECOVERY SERVICE CONTACT SPARTAN TECH GROUP RETR...derricklucero76090

╠²

All the time, I had believed in networking, but I never knew that a local crypto meetup would save me from financial disaster. Discussion at the event ranged from trading strategies to security tips, but one name cropped up repeatedly that sounded impressive: SPARTAN TECH GROUP RETRIEVAL. Many spoke about how that service had rescued them from lost wallets, forgotten passwords, and even cyber-attacks. I filed that away mentally but never thought I'd find myself in that position. That changed just weeks later. One morning, I went into my Bitcoin wallet and saw suspicious activity. My heart sank as I realized that $180,000 in crypto was on the line. Someone had access, and if I didn't act fast, I'd lose everything. Panic set in, and I scrambled to figure out how it happened: had I clicked a phishing link, was my private key compromised? No matter the cause, I needed help. And fast. That's when I remembered the crypto meetup. I scrolled through my notes and found SPARTAN TECH GROUP RETRIEVAL's name. With no time to waste, I sent a reply-my anxious and desperate words spilling into one frenetic sentence. They responded very fast and professionally. They immediately initiated an investigation into my wallet's transaction history and security logs. They were able to trace the breach and lock it, trying not to be late in recovering the stolen money. Then they worked around the clock for several days, coordinating tracking on the blockchain, forensic data recovery, and reinforcements of security. I barely slept, but at each and every stage, they kept reassuring me. Then came that call I was praying for: They had recovered my funds. Speechless. Relieved. Grateful. But SPARTAN TECH GROUP RETRIEVAL didn't just stop with the recovery, teaching me means of security practices, helped fortify the defense around my wallet, and making sure this does not happen again. I consider it one of the best I have done so far-attending that crypto meet-up. I might never have heard of SPARTAN TECH GROUP RETRIEVAL if it had not been that night, or the outcome worse. Now I do my best to spread the word. For a reason is their reputation preceding them, and personally I can vouch for their expertise, efficiency, and reliability.

SPARTAN TECH GROUP RETRIEVAL CONTACT INFO:

Email: spartantech (@) cyber services . com OR support (@) spartantechgroupretrieval. org

Website : h t t p s : / / spartantechgroupretrieval. org

WhatsApp: +1╠²(971) 487 - 3538

Telegram: +1 (581) 286 - 8092HIRE THE MOST EXPERIENCE BTC SCAM RECOVERY SERVICE- CONTACT SALVAGE ASSET REC...

HIRE THE MOST EXPERIENCE BTC SCAM RECOVERY SERVICE- CONTACT SALVAGE ASSET REC...petradiego352

╠²

CONTACT INFO-- WEBSITE.......https://salvageassetrecovery.com

TELEGRAM---@Salvageasset

Email...Salvageass...@alumni.com

WhatsApp+ 1 8 4 7 6 5 4 7 0 9 6

Life is amusingly funny. One minute I was waiting for my morning coffee, and the next, I was eavesdropping on a barista raving about Salvage Asset Recovery like they were actual superheroes.

At the time, I laughed it off. I was under the impression that I would never need such crypto recovery services. My wallet was safe, my security was on solid grounds-or so it seemed.

That all changed one week later. I had been planning to transfer some Bitcoin when, out of nowhere, my wallet rejected my credentials. Incorrect password.

I tried again. And again. Panic set in.

My $330,000 was locked away, and for the life of me, I couldn't remember the password. I was sure I had it right, but the wallet said otherwise. That's when I remembered the barista's enthusiastic endorsement of Salvage Asset Recovery; desperate, I looked them up and decided to reach out. From the very first message, their team showed patience, understanding, and a great deal of professionalism, assuring me that I wasn't the first-not to say the last-person in the world who had lost access to his wallet because he forgot the password. Their confidence set me at ease, but I couldn't help it: I was nervous. Was my Bitcoin gone forever? Not a chance. Over the succeeding days, their experts worked through different advanced decryption techniques to crack my forgotten password. They swam through the security layers, tested all sorts of possible variations, and-miraculously-got me back in. It felt like I had won the lottery when I saw my balance restored. I must have sounded just like that barista, singing Salvage Asset Recovery's praises to anyone who would listen, as the relief was overwhelming. They didn't just recover my funds but also gave me practical advice on password management, securing my crypto, and avoiding similar disasters in the future. Nowadays, every time I pass that coffee shop, I make sure to leave a fat tipŌĆöjust because, if it wasn't for that conversation, I could still be locked out of my Bitcoin.

Lesson learned: Always double-check your passwords. And if you ever find yourself locked out of your crypto, Salvage Asset Recovery is the name to remember.Clear the Air How to Choose the Perfect Extractor Fan.pptx

Clear the Air How to Choose the Perfect Extractor Fan.pptxMeteor Electrical

╠²

Buy kitchen extractor fan online from Meteor Electrical. We offer a wide range of high-quality, low energy fan for sale. Upgrade your kitchen today!Biography of Vincenzo Carnovale

Biography of Vincenzo Carnovale Vincenzo Carnovale

╠²

As a venture capitalist, Carnovale works closely with the companies he invests in to ensure that they are positioned for success. He sees himself as an investor and a strategic partner, offering business advice, industry insights, and operational expertise. He aims to help businesses navigate growth challenges and take advantage of opportunities. Whether guiding business strategy, helping to refine product offerings, or supporting marketing and sales efforts, his active involvement plays a key role in the success of the ventures he supports.Mac to Windows QuickBooks File Conversion Guide

Mac to Windows QuickBooks File Conversion Guidedennislopez2310

╠²

To guarantee compatibility and data integrity, converting QuickBooks files from Mac to Windows needs to be done in a systematic manner. This entails exporting the Mac file as a.qbb backup, updating QuickBooks, and confirming and restoring data. After that, the file is moved to a Windows machine, restored in QuickBooks for Windows, and its discrepancies are examined. To guarantee correctness after conversion, users need to review financial reports, customer lists, and settings. Verifying data and eliminating special characters can fix common problems like missing transactions or format errors. Using expert conversion services or adhering to a thorough step-by-step instruction is advised for a smooth relocation.Robotics & Coding: Unlocking Innovation and Future Technology

Robotics & Coding: Unlocking Innovation and Future Technologyaeroboticsmarketing0

╠²

Explore the exciting world of robotics and coding, where innovation meets technology. Learn how programming and automation drive advancements in AI, engineering, and everyday applications. From beginners to experts, dive into hands-on projects, STEM education, and career opportunities in this ever-evolving field. Unlock the future by mastering robotics and coding today! https://aeroboticsglobal.com/

Library display February-March Commemorating New Zealand

Library display February-March Commemorating New ZealandNZSG

╠²

Our collections are a treasure trove of information for New Zealanders from all backgrounds and heritages.Vue vs React In-Depth Comparison of 2 Leading JavaScript Frameworks

Vue vs React In-Depth Comparison of 2 Leading JavaScript FrameworksPixlogix Infotech

╠²

React or VueŌĆöwhich one should you choose? Both are powerful JavaScript frameworks, but they cater to different needs. React is ideal for large-scale applications with high flexibility, while Vue is lightweight and great for quick development. If you're looking for a comparison on performance, scalability, and ease of use, our latest blog breaks it all down! Stay ahead in web developmentŌĆöread now and make the right choice! good material for managerial students to know more about management

good material for managerial students to know more about managementMinbiyewMekonnen

╠²

Management theoryHeather Unruh .

Heather Unruh .Heather Unruh

╠²

As a Nantucket-based artist, Heather loves to create original copper designs that reflect what makes Nantucket unforgettable. From the shape of our beautiful island to the treasures found on her sandy shores and in her surrounding waters, Heather finds herself constantly wandering in awe and excited to express what she has just seen.

HIRE A HACKER TO RECOVER SCAMMED CRYPTO// CRANIX ETHICAL SOLUTIONS HAVEN

HIRE A HACKER TO RECOVER SCAMMED CRYPTO// CRANIX ETHICAL SOLUTIONS HAVENduranolivia584

╠²

One night, deep within one of those YouTube rabbit holes-you know, the ones where you progress from video to video until you already can't remember what you were searching for-well, I found myself stuck in crypto horror stories. I have watched people share how they lost access to their Bitcoin wallets, be it through hacks, forgotten passwords, glitches in software, or mislaid seed phrases. Some of the stupid mistakes made me laugh; others were devastating losses. At no point did I think I would be the next story. Literally the next morning, I tried to get to my wallet like usual, but found myself shut out. First, I assumed it was some sort of minor typo, but after multiple attempts-anything I could possibly do with the password-I realized that something had gone very wrong. $400,000 in Bitcoin was inside that wallet. I tried not to panic. Instead, I went back over my steps, checked my saved credentials, even restarted my device. Nothing worked. The laughter from last night's videos felt like a cruel joke now. This wasn't funny anymore. It was then that I remembered: One of the videos on YouTube spoke about Cranix Ethical Solutions Haven. It was some dude who lost his crypto in pretty similar circumstances. He swore on their expertise; I was out of options and reached out to them. From the very moment I contacted them, their staff was professional, patient, and very knowledgeable indeed. I told them my case, and then they just went ahead and introduced me to the plan. They reassured me that they have dealt with cases similar to this-and that I wasn't doomed as I felt. Over the course of a few days, they worked on meticulously analyzing all security layers around my wallet, checking for probable failure points, and reconstructing lost credentials with accuracy and expertise. Then came the call that changed everything: ŌĆ£Your funds are safe. YouŌĆÖre back in.ŌĆØ I canŌĆÖt even put into words the relief I felt at that moment. Cranix Ethical Solutions Haven didnŌĆÖt just restore my walletŌĆöthey restored my sanity. I walked away from this experience with two important lessons:

1. Never, ever neglect a wallet backup.

2. If disaster strikes, Cranix Ethical Solutions Haven is the only name you need to remember.

If you're reading this and thinking, "That would never happen to me," I used to think the same thing.╠²Until╠²it╠²did.

EMAIL: cranixethicalsolutionshaven at post dot com

WHATSAPP: +44 (7460) (622730)

TELEGRAM: @ cranixethicalsolutionshavenBirth Flowers for the Month of March: Daffodil & Jonquil

Birth Flowers for the Month of March: Daffodil & Jonquilallen flower

╠²

Discover the Birth Flowers for the Month of MarchŌĆöDaffodil and Jonquil. These vibrant blooms symbolize renewal, joy, and new beginnings. Learn their meanings and the perfect occasions to gift them. Explore stunning floral arrangements at Flora2000 and send fresh flowers worldwide!

Visit now: https://www.flora2000.com/send-flowers-usa.htmlTran Quoc Bao the first Vietnam joining the prestigiousAdvisory Board of Asia...

Tran Quoc Bao the first Vietnam joining the prestigiousAdvisory Board of Asia...Ignite Capital

╠²

Tran Quoc Bao: A Visionary Leader Shaping the Future of Healthcare

Tran Quoc Bao, the first Vietnamese to join the prestigious Advisory Board of Asian Hospital & Healthcare Management, is a trailblazer in both healthcare and finance. As CEO of Prima Saigon, VietnamŌĆÖs premier international daycare and ambulatory hospital, Bao has set new benchmarks for medical care and innovation, positioning the institution as a leader in Southeast AsiaŌĆÖs healthcare landscape.

BaoŌĆÖs career spans nearly two decades, blending healthcare administration with investment banking expertise. He has held key roles at institutions like City International Hospital, FV Hospital, and TMMC Healthcare, and played an instrumental part in transforming Cao Tang Hospital into VietnamŌĆÖs first Joint Commission International (JCI)-accredited facility. This milestone placed Vietnam firmly on the global healthcare map.

Not just a clinical leader, Bao is also a financial strategist with elite credentialsŌĆöCFA┬«, CMT┬«, CPWA┬«, and FMVA┬«ŌĆöwho has driven over $2 billion in healthcare mergers and acquisitions. His ability to marry medical expertise with financial acumen has redefined healthcare investments in Vietnam and beyond.

BaoŌĆÖs influence extends through his prolific contributions to major publications such as Bloomberg, Forbes, and Voice of America, where his articles on healthcare investment and innovation have made him a sought-after thought leader. His accolades include being named Healthcare Executive of the Year (Vietnam) in 2021 and Medical Tourism Leader of the Year (Japan) in 2021.

His advisory roles with consulting giants like BCG, Bain, and McKinsey have positioned Bao at the forefront of strategic healthcare investments in Asia, ensuring that he continues to shape the future of global healthcare. With his unmatched vision and leadership, Tran Quoc Bao is more than a pioneer; heŌĆÖs a catalyst for change, revolutionizing healthcare on the world stage.HOW TO HIRE A GENUINE CRYPTO RECOVERY SERVICE CONTACT SPARTAN TECH GROUP RETR...

HOW TO HIRE A GENUINE CRYPTO RECOVERY SERVICE CONTACT SPARTAN TECH GROUP RETR...derricklucero76090

╠²

Competative structure of industries ..

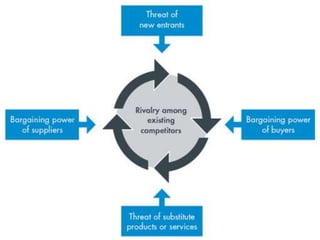

- 1. Competative structure of industries PorterŌĆÖs five factors model (Michael E Porter)

- 3. Components of the model 1) Threat of new entrants 2) Threats of subsitutes 3) Bargaining powers of suppliers 4) Bargaining powers of buyers

- 4. Threats of the subsitutes when 1) If the subsitute is cheaper than inustries product 2) If the attributes , performance and fuctions of the subsitute is superior 3) Quality of the subsitute is superior

- 5. Suppliers find them in a powerful situation when ŌĆóThere are only a few large suppliers ŌĆóThe resource they supply is scarce ŌĆóThe cost of switching to an alternative supplier is high ŌĆóThe product is easy to distinguish and loyal customers are reluctant to switch ŌĆóThe supplier can threaten to integrate vertically ŌĆóThe customer is small and unimportant ŌĆóThere are no or few substitute resources available

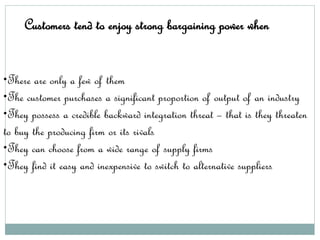

- 6. Customers tend to enjoy strong bargaining power when ŌĆóThere are only a few of them ŌĆóThe customer purchases a significant proportion of output of an industry ŌĆóThey possess a credible backward integration threat ŌĆō that is they threaten to buy the producing firm or its rivals ŌĆóThey can choose from a wide range of supply firms ŌĆóThey find it easy and inexpensive to switch to alternative suppliers