Intro To Supp Disability Plans Ufg

Download as PPT, PDF1 like400 views

An advanced concept of integrating non-cancellable disability income to group long term disablity. Integrate into either of the following (Traditional Combo; Traditional Combo Plus; Reverse Combo Plan; Split Benefit Plan)

1 of 18

Download to read offline

Recommended

Checklist and decisions for employers facing healthcare law

Checklist and decisions for employers facing healthcare lawjchrishodge

╠²

The document provides an overview of key provisions and deadlines employers need to be aware of under the Affordable Care Act. It outlines requirements in 2011-2014, including coverage of adult children up to age 26, prohibitions on pre-existing condition exclusions and lifetime limits. It also details the employer mandate beginning in 2014, penalties for non-compliance, and considerations for maintaining or starting to provide group health coverage. Employers are advised to carefully analyze their specific situations and run the numbers to determine the most cost-effective approach.Impact of CEO Compensation Structure on M&A Performance

Impact of CEO Compensation Structure on M&A PerformanceAnton Zhukov

╠²

Master Thesis Defense. Topic "Impact of CEO Compensation Structure on M&A Performance" (Rotterdam School of Management/ Erasmus University)Group Disability Presentation

Group Disability PresentationDerek Eskam

╠²

The document discusses group disability insurance from Northwestern Mutual. It highlights key aspects to consider including the strength of the insurance contract, definitions used, costs, the financial strength of the insurance company, and optional benefits. Northwestern Mutual aims to provide comprehensive coverage through clear contract language and benefits like lifetime security benefits that extend coverage beyond the normal benefit period.Tribal Worker Benefits and the Power Of 5 Presentation

Tribal Worker Benefits and the Power Of 5 Presentationjdwandassociates

╠²

Tribal Worker Benefits is changing the way tribes and their enterprises handle their workers\' comp and other employee related expences.Remuneration of ceos

Remuneration of ceosChandan Arora

╠²

The document discusses CEO remuneration in India and internationally. It notes that average CEO salary in India is Rs. 3.3 million per year, while in the US it is $748,805. The highest paid CEOs in India make over Rs. 50 crore annually. CEO pay includes salary, bonuses, stock options, and other compensation. Boards of directors are responsible for setting CEO pay but there are debates around whether CEOs are overpaid and if high pay is linked to company and stock performance. Transparent reporting of CEO compensation is important for good corporate governance.Business Owner Insurance Planning By Mark Simon

Business Owner Insurance Planning By Mark SimonMark L. Simon

╠²

The document discusses various business planning strategies for owners, including benefits for key employees like supplemental retirement plans, executive bonus plans, and split-dollar insurance. It also covers benefits for all employees like qualified pension and health plans. The document provides an overview of different business entity structures and considerations for choosing life insurance, buy-sell agreements, disability insurance, and estate planning.Ceo compensation controversy

Ceo compensation controversyDipu Thomas joy

╠²

The document discusses the controversy around CEO compensation. It notes that while CEOs make strategic decisions that impact company performance, very high compensation can create issues like lack of team performance and loyalty when there is a large gap compared to lower level employees. It suggests that CEO pay should be tied to company performance and layoffs, and that independent committees should set compensation to address these issues. Overall performance depends on both CEO leadership and external factors, so stock price alone can't determine a CEO's contribution. Uniform compensation across industries is impractical given varying company sizes and CEO roles.Executive Compensation

Executive Compensation4Good.org

╠²

Take this opportunity to learn about identifying and comparing to your competitors, building commitment and employee engagement and developing a total strategy that supports your organizationŌĆÖs mission and strategic plan.

Our webinar is structured to provide not only education but also useful strategies for addressing the many pressures on executive compensation, wages and salaries. Nonprofits are being scrutinized by the IRS, and executive compensation is a staple of all audits. Nonprofit managers and trustees must prepare for public, media, Form 990, IRS and State scrutiny. Wage and salary programs face a difficult economy as they struggle to attract and retain the best talent with scarce dollars.10 Things Credit Union Executives Need to Know about Pensions and 401(k)s (We...

10 Things Credit Union Executives Need to Know about Pensions and 401(k)s (We...NAFCU Services Corporation

╠²

This document discusses 10 things credit union executives need to know about pensions and 401(k) plans. It covers topics such as how interest rates impact defined benefit and defined contribution plans, the risks of bad tax reform proposals, how fiduciary outsourcing can save time and money, and that the primary source of fiduciary risk is plan administration rather than investments. It also discusses how most plans can cut costs by at least 20% through lower fees, ways to run a plan that is above reproach, steps fiduciaries can take to mitigate liability, issues with fee disclosure requirements, the complexity of how pension costs affect financial statements, and developing a proactive plan to terminate a pension in the lowest risk and cost manner.Executive Disability Income Plan

Executive Disability Income Planmdw9588

╠²

Most employees are unaware of the level of disability protection their employers provide and executives' needs are not fully met by traditional group plans. An executive disability income plan can address shortfalls by utilizing both group LTD and individual disability insurance to provide enhanced, portable coverage for executives. This comprehensive strategy provides stronger benefits to attract and retain key talent.Understanding the Affordable Care Act: Should You Pay or Play?

Understanding the Affordable Care Act: Should You Pay or Play?EPAY Systems

╠²

The Affordable Care Act (ObamaCare) is upon us and thereŌĆÖs a lot to do in order to be ready for the employer mandate coming in Jan 2015. It starts with determining if you should pay or play. Jennifer Kraft, gives us an update of where healthcare reform stands now and how to calculate your real cost. SheŌĆÖll also cover: what steps should you be taking right now to determine whether you should pay or play; how can you ensure that youŌĆÖre minimizing the financial impact of the ACA on your business?

Jennifer Kraft of Seyfarth Shaw LLP, will review this pay or play mandate and ways employers can mitigate the financial impact, including:

ŌŚŠAre you even subject to the Affordable Care Act and if you are, what are your options? Which employees must you offer coverage to or pay a penalty? What are the state exchanges and how do they work with the employer mandate?

ŌŚŠHow is the employer penalty calculated?

ŌŚŠHow will the expansion of eligibility for Medicaid in your state affect the employer penalty? How do you discover whether your stateŌĆÖs ruling will impact your employees and who you will need to provide insurance to?

ŌŚŠIf your employee hours vary (i.e., part-time and fluctuating schedule workers in industries such as retail, hospitality, and health care), how do you calculate your ACA liabilities?

ŌŚŠWhat steps should you be taking right now to determine whether you should pay or play? How can you ensure that youŌĆÖre minimizing the financial impact of the ACA on your business?

In addition, EPAY will briefly discuss how a time and labor management system can help you monitor and track the data required to make these decisions and manage the ACA on an ongoing basis. Automated tools from your time-tracking system, such as reports and alerts, will be critical to managing who is eligible and mitigating the risk of non-compliance. For more than 60 years, Seyfarth Shaw has been recognized as one of the ŌĆ£go-toŌĆØ labor and employment firms for business by providing extraordinary, cost-effective results. EPAY Systems, Inc. has joined forces with Seyfarth Shaw to educate employers of distributed labor environments on how compliance risk can be minimized

.Employee Benefits in the Obamacare World & How to Maximize Its Impact

Employee Benefits in the Obamacare World & How to Maximize Its ImpactJoseph Appelbaum

╠²

Are you struggling to understand Obamacare and how it impacts your company? Do you want to learn about how to use employee benefits as a recruitment and retention tool?

This presentation will provide valuable insight into employee benefits in the Obamacare world and how to maximize its impact. Under Obamacare, employers are offered the option to "pay or play." But, for most companies there is no choiceŌĆöthey must ŌĆ£playŌĆØ in order to recruit and retain employees. This not only includes offering health insurance but also life, disability, and the whole spectrum of employee benefits.

Here you'll learn about the impact of Obamacare on the employee benefits mix and employer decision-making process, along with understanding the importance of insurance benefits as a mandatory piece of the total compensation puzzle. Executive compensation

Executive compensationCharan Singh

╠²

This document discusses executive compensation, including its meaning, features, and common components. Executive compensation packages typically include a base salary, allowances, incentives, and perquisites. Companies determine compensation based on external competition, internal equity, and pay for performance. Packages may include salary, bonuses, equity compensation, and benefits like healthcare. Public sector executive pay is often lower than comparable private sector roles.Remuneration of ceos in india

Remuneration of ceos in indiaChandan Arora

╠²

This document discusses CEO remuneration in India. It provides an overview of corporate governance and compensation components. It then lists the highest and lowest paid CEOs in India in 2013-2014. On average, CEOs in India earn 3.3 million rupees per year. The document discusses factors that influence CEO pay such as experience, location, and related job salaries. It also discusses issues around pay inequity, pay for performance, and efforts to reform compensation.Executive compensation main ppt

Executive compensation main pptVincent Wedelich, PE MBA

╠²

This document discusses effective compensation management from GE's perspective. It outlines different types of compensation systems and notes strengths like flexibility but also weaknesses like inequities. It profiles former GE CEO Jack Welch and current CEO Jeffrey Immelt's compensation. It examines the board of director's role in aligning pay with performance and shareholder interests. It also profiles Whole Foods CEO John Mackey and his policy of limiting executive pay to 14 times the average employee. In conclusion, it questions whether CEOs deserve the high levels of pay they receive.Executive Compensation Checklist for New and Experienced Board Members (Credi...

Executive Compensation Checklist for New and Experienced Board Members (Credi...NAFCU Services Corporation

╠²

Looking for an Executive Compensation Checklist for your Credit Union? This presentation serves as a valuable tool for new and experienced board members in pinning down the latest information on new regulations and compensation philosophies associated with creating a successful executive compensation plan. For more info, visit: www.nafcu.org/bfbCase study on executive compensation

Case study on executive compensationAl-Qurmoshi Institute of Business Management, Hyderabad

╠²

1) A union campaign brought executive compensation into the public eye through media coverage, highlighting concerns about high CEO pay.

2) The union's annual awareness campaign aims to build awareness of perceived pay inequities between CEOs and frontline workers, sometimes prompting union formation.

3) The publicity has caused turmoil at Oakwood Lawn, where employees learned their CEO is among the highest paid in the US, despite not receiving a pay increase due to the company's financial challenges.Cash balance workshop 11 12

Cash balance workshop 11 12Brad wexler

╠²

This document summarizes a presentation about cash balance pension plans. It describes how cash balance plans work, their key features and advantages compared to 401(k) plans. It provides examples showing how a cash balance plan could allow a business owner named Joe Smith to contribute over $180,000 to his retirement plan in one year by combining a 401(k) plan with a cash balance plan. The document concludes by identifying common candidates for cash balance plans and encouraging attendees to contact the presenter if interested in establishing a plan before the end of 2012.CEO Compensation Meets Pay for Performance: Emerging Trends for Executive Pay

CEO Compensation Meets Pay for Performance: Emerging Trends for Executive PayIntegrated Healthcare Strategies

╠²

This document discusses trends in CEO compensation for nonprofit hospitals. It summarizes recent media reports that found CEO pay is linked more to factors like hospital size, technology use, and patient satisfaction rather than quality metrics. It then outlines a preliminary study that found a strong correlation between hospital and health system performance on balanced scorecards and CEO compensation. Higher performance was associated with an average 1.1-1.5% rise in direct pay. The document concludes that boards appropriately incentivized cost-cutting in 2012 and acted responsibly to ensure organizational survival during healthcare reform implementation. It provides best practices for compensation committees to establish a rebuttable presumption of reasonableness and protect against executive pay excess.Executive compensation

Executive compensationMateen Altaf

╠²

The document discusses executive compensation at United Bank Limited (UBL) in Pakistan. It provides details on the compensation packages of UBL's highest paid executives. The President and CEO receives an annual remuneration of approximately Rs. 246.5 million, including a monthly salary of Rs. 20 million. The document also reviews UBL's SWOT analysis and concludes that executive compensation is an important tool for organizations to attract, retain, and motivate top managers.Cb overview

Cb overviewJoe Long, CPC, QPFC, QPA, AIF

╠²

- BPAS provides actuarial and pension services including cash balance plans. It has over 3,800 engagements, over $1 trillion in fund administration, and 335 professional employees across the US and Puerto Rico.

- Cash balance plans allow for much higher maximum contributions (up to $200,000/year for a 55-year-old) and tax deferrals compared to a traditional 401(k). They are best for business owners who have higher compensation and want to maximize retirement savings.

- BPAS has expertise in designing and administering combined cash balance and 401(k) plans to maximize savings opportunities within legal limits. Candidates for cash balance plans are businesses where owners can contribute at least 7Checklist and Decisions for Employers Facing Healthcare Law

Checklist and Decisions for Employers Facing Healthcare LawLighthouse Growth Resources

╠²

1. Employers with 50 or more full-time employees face new requirements under the Affordable Care Act in 2014, including providing affordable health insurance or paying penalties.

2. Key deadlines and provisions for employers in 2013 include a $2,500 limit on health care flexible spending accounts, paying a comparative effectiveness fee, and notifying employees about health insurance exchanges.

3. In 2014, employers must ensure any health plans meet requirements around affordability, adequate coverage, and automatic enrollment of new employees within 90 days of hire. Failure to comply could result in tax penalties. case study , Executive compensation: needed incentives, justly deserved, or ...

case study , Executive compensation: needed incentives, justly deserved, or ...Fatima Aljaidi

╠²

business ethics case study about Executive compensation: needed incentives, justly deserved, or just distasteful?Trends in Executive Benefits

Trends in Executive Benefitslbaldevia

╠²

The document discusses trends in executive benefits, including trends in cash and incentive compensation, retirement plans, and equity programs. It provides examples of different types of non-qualified deferred compensation plans, cash bonus plans, long-term incentive plans, and retirement plans that employers can offer executives. The summaries highlight advantages and disadvantages for both employers and executives of these various executive benefit plan types.Health Care Reform Preparedness: An Employer's Pocket Guide

Health Care Reform Preparedness: An Employer's Pocket GuideDenver Metro Small Business Development Center

╠²

In less than one year, major provisions of the Patient Protection and Affordable Care Act are taking effect at state and federal levels, and many of those new provisions will directly impact businesses around the country. At this event, weŌĆÖll present fact-based, non-partisan information thatŌĆÖs important to Colorado business leaders: the timeline of the law and important dates. Ceo Compensation

Ceo CompensationBalancedComp, LLC

╠²

The document discusses executive compensation practices at banks and financial institutions. It covers issues like pay freezes, incentive pay, performance metrics, restrictions on TARP recipients, calls for increased transparency and shareholder votes on compensation. It provides advice on selecting appropriate performance measures and ensuring compensation is tied to achieving goals.Employee benefits

Employee benefitsICAB

╠²

This document discusses employee benefits, including legally required benefits like Social Security, unemployment compensation, workers' compensation, and FMLA. It also discusses voluntary benefits such as various health insurance options, retirement benefits like pensions and 401(k)s, paid time off for vacation and sick leave, survivor benefits, and flexible spending accounts. The goal of benefits is to attract and retain employees while complying with legal regulations.Ceo Presentation

Ceo Presentationlaurajibson

╠²

This document discusses CEO compensation levels and arguments around their fairness. It provides historical data showing CEO pay increasing 340% from 1991-2001, far outpacing average worker pay which rose 36%. Views of justice in wages are examined, including agreement between parties, deservedness based on role, and maximizing utility. Examples are given of both controversial high payouts and profit sharing compensation models. Arguments for and against high CEO pay are outlined. Recommendations are made to tie compensation more closely to performance and restrict stock sales.Backto School Night

Backto School Nightjlunssford

╠²

Ms. Lunsford welcomes parents to Back to School Night and provides information about herself including her teaching experience and contact information. She discusses discipline policies, homework expectations, multiplication tables practice, and classroom website. Parents are encouraged to check Friday folders for tests and homework. Ms. Lunsford also provides her school library information and takes any questions from parents. She thanks parents for their partnership in their child's education and for attending the event.Letthe trumpet sound 2003 version

Letthe trumpet sound 2003 versionguest3e969a

╠²

This document provides an overview of 21st century literacy skills and concepts such as new literacies, information literacy, and guided inquiry that are needed for learning in today's digital age. It discusses models for teaching these skills, including the Big 6 research process and implementing guided inquiry lessons, which structure information seeking while allowing students to learn collaboratively. The document emphasizes that students must develop abilities to critically evaluate online information and sources.More Related Content

What's hot (20)

10 Things Credit Union Executives Need to Know about Pensions and 401(k)s (We...

10 Things Credit Union Executives Need to Know about Pensions and 401(k)s (We...NAFCU Services Corporation

╠²

This document discusses 10 things credit union executives need to know about pensions and 401(k) plans. It covers topics such as how interest rates impact defined benefit and defined contribution plans, the risks of bad tax reform proposals, how fiduciary outsourcing can save time and money, and that the primary source of fiduciary risk is plan administration rather than investments. It also discusses how most plans can cut costs by at least 20% through lower fees, ways to run a plan that is above reproach, steps fiduciaries can take to mitigate liability, issues with fee disclosure requirements, the complexity of how pension costs affect financial statements, and developing a proactive plan to terminate a pension in the lowest risk and cost manner.Executive Disability Income Plan

Executive Disability Income Planmdw9588

╠²

Most employees are unaware of the level of disability protection their employers provide and executives' needs are not fully met by traditional group plans. An executive disability income plan can address shortfalls by utilizing both group LTD and individual disability insurance to provide enhanced, portable coverage for executives. This comprehensive strategy provides stronger benefits to attract and retain key talent.Understanding the Affordable Care Act: Should You Pay or Play?

Understanding the Affordable Care Act: Should You Pay or Play?EPAY Systems

╠²

The Affordable Care Act (ObamaCare) is upon us and thereŌĆÖs a lot to do in order to be ready for the employer mandate coming in Jan 2015. It starts with determining if you should pay or play. Jennifer Kraft, gives us an update of where healthcare reform stands now and how to calculate your real cost. SheŌĆÖll also cover: what steps should you be taking right now to determine whether you should pay or play; how can you ensure that youŌĆÖre minimizing the financial impact of the ACA on your business?

Jennifer Kraft of Seyfarth Shaw LLP, will review this pay or play mandate and ways employers can mitigate the financial impact, including:

ŌŚŠAre you even subject to the Affordable Care Act and if you are, what are your options? Which employees must you offer coverage to or pay a penalty? What are the state exchanges and how do they work with the employer mandate?

ŌŚŠHow is the employer penalty calculated?

ŌŚŠHow will the expansion of eligibility for Medicaid in your state affect the employer penalty? How do you discover whether your stateŌĆÖs ruling will impact your employees and who you will need to provide insurance to?

ŌŚŠIf your employee hours vary (i.e., part-time and fluctuating schedule workers in industries such as retail, hospitality, and health care), how do you calculate your ACA liabilities?

ŌŚŠWhat steps should you be taking right now to determine whether you should pay or play? How can you ensure that youŌĆÖre minimizing the financial impact of the ACA on your business?

In addition, EPAY will briefly discuss how a time and labor management system can help you monitor and track the data required to make these decisions and manage the ACA on an ongoing basis. Automated tools from your time-tracking system, such as reports and alerts, will be critical to managing who is eligible and mitigating the risk of non-compliance. For more than 60 years, Seyfarth Shaw has been recognized as one of the ŌĆ£go-toŌĆØ labor and employment firms for business by providing extraordinary, cost-effective results. EPAY Systems, Inc. has joined forces with Seyfarth Shaw to educate employers of distributed labor environments on how compliance risk can be minimized

.Employee Benefits in the Obamacare World & How to Maximize Its Impact

Employee Benefits in the Obamacare World & How to Maximize Its ImpactJoseph Appelbaum

╠²

Are you struggling to understand Obamacare and how it impacts your company? Do you want to learn about how to use employee benefits as a recruitment and retention tool?

This presentation will provide valuable insight into employee benefits in the Obamacare world and how to maximize its impact. Under Obamacare, employers are offered the option to "pay or play." But, for most companies there is no choiceŌĆöthey must ŌĆ£playŌĆØ in order to recruit and retain employees. This not only includes offering health insurance but also life, disability, and the whole spectrum of employee benefits.

Here you'll learn about the impact of Obamacare on the employee benefits mix and employer decision-making process, along with understanding the importance of insurance benefits as a mandatory piece of the total compensation puzzle. Executive compensation

Executive compensationCharan Singh

╠²

This document discusses executive compensation, including its meaning, features, and common components. Executive compensation packages typically include a base salary, allowances, incentives, and perquisites. Companies determine compensation based on external competition, internal equity, and pay for performance. Packages may include salary, bonuses, equity compensation, and benefits like healthcare. Public sector executive pay is often lower than comparable private sector roles.Remuneration of ceos in india

Remuneration of ceos in indiaChandan Arora

╠²

This document discusses CEO remuneration in India. It provides an overview of corporate governance and compensation components. It then lists the highest and lowest paid CEOs in India in 2013-2014. On average, CEOs in India earn 3.3 million rupees per year. The document discusses factors that influence CEO pay such as experience, location, and related job salaries. It also discusses issues around pay inequity, pay for performance, and efforts to reform compensation.Executive compensation main ppt

Executive compensation main pptVincent Wedelich, PE MBA

╠²

This document discusses effective compensation management from GE's perspective. It outlines different types of compensation systems and notes strengths like flexibility but also weaknesses like inequities. It profiles former GE CEO Jack Welch and current CEO Jeffrey Immelt's compensation. It examines the board of director's role in aligning pay with performance and shareholder interests. It also profiles Whole Foods CEO John Mackey and his policy of limiting executive pay to 14 times the average employee. In conclusion, it questions whether CEOs deserve the high levels of pay they receive.Executive Compensation Checklist for New and Experienced Board Members (Credi...

Executive Compensation Checklist for New and Experienced Board Members (Credi...NAFCU Services Corporation

╠²

Looking for an Executive Compensation Checklist for your Credit Union? This presentation serves as a valuable tool for new and experienced board members in pinning down the latest information on new regulations and compensation philosophies associated with creating a successful executive compensation plan. For more info, visit: www.nafcu.org/bfbCase study on executive compensation

Case study on executive compensationAl-Qurmoshi Institute of Business Management, Hyderabad

╠²

1) A union campaign brought executive compensation into the public eye through media coverage, highlighting concerns about high CEO pay.

2) The union's annual awareness campaign aims to build awareness of perceived pay inequities between CEOs and frontline workers, sometimes prompting union formation.

3) The publicity has caused turmoil at Oakwood Lawn, where employees learned their CEO is among the highest paid in the US, despite not receiving a pay increase due to the company's financial challenges.Cash balance workshop 11 12

Cash balance workshop 11 12Brad wexler

╠²

This document summarizes a presentation about cash balance pension plans. It describes how cash balance plans work, their key features and advantages compared to 401(k) plans. It provides examples showing how a cash balance plan could allow a business owner named Joe Smith to contribute over $180,000 to his retirement plan in one year by combining a 401(k) plan with a cash balance plan. The document concludes by identifying common candidates for cash balance plans and encouraging attendees to contact the presenter if interested in establishing a plan before the end of 2012.CEO Compensation Meets Pay for Performance: Emerging Trends for Executive Pay

CEO Compensation Meets Pay for Performance: Emerging Trends for Executive PayIntegrated Healthcare Strategies

╠²

This document discusses trends in CEO compensation for nonprofit hospitals. It summarizes recent media reports that found CEO pay is linked more to factors like hospital size, technology use, and patient satisfaction rather than quality metrics. It then outlines a preliminary study that found a strong correlation between hospital and health system performance on balanced scorecards and CEO compensation. Higher performance was associated with an average 1.1-1.5% rise in direct pay. The document concludes that boards appropriately incentivized cost-cutting in 2012 and acted responsibly to ensure organizational survival during healthcare reform implementation. It provides best practices for compensation committees to establish a rebuttable presumption of reasonableness and protect against executive pay excess.Executive compensation

Executive compensationMateen Altaf

╠²

The document discusses executive compensation at United Bank Limited (UBL) in Pakistan. It provides details on the compensation packages of UBL's highest paid executives. The President and CEO receives an annual remuneration of approximately Rs. 246.5 million, including a monthly salary of Rs. 20 million. The document also reviews UBL's SWOT analysis and concludes that executive compensation is an important tool for organizations to attract, retain, and motivate top managers.Cb overview

Cb overviewJoe Long, CPC, QPFC, QPA, AIF

╠²

- BPAS provides actuarial and pension services including cash balance plans. It has over 3,800 engagements, over $1 trillion in fund administration, and 335 professional employees across the US and Puerto Rico.

- Cash balance plans allow for much higher maximum contributions (up to $200,000/year for a 55-year-old) and tax deferrals compared to a traditional 401(k). They are best for business owners who have higher compensation and want to maximize retirement savings.

- BPAS has expertise in designing and administering combined cash balance and 401(k) plans to maximize savings opportunities within legal limits. Candidates for cash balance plans are businesses where owners can contribute at least 7Checklist and Decisions for Employers Facing Healthcare Law

Checklist and Decisions for Employers Facing Healthcare LawLighthouse Growth Resources

╠²

1. Employers with 50 or more full-time employees face new requirements under the Affordable Care Act in 2014, including providing affordable health insurance or paying penalties.

2. Key deadlines and provisions for employers in 2013 include a $2,500 limit on health care flexible spending accounts, paying a comparative effectiveness fee, and notifying employees about health insurance exchanges.

3. In 2014, employers must ensure any health plans meet requirements around affordability, adequate coverage, and automatic enrollment of new employees within 90 days of hire. Failure to comply could result in tax penalties. case study , Executive compensation: needed incentives, justly deserved, or ...

case study , Executive compensation: needed incentives, justly deserved, or ...Fatima Aljaidi

╠²

business ethics case study about Executive compensation: needed incentives, justly deserved, or just distasteful?Trends in Executive Benefits

Trends in Executive Benefitslbaldevia

╠²

The document discusses trends in executive benefits, including trends in cash and incentive compensation, retirement plans, and equity programs. It provides examples of different types of non-qualified deferred compensation plans, cash bonus plans, long-term incentive plans, and retirement plans that employers can offer executives. The summaries highlight advantages and disadvantages for both employers and executives of these various executive benefit plan types.Health Care Reform Preparedness: An Employer's Pocket Guide

Health Care Reform Preparedness: An Employer's Pocket GuideDenver Metro Small Business Development Center

╠²

In less than one year, major provisions of the Patient Protection and Affordable Care Act are taking effect at state and federal levels, and many of those new provisions will directly impact businesses around the country. At this event, weŌĆÖll present fact-based, non-partisan information thatŌĆÖs important to Colorado business leaders: the timeline of the law and important dates. Ceo Compensation

Ceo CompensationBalancedComp, LLC

╠²

The document discusses executive compensation practices at banks and financial institutions. It covers issues like pay freezes, incentive pay, performance metrics, restrictions on TARP recipients, calls for increased transparency and shareholder votes on compensation. It provides advice on selecting appropriate performance measures and ensuring compensation is tied to achieving goals.Employee benefits

Employee benefitsICAB

╠²

This document discusses employee benefits, including legally required benefits like Social Security, unemployment compensation, workers' compensation, and FMLA. It also discusses voluntary benefits such as various health insurance options, retirement benefits like pensions and 401(k)s, paid time off for vacation and sick leave, survivor benefits, and flexible spending accounts. The goal of benefits is to attract and retain employees while complying with legal regulations.Ceo Presentation

Ceo Presentationlaurajibson

╠²

This document discusses CEO compensation levels and arguments around their fairness. It provides historical data showing CEO pay increasing 340% from 1991-2001, far outpacing average worker pay which rose 36%. Views of justice in wages are examined, including agreement between parties, deservedness based on role, and maximizing utility. Examples are given of both controversial high payouts and profit sharing compensation models. Arguments for and against high CEO pay are outlined. Recommendations are made to tie compensation more closely to performance and restrict stock sales.10 Things Credit Union Executives Need to Know about Pensions and 401(k)s (We...

10 Things Credit Union Executives Need to Know about Pensions and 401(k)s (We...NAFCU Services Corporation

╠²

Executive Compensation Checklist for New and Experienced Board Members (Credi...

Executive Compensation Checklist for New and Experienced Board Members (Credi...NAFCU Services Corporation

╠²

CEO Compensation Meets Pay for Performance: Emerging Trends for Executive Pay

CEO Compensation Meets Pay for Performance: Emerging Trends for Executive PayIntegrated Healthcare Strategies

╠²

Health Care Reform Preparedness: An Employer's Pocket Guide

Health Care Reform Preparedness: An Employer's Pocket GuideDenver Metro Small Business Development Center

╠²

Viewers also liked (9)

Backto School Night

Backto School Nightjlunssford

╠²

Ms. Lunsford welcomes parents to Back to School Night and provides information about herself including her teaching experience and contact information. She discusses discipline policies, homework expectations, multiplication tables practice, and classroom website. Parents are encouraged to check Friday folders for tests and homework. Ms. Lunsford also provides her school library information and takes any questions from parents. She thanks parents for their partnership in their child's education and for attending the event.Letthe trumpet sound 2003 version

Letthe trumpet sound 2003 versionguest3e969a

╠²

This document provides an overview of 21st century literacy skills and concepts such as new literacies, information literacy, and guided inquiry that are needed for learning in today's digital age. It discusses models for teaching these skills, including the Big 6 research process and implementing guided inquiry lessons, which structure information seeking while allowing students to learn collaboratively. The document emphasizes that students must develop abilities to critically evaluate online information and sources.

Tomosfactory FRThe Floating Stone

╠²

Tomosfactory, lŌĆÖoutil web cr├®atif pour la nouvelle g├®n├®ration du webdesign.

bill_wedemeyer_nih_2009_talk_on_wikipedia

bill_wedemeyer_nih_2009_talk_on_wikipediaProteins

╠²

A talk delivered to the NIH on 16 July 2009. A description of Wikipedia's articles (their structure and quality), its contributors and reasons why scientists and science educators&writers should contribute.

M├®moire Luxe et InternetLaure Neria

╠²

LŌĆÖ├®mergence du web a boulevers├® le secteur du luxe car Internet a accentu├® le ph├®nom├©ne de la d├®mocratisation des objets de luxe. Ainsi, on est pass├® dŌĆÖun secteur r├®serv├® ├Ā une ├®lite, contraint par des codes, ├Ā un domaine ouvert ├Ā toutes les cultures et notamment celles du web 2. 0. Bien que souhaitant conserver leur aura, les maisons de luxe ne peuvent plus se passer dŌĆÖune pr├®sence sur Internet via un site web officiel, ou r├®serv├® ├Ā la vente, ou encore des pages sur les m├®dias sociaux. Cette concession a pour m├®rite dŌĆÖ├®largir leur client├©le et dŌĆÖagrandir leur couverture mondiale gr├óce ├Ā la globalisation des ├®changes. Toutefois, la qualit├® des sites web et des applications mises en place permettent dŌĆÖ├®tablir un nouveau lien de proximit├® avec le consommateur et de d├®velopper des id├®es innovantes. Depuis Internet, lŌĆÖesth├®tique et lŌĆÖ├®thique des marques de luxe ont connu un changement en faveur de lŌĆÖauthenticit├® et de la sensorialit├® exacerb├®e via les nouvelles technologies. Internet a donc tout dŌĆÖun nouveau terrain de conqu├¬te pour les grandes marques prestigieuses.

The emergence of the Web disrupted the luxury area because Internet accentuated the phenomenon of democratization of luxury items. Thus, the luxury field went from, reserved for an ├®lite, strained by codes, to open to every cultures and notably the Web 2.0 culture. Although wishing to maintain their aura, the luxury houses can not do without a presence on the Internet via an official website or reserved to sale, or pages on social networking websites. This concession permits them to broaden their customers and enlarge their global coverage thanks to the globalization of trade. However, the websites quality and the applications set up permit to establish a close link with the consumer and to develop innovative ideas. Since Internet, the aesthetic and ethic of luxury brands have known a change in favor of authenticity and an exacerbated sensoriness via new technologies. So Internet is a whole new land of conquest for the prestigious luxury houses.Building Your Ideal Life - Top 10

Building Your Ideal Life - Top 10PIQ Mentoring

╠²

The document outlines 10 proven techniques for building an ideal life through a global mentoring program called LifeMAPP. The techniques include clarifying your purpose and strengths, developing your top strengths, accepting your starting point, solving problems and resolving conflicts, investing 10% of your time for your future, identifying and building up your margins, removing negative influences, surrounding yourself with positive influences, regularly reviewing and re-committing to your goals, and polishing your skills with the help of a mentor. The document encourages joining LifeMAPP's mentoring programs to help apply these techniques.

Similar to Intro To Supp Disability Plans Ufg (20)

Why You Should Partner With Colonial Life

Why You Should Partner With Colonial Lifedonnadwyer

╠²

This document summarizes how brokers can partner with Colonial Life to provide benefits counseling services to employers and their employees. It outlines how this differentiated service approach can help employees better understand and appreciate their benefits while saving employers money through lower payroll taxes and premiums. Specific voluntary benefits like life insurance, disability insurance, and cancer coverage are highlighted.Puzzlebox comp 2010

Puzzlebox comp 2010BalancedComp, LLC

╠²

The allocation of executive compensation resources is being scrutinized by internal and external forces. Regulations, board governance issues, and the lower margins require new thought processes on the various pieces of the compensation puzzle and how they fit together. Portsmouth Chamber Business Toolkit Series

Portsmouth Chamber Business Toolkit Seriesdlinehan2

╠²

The presentation provided an overview of Retirement Solution Group (RSG) and how they help business owners supplement future "transaction events" like sales through customized retirement plans. RSG administers over 250 retirement plans, works with over 8,000 participants, and has expertise in fiduciary responsibilities, investment strategies, and plan design. Case studies showed how RSG increased clients' tax deductions through crossover testing, cash balance plans, and defined benefit carve-outs. The presentation concluded that working with specialists like RSG can help business owners fix financial "problems" and ensure strong retirement accounts complement future transactions.Strategic Retirement Plan Designs for Professional Practices 92011

Strategic Retirement Plan Designs for Professional Practices 92011twosons

╠²

A discussion of how to rapidly accelerate your contributions and significantly reduce your tax liability via a retirement plan designed for your specific personal and corporate objectives.10 Questions You Should be Able to Answer About Your Pay Strategy

10 Questions You Should be Able to Answer About Your Pay StrategyThe VisionLink Advisory Group

╠²

For most companies, compensation is the costliest item on the P&L. And yet business leaders typically know little about their organizationŌĆÖs pay strategy. In todayŌĆÖs hyper competitive world, thatŌĆÖs not okay. Pay is a strategic tool that can either drive or diminish company profitability. It is a key to recruiting the kind of talent that can positively impact the trajectory of the business. Therefore, chief executives need to play a leading role in charting the compensation course their companies take. But, to do that effectively, they must become better informed about core pay issues. But which issues? What, exactly, do they need to know?

This webinar will answer those questions. It is designed for enterprise leaders who want to learn how compensation can play a more productive role in their businesses.Leveraged Planning Solutions

Leveraged Planning SolutionsReena Friedman Watts

╠²

Leveraged Planning Solutions are financial strategies designed for business owners. They allow business owners to use funds from a commercial loan to invest large sums tax-deferred through an insurance or annuity product. This leverages the business owner's funds to grow tax-deferred over time. A case study examines how a $1 million loan at competitive rates could provide a physician business owner over $3 million in tax-free retirement income starting at age 65 through an indexed universal life policy. Leveraged Planning Solutions offer business owners flexible financing options to fund tax-advantaged retirement plans.║▌║▌▀Żs from the NQDC Webinar for Financial Advisors

║▌║▌▀Żs from the NQDC Webinar for Financial AdvisorsFulcrum Partners LLC

╠²

║▌║▌▀Żs from July 2019 Webinar for Financial Advisors. Topic is Nonqualified Deferred Compensation (NQDC) for Financial Advisors. Presenters include Phil Currie, Managing Director, Fulcrum Partners, an executive benefits consultancy.EBS Designing NQDC

EBS Designing NQDCWilliam L. (Bill) MacDonald

╠²

This document provides an overview of nonqualified deferred compensation (NQDC) plans. It discusses how NQDC plans help address retirement savings gaps for highly compensated executives due to ERISA contribution limits. NQDC plans allow flexible deferral of salary and bonuses, company matching, and tax-deferred growth. While unfunded, companies often informally fund NQDC plans through investment vehicles like rabbi trusts. The document aims to help company leaders understand NQDC plans and their value in attracting, retaining, and rewarding top talent.Which is Better - Higher Salaries or Bigger Incentives?

Which is Better - Higher Salaries or Bigger Incentives?The VisionLink Advisory Group

╠²

How do you determine the right blend of salaries and incentives in your pay strategy? Some believe that paying higher salaries attracts the best people, and therefore improves company performance. Others believe employee earnings should be tied to results, so they emphasize variable pay. So, is one right and the other wrong?

Obviously, there is no universal ŌĆ£rightŌĆØ way to pay employees. Instead, you must find what works best for your organization. So, how do you do that?

That is the question this webinar plans to answer. We will discuss 3 principles for determining the right rewards balance for your company and how they can be used to resolve the higher salary versus bigger incentives dilemma.Finances1

Finances1Ismael

╠²

The document provides an overview of Entaire Programs, which are financed retirement planning programs for business owners. The programs allow business owners to accelerate retirement funding using business assets. Business owners make interest payments on a loan while their retirement funds grow tax-deferred. This can provide better returns than traditional retirement plans. The overview includes an example case study of a business owner who implements a program to fund $600,000 in retirement savings through a loan from his business.Small Business Retirement Plans

Small Business Retirement Plansmrbeckerphd

╠²

Small business owners have several options for establishing a retirement plan for their employees. The document discusses the need for retirement planning and outlines various plan types including defined benefit pensions, 401(k) plans, SEP-IRAs, and SIMPLE IRAs. It provides details on eligibility requirements, contribution limits, tax benefits and administration considerations for small business retirement plans. UBS Financial Services can help business owners evaluate their options and set up a plan that meets their needs.Executive Bonus Plan Mark Simon

Executive Bonus Plan Mark SimonMark L. Simon

╠²

This document presents an executive bonus plan that allows businesses to reward key employees through tax-deductible insurance policies. The plan benefits businesses by attracting, motivating and retaining key employees, while benefiting employees through life insurance protection, tax-advantaged access to policy cash values, and income-tax free death benefits. The document outlines various plan design alternatives and tax implications.The Affordable Care Act- A Timeline of Provisions That Will Affect Your Business

The Affordable Care Act- A Timeline of Provisions That Will Affect Your BusinessG&A Partners

╠²

This document provides a timeline of provisions from the Patient Protection and Affordable Care Act (PPACA) that will affect businesses. Key provisions discussed include the employer mandate taking effect in 2014, which will require employers with 50 or more full-time equivalent employees to provide affordable health insurance or face penalties. The document also outlines other upcoming requirements such as increased Medicare taxes, mandatory employer reporting on employee health insurance costs, and health insurance exchanges beginning in 2014.Health Care Reform Strategies for Small Employers

Health Care Reform Strategies for Small EmployersFraser Trebilcock Lawyers

╠²

Health Care Reform Strategies for Small Employers:

ŌĆó Health Care Tax Credits and Penalties

ŌĆó The Recently Delayed Pay or Play Mandate

ŌĆó Health Insurance Exchanges

ŌĆó SHOPs

ŌĆó Other Cost-Savings Opportunities

ŌĆó Strategic Decision Making for Large and Small Employers

ŌĆó And more!CDC - an alternative way to keep collective schemes open

CDC - an alternative way to keep collective schemes openHenry Tapper

╠²

This document discusses problems with defined benefit and defined contribution pension schemes and proposes collective defined contribution (CDC) schemes as an alternative. It summarizes that CDC schemes combine features of defined benefit and defined contribution schemes by offering target benefits rather than guarantees, collectively investing contributions, and adjusting benefits up or down based on funding levels. The document outlines how CDC schemes could work for both single and multi-employer plans as well as individuals, and provides contact information to learn more about CDC schemes.4 Secrets To Lowering Taxes

4 Secrets To Lowering Taxeskshapero

╠²

4 Secrets Successful Business Owners & Professionals Use to Reduce Taxes and Create WealthConversion of DB to DC ŌĆō A Case Study

Conversion of DB to DC ŌĆō A Case StudyRon Cheshire

╠²

The document discusses a case study of converting a defined benefit pension plan to a hybrid defined contribution plan. Key points:

- The hybrid plan design aims to replicate future benefits under a defined contribution plan while preserving early retirement subsidies, bridging benefits, and cost-of-living adjustments from the defined benefit plan.

- Employees receive replacement income from three sources: employer contributions to the hybrid plan, individual savings, and social insurance. Target replacement ratios range from 75-85% of pre-retirement income.

- The hybrid plan provides higher contribution rates for older, longer-serving "grandfathered" employees to make up for less time to accumulate savings compared to younger employees.

- Projected replacementPaying for Performance - February 2019

Paying for Performance - February 2019Steve Hall

╠²

The document summarizes a study on CEO incentive compensation plans among 600 large, mid-size, and small U.S. companies. Key findings include:

1) Larger companies have a higher percentage of variable pay, with CEOs of top 200 companies having an average of 87% of target pay in variable compensation. Performance-based long-term incentives represent the largest portion of long-term incentive value across all company sizes.

2) Earnings metrics are the most commonly used and heavily weighted performance metric in annual incentive plans, present in over 85% of plans across all company sizes. Larger companies tend to include more performance metrics in their plans.

3) Usage of environmental, social, andHealthcare Reform ŌĆō The State of the Union

Healthcare Reform ŌĆō The State of the Union AlphaStaff

╠²

Participants will be brought up to date on implementation of the Affordable Care ActŌĆÖs provisions. WhatŌĆÖs been implemented in 2012 and whatŌĆÖs on the way for 2013 and 2014. Employers will learn about the pre-existing condition, claims and appeals, automatic enrollment and ŌĆ£play or payŌĆØ provisions of the law. Presented by Jackson Lewis.3 Habits of Highly Effective Pay Plans

3 Habits of Highly Effective Pay PlansKen Gibson

╠²

Effectiveness in compensation can be defined by attracting premier talent (offer compelling value proposition), driving sustained success (reward results) and instilling a culture of confidence (build a competitive advantage). Learn the "habit" of pay planning that will drive that result.

Intro To Supp Disability Plans Ufg

- 1. Lance B Kolbet, RHU, LUTCF University Financial Group Supplemental Disability Meeting the Needs of Key Employees

- 2. Review Topics: ŌĆó Perspective & Relevance of Income ŌĆó Interesting Disability Facts ŌĆó Financial Resources ŌĆó Employer Response ŌĆó Creating Solutions ŌĆó Next Steps

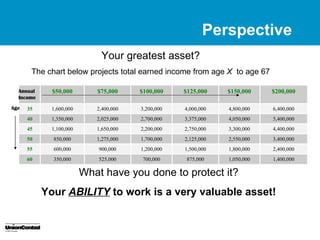

- 3. Perspective Your greatest asset? The chart below projects total earned income from age X to age 67 Annual $50,000 $75,000 $100,000 $125,000 $150,000 $200,000 Income Age 35 1,600,000 2,400,000 3,200,000 4,000,000 4,800,000 6,400,000 40 1,350,000 2,025,000 2,700,000 3,375,000 4,050,000 5,400,000 45 1,100,000 1,650,000 2,200,000 2,750,000 3,300,000 4,400,000 50 850,000 1,275,000 1,700,000 2,125,000 2,550,000 3,400,000 55 600,000 900,000 1,200,000 1,500,000 1,800,000 2,400,000 60 350,000 525,000 700,000 875,000 1,050,000 1,400,000 What have you done to protect it? Your ABILITY to work is a very valuable asset!

- 4. Perspective Two disturbing and relevant facts: Fact 1. For most Americans, financial obligations demand 100% of paycheck Fact 2. Americans donŌĆÖt save enough

- 5. Perspective Everything rests on income DIS-ABILITY causes income loss

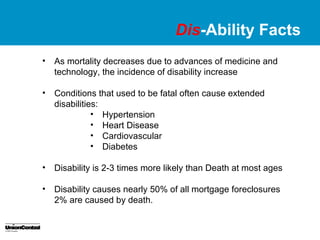

- 6. Dis-Ability Facts ŌĆó As mortality decreases due to advances of medicine and technology, the incidence of disability increase ŌĆó Conditions that used to be fatal often cause extended disabilities: ŌĆó Hypertension ŌĆó Heart Disease ŌĆó Cardiovascular ŌĆó Diabetes ŌĆó Disability is 2-3 times more likely than Death at most ages ŌĆó Disability causes nearly 50% of all mortgage foreclosures 2% are caused by death.

- 7. Financial Resources ŌĆó Savings / Retirement Accounts ŌĆó Liquidate Assets ŌĆó Family/Friends ŌĆó Government Benefits ŌĆó EmployerŌĆÖs Group Long Term Disability plan

- 8. Employer Response Provide LTD for all employees ŌĆó Efficient and cost effective ŌĆó Transfer of risk to 3rd party ŌĆó Isolate company from claims management ŌĆó Increase employee confidence ŌĆó All treated equally

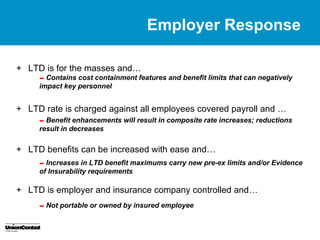

- 9. Employer Response + LTD is for the masses andŌĆ” - Contains personnel impact key cost containment features and benefit limits that can negatively + LTD rate is charged against all employees covered payroll and ŌĆ” - Benefitdecreases will result in composite rate increases; reductions result in enhancements + LTD benefits can be increased with ease andŌĆ” - Increases in requirementsmaximums carry new pre-ex limits and/or Evidence of Insurability LTD benefit + LTD is employer and insurance company controlled andŌĆ” - Not portable or owned by insured employee

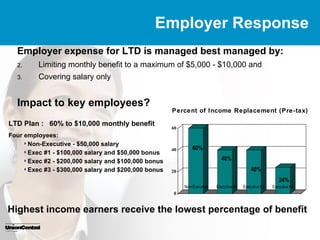

- 10. Employer Response Employer expense for LTD is managed best managed by: 2. Limiting monthly benefit to a maximum of $5,000 - $10,000 and 3. Covering salary only Impact to key employees? Percent of Income Replacement (Pre-tax) LTD Plan : 60% to $10,000 monthly benefit 60 Four employees:  Non-Executive - $50,000 salary 40 60%  Exec #1 - $100,000 salary and $50,000 bonus  Exec #2 - $200,000 salary and $100,000 bonus 40%  Exec #3 - $300,000 salary and $200,000 bonus 20 40% 24% Non-Executive Executive #1 Executive #2 Executive #3 0 Highest income earners receive the lowest percentage of benefit

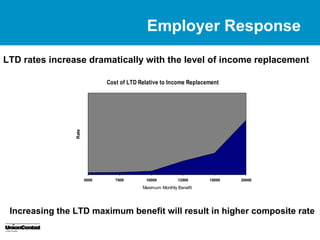

- 11. Employer Response LTD rates increase dramatically with the level of income replacement Cost of LTD Relative to Income Replacement Rate 5000 7500 10000 12500 15000 20000 Maximum Monthly Benefit Increasing the LTD maximum benefit will result in higher composite rate

- 12. Creating Solutions While all employees are important, all employees are not equal. So then, how do employers take care of key employee needs?

- 13. Creating Solutions Group LTD is an ideal foundation and can be supplemented with an Individual policy. Supplemental policies are effective because they contain cost and benefit features not found in LTD. Employer can offer different supplemental disability policy designs to different classes of employee. Employer selects/designs his own classes, so if desired, supplemental policies are provided for select participants only.

- 14. Plan design highlights Creating Solutions ’āś Supplemental policy designs vary to serve different objectives. The most common are: Fill in the gap created by a low benefit LTD plan (ex: a 60% to $5000 LTD protects incomes to $100k, those over 100k have <60%) OR Design plan to include protection for incentive comp (ex: 60% LTD covers Salary only, Supp provides 60% for Salary AND Incentive) OR Cover Salary and Incentive at highest % available (ex: Supp may provide between 75% - 100% income replacement) ’āś The cost of a supplemental plan can be either employer or employee paid. ’āś Taxation of benefits and impact on actual replacement ratios may be worth considering

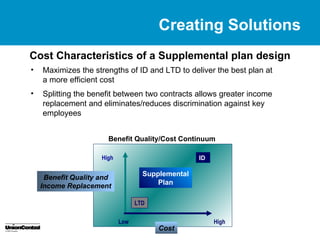

- 15. Creating Solutions Cost Characteristics of a Supplemental plan design ŌĆó Maximizes the strengths of ID and LTD to deliver the best plan at a more efficient cost ŌĆó Splitting the benefit between two contracts allows greater income replacement and eliminates/reduces discrimination against key employees Benefit Quality/Cost Continuum High ID Supplemental Benefit Quality and Plan Income Replacement LTD Low High Cost

- 16. Creating Solutions ’āś Supplemental policies deliver unique features and benefits ŌĆó Rates are discounted, fixed, and guaranteed to age 65 ŌĆó Coverage is portable at existing discounted rates ŌĆó Inclusion of bonus and incentive compensation in covered earnings ŌĆó No benefit offsets for Social Security, WorkerŌĆÖs Compensation, other income ŌĆó Contains benefits for Catastrophic disability and Non-Disabling injuries ŌĆó Annual benefit increases up to the maximum guaranteed standard issue (GSI) offer Supplemental plans deliver a best of both worlds approach for your most valued employees!

- 17. Creating Solutions Next steps. ’āś To design a supplemental plan we need: 1. Detailed census of employees being considered for supplemental plan 2. Copy of current LTD certificate and confirmation of current rate 3. Set date to review plan options ’āś When plan is approved we move on to installation: ŌĆó Authorized signature on employer documents ŌĆó Pre-payment of 1st months premium ŌĆó Each participant completes a short form application. (There is no need for medical exam or personal tax records) ŌĆó Policies are issued to participants.

- 18. Questions?