Elasticity - AS Economics

- 2. Elasticity âĒ âThe proportionate responsiveness of a second variable to an initial proportionate change in the first variable.â

- 3. Elasticity For example: âĒ An increase of price by 5% increases supply by 10%. (Elastic) âĒ An increase of price by 10% increases supply by 5%. (Inelastic) âĒ When the price rises but the supply is still kept constant. (Unity = elasticity = 1) It is neither elastic nor inelastic.

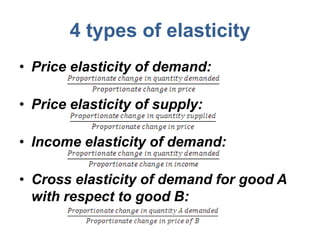

- 4. 4 types of elasticity âĒ Price elasticity of demand: âĒ Price elasticity of supply: âĒ Income elasticity of demand: âĒ Cross elasticity of demand for good A with respect to good B:

- 5. Price elasticity of demand âĒ âThe proportionate change in demand for a good following an initial proportionate change in the goodâs own price.â âĒ Note that the price is the goodâs own price, not of the price of its substitute good.

- 6. Price elasticity of demand âĒ If we look at the curve of a constant elasticity = 1 at all points of PeD:

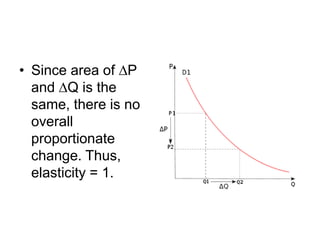

- 7. âĒ Since area of âP and âQ is the same, there is no overall proportionate change. Thus, elasticity = 1.

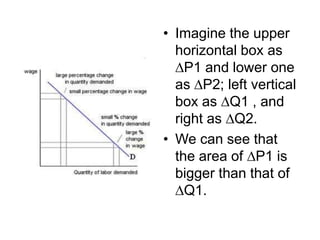

- 8. âĒ Imagine the upper horizontal box as âP1 and lower one as âP2; left vertical box as âQ1 , and right as âQ2. âĒ We can see that the area of âP1 is bigger than that of âQ1.

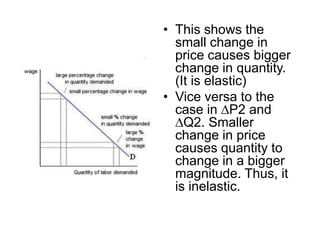

- 9. âĒ This shows the small change in price causes bigger change in quantity. (It is elastic) âĒ Vice versa to the case in âP2 and âQ2. Smaller change in price causes quantity to change in a bigger magnitude. Thus, it is inelastic.

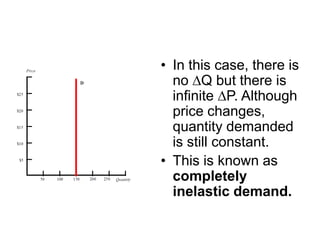

- 10. âĒ In this case, there is no âQ but there is infinite âP. Although price changes, quantity demanded is still constant. âĒ This is known as completely inelastic demand.

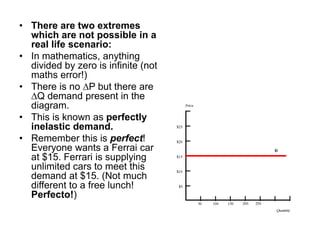

- 11. âĒ There are two extremes which are not possible in a real life scenario: âĒ In mathematics, anything divided by zero is infinite (not maths error!) âĒ There is no âP but there are âQ demand present in the diagram. âĒ This is known as perfectly inelastic demand. âĒ Remember this is perfect! Everyone wants a Ferrai car at $15. Ferrari is supplying unlimited cars to meet this demand at $15. (Not much different to a free lunch! Perfecto!)

- 12. Factors affecting PeD âĒ Substitutability: When there are substitute good available, customers will always switch to them when the price of the original good rises. This is elastic. When there are no subsititutes available demand will be inelastic. âĒ Percentage of income: More expensive good tends to be more elastic as households spends a higher proportion of their income compared to cheap items.

- 13. Factors affecting PeD âĒ âThe width of mesurementâ: If we solely measure the responsiveness of the change of a single product from a single firm, the elasticity may be more apparent. Since the market is quite large, elasticity will be lowered when we measure the responsiveness of the products as a whole market.

- 14. Factors affecting PeD âĒ Time: Longer the time period, more time we are allowing things to be changed. Thus elasticity is more apparent in long run compared to short run.

- 15. Price elasticity of supply âĒ âThe proportionate change in supply of a good following an initial proportionate change in the goodâs own price.â

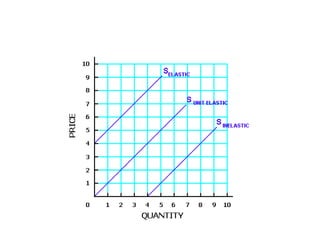

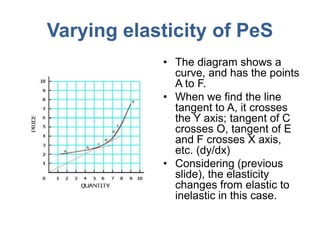

- 16. Measuring elasticity: âĒ When the gradient of the curve increases (towards positive), it reduces the elasticity. âĒ If the S curve intersects the (Y) price-axis, PeS is elastic at all points. âĒ If the S curve intersects the (X) demand- axis, PeD is inelastic at all points. âĒ If the S curve passes through the origin (O), elasticity = unity = 1.

- 18. Varying elasticity of PeS âĒ The diagram shows a curve, and has the points A to F. âĒ When we find the line tangent to A, it crosses the Y axis; tangent of C crosses O, tangent of E and F crosses X axis, etc. (dy/dx) âĒ Considering (previous slide), the elasticity changes from elastic to inelastic in this case.

- 19. Factors determining PeS âĒ Length of production period (how long?) âĒ The availability of spare capacity âĒ The ease of accumulating stocks (Selling stocks when there is an increase in demand) âĒ How easy for the firm to enter the market âĒ Ease of switching between different production methods

- 20. Extremes âĒ Perfectly inelastic supply: Time is an important determinant on elasticity of supply. Imagine there is a increased demand on electricity in the UK, but there is only one power plant, running 24/7 at full capacity. It could not produce anymore than it is producing. The price of electricity rose, but supply is still kept constant.

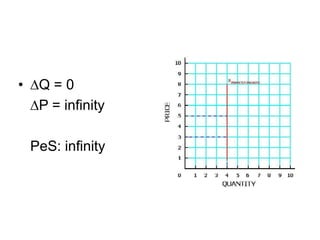

- 21. âĒ âQ = 0 âP = infinity PeS: infinity

- 22. Extremes âĒ Price elastic supply: The change of prices immediately changes the quantity demanded to zero. âĒ This is because the customer will immediately switch to another perfect substitute which price hasnât changed.

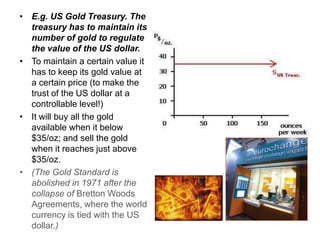

- 23. âĒ E.g. US Gold Treasury. The treasury has to maintain its number of gold to regulate the value of the US dollar. âĒ To maintain a certain value it has to keep its gold value at a certain price (to make the trust of the US dollar at a controllable level!) âĒ It will buy all the gold available when it below $35/oz; and sell the gold when it reaches just above $35/oz. âĒ (The Gold Standard is abolished in 1971 after the collapse of Bretton Woods Agreements, where the world currency is tied with the US dollar.)

- 24. Income elasticity of demand âĒ The proportionate change in demand for a good following an initial proportionate change in consumerâs income. âĒ Positive for normal good. Luxury good is above +1. Basic good is between 0 and 1. âĒ Negative for inferior good.

- 25. Cross elasticity of demand âĒ The proportionate change in demand for a good following an initial proportionate change in price of another good. âĒ There are three possibilities: 1. Joint (complementary) demand 2. Competing (substitutes) demand 3. Absence of any sort of relationship.

- 26. Effects of tax on elasticity of demand âĒ A tax shifts the supply curve leftwards. There is an opportunity cost for it. âĒ The quantity supplied shifted leftwards and is decreased. âĒ The quantity demanded remain constant.

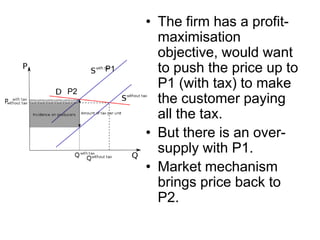

- 27. âĒ The firm has a profit- maximisation objective, would want P1 to push the price up to P2 P1 (with tax) to make the customer paying all the tax. âĒ But there is an over- supply with P1. âĒ Market mechanism brings price back to P2.

- 28. âĒ Shifted incidence: The tax which is passed onto the customers. âĒ Unshifted incidence: The tax which is borne by firms. âĒ Vice versa, subsidies shifts the supply curve rightwards or downwards.

- 29. Reference âĒ Source: http://cstl- hcb.semo.edu/kerr/EC101/Price%20Elasti city/price%20elasticity%20frt%20pg.htm