Checklist for CT3 Exemption

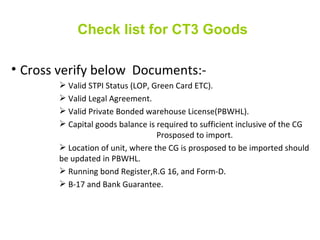

- 1. Check list for CT3 Goods Cross verify below Documents:- Valid STPI Status (LOP, Green Card ETC). Valid Legal Agreement. Valid Private Bonded warehouse License(PBWHL). Capital goods balance is required to sufficient inclusive of the CG Prosposed to import. Location of unit, where the CG is prosposed to be imported should be updated in PBWHL. Running bond Register,R.G 16, and Form-D. B-17 and Bank Guarantee.

- 2. Procedure of STPI A Request letter accompanied with Annexure IX ŌĆō A and the Proforma invoice to STPI (Triplicate copy) . Below points cross verify. Name and Location of STP/EHTP unit Name of supplier and Country of origin Invoice no. & Date Description of goods New equipment/used Equipment Check for the basic value and exercise duty component in the invoice If all the requirement are fulfilled, CT3 approval will issued by along with the duly attested Proforma Invoice. (Letter containing to apprach customs and execise Authorities)

- 3. We need request letter to customs with Form CT3 and letter of STPI, Proforma Invoice attested by STP units.we need to enter the RG 16 Books. Requirement fulfill, then Form CT3 duly attested customs officer. and issue number to form CT3. Once, We get approval from customs we need give all the original to supplier. Goods arrive same location STPI units comes along with AR-3. We need to take from ARE-3 along with we need enter Form- D and Running bond register. A bond register for exercise exempted goods is to be maintained in the specific format as stipulated be customs authorities. Once the Materials comes to STP units, we need to request to customs officer to see materials. Once Customs officer check the goods, and RG-16 and Running Bond register endorse by Customs officer. Procedure of Customs

- 4. To ┬Ā The Director, Software Technology Parks of India ┬Ā Dear Sir/Madam, ┬Ā ┬Ā Sub: Central Excise Exemption. ┬Ā S7 Software solutions private Limited, Bangalore is registered under the software Technology park of Govt. of India vide approval _______________ ┬Ā SL.NO Invoice No Descrption of QTY Invoice value ┬Ā ┬Ā Further it is intimated the purchase of the above equipment from Supper Name smooth functioning of our office. These equipment are going to be used in the STP facility located at. No. Our Company Address ┬Ā Kindly certify the ingenious equipment purchase for excise duty exemption. ┬Ā Thanking You, ┬Ā Regards,

- 5. ┬Ā OFFICE OF THE SUPERITENDENT OF CUSTOMS EOU - II -Range Karnataka Housing Board Building, 1 st Floor, Above SBI, F Wing, Near Kaveri Bhavan, Bangalore- 560 009 Original / Duplicate/ Triplicate No. _________. Date: 21 /04 /2010 FORM CT 3 ┬Ā CERTIFICATE FOR REMOVAL OF EXCISABLE GOODS UNDER BOND ┬Ā This is to certify that: ┬Ā 1. M/S. __________________________is/are bonafied licensee holding License No . ________________valid upto _______________ ┬Ā 2. That they have executed a bond in form B-17( General Surety /General Security ) No : ___________________for Rupees _______________( Rs ________________) with the Assistant Commissioner of Customs , Customs Division, Crescent Road, Bangalore along with Bank Gurantee No ___________________________and as such may be permitted to remove _____________________________________________________________________________as Detailed Below. ┬Ā Sl No Description of Material Unit Qty Unit Set Amount 1 From the unit at ________________________________________________ . In terms of notification No 22/03 C Ex dated 31.03.03 as amended without payment of duty. ┬Ā 3 That the specimen signature of their authorized person namely _ _______________________. furnished below is duly attested . For ┬Ā Authorised Signatory ┬Ā ┬Ā Attested ┬Ā ┬Ā Superitendent of Customs Superitendent of Customs ( E.O.U ) ┬Ā