The 3 most common profitable chart patterns

- 1. THE 3 MOST COMMON & PROFITABLE CHART PATTERNS INVESTORŌĆÖS BUSINESS DAILY

- 2. Just as doctors would be irresponsible not to use x-rays on their patients, investors are just plain foolish if they donŌĆÖt learn to interpret the price and volume patterns found on stock charts. William J. OŌĆÖNeil, IBD Founder 2

- 3. WHY SHOULD YOU USE STOCK CHARTS?

- 4. CHARTS, CHARTS, CHARTS Charts are used to determined when to buy and sell stocks Fund managers and other large institutional investors account for 80% of all trading activity The goal of the investor should be to: Buy stocks institutional investors are buying heavily Avoid stocks that are selling aggressively 4

- 5. WHAT ARE THE 3 MOST COMMON & PROFITABLE CHART PATTERNS?

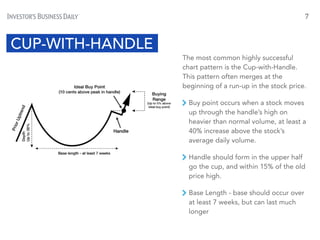

- 7. The most common highly successful chart pattern is the Cup-with-Handle. This pattern often merges at the beginning of a run-up in the stock price. Buy point occurs when a stock moves up through the handleŌĆÖs high on heavier than normal volume, at least a 40% increase above the stockŌĆÖs average daily volume. Handle should form in the upper half go the cup, and within 15% of the old price high. Base Length - base should occur over at least 7 weeks, but can last much longer 7 CUP-WITH-HANDLE

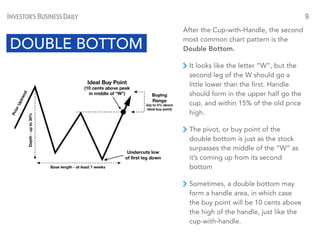

- 9. 9 After the Cup-with-Handle, the second most common chart pattern is the Double Bottom. It looks like the letter ŌĆ£WŌĆØ, but the second leg of the W should go a little lower than the first. Handle should form in the upper half go the cup, and within 15% of the old price high. The pivot, or buy point of the double bottom is just as the stock surpasses the middle of the ŌĆ£WŌĆØ as itŌĆÖs coming up from its second bottom Sometimes, a double bottom may form a handle area, in which case the buy point will be 10 cents above the high of the handle, just like the cup-with-handle. DOUBLE BOTTOM

- 10. FLAT BASE 10

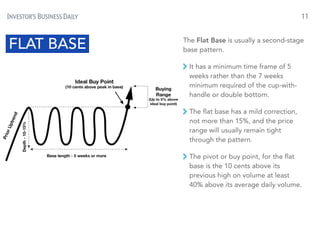

- 11. 11 The Flat Base is usually a second-stage base pattern. It has a minimum time frame of 5 weeks rather than the 7 weeks minimum required of the cup-with- handle or double bottom. The flat base has a mild correction, not more than 15%, and the price range will usually remain tight through the pattern. The pivot or buy point, for the flat base is the 10 cents above its previous high on volume at least 40% above its average daily volume. FLAT BASE

- 12. investors.com/chartreading ENHANCE YOUR CHART READING SKILLS MORE BY VISITING 12