Esterhuyse LT transparency

Download as ppt, pdf0 likes27 views

The document explores the relationship between shareholder familiarity and voluntary disclosure practices among companies listed on the Johannesburg Stock Exchange. It highlights the agency problem and information asymmetry that companies face, noting that investor relations can enhance transparency and reduce costs of equity. A hypothesis is tested through OLS regression, revealing that long-term investors influence the demand for voluntary disclosure, with findings indicating a significant relationship between investor stability and disclosure quality.

1 of 3

Download to read offline

Ad

Recommended

Poster Shareholder familiarity and companies' voluntary disclosure informatio...

Poster Shareholder familiarity and companies' voluntary disclosure informatio...Leana Esterhuyse

?

The document discusses the agency problem arising from the asymmetry of information between management and shareholders in publicly traded companies, emphasizing the importance of voluntary disclosure through investor relations (IR) webpages to enhance transparency. It investigates the factors influencing the quality of voluntary information and the disparity in IR practices among companies listed on the Johannesburg Stock Exchange (JSE), particularly focusing on the impact of investment horizons of shareholders. The study employs OLS regression analysis on data collected from 205 JSE companies to explore the relationship between shareholder stability and the quality of online IR disclosure.KAS-PROPOSITIONSHEET-Cost Transparency-V2

KAS-PROPOSITIONSHEET-Cost Transparency-V2Emma Craig

?

The document discusses the need for greater transparency of pension costs in the UK. It notes that total cost of ownership is an important factor for pension schemes but is often poorly understood. This affects schemes' long-term ability to meet liabilities. KAS BANK can help provide transparency by collecting and analyzing cost data across schemes to identify hidden costs and compare schemes' costs. Their platform identifies a spectrum of pension costs and delivers comprehensive analysis to help trustees ensure value and efficiency.The performance of angel-backed companies “Journal of Banking & Finance 2019....

The performance of angel-backed companies “Journal of Banking & Finance 2019....Florida Atlantic University

?

The paper analyzes the performance of angel-backed companies, identifying key factors that influence their success, including co-investor participation, business angel network membership, and active involvement of investors. It introduces a performance index as a predictive measure of company survival and growth post-investment. The study suggests that a combination of investment practices and mentoring by business angels significantly enhances company performance, providing insights for designing effective funding strategies in the entrepreneurial ecosystem.Powering Your ESG Ambitions WIth Data

Powering Your ESG Ambitions WIth Datadeepparekh3646

?

This document summarizes a webinar on powering ESG ambitions through data. It discusses how ESG reporting is challenging due to different standards and data sources, but that a targeted data strategy can help. It recommends starting with cataloging ESG data, selecting key stakeholder dimensions, targeting a maturity level, building a data sandbox, and creating a community of practice to embark on an ESG journey through data. The webinar emphasizes that ESG is both urgent and important given regulatory demands, consumer expectations, and how financial markets are increasingly considering ESG metrics.Material Engagement (with suppliment included)

Material Engagement (with suppliment included)Nawar Alsaadi

?

The document discusses the concept of "Material Engagement" which involves identifying priority UN Sustainable Development Goals (SDGs), scanning them against the Sustainability Accounting Standards Board's (SASB) materiality map, and identifying laggard companies within relevant sectors. It recommends engaging with companies using an 8-step process to define the engagement scope, set key performance indicators and milestones, select an engagement approach, and establish an escalation strategy. The goal is to focus engagement efforts on the most financially material ESG issues as defined by SASB in order to drive tangible outcomes through the identified ESG transmission channels and progress on priority SDGs.Waters USA 2013: Data Leaders vs. Data Laggards

Waters USA 2013: Data Leaders vs. Data LaggardsState Street

?

The document outlines findings from a survey conducted by State Street, emphasizing the disparity between data leaders and data laggards in the investment industry regarding data and analytics. It highlights the strategic priorities of institutional investors, the challenges they face, and the importance of investing in infrastructure to leverage data effectively. Key recommendations for firms transitioning from laggards to leaders include improving risk tools, enhancing regulatory compliance capabilities, and optimizing electronic trading platforms.The Innovator’s Journey: Insurance Sector Insights

The Innovator’s Journey: Insurance Sector InsightsState Street

?

The document presents findings from the State Street 2014 data and analytics survey focusing on the insurance sector, highlighting the varying confidence and capabilities in data management among companies. It categorizes firms into three groups: data starters, data movers, and data innovators, revealing that innovators view data analytics as a strategic priority and invest more heavily in technology. The survey indicates a significant concern among insurance companies regarding the ability to adapt to evolving regulatory requirements, with many fearing their systems may struggle to keep pace.Whom You Know Matters in Venture Capital

Whom You Know Matters in Venture CapitalBreatheBusiness

?

The article by Hochberg, Ljungqvist, and Lu explores the critical role of venture capital (VC) networks in enhancing investment performance, demonstrating that better-networked VC firms yield higher success rates for fund exits through IPOs or acquisitions. The study utilizes extensive data from U.S.-based VC firms to analyze how network centrality affects fund performance, revealing that network ties—especially those involving well-connected peers—significantly influence outcomes. The findings emphasize the importance of networking in the VC industry as a strategic consideration for both established and emerging firms.Webinar for Grantmakers—Financial Analysis in Action: Getting the Most Out of...

Webinar for Grantmakers—Financial Analysis in Action: Getting the Most Out of...GuideStar

?

This document summarizes a presentation about analyzing Form 990 data from nonprofits to better understand their financial health and inform funding decisions. It provides an overview of the Financial SCAN tool, which analyzes 5 years of 990 data to show financial trends, ratios, expenses, revenues, and compares organizations to peers. As a case study, it examines the nonprofit Help for Homeless Youth, showing metrics like their income statement, balance sheet, expenses over time, and liquidity issues. The presentation concludes with considerations for funders to have more data-driven conversations with grantees about their financial situations.Solution

SolutionAssignment Help

?

Firms in Fiji and other USP region countries demonstrate low levels of sustainability disclosures due to factors such as legal conditions, limited industrial exposure, and a strong emphasis on shareholder wealth creation over stakeholder interests. In contrast, Australian commercial banks face higher demands for non-financial information owing to their social impact and governance frameworks that prioritize stakeholder interests. The choice of assurance providers for sustainability reports typically leans towards large accounting firms within Australia for their credibility, while firms in the USP region may opt for non-auditing firms to obscure potentially harmful non-financial information.Helping asset managers navigate the data sea

Helping asset managers navigate the data seaThe Economist Media Businesses

?

A global study by the Economist Intelligence Unit, sponsored by Northern Trust, reveals that asset managers face significant challenges in managing an overwhelming volume of data, with many lacking effective strategies. While a majority express intent to improve their data utilization and anticipate better returns on their investments, only a small percentage feel they capture data value effectively. The need for clear, flexible data strategies along with strong leadership is crucial for navigating this complex landscape and improving outcomes in asset management.OSAE data final

OSAE data finalAllen Lloyd

?

The document discusses how the Ohio Society of CPAs uses data to understand its members and improve events and programs. Some key points:

- The OSCPA gathers data on members through surveys to learn about demographics, interests, and event attendance. They analyze trends over time.

- About half of members work in industry firms, while the other half work in public accounting firms. Programs need to address the different needs of these groups.

- Most members are between 40-60 years old, so the OSCPA is exploring format changes like webcasts to attract younger professionals.

- Data on member clicks and links is used to optimize website content and titles. Mapping and visualization tools help turnGRESB Infrastructure Results | New York

GRESB Infrastructure Results | New YorkGRESB

?

GRESB assesses and benchmarks the environmental, social, and governance (ESG) performance of real asset investments, providing standardized data to capital markets. It represents over $4 trillion in real asset value through the participation of over 100 investor members and the assessment of hundreds of assets and funds. GRESB helps investors integrate ESG factors into investment decisions and engage with general partners and asset managers.Effect of managerial ownership, financial leverage, profitability, firm size,...

Effect of managerial ownership, financial leverage, profitability, firm size,...Alexander Decker

?

- The document discusses a study that examined the effect of various firm characteristics (managerial ownership, financial leverage, profitability, firm size, and investment opportunity) on dividend policy and firm value.

- The study found that managerial ownership and investment opportunity significantly affect dividend policy, while financial leverage, profitability, and firm size do not significantly affect dividend policy.

- The study also found that all the firm characteristics, as well as dividend policy, significantly affect firm value.Corporate reputation on performance of banking industries in nigeria

Corporate reputation on performance of banking industries in nigeriaAlexander Decker

?

The document analyzes the influence of corporate reputation on the performance of banking industries in Kano State, Nigeria, using a survey of 384 respondents and Partial Least Squares Structural Equation Modeling (PLS-SEM). It concludes that corporate reputation significantly affects performance, providing insights relevant for banks and policymakers in Nigeria, an area previously under-researched in this context. The paper discusses the methodology, results, and implications for management practices and future research avenues.XBRL and ESG: The nonfinancial spillovers of Financial information processing...

XBRL and ESG: The nonfinancial spillovers of Financial information processing...MohammedZakriya8

?

This document explores the impact of the U.S. XBRL mandate on firms' ESG (Environmental, Social, and Governance) performance, highlighting that reduced information processing costs have led to improved ESG ratings, particularly in governance scores. The study finds that firms with higher monitoring from institutional investors, greater opacity, and risk-taking managers experienced the most significant improvements. Overall, the research concludes that information processing costs influence ESG engagement, with potential implications for capital market incentives beyond regulatory mandates.Questions Addressed, Questions Remaining: Notes from the Calgary ES&G Account...

Questions Addressed, Questions Remaining: Notes from the Calgary ES&G Account...Canadian Business for Social Responsibility (CBSR)

?

The ES&G Accountability Forum held on October 8, 2013, aimed to improve the disclosure of both financial and non-financial information by companies in Canada. Key discussions highlighted the need for better communication and credibility in sustainability reports, with recommendations for companies, investors, and evaluation organizations on improving transparency and engagement. Challenges remain in aligning the diverse expectations and needs of stakeholders involved in the ESG reporting process.IRENA - Analysis of Renewable Costs: The Need for Better Data

IRENA - Analysis of Renewable Costs: The Need for Better DataIRENAslides

?

This document discusses the need for better renewable energy cost data collection. It notes that current cost data is patchy and outdated, creating risks and reducing policy ambition. The International Renewable Energy Agency (IRENA) aims to become a leading source of cost data by ramping up its data collection efforts. IRENA now has a large database but limited resources, so it seeks to engage industry and members to help shift toward more systematic cost data collection from a variety of sources. Better cost data would reduce uncertainty, improve policymaking and market development, and communicate the benefits of renewable energy.Thesis final bilal n saif 222 (2010 2011)

Thesis final bilal n saif 222 (2010 2011)Saifullah Malik

?

The document discusses using the information ratio to measure the performance of mutual funds relative to a benchmark. It defines the information ratio as the excess return of a portfolio over the benchmark return, divided by the tracking error. A higher information ratio means a fund's performance is more consistent relative to the benchmark. The document also notes limitations of the information ratio include needing substantial data and being sensitive to the chosen benchmark.Metrus Group Presentation at EEA Networking Event.

Metrus Group Presentation at EEA Networking Event.Enterprise Engagement Alliance

?

The document discusses the importance of engagement across various stakeholders in the value chain, emphasizing that engagement is key to enhancing shareholder equity. It highlights metrics for measuring engagement in employees, customers, suppliers, and the community, while providing evidence of the financial benefits of high engagement levels. The document advocates for a strategic approach to engagement, recommending the implementation of metrics to track engagement throughout the entire value chain.The CDO and the Delivery of Enterprise Value

The CDO and the Delivery of Enterprise ValueMark Albala

?

The document discusses the role of the Chief Data Officer (CDO) and how they can help deliver enterprise value through effective use of data and information. The key points are:

1) The CDO is responsible for treating data/information as valuable assets and ensuring their optimal use to support business strategies and value propositions.

2) Information flows through an organization's business model and influences the success of value propositions. The CDO aims to maximize this value by addressing issues like data quality, accessibility, and understanding.

3) The effectiveness of the CDO is measured by their influence on how information is used strategically in the business, and by improving the "information value levers" that can restrictERC Research Showcase presentations 29.01.2018

ERC Research Showcase presentations 29.01.2018 enterpriseresearchcentre

?

This document summarizes research on skills, management practices, and productivity in small and medium enterprises (SMEs). The main points are:

1. The research examines the links between managerial skills, practices adopted by SMEs, and productivity using survey and longitudinal data. It finds that higher entrepreneurial skills are associated with more structured managerial practices, and adopting more practices leads to higher productivity.

2. Key results show entrepreneurial skills, leadership skills, and organizational skills are positively correlated with productivity. Adopting additional human resource practices is also linked to around 2% higher productivity after 3 years.

3. The implications are that both skills development and coaching to help firms adopt practices are needed toThe Next Frontier for ESG Research and Ratings

The Next Frontier for ESG Research and RatingsSustainable Brands

?

This document summarizes a presentation about the next frontier for environmental, social, and governance (ESG) research and ratings. It discusses how ESG metrics and measurements are moving from qualitative to quantitative and from niche to critical mass coverage. It also describes the establishment of a Center for Ratings Excellence to develop ESG rating principles and standards through research labs and collaborations. Finally, it addresses the need for standardized ESG metrics to properly value externalities and enable more efficient capital allocation.Proposal of the study THE IMPACT OF CORPORATE GOVERNANCE ON VOLUNTARY DISCLOS...

Proposal of the study THE IMPACT OF CORPORATE GOVERNANCE ON VOLUNTARY DISCLOS...Madiha kiran

?

This study examines the impact of corporate governance on voluntary disclosure among 10 commercial banks in Pakistan from 2011-2018. A regression analysis is used to analyze the relationship between various corporate governance factors and a voluntary disclosure index. The corporate governance factors tested as independent variables include board composition, board size, firm size, return on assets, block holders ownership, institutional ownership, audit committee size, foreign ownership, firm age, and leverage. The results could help determine whether stronger corporate governance leads to greater voluntary disclosure by commercial banks in Pakistan.Extreme Engagement Engine with Case Studies

Extreme Engagement Engine with Case StudiesNawar Alsaadi

?

Mark Labs believes that effective engagement is key to achieving ESG goals. Their Extreme Engagement Engine provides tools to facilitate engagement, including: tracking engagements; managing the engagement process; collaboration features; escalation management; and reporting. Research presented shows that successful engagements can yield stock price gains, effective governance mitigates crashes, and shareholder proposals increase gender diversity on boards. The platform aims to enhance stewardship through engagement intelligence and analytics.The Innovator’s Journey: Alternative Asset Managers

The Innovator’s Journey: Alternative Asset ManagersState Street

?

The document summarizes the findings of a survey conducted by Longitude Research on behalf of State Street regarding data and analytics capabilities among alternative asset managers. It identifies companies as being at one of three stages - Data Starters, Data Movers, or Data Innovators - based on their infrastructure, insights generation, adaptability, compliance, skills, and governance capabilities. Data Innovators are characterized as having advanced, integrated infrastructure and the ability to generate insights across asset classes. Most companies report increasing investments in data and analytics but lack confidence in key capabilities like risk assessment and generating insights from large datasets. Cyber threats and increasing regulation are key challenges cited.Panel 2 - Panel discussion - Demystifying key critical & practical issues und...

Panel 2 - Panel discussion - Demystifying key critical & practical issues und...imccci

?

Panel 2 - Panel discussion - Demystifying key critical & practical issues under VSV 2.0

How Zenko Properties Streamlined Financial Operations and Scaled Efficiently ...

How Zenko Properties Streamlined Financial Operations and Scaled Efficiently ...Ratiobox Limited

?

Zenko Properties, a dynamic and fast-growing real estate agency based in the UK, faced mounting operational challenges as its portfolio and client base expanded. Managing financial workflows across multiple property types, client accounts, and compliance requirements had become increasingly complex. Manual bookkeeping, fragmented systems, and limited in-house financial oversight were slowing down growth and exposing the company to potential compliance risks.

Recognising the need for a scalable, technology-driven solution, Zenko Properties partnered with Ratiobox to transform its financial operations. This case study explores how Ratiobox enabled Zenko to achieve greater operational efficiency, compliance assurance, and real-time financial clarity — all without the burden of maintaining a full in-house finance team.

Through a tailored combination of outsourced accounting services, automated bookkeeping, and integrated reporting tools, Ratiobox provided Zenko Properties with an end-to-end financial management solution. Our team began by conducting a deep-dive assessment of Zenko’s legacy accounting practices, identifying critical inefficiencies and opportunities for automation. We then implemented a streamlined accounting framework using cloud-based platforms such as Xero, integrated with Zenko’s CRM and property management systems.

Key improvements included:

Automated transaction processing, eliminating manual errors and reducing month-end closing time by over 50%.

Real-time financial dashboards, giving directors clear visibility into cash flow, revenue streams, and liabilities.

Fully managed payroll and HMRC submissions, ensuring Zenko stayed compliant and up to date with the latest tax regulations.

Scalable support for property acquisitions, enabling the finance function to grow in lockstep with Zenko’s portfolio.

Beyond day-to-day accounting, Ratiobox also delivered strategic insights through periodic reporting and advisory input, helping Zenko's leadership make data-backed decisions on expansion, cost control, and investment timing.

As a result, Zenko Properties not only improved operational efficiency but also gained a future-proof financial infrastructure that supports long-term growth. With fewer internal resources tied up in routine tasks, the team was free to focus on delivering exceptional service to clients and exploring new market opportunities.

More Related Content

Similar to Esterhuyse LT transparency (20)

Whom You Know Matters in Venture Capital

Whom You Know Matters in Venture CapitalBreatheBusiness

?

The article by Hochberg, Ljungqvist, and Lu explores the critical role of venture capital (VC) networks in enhancing investment performance, demonstrating that better-networked VC firms yield higher success rates for fund exits through IPOs or acquisitions. The study utilizes extensive data from U.S.-based VC firms to analyze how network centrality affects fund performance, revealing that network ties—especially those involving well-connected peers—significantly influence outcomes. The findings emphasize the importance of networking in the VC industry as a strategic consideration for both established and emerging firms.Webinar for Grantmakers—Financial Analysis in Action: Getting the Most Out of...

Webinar for Grantmakers—Financial Analysis in Action: Getting the Most Out of...GuideStar

?

This document summarizes a presentation about analyzing Form 990 data from nonprofits to better understand their financial health and inform funding decisions. It provides an overview of the Financial SCAN tool, which analyzes 5 years of 990 data to show financial trends, ratios, expenses, revenues, and compares organizations to peers. As a case study, it examines the nonprofit Help for Homeless Youth, showing metrics like their income statement, balance sheet, expenses over time, and liquidity issues. The presentation concludes with considerations for funders to have more data-driven conversations with grantees about their financial situations.Solution

SolutionAssignment Help

?

Firms in Fiji and other USP region countries demonstrate low levels of sustainability disclosures due to factors such as legal conditions, limited industrial exposure, and a strong emphasis on shareholder wealth creation over stakeholder interests. In contrast, Australian commercial banks face higher demands for non-financial information owing to their social impact and governance frameworks that prioritize stakeholder interests. The choice of assurance providers for sustainability reports typically leans towards large accounting firms within Australia for their credibility, while firms in the USP region may opt for non-auditing firms to obscure potentially harmful non-financial information.Helping asset managers navigate the data sea

Helping asset managers navigate the data seaThe Economist Media Businesses

?

A global study by the Economist Intelligence Unit, sponsored by Northern Trust, reveals that asset managers face significant challenges in managing an overwhelming volume of data, with many lacking effective strategies. While a majority express intent to improve their data utilization and anticipate better returns on their investments, only a small percentage feel they capture data value effectively. The need for clear, flexible data strategies along with strong leadership is crucial for navigating this complex landscape and improving outcomes in asset management.OSAE data final

OSAE data finalAllen Lloyd

?

The document discusses how the Ohio Society of CPAs uses data to understand its members and improve events and programs. Some key points:

- The OSCPA gathers data on members through surveys to learn about demographics, interests, and event attendance. They analyze trends over time.

- About half of members work in industry firms, while the other half work in public accounting firms. Programs need to address the different needs of these groups.

- Most members are between 40-60 years old, so the OSCPA is exploring format changes like webcasts to attract younger professionals.

- Data on member clicks and links is used to optimize website content and titles. Mapping and visualization tools help turnGRESB Infrastructure Results | New York

GRESB Infrastructure Results | New YorkGRESB

?

GRESB assesses and benchmarks the environmental, social, and governance (ESG) performance of real asset investments, providing standardized data to capital markets. It represents over $4 trillion in real asset value through the participation of over 100 investor members and the assessment of hundreds of assets and funds. GRESB helps investors integrate ESG factors into investment decisions and engage with general partners and asset managers.Effect of managerial ownership, financial leverage, profitability, firm size,...

Effect of managerial ownership, financial leverage, profitability, firm size,...Alexander Decker

?

- The document discusses a study that examined the effect of various firm characteristics (managerial ownership, financial leverage, profitability, firm size, and investment opportunity) on dividend policy and firm value.

- The study found that managerial ownership and investment opportunity significantly affect dividend policy, while financial leverage, profitability, and firm size do not significantly affect dividend policy.

- The study also found that all the firm characteristics, as well as dividend policy, significantly affect firm value.Corporate reputation on performance of banking industries in nigeria

Corporate reputation on performance of banking industries in nigeriaAlexander Decker

?

The document analyzes the influence of corporate reputation on the performance of banking industries in Kano State, Nigeria, using a survey of 384 respondents and Partial Least Squares Structural Equation Modeling (PLS-SEM). It concludes that corporate reputation significantly affects performance, providing insights relevant for banks and policymakers in Nigeria, an area previously under-researched in this context. The paper discusses the methodology, results, and implications for management practices and future research avenues.XBRL and ESG: The nonfinancial spillovers of Financial information processing...

XBRL and ESG: The nonfinancial spillovers of Financial information processing...MohammedZakriya8

?

This document explores the impact of the U.S. XBRL mandate on firms' ESG (Environmental, Social, and Governance) performance, highlighting that reduced information processing costs have led to improved ESG ratings, particularly in governance scores. The study finds that firms with higher monitoring from institutional investors, greater opacity, and risk-taking managers experienced the most significant improvements. Overall, the research concludes that information processing costs influence ESG engagement, with potential implications for capital market incentives beyond regulatory mandates.Questions Addressed, Questions Remaining: Notes from the Calgary ES&G Account...

Questions Addressed, Questions Remaining: Notes from the Calgary ES&G Account...Canadian Business for Social Responsibility (CBSR)

?

The ES&G Accountability Forum held on October 8, 2013, aimed to improve the disclosure of both financial and non-financial information by companies in Canada. Key discussions highlighted the need for better communication and credibility in sustainability reports, with recommendations for companies, investors, and evaluation organizations on improving transparency and engagement. Challenges remain in aligning the diverse expectations and needs of stakeholders involved in the ESG reporting process.IRENA - Analysis of Renewable Costs: The Need for Better Data

IRENA - Analysis of Renewable Costs: The Need for Better DataIRENAslides

?

This document discusses the need for better renewable energy cost data collection. It notes that current cost data is patchy and outdated, creating risks and reducing policy ambition. The International Renewable Energy Agency (IRENA) aims to become a leading source of cost data by ramping up its data collection efforts. IRENA now has a large database but limited resources, so it seeks to engage industry and members to help shift toward more systematic cost data collection from a variety of sources. Better cost data would reduce uncertainty, improve policymaking and market development, and communicate the benefits of renewable energy.Thesis final bilal n saif 222 (2010 2011)

Thesis final bilal n saif 222 (2010 2011)Saifullah Malik

?

The document discusses using the information ratio to measure the performance of mutual funds relative to a benchmark. It defines the information ratio as the excess return of a portfolio over the benchmark return, divided by the tracking error. A higher information ratio means a fund's performance is more consistent relative to the benchmark. The document also notes limitations of the information ratio include needing substantial data and being sensitive to the chosen benchmark.Metrus Group Presentation at EEA Networking Event.

Metrus Group Presentation at EEA Networking Event.Enterprise Engagement Alliance

?

The document discusses the importance of engagement across various stakeholders in the value chain, emphasizing that engagement is key to enhancing shareholder equity. It highlights metrics for measuring engagement in employees, customers, suppliers, and the community, while providing evidence of the financial benefits of high engagement levels. The document advocates for a strategic approach to engagement, recommending the implementation of metrics to track engagement throughout the entire value chain.The CDO and the Delivery of Enterprise Value

The CDO and the Delivery of Enterprise ValueMark Albala

?

The document discusses the role of the Chief Data Officer (CDO) and how they can help deliver enterprise value through effective use of data and information. The key points are:

1) The CDO is responsible for treating data/information as valuable assets and ensuring their optimal use to support business strategies and value propositions.

2) Information flows through an organization's business model and influences the success of value propositions. The CDO aims to maximize this value by addressing issues like data quality, accessibility, and understanding.

3) The effectiveness of the CDO is measured by their influence on how information is used strategically in the business, and by improving the "information value levers" that can restrictERC Research Showcase presentations 29.01.2018

ERC Research Showcase presentations 29.01.2018 enterpriseresearchcentre

?

This document summarizes research on skills, management practices, and productivity in small and medium enterprises (SMEs). The main points are:

1. The research examines the links between managerial skills, practices adopted by SMEs, and productivity using survey and longitudinal data. It finds that higher entrepreneurial skills are associated with more structured managerial practices, and adopting more practices leads to higher productivity.

2. Key results show entrepreneurial skills, leadership skills, and organizational skills are positively correlated with productivity. Adopting additional human resource practices is also linked to around 2% higher productivity after 3 years.

3. The implications are that both skills development and coaching to help firms adopt practices are needed toThe Next Frontier for ESG Research and Ratings

The Next Frontier for ESG Research and RatingsSustainable Brands

?

This document summarizes a presentation about the next frontier for environmental, social, and governance (ESG) research and ratings. It discusses how ESG metrics and measurements are moving from qualitative to quantitative and from niche to critical mass coverage. It also describes the establishment of a Center for Ratings Excellence to develop ESG rating principles and standards through research labs and collaborations. Finally, it addresses the need for standardized ESG metrics to properly value externalities and enable more efficient capital allocation.Proposal of the study THE IMPACT OF CORPORATE GOVERNANCE ON VOLUNTARY DISCLOS...

Proposal of the study THE IMPACT OF CORPORATE GOVERNANCE ON VOLUNTARY DISCLOS...Madiha kiran

?

This study examines the impact of corporate governance on voluntary disclosure among 10 commercial banks in Pakistan from 2011-2018. A regression analysis is used to analyze the relationship between various corporate governance factors and a voluntary disclosure index. The corporate governance factors tested as independent variables include board composition, board size, firm size, return on assets, block holders ownership, institutional ownership, audit committee size, foreign ownership, firm age, and leverage. The results could help determine whether stronger corporate governance leads to greater voluntary disclosure by commercial banks in Pakistan.Extreme Engagement Engine with Case Studies

Extreme Engagement Engine with Case StudiesNawar Alsaadi

?

Mark Labs believes that effective engagement is key to achieving ESG goals. Their Extreme Engagement Engine provides tools to facilitate engagement, including: tracking engagements; managing the engagement process; collaboration features; escalation management; and reporting. Research presented shows that successful engagements can yield stock price gains, effective governance mitigates crashes, and shareholder proposals increase gender diversity on boards. The platform aims to enhance stewardship through engagement intelligence and analytics.The Innovator’s Journey: Alternative Asset Managers

The Innovator’s Journey: Alternative Asset ManagersState Street

?

The document summarizes the findings of a survey conducted by Longitude Research on behalf of State Street regarding data and analytics capabilities among alternative asset managers. It identifies companies as being at one of three stages - Data Starters, Data Movers, or Data Innovators - based on their infrastructure, insights generation, adaptability, compliance, skills, and governance capabilities. Data Innovators are characterized as having advanced, integrated infrastructure and the ability to generate insights across asset classes. Most companies report increasing investments in data and analytics but lack confidence in key capabilities like risk assessment and generating insights from large datasets. Cyber threats and increasing regulation are key challenges cited.Questions Addressed, Questions Remaining: Notes from the Calgary ES&G Account...

Questions Addressed, Questions Remaining: Notes from the Calgary ES&G Account...Canadian Business for Social Responsibility (CBSR)

?

Recently uploaded (20)

Panel 2 - Panel discussion - Demystifying key critical & practical issues und...

Panel 2 - Panel discussion - Demystifying key critical & practical issues und...imccci

?

Panel 2 - Panel discussion - Demystifying key critical & practical issues under VSV 2.0

How Zenko Properties Streamlined Financial Operations and Scaled Efficiently ...

How Zenko Properties Streamlined Financial Operations and Scaled Efficiently ...Ratiobox Limited

?

Zenko Properties, a dynamic and fast-growing real estate agency based in the UK, faced mounting operational challenges as its portfolio and client base expanded. Managing financial workflows across multiple property types, client accounts, and compliance requirements had become increasingly complex. Manual bookkeeping, fragmented systems, and limited in-house financial oversight were slowing down growth and exposing the company to potential compliance risks.

Recognising the need for a scalable, technology-driven solution, Zenko Properties partnered with Ratiobox to transform its financial operations. This case study explores how Ratiobox enabled Zenko to achieve greater operational efficiency, compliance assurance, and real-time financial clarity — all without the burden of maintaining a full in-house finance team.

Through a tailored combination of outsourced accounting services, automated bookkeeping, and integrated reporting tools, Ratiobox provided Zenko Properties with an end-to-end financial management solution. Our team began by conducting a deep-dive assessment of Zenko’s legacy accounting practices, identifying critical inefficiencies and opportunities for automation. We then implemented a streamlined accounting framework using cloud-based platforms such as Xero, integrated with Zenko’s CRM and property management systems.

Key improvements included:

Automated transaction processing, eliminating manual errors and reducing month-end closing time by over 50%.

Real-time financial dashboards, giving directors clear visibility into cash flow, revenue streams, and liabilities.

Fully managed payroll and HMRC submissions, ensuring Zenko stayed compliant and up to date with the latest tax regulations.

Scalable support for property acquisitions, enabling the finance function to grow in lockstep with Zenko’s portfolio.

Beyond day-to-day accounting, Ratiobox also delivered strategic insights through periodic reporting and advisory input, helping Zenko's leadership make data-backed decisions on expansion, cost control, and investment timing.

As a result, Zenko Properties not only improved operational efficiency but also gained a future-proof financial infrastructure that supports long-term growth. With fewer internal resources tied up in routine tasks, the team was free to focus on delivering exceptional service to clients and exploring new market opportunities.

最新版意大利布雷西亚大学毕业证(叠搁贰厂颁滨础毕业证书)原版定制

最新版意大利布雷西亚大学毕业证(叠搁贰厂颁滨础毕业证书)原版定制taqyea

?

2025原版布雷西亚大学毕业证书pdf电子版【q薇1954292140】意大利毕业证办理BRESCIA布雷西亚大学毕业证书多少钱?【q薇1954292140】海外各大学Diploma版本,因为疫情学校推迟发放证书、证书原件丢失补办、没有正常毕业未能认证学历面临就业提供解决办法。当遭遇挂科、旷课导致无法修满学分,或者直接被学校退学,最后无法毕业拿不到毕业证。此时的你一定手足无措,因为留学一场,没有获得毕业证以及学历证明肯定是无法给自己和父母一个交代的。

【复刻布雷西亚大学成绩单信封,Buy Università degli Studi di BRESCIA Transcripts】

购买日韩成绩单、英国大学成绩单、美国大学成绩单、澳洲大学成绩单、加拿大大学成绩单(q微1954292140)新加坡大学成绩单、新西兰大学成绩单、爱尔兰成绩单、西班牙成绩单、德国成绩单。成绩单的意义主要体现在证明学习能力、评估学术背景、展示综合素质、提高录取率,以及是作为留信认证申请材料的一部分。

布雷西亚大学成绩单能够体现您的的学习能力,包括布雷西亚大学课程成绩、专业能力、研究能力。(q微1954292140)具体来说,成绩报告单通常包含学生的学习技能与习惯、各科成绩以及老师评语等部分,因此,成绩单不仅是学生学术能力的证明,也是评估学生是否适合某个教育项目的重要依据!

我们承诺采用的是学校原版纸张(原版纸质、底色、纹路)我们工厂拥有全套进口原装设备,特殊工艺都是采用不同机器制作,仿真度基本可以达到100%,所有成品以及工艺效果都可提前给客户展示,不满意可以根据客户要求进行调整,直到满意为止!

【主营项目】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理毕业证|办理文凭: 买大学毕业证|买大学文凭【q薇1954292140】布雷西亚大学学位证明书如何办理申请?

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理意大利成绩单布雷西亚大学毕业证【q薇1954292140】国外大学毕业证, 文凭办理, 国外文凭办理, 留信网认证C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 202...

C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 202...imccci

?

C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 2025-26

Family Governance Presentation by Dinesh Kanabar

Family Governance Presentation by Dinesh Kanabarimccci

?

Family Governance Presentation by Dinesh Kanabar 15 2024Family Owned Business Succession/Estate Planning

Family Owned Business Succession/Estate Planningimccci

?

Family Owned Business Succession/Estate PlanningShakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24

Shakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24Business Analysis

?

Qualitative Fundamental Analysis of Shakti Pumps (India) share for its future growth potential (based on the Annual Report FY2024)

Get a sense of the Shakti Pumps (India)'s business activities, by understanding its values, business and risks.

YouTube video: https://youtu.be/lx5SxXcu90g

Order a printed copy of this presentation: BusinessAnalysis.BA.info@gmail.com

--

Disclaimer:

We are not SEBI RIAs. This presentation is not an investment advice. It is only for study and reference purposes.RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUST

RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUSTimccci

?

RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUST

Macroeconomic Study of the country - Vietnam.pptx

Macroeconomic Study of the country - Vietnam.pptxAnkush Upadhyay

?

PPT summarises our study of the economy as a whole of VietnamINVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptx

INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptxAnkush Upadhyay

?

This presentation analyzes investment strategies for a 30-year-old risk-averse investor with ?50 lakhs. Based on a 35:65 equity-debt allocation, it recommends equity investments in HAL, BEL, and Bajaj Auto due to their strong financials and low debt, and debt investments in government and tax-free bonds with stable yields. The analysis balances risk and return for long-term portfolio growth in the defense sector and public sector bonds.STOCK TRADING COURSE BY FINANCEWORLD.IO (PDF)

STOCK TRADING COURSE BY FINANCEWORLD.IO (PDF)AndrewBorisenko3

?

Unlock the Power of the Stock Market – Stock Trading Course by FinanceWorld.io (PDF)

Take your first step towards financial independence with FinanceWorld.io’s in-depth Stock Trading Course. This easy-to-follow PDF guide demystifies the stock market, providing you with all the essential tools and knowledge to begin trading with confidence.

What’s Included in This Course:

Introduction to stocks and the stock market ecosystem

Understanding shares, indices, and different market sectors

How to open a brokerage account and place your first trades

Fundamental analysis: reading financial statements and news

Technical analysis: chart patterns, trends, and indicators

Time-tested strategies for beginners and experienced traders

Essential risk management techniques to protect your capital

Trading psychology: mastering emotions and staying disciplined

Real-world examples, practice exercises, and actionable tips

Who Is This PDF For?

New investors looking to enter the world of stock trading

Current traders wanting to refine their approach and strategy

Anyone seeking to build wealth through the stock market

Why Choose FinanceWorld.io?

Our expert-written guides strip away the jargon and focus on practical, real-world trading skills. With FinanceWorld.io, you gain clarity, confidence, and a proven roadmap to succeed in the markets.Issues of Trust Returns-ITR 7 CA. Ashok D. Mehta

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehtaimccci

?

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehta

原版西班牙维克大学-加泰罗尼亚中央大学毕业证(鲍痴滨颁毕业证书)如何办理

原版西班牙维克大学-加泰罗尼亚中央大学毕业证(鲍痴滨颁毕业证书)如何办理taqyed

?

鉴于此,办理UVIC大学毕业证维克大学-加泰罗尼亚中央大学毕业证书【q薇1954292140】留学一站式办理学历文凭直通车(维克大学-加泰罗尼亚中央大学毕业证UVIC成绩单原版维克大学-加泰罗尼亚中央大学学位证假文凭)未能正常毕业?【q薇1954292140】办理维克大学-加泰罗尼亚中央大学毕业证成绩单/留信学历认证/学历文凭/使馆认证/留学回国人员证明/录取通知书/Offer/在读证明/成绩单/网上存档永久可查!

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

【办理维克大学-加泰罗尼亚中央大学成绩单Buy Universitat de Vic-Universitat Central de Catalunya Transcripts】

购买日韩成绩单、英国大学成绩单、美国大学成绩单、澳洲大学成绩单、加拿大大学成绩单(q微1954292140)新加坡大学成绩单、新西兰大学成绩单、爱尔兰成绩单、西班牙成绩单、德国成绩单。成绩单的意义主要体现在证明学习能力、评估学术背景、展示综合素质、提高录取率,以及是作为留信认证申请材料的一部分。

维克大学-加泰罗尼亚中央大学成绩单能够体现您的的学习能力,包括维克大学-加泰罗尼亚中央大学课程成绩、专业能力、研究能力。(q微1954292140)具体来说,成绩报告单通常包含学生的学习技能与习惯、各科成绩以及老师评语等部分,因此,成绩单不仅是学生学术能力的证明,也是评估学生是否适合某个教育项目的重要依据!Business sentiment stabilized in May, but exporters’ anxiety and labor shorta...

Business sentiment stabilized in May, but exporters’ anxiety and labor shorta...?нститут економ?чних досл?джень та пол?тичних консультац?й

?

Key points:

? The highest uncertainty in the 3-month perspective was recorded among exporters, 20.7%

? The share of enterprises planning to scale down operations over a 2-year horizon rose to 5%, but 95% do not expect a decline or foresee growth

? Labor shortages remain the main obstacle — 63% of businesses noted this issue

? The second most common obstacles were safety risks and rising prices

? Power outages remain a relatively minor issue — only 7% mentioned it

Most key indicators of business sentiment remained stable in May. The Business Activity Recovery Index remained unchanged from April at 0.13. The aggregated indicator of industrial prospects, which reflects short-term expectations, slightly declined to 0.11 from 0.12 in March–April.

These are the findings of the 37th monthly survey conducted by the IER among 474 industrial enterprises.

Uncertainty in the three-month outlook remained unchanged primarily for key production indicators.

“However, we recorded the highest level of three-month uncertainty among exporters. Every fifth exporter — 20.7% — currently does not know what their export dynamics will be over the next 3–4 months,” said IER Executive Director Oksana Kuziakiv.

Uncertainty decreased over longer horizons — 6-month and 2-year periods. Currently, only 28.7% of respondents find it difficult to predict their activities two years in advance. This is the lowest share since at least October 2022, when 42.3% of businesses reported uncertainty.

“In May, the share of those planning to reduce their enterprise’s activity over two years increased to 5%. This is still a small number, though higher than April’s 1.4%. Nearly 80% don’t foresee major changes. In fact, 95% of respondents indicate that they will either remain unchanged or experience slight growth. Considering the instability, security, and economic challenges Ukraine faces, this is a very good result,” said Oksana Kuziakiv.

The share of enterprises that increased production in May fell from 26.2% to 19.5%, while the share of those that reduced output grew from 10% to 13.5%. The share of businesses planning to increase production in the next 3–4 months slightly declined, from 40.8% to 39.9%.

The total share of enterprises operating at full or near-full production capacity slightly increased in May, from 62% to 63%.

“In January this year, the share of those operating at over 75% of capacity rose significantly. Since then, it has remained relatively unchanged. For example, in May, 53% of companies were in this category,” noted Oksana Kuziakiv.

Expectations for new orders remain cautious: the share of companies with order portfolios longer than a year slightly decreased, from 16% to 15%. On average, the duration of new orders increased from 4.9 to 5 months.

“This happened because the share of those with orders for just one to two months declined from 33% to 24%. Likely, these orders were redistributed: some now work ‘on the fly,’ others shifted into the three-to-five month category,Invoice Factoring Broker Training | Charter Capital

Invoice Factoring Broker Training | Charter CapitalKeith Mabe

?

If you are new to brokering invoice factoring deals. Here is a quick primer to get you started.Business sentiment stabilized in May, but exporters’ anxiety and labor shorta...

Business sentiment stabilized in May, but exporters’ anxiety and labor shorta...?нститут економ?чних досл?джень та пол?тичних консультац?й

?

Ad

Esterhuyse LT transparency

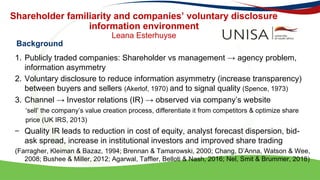

- 1. Shareholder familiarity and companies’ voluntary disclosure information environment Leana Esterhuyse 1. Publicly traded companies: Shareholder vs management → agency problem, information asymmetry 2. Voluntary disclosure to reduce information asymmetry (increase transparency) between buyers and sellers (Akerlof, 1970) and to signal quality (Spence, 1973) 3. Channel → Investor relations (IR) → observed via company’s website ‘sell’ the company’s value creation process, differentiate it from competitors & optimize share price (UK IRS, 2013) – Quality IR leads to reduction in cost of equity, analyst forecast dispersion, bid- ask spread, increase in institutional investors and improved share trading (Farragher, Kleiman & Bazaz, 1994; Brennan & Tamarowski, 2000; Chang, D’Anna, Watson & Wee, 2008; Bushee & Miller, 2012; Agarwal, Taffler, Belloti & Nash, 2016; Nel, Smit & Brummer, 2018) Background

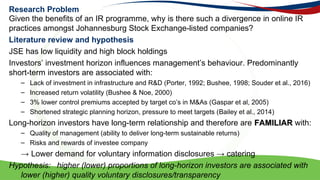

- 2. Research Problem Given the benefits of an IR programme, why is there such a divergence in online IR practices amongst Johannesburg Stock Exchange-listed companies? JSE has low liquidity and high block holdings Investors’ investment horizon influences management’s behaviour. Predominantly short-term investors are associated with: – Lack of investment in infrastructure and R&D (Porter, 1992; Bushee, 1998; Souder et al., 2016) – Increased return volatility (Bushee & Noe, 2000) – 3% lower control premiums accepted by target co’s in M&As (Gaspar et al, 2005) – Shortened strategic planning horizon, pressure to meet targets (Bailey et al., 2014) Long-horizon investors have long-term relationship and therefore are FAMILIARFAMILIAR with: – Quality of management (ability to deliver long-term sustainable returns) – Risks and rewards of investee company → Lower demand for voluntary information disclosures → catering Hypothesis: higher (lower) proportions of long-horizon investors are associated with lower (higher) quality voluntary disclosures/transparency Literature review and hypothesis

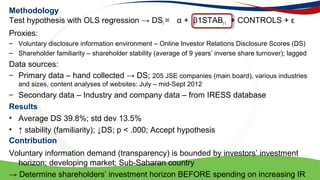

- 3. Methodology Test hypothesis with OLS regression → DSt = α + β1STABt-1 + CONTROLS + ε Proxies: – Voluntary disclosure information environment – Online Investor Relations Disclosure Scores (DS) – Shareholder familiarity – shareholder stability (average of 9 years’ inverse share turnover); lagged Data sources: – Primary data – hand collected → DS; 205 JSE companies (main board), various industries and sizes, content analyses of websites: July – mid-Sept 2012 – Secondary data – Industry and company data – from IRESS database ? Average DS 39.8%; std dev 13.5% ? ↑ stability (familiarity); ↓DS; p < .000; Accept hypothesis Voluntary information demand (transparency) is bounded by investors’ investment horizon; developing market; Sub-Saharan country → Determine shareholders’ investment horizon BEFORE spending on increasing IR Results Contribution