Pursuing a Better Investment Experience

- 1. Pursuing a Better Investment Experience Last updated: March 2015

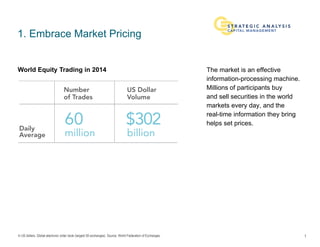

- 2. In US dollars. Global electronic order book (largest 50 exchanges). Source: World Federation of Exchanges. 1. Embrace Market Pricing The market is an effective information-processing machine. Millions of participants buy and sell securities in the world markets every day, and the real-time information they bring helps set prices. 1 World Equity Trading in 2014

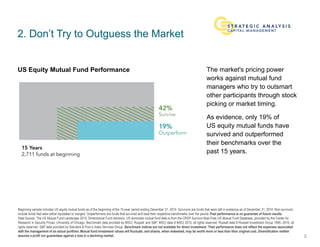

- 3. Beginning sample includes US equity mutual funds as of the beginning of the 15-year period ending December 31, 2014. Survivors are funds that were still in existence as of December 31, 2014. Non-survivors include funds that were either liquidated or merged. Outperformers are funds that survived and beat their respective benchmarks over the period. Past performance is no guarantee of future results. Data Source: The US Mutual Fund Landscape 2015, Dimensional Fund Advisors. US-domiciled mutual fund data is from the CRSP Survivor-Bias-Free US Mutual Fund Database, provided by the Center for Research in Security Prices, University of Chicago. Benchmark data provided by MSCI, Russell, and S&P. MSCI data ┬® MSCI 2015, all rights reserved. Russell data ┬® Russell Investment Group 1995’ĆŁ2015, all rights reserved. S&P data provided by Standard & PoorŌĆÖs Index Services Group. Benchmark indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Mutual fund investment values will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Diversification neither assures a profit nor guarantees against a loss in a declining market. 2. DonŌĆÖt Try to Outguess the Market The market's pricing power works against mutual fund managers who try to outsmart other participants through stock picking or market timing. As evidence, only 19% of US equity mutual funds have survived and outperformed their benchmarks over the past 15 years. 2 US Equity Mutual Fund Performance

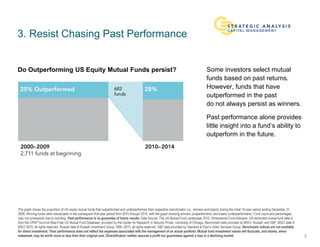

- 4. The graph shows the proportion of US equity mutual funds that outperformed and underperformed their respective benchmarks (i.e., winners and losers) during the initial 10-year period ending December 31, 2009. Winning funds were reevaluated in the subsequent five-year period from 2010 through 2014, with the graph showing winners (outperformers) and losers (underperformers). Fund count and percentages may not correspond due to rounding. Past performance is no guarantee of future results. Data Source: The US Mutual Fund Landscape 2015, Dimensional Fund Advisors. US-domiciled mutual fund data is from the CRSP Survivor-Bias-Free US Mutual Fund Database, provided by the Center for Research in Security Prices, University of Chicago. Benchmark data provided by MSCI, Russell, and S&P. MSCI data ┬® MSCI 2015, all rights reserved. Russell data ┬® Russell Investment Group 1995ŌĆō2015, all rights reserved. S&P data provided by Standard & PoorŌĆÖs Index Services Group. Benchmark indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Mutual fund investment values will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Diversification neither assures a profit nor guarantees against a loss in a declining market. 3. Resist Chasing Past Performance Some investors select mutual funds based on past returns. However, funds that have outperformed in the past do not always persist as winners. Past performance alone provides little insight into a fundŌĆÖs ability to outperform in the future. 3 Do Outperforming US Equity Mutual Funds persist?

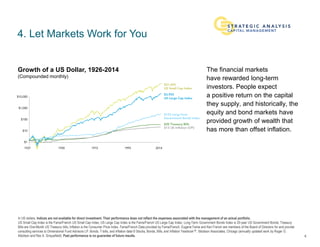

- 5. In US dollars. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. US Small Cap Index is the Fama/French US Small Cap Index; US Large Cap Index is the Fama/French US Large Cap Index; Long-Term Government Bonds Index is 20-year US Government Bonds; Treasury Bills are One-Month US Treasury bills; Inflation is the Consumer Price Index. Fama/French Data provided by Fama/French. Eugene Fama and Ken French are members of the Board of Directors for and provide consulting services to Dimensional Fund Advisors LP. Bonds, T-bills, and inflation data ┬® Stocks, Bonds, Bills, and Inflation YearbookŌäó, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). Past performance is no guarantee of future results. 4. Let Markets Work for You The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation. 4 Growth of a US Dollar, 1926-2014 (Compounded monthly)

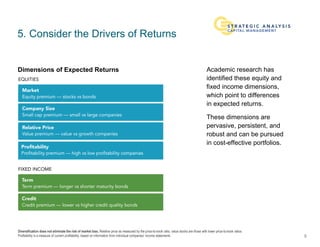

- 6. Diversification does not eliminate the risk of market loss. Relative price as measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. Profitability is a measure of current profitability, based on information from individual companiesŌĆÖ income statements. 5. Consider the Drivers of Returns Academic research has identified these equity and fixed income dimensions, which point to differences in expected returns. These dimensions are pervasive, persistent, and robust and can be pursued in cost-effective portfolios. 5 Dimensions of Expected Returns

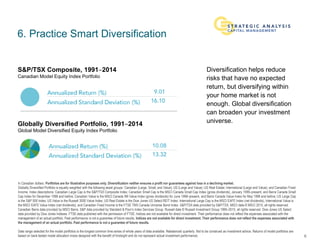

- 7. 6. Practice Smart Diversification Diversification helps reduce risks that have no expected return, but diversifying within your home market is not enough. Global diversification can broaden your investment universe. 6 S&P/TSX Composite, 1991ŌĆÆ2014 Canadian Model Equity Index Portfolio Globally Diversified Portfolio, 1991ŌĆÆ2014 Global Model Diversified Equity Index Portfolio In Canadian dollars. Portfolios are for illustrative purposes only. Diversification neither ensures a profit nor guarantees against loss in a declining market. Globally Diversified Portfolio is equally weighted with the following asset groups: Canadian (Large, Small, and Value); US (Large and Value); US Real Estate; International (Large and Value); and Canadian Fixed Income. Index descriptions: Canadian Large Cap is the S&P/TSX Composite Index; Canadian Small Cap is the MSCI Canada Small Cap Index (gross dividends), January 1999ŌĆōpresent, and Barra Canada Small Cap Index for December 1998 and before; Canadian Value is the MSCI Canada IMI Value Index (gross dividends) for June 1998ŌĆōpresent, and Barra Canada Value Index for May 1998 and before; US Large Cap is the S&P 500 Index; US Value is the Russell 3000 Value Index; US Real Estate is the Dow Jones US Select REIT Index; International Large Cap is the MSCI EAFE Index (net dividends); International Value is the MSCI EAFE Value Index (net dividends); and Canadian Fixed Income is the FTSE TMX Canada Universe Bond Index. S&P/TSX data provided by S&P/TSX. MSCI data ┬® MSCI 2015, all rights reserved. Canadian Barra data provided by MSCI Barra. S&P data provided by Standard & PoorŌĆÖs Index Services Group. Russell data ┬® Russell Investment Group 1995ŌĆō2015, all rights reserved. Dow Jones US Select data provided by Dow Jones Indexes. FTSE data published with the permission of FTSE. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Date range selected for the model portfolios is the longest common time series of whole years of data available. Rebalanced quarterly. Not to be construed as investment advice. Returns of model portfolios are based on back-tested model allocation mixes designed with the benefit of hindsight and do not represent actual investment performance.

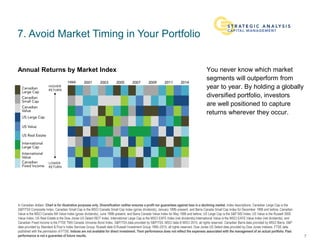

- 8. In Canadian dollars. Chart is for illustrative purposes only. Diversification neither ensures a profit nor guarantees against loss in a declining market. Index descriptions: Canadian Large Cap is the S&P/TSX Composite Index; Canadian Small Cap is the MSCI Canada Small Cap Index (gross dividends), January 1999ŌĆōpresent, and Barra Canada Small Cap Index for December 1998 and before; Canadian Value is the MSCI Canada IMI Value Index (gross dividends), June 1998ŌĆōpresent, and Barra Canada Value Index for May 1998 and before; US Large Cap is the S&P 500 Index; US Value is the Russell 3000 Value Index; US Real Estate is the Dow Jones US Select REIT Index; International Large Cap is the MSCI EAFE Index (net dividends);International Value is the MSCI EAFE Value Index (net dividends); and Canadian Fixed Income is the FTSE TMX Canada Universe Bond Index. S&P/TSX data provided by S&P/TSX. MSCI data ┬® MSCI 2015, all rights reserved. Canadian Barra data provided by MSCI Barra. S&P data provided by Standard & PoorŌĆÖs Index Services Group. Russell data ┬® Russell Investment Group 1995ŌĆō2015, all rights reserved. Dow Jones US Select data provided by Dow Jones Indexes. FTSE data published with the permission of FTSE. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. 7. Avoid Market Timing in Your Portfolio You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well positioned to capture returns wherever they occur. 7 Annual Returns by Market Index

- 9. For illustrative purposes only. 8. Manage Your Emotions Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions at the worst times. 8 Reactive Investing in a Market Cycle

- 10. For illustrative purposes only. 9. DonŌĆÖt Confuse Entertainment with Advice Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future while others tempt you to chase the latest investment fad. When tested, consider the source and maintain a long-term perspective. 9

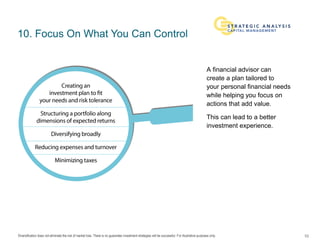

- 11. Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. For illustrative purposes only. 10. Focus On What You Can Control A financial advisor can create a plan tailored to your personal financial needs while helping you focus on actions that add value. This can lead to a better investment experience. 10