test again

0 likes72 views

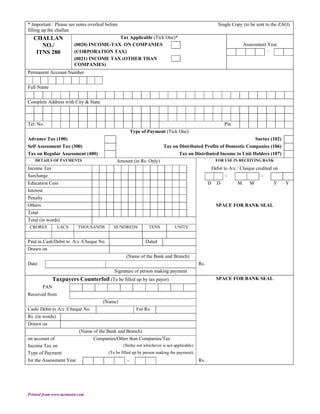

This document is an income tax challan form used to make various income tax payments in India. It contains fields to enter details of the taxpayer like permanent account number, name, address and contact details. It also contains fields to specify the type of tax payment like advance tax, self-assessment tax, tax on distributed profits etc. and the amount being paid. Notes on the reverse provide instructions on using separate challans for different payments, quoting permanent account number, depositing appeal fees and taxes for block periods. It also mentions the bank acknowledgement should contain the 7 digit BSR code, deposit date and challan serial number to be quoted in the income tax return.

1 of 2

Download to read offline

Recommended

tax.utah.gov forms current tc-55a

tax.utah.gov forms current tc-55ataxman taxman

Ėý

A taxpayer filed a claim for a refund of $XX in sales tax or license fees paid for a motor vehicle. The taxpayer paid $YY in fees or taxes originally but believes the correct amount should have been $ZZ based on their own computation. They are requesting a refund of $XX, which is the difference between what they paid and what they calculated as correct. They have provided documentation to support their reason for requesting the refund.tax.state.nv.us documents let under 7500

tax.state.nv.us documents let under 7500taxman taxman

Ėý

This document is a tax return form for non-gaming facilities in Nevada with between 200-7499 occupants to report their live entertainment tax liability. It requires the facility to provide their tax identification number, the month being reported, and calculations for admission charges, concession sales, total taxable amount, net live entertainment tax, any penalties or interest due based on late filing, and the total amount due or refund owed. It includes instructions for completing each line and additional information about applicable tax rates, credits, and requirements for facilities above or below the reported occupancy range.colorado.gov cms forms dor-tax dr5785f

colorado.gov cms forms dor-tax dr5785ftaxman taxman

Ėý

This document is an authorization form for the Colorado Department of Revenue to set up electronic funds transfer (EFT) for tax payments. It collects information such as taxpayer name, address, tax ID number, contact details, bank account and routing numbers. The taxpayer authorizes the DOR to initiate debit entries from their bank account to pay taxes. It lists the different tax types that can be paid via EFT with their corresponding codes. The taxpayer must sign to authorize ACH debit transactions or contact their bank to set up ACH credit transactions to pay taxes electronically.scheduleL wv.us taxrev forms

scheduleL wv.us taxrev forms taxman taxman

Ėý

This document is a 2008 Schedule L form requesting an extension to file West Virginia personal income tax returns. It collects information such as the taxpayer's name, address, social security number, total income tax liability, total payments made, and amount of tax due. It notes that the form is not an extension to pay taxes due, but rather requests a six-month extension to file the 2008 tax return by October 15, 2009. It must be filed by the original due date of April 15, 2009 along with any payment owed to avoid penalties for late filing or payment.Universal VAT Services (UVS)

Universal VAT Services (UVS)Samip Shah

Ėý

At UVS our mission is to MAXIMIZE "VAT Recovery" within the scope of the laws, while providing a low cost, efficient solution to all our clients.

Please visit us @

www.universalvatservices.com

Thank Youegov.oregon.gov DOR PERTAX 101-093

egov.oregon.gov DOR PERTAX 101-093taxman taxman

Ėý

This document is a request form for doubtful liability relief from the Oregon Department of Revenue. It allows taxpayers to request that taxes be canceled even if they did not file an appeal on time, if certain conditions are met. These conditions include: (1) the tax assessment must exceed what the taxpayer says they owe by $100 or more; (2) the taxpayer must be in compliance with all filing requirements; and (3) the taxpayer must pay any taxes, penalties, and interest owed and provide requested information. By signing the form, the taxpayer verifies the information is correct and they meet the conditions for relief.Form 1-ES

Form 1-EStaxman taxman

Ėý

This document is a voucher for estimated Wisconsin income tax payments. It provides instructions for accurately printing the voucher at 100% size without auto-rotation or centering. The voucher includes fields for the payer's name, address, social security number, payment amount, and payment due dates. It directs filers to mail the voucher with payment to the Wisconsin Department of Revenue.2011 final fixed-seprate block_tax_regimes_updated

2011 final fixed-seprate block_tax_regimes_updatedUniversity Of Central Punjab

Ėý

The document discusses income subject to separate charge under the Income Tax Ordinance of Pakistan. It covers four types of income subject to separate charge: [1] dividend income, [2] royalty income of non-residents, [3] fee for technical services of non-residents, and [4] shipping and air transport income of non-residents. These incomes are taxed separately on a gross basis at final tax rates without consideration of deductions or other incomes. The document outlines the tax rates and procedures for tax payment and clearance for ships and aircrafts.400-ext-enabled nd.gov tax indincome forms 2008

400-ext-enabled nd.gov tax indincome forms 2008taxman taxman

Ėý

This document provides instructions for making an extension payment for North Dakota individual income taxes. It explains that taxpayers can pay by check or credit card to prepay expected taxes and avoid extension interest. It provides the payment address and instructions for filling out the voucher if paying by check. It also gives the website and phone number for paying by credit card through a third party payment processor, including that a fee will be charged. The deadline to make an extension payment is April 15, 2009 to avoid extension interest.Nonresident Seller's Tax Prepayment Receipt

Nonresident Seller's Tax Prepayment Receipttaxman taxman

Ėý

This document is a Nonresident Seller's Tax Prepayment Receipt form used in New Jersey. It requires sellers who are nonresidents of New Jersey to provide information such as their name, address, ownership percentage of the property being sold, the sale price, and signature to certify the information. The form serves to document payment of taxes by nonresident sellers when selling property in New Jersey as required by law. It must be completed prior to closing, submitted to the Division of Taxation for a receipt, and then given to the buyer's attorney to submit to the county clerk for the deed to be recorded.Form EPV

Form EPVtaxman taxman

Ėý

This 3 sentence summary provides the key information from the document:

Print the voucher at 100% by selecting "None" under Page Scaling in the Print menu and unchecking the Auto-Rotate and Center checkbox to ensure the Wisconsin Electronic Payment Voucher prints accurately. Cut out the voucher below the dotted line and mail it with your payment to the Wisconsin Department of Revenue at the provided address. Be sure to enter your name, address, social security number without hyphens, phone number, and payment amount on the voucher.tax.utah.gov forms current tc tc-549

tax.utah.gov forms current tc tc-549taxman taxman

Ėý

This document provides instructions for making a payment for a Utah fiduciary income tax return. It explains that the payment coupon should be included with any payment if a return was previously filed without payment. The coupon and payment should be mailed to the Utah State Tax Commission with the name, address, EIN, and tax year written on the check. Electronic payment is also an option. Sending a duplicate copy of the return with the payment may delay processing.How to fill up challan 280 for paying income tax

How to fill up challan 280 for paying income taxInvestdunia

Ėý

Did you forget to report an income and hence paid lower income tax. You can use challan 280 and pay the balance income tax at bank. E2A - Estate Tax Info & App for Tax Clearance

E2A - Estate Tax Info & App for Tax Clearancetaxman taxman

Ėý

This document is an application for refund of Vermont sales and use tax, meals and rooms tax, or withholding tax. It requests the claimant's name and contact information, the tax period and amount being claimed, and an explanation of the refund request. The instructions provide details on documentation needed to substantiate refund claims, including invoices, exemption certificates, credit memos, and examples of acceptable documentation for different types of refund claims. Refund requests must be made within three years of the original tax return due date, or two years for uncollectible accounts.Individual Income Tax Electronic Payment Voucher

Individual Income Tax Electronic Payment Vouchertaxman taxman

Ėý

This document provides instructions for filing and paying South Carolina individual income taxes electronically for tax year 2008. It outlines that taxpayers owing $15,000 or more are required to pay electronically. It provides instructions for completing payment voucher form SC1040-V, including entering identifying information and payment amounts. It details that payments are due by May 1, 2009 to avoid penalties and interest and must be mailed to the SC Department of Revenue Electronic Filing address in Columbia.tax.utah.gov forms current tc tc-542

tax.utah.gov forms current tc tc-542taxman taxman

Ėý

This document is a request form for a refund of an administrative impound fee from a DUI incident. To be eligible for a refund, the applicant must provide proof of duplicate payment, a police report if the vehicle was stolen, or a letter from the Driver License Division stating their license will not be suspended. The completed form and supporting documents should be mailed to the Utah State Tax Commission for processing of the refund request.tax.utah.gov forms current tc tc-719

tax.utah.gov forms current tc tc-719taxman taxman

Ėý

This document is an affidavit for sales and use tax exemption for authorized interstate carriers purchasing vehicles, aircraft, locomotives, or other rolling stock. It requires the purchaser to provide their IRP, IFTA, FAA, or Surface Transportation Board certificate number to certify that the purchase is for a qualified vehicle that will be used for interstate commerce. The purchaser must sign the affidavit under penalty of perjury to claim the sales tax exemption.IncomeTax Declaration FY 09-10

IncomeTax Declaration FY 09-10guest1f4f89d

Ėý

The document provides information to employees about tax declarations for the financial year 2008-2009, including details on investments eligible for tax deductions under sections 80C and 80CCC, house rent allowance calculations and tax implications, medical expense exemptions, and income tax slabs and rates for male and female assessees. Employees are required to submit proof of eligible investments and rent payments by December 31, 2008 to receive applicable tax rebates and exemptions.it140esi wv.us taxrev forms 2008/

it140esi wv.us taxrev forms 2008/ taxman taxman

Ėý

1) This document provides instructions for completing West Virginia estimated tax vouchers and worksheets. It explains who must make estimated tax payments, how to calculate estimated tax liability, and payment due dates.

2) Failure to pay at least 90% of estimated tax can result in penalties. Exceptions to penalties include having a tax liability under $600 or paying 100% of the prior year's tax.

3) The worksheet walks through calculating estimated tax by determining income, exemptions, taxable income, tax amount, credits, and estimated payments vs. tax due. The minimum payment with each voucher is the remaining balance divided by payments remaining.Microsoft Power Point Afrithuto Presents Revenue, Debt Management And Suspe...

Microsoft Power Point Afrithuto Presents Revenue, Debt Management And Suspe...fred fred

Ėý

The document discusses responsibilities for managing revenue in the public sector, including identifying and collecting revenue, safeguarding funds, maintaining accurate records, and submitting regular financial reports. It also outlines requirements for reviewing fees and tariffs annually, obtaining treasury approval for rate changes, and disclosing tariff structures. Public sector managers are responsible for efficiently managing revenue collection and ensuring adequate separation of financial duties.tax.utah.gov forms current tc tc-366

tax.utah.gov forms current tc tc-366taxman taxman

Ėý

This document provides instructions for filing a Compressed Natural Gas (CNG) Tax Return in Utah. Taxpayers who own or lease equipment to compress natural gas for highway vehicles must file a monthly return, even if there is no activity to report. The return requires the taxpayer to report the total quantity of CNG dispensed in gasoline gallon equivalents, calculate the tax by multiplying the quantity by $0.085 per gallon, and submit payment of the tax amount due. Contact information is provided for questions about filing the return.tax.utah.gov forms current tc tc-943

tax.utah.gov forms current tc tc-943taxman taxman

Ėý

This document provides instructions for applying for a refund of Utah tax paid on exported diesel fuel. It outlines that exporters may file for a refund up to 180 days after exporting the fuel by completing form TC-943. The form requests information about the exporter, origin and destination of the exported fuel, tax paid, gallons exported, and supporting documentation. Original records must be kept for three years and the completed form can be mailed or hand delivered to the Utah State Tax Commission to apply for the refund.Direct Tax Code

Direct Tax CodeMehul Panchal

Ėý

This document is the Direct Taxes Code Bill of 2010 from India. It contains 113 clauses that cover topics such as:

1) Establishing the basis of income tax liability and defining types of income like employment, house property, business, capital gains, and residuary sources.

2) Detailing how to compute total income under each head and aggregate income across sources.

3) Providing tax incentives like deductions for savings, insurance, education, donations, etc.

4) Covering special provisions for non-profit organizations and provisions to prevent tax avoidance.

5) Outlining tax administration and procedures as well as authorities' powers.Combined Group Business Enterprise Tax Return

Combined Group Business Enterprise Tax Returntaxman taxman

Ėý

This document is instructions for a New Hampshire Business Enterprise Tax Return form. It provides the following information:

1) This form is required to be filed if a business's gross receipts were over $150,000 or its enterprise value tax base was over $75,000 for at least one member of a combined group.

2) It includes steps to calculate the taxable enterprise value tax base and figure the business enterprise tax.

3) There are statutory credits that can be applied against the business enterprise tax, including credits for investments, community reinvestment, research and development, and job creation. Individual Declaration of Estimated Tax with Instructions and Worksheet

Individual Declaration of Estimated Tax with Instructions and Worksheettaxman taxman

Ėý

The document provides instructions for South Carolina taxpayers filing estimated individual income tax payments for 2009. It explains that estimated tax payments are due quarterly on April 15, June 15, September 15, and January 15, unless an exception applies. Taxpayers can pay by credit card, electronic check, or by mailing a payment voucher along with a check or money order. Failure to make required estimated payments may result in penalties. Utility Property Tax Information Update

Utility Property Tax Information Updatetaxman taxman

Ėý

This document is a payment form for the New Hampshire Department of Revenue Administration's private car tax for 2007. It provides instructions for taxpayers to report their annual private car tax amount from their tax bill, make payments on any balance due including estimated tax payments, and claim overpayment credits or refunds. Taxpayers are directed to sign and submit the form along with any payment due by December 30, 2007.tax.state.nv.us documents let under 7500

tax.state.nv.us documents let under 7500taxman taxman

Ėý

This document is a tax return form for non-gaming facilities in Nevada with between 200-7499 occupants to report their live entertainment tax liability. It requires the facility to provide their tax identification number, the month being reported, and calculations for admission charges, concession sales, total taxable amount, net live entertainment tax, any penalties or interest due based on late filing, and the total amount due or refund owed. It includes instructions for completing each line of the return and provides additional information about applicable occupancy thresholds, licensing, and contacts for questions.Form CT-1X Adjusted Employer's Annual Railroad Retirement Tax Return or Clai...

Form CT-1X Adjusted Employer's Annual Railroad Retirement Tax Return or Clai...taxman taxman

Ėý

This document is an adjusted employer's annual railroad retirement tax return form (Form CT-1 X) used to correct errors made on the original Form CT-1 for a single year. The form instructs the taxpayer to select either the adjusted return process if underreporting or both underreporting and overreporting amounts, or the claim process if overreporting amounts only. It also provides boxes to certify filing corrected W-2s, certify repayment of excess taxes to employees, and explain the corrections made on the form in three or fewer sentences.2307

2307mr2010cutee

Ėý

This document appears to be a Certificate of Creditable Tax Withheld at Source form from the Philippines. It contains information about taxes withheld from income payments between a payor and payee within certain date ranges. It includes sections for payee information, payor information, details of income payments and taxes withheld by payment type for the quarter using alphanumeric tax codes. The payor and payee representatives sign the form, declaring the information provided is true and correct according to Philippines tax regulations.2307

2307Lou Anchero

Ėý

This document appears to be a Certificate of Creditable Tax Withheld at Source form from the Philippines. It contains information about payors and payees, including their tax identification numbers and addresses. There are also tables to provide details of income payments and tax withheld on a quarterly basis, including categories with alphanumeric tax codes. The payor and payee representatives must sign to declare the form was completed in good faith and is true and correct.More Related Content

What's hot (15)

400-ext-enabled nd.gov tax indincome forms 2008

400-ext-enabled nd.gov tax indincome forms 2008taxman taxman

Ėý

This document provides instructions for making an extension payment for North Dakota individual income taxes. It explains that taxpayers can pay by check or credit card to prepay expected taxes and avoid extension interest. It provides the payment address and instructions for filling out the voucher if paying by check. It also gives the website and phone number for paying by credit card through a third party payment processor, including that a fee will be charged. The deadline to make an extension payment is April 15, 2009 to avoid extension interest.Nonresident Seller's Tax Prepayment Receipt

Nonresident Seller's Tax Prepayment Receipttaxman taxman

Ėý

This document is a Nonresident Seller's Tax Prepayment Receipt form used in New Jersey. It requires sellers who are nonresidents of New Jersey to provide information such as their name, address, ownership percentage of the property being sold, the sale price, and signature to certify the information. The form serves to document payment of taxes by nonresident sellers when selling property in New Jersey as required by law. It must be completed prior to closing, submitted to the Division of Taxation for a receipt, and then given to the buyer's attorney to submit to the county clerk for the deed to be recorded.Form EPV

Form EPVtaxman taxman

Ėý

This 3 sentence summary provides the key information from the document:

Print the voucher at 100% by selecting "None" under Page Scaling in the Print menu and unchecking the Auto-Rotate and Center checkbox to ensure the Wisconsin Electronic Payment Voucher prints accurately. Cut out the voucher below the dotted line and mail it with your payment to the Wisconsin Department of Revenue at the provided address. Be sure to enter your name, address, social security number without hyphens, phone number, and payment amount on the voucher.tax.utah.gov forms current tc tc-549

tax.utah.gov forms current tc tc-549taxman taxman

Ėý

This document provides instructions for making a payment for a Utah fiduciary income tax return. It explains that the payment coupon should be included with any payment if a return was previously filed without payment. The coupon and payment should be mailed to the Utah State Tax Commission with the name, address, EIN, and tax year written on the check. Electronic payment is also an option. Sending a duplicate copy of the return with the payment may delay processing.How to fill up challan 280 for paying income tax

How to fill up challan 280 for paying income taxInvestdunia

Ėý

Did you forget to report an income and hence paid lower income tax. You can use challan 280 and pay the balance income tax at bank. E2A - Estate Tax Info & App for Tax Clearance

E2A - Estate Tax Info & App for Tax Clearancetaxman taxman

Ėý

This document is an application for refund of Vermont sales and use tax, meals and rooms tax, or withholding tax. It requests the claimant's name and contact information, the tax period and amount being claimed, and an explanation of the refund request. The instructions provide details on documentation needed to substantiate refund claims, including invoices, exemption certificates, credit memos, and examples of acceptable documentation for different types of refund claims. Refund requests must be made within three years of the original tax return due date, or two years for uncollectible accounts.Individual Income Tax Electronic Payment Voucher

Individual Income Tax Electronic Payment Vouchertaxman taxman

Ėý

This document provides instructions for filing and paying South Carolina individual income taxes electronically for tax year 2008. It outlines that taxpayers owing $15,000 or more are required to pay electronically. It provides instructions for completing payment voucher form SC1040-V, including entering identifying information and payment amounts. It details that payments are due by May 1, 2009 to avoid penalties and interest and must be mailed to the SC Department of Revenue Electronic Filing address in Columbia.tax.utah.gov forms current tc tc-542

tax.utah.gov forms current tc tc-542taxman taxman

Ėý

This document is a request form for a refund of an administrative impound fee from a DUI incident. To be eligible for a refund, the applicant must provide proof of duplicate payment, a police report if the vehicle was stolen, or a letter from the Driver License Division stating their license will not be suspended. The completed form and supporting documents should be mailed to the Utah State Tax Commission for processing of the refund request.tax.utah.gov forms current tc tc-719

tax.utah.gov forms current tc tc-719taxman taxman

Ėý

This document is an affidavit for sales and use tax exemption for authorized interstate carriers purchasing vehicles, aircraft, locomotives, or other rolling stock. It requires the purchaser to provide their IRP, IFTA, FAA, or Surface Transportation Board certificate number to certify that the purchase is for a qualified vehicle that will be used for interstate commerce. The purchaser must sign the affidavit under penalty of perjury to claim the sales tax exemption.IncomeTax Declaration FY 09-10

IncomeTax Declaration FY 09-10guest1f4f89d

Ėý

The document provides information to employees about tax declarations for the financial year 2008-2009, including details on investments eligible for tax deductions under sections 80C and 80CCC, house rent allowance calculations and tax implications, medical expense exemptions, and income tax slabs and rates for male and female assessees. Employees are required to submit proof of eligible investments and rent payments by December 31, 2008 to receive applicable tax rebates and exemptions.it140esi wv.us taxrev forms 2008/

it140esi wv.us taxrev forms 2008/ taxman taxman

Ėý

1) This document provides instructions for completing West Virginia estimated tax vouchers and worksheets. It explains who must make estimated tax payments, how to calculate estimated tax liability, and payment due dates.

2) Failure to pay at least 90% of estimated tax can result in penalties. Exceptions to penalties include having a tax liability under $600 or paying 100% of the prior year's tax.

3) The worksheet walks through calculating estimated tax by determining income, exemptions, taxable income, tax amount, credits, and estimated payments vs. tax due. The minimum payment with each voucher is the remaining balance divided by payments remaining.Microsoft Power Point Afrithuto Presents Revenue, Debt Management And Suspe...

Microsoft Power Point Afrithuto Presents Revenue, Debt Management And Suspe...fred fred

Ėý

The document discusses responsibilities for managing revenue in the public sector, including identifying and collecting revenue, safeguarding funds, maintaining accurate records, and submitting regular financial reports. It also outlines requirements for reviewing fees and tariffs annually, obtaining treasury approval for rate changes, and disclosing tariff structures. Public sector managers are responsible for efficiently managing revenue collection and ensuring adequate separation of financial duties.tax.utah.gov forms current tc tc-366

tax.utah.gov forms current tc tc-366taxman taxman

Ėý

This document provides instructions for filing a Compressed Natural Gas (CNG) Tax Return in Utah. Taxpayers who own or lease equipment to compress natural gas for highway vehicles must file a monthly return, even if there is no activity to report. The return requires the taxpayer to report the total quantity of CNG dispensed in gasoline gallon equivalents, calculate the tax by multiplying the quantity by $0.085 per gallon, and submit payment of the tax amount due. Contact information is provided for questions about filing the return.tax.utah.gov forms current tc tc-943

tax.utah.gov forms current tc tc-943taxman taxman

Ėý

This document provides instructions for applying for a refund of Utah tax paid on exported diesel fuel. It outlines that exporters may file for a refund up to 180 days after exporting the fuel by completing form TC-943. The form requests information about the exporter, origin and destination of the exported fuel, tax paid, gallons exported, and supporting documentation. Original records must be kept for three years and the completed form can be mailed or hand delivered to the Utah State Tax Commission to apply for the refund.Direct Tax Code

Direct Tax CodeMehul Panchal

Ėý

This document is the Direct Taxes Code Bill of 2010 from India. It contains 113 clauses that cover topics such as:

1) Establishing the basis of income tax liability and defining types of income like employment, house property, business, capital gains, and residuary sources.

2) Detailing how to compute total income under each head and aggregate income across sources.

3) Providing tax incentives like deductions for savings, insurance, education, donations, etc.

4) Covering special provisions for non-profit organizations and provisions to prevent tax avoidance.

5) Outlining tax administration and procedures as well as authorities' powers.Similar to test again (20)

Combined Group Business Enterprise Tax Return

Combined Group Business Enterprise Tax Returntaxman taxman

Ėý

This document is instructions for a New Hampshire Business Enterprise Tax Return form. It provides the following information:

1) This form is required to be filed if a business's gross receipts were over $150,000 or its enterprise value tax base was over $75,000 for at least one member of a combined group.

2) It includes steps to calculate the taxable enterprise value tax base and figure the business enterprise tax.

3) There are statutory credits that can be applied against the business enterprise tax, including credits for investments, community reinvestment, research and development, and job creation. Individual Declaration of Estimated Tax with Instructions and Worksheet

Individual Declaration of Estimated Tax with Instructions and Worksheettaxman taxman

Ėý

The document provides instructions for South Carolina taxpayers filing estimated individual income tax payments for 2009. It explains that estimated tax payments are due quarterly on April 15, June 15, September 15, and January 15, unless an exception applies. Taxpayers can pay by credit card, electronic check, or by mailing a payment voucher along with a check or money order. Failure to make required estimated payments may result in penalties. Utility Property Tax Information Update

Utility Property Tax Information Updatetaxman taxman

Ėý

This document is a payment form for the New Hampshire Department of Revenue Administration's private car tax for 2007. It provides instructions for taxpayers to report their annual private car tax amount from their tax bill, make payments on any balance due including estimated tax payments, and claim overpayment credits or refunds. Taxpayers are directed to sign and submit the form along with any payment due by December 30, 2007.tax.state.nv.us documents let under 7500

tax.state.nv.us documents let under 7500taxman taxman

Ėý

This document is a tax return form for non-gaming facilities in Nevada with between 200-7499 occupants to report their live entertainment tax liability. It requires the facility to provide their tax identification number, the month being reported, and calculations for admission charges, concession sales, total taxable amount, net live entertainment tax, any penalties or interest due based on late filing, and the total amount due or refund owed. It includes instructions for completing each line of the return and provides additional information about applicable occupancy thresholds, licensing, and contacts for questions.Form CT-1X Adjusted Employer's Annual Railroad Retirement Tax Return or Clai...

Form CT-1X Adjusted Employer's Annual Railroad Retirement Tax Return or Clai...taxman taxman

Ėý

This document is an adjusted employer's annual railroad retirement tax return form (Form CT-1 X) used to correct errors made on the original Form CT-1 for a single year. The form instructs the taxpayer to select either the adjusted return process if underreporting or both underreporting and overreporting amounts, or the claim process if overreporting amounts only. It also provides boxes to certify filing corrected W-2s, certify repayment of excess taxes to employees, and explain the corrections made on the form in three or fewer sentences.2307

2307mr2010cutee

Ėý

This document appears to be a Certificate of Creditable Tax Withheld at Source form from the Philippines. It contains information about taxes withheld from income payments between a payor and payee within certain date ranges. It includes sections for payee information, payor information, details of income payments and taxes withheld by payment type for the quarter using alphanumeric tax codes. The payor and payee representatives sign the form, declaring the information provided is true and correct according to Philippines tax regulations.2307

2307Lou Anchero

Ėý

This document appears to be a Certificate of Creditable Tax Withheld at Source form from the Philippines. It contains information about payors and payees, including their tax identification numbers and addresses. There are also tables to provide details of income payments and tax withheld on a quarterly basis, including categories with alphanumeric tax codes. The payor and payee representatives must sign to declare the form was completed in good faith and is true and correct. Request for Department Identification Number (DIN)

Request for Department Identification Number (DIN)taxman taxman

Ėý

This document is a request form for a New Hampshire Department of Revenue Administration identification number (DIN). It provides instructions for who must request a DIN, when to file the form, and where to file. The form collects business entity and taxpayer information needed to issue a DIN, which is required for certain taxpayers to file New Hampshire tax documents.tax.utah.gov forms current tc tc-62e

tax.utah.gov forms current tc tc-62etaxman taxman

Ėý

This document is a municipal energy sales and use tax return form for reporting taxes owed to the Utah State Tax Commission. It includes instructions for completing the form which has columns for listing taxable localities, quantities of energy delivered, taxable amounts, tax rates, calculated taxes, credits for taxes paid to suppliers, and a net tax due amount. The completed form and payment are due on a specified date each tax period and must be filed even if no tax is owed.Kentucky Individual Income Tax Installment Agreement Request - Form 12A200

Kentucky Individual Income Tax Installment Agreement Request - Form 12A200taxman taxman

Ėý

The document provides instructions for Kentucky taxpayers to request an installment agreement to pay delinquent taxes over time. Taxpayers should complete Form 12A200 and attach it to their tax return, specifying their proposed monthly payment amount. Payments can be made by credit card, electronic check by attaching a voided check, or by mailed check. The agreement is subject to approval, and interest and penalties will continue to accrue during the installment period. Railroad Tax Return Booklet, Includes DP-255-ES Quarterly Payment Forms

Railroad Tax Return Booklet, Includes DP-255-ES Quarterly Payment Formstaxman taxman

Ėý

This document is a payment form for the New Hampshire Department of Revenue Administration's 2007 Railroad Tax. It provides instructions for taxpayers to pay their annual railroad tax, including any balance due, overpayment credits or refunds. Taxpayers must provide their name, address, federal employer identification number and calculate amounts for their annual tax, payments, balance due, additions to tax and net balance/overpayment. The form is due by December 30, 2007 and payments should be made payable to the State of New Hampshire. Private Car Tax Return

Private Car Tax Returntaxman taxman

Ėý

This document is a payment form for the New Hampshire Department of Revenue Administration's 2007 Railroad Tax. It provides instructions for taxpayers to pay their annual railroad tax, including any balance due, overpayment credits or refunds. Taxpayers must provide their name, address, federal employer identification number and calculate amounts for their annual tax, payments, balance due, additions to tax and net balance/overpayment. The form is due by December 30, 2007 and payments should be made payable to the State of New Hampshire. Utility Property Tax Return

Utility Property Tax Return taxman taxman

Ėý

The document is a utility property tax return form for New Hampshire. It includes instructions for completing the form to file an annual utility property tax return or make estimated quarterly tax payments. Taxpayers must report their assessed property valuation, calculate taxes owed, and pay any amounts due. The form also addresses interest, penalties, credits, and overpayments that may apply. IN-151 - Extension of Time to File VT Individual Income Tax Return

IN-151 - Extension of Time to File VT Individual Income Tax Returntaxman taxman

Ėý

This document contains instructions and payment vouchers for making estimated income tax payments to Vermont for tax year 2007. Key details include:

- Estimated tax payments are due quarterly on April 15, June 15, September 15 of 2007, and January 15, 2008 to avoid penalties for underpayment.

- Vermont taxable income is generally federal taxable income with some additions and subtractions defined by Vermont.

- The instructions provide a worksheet and guidelines for taxpayers to estimate their 2007 Vermont tax liability and determine the proper amount to pay in quarterly installments.Account info

Account infoLelybeth Lopez

Ėý

This document is an account information form for opening a deposit account at a bank. It requests information such as the name, ID number, and address of the account holder(s). It specifies what type of account is being applied for, such as savings, checking, term deposit, etc. It outlines the terms and conditions for deposit accounts, including how deposited funds can be withdrawn, joint account structures, account statements, and liability issues. Signatures are required from the account holders to agree to these terms.IN-152 - Underpayment of 2007 Estimated Individual Income Tax

IN-152 - Underpayment of 2007 Estimated Individual Income Tax taxman taxman

Ėý

This document contains instructions and payment vouchers for making estimated income tax payments to Vermont for tax year 2008. Taxpayers who expect to owe more than $500 after withholding and credits are required to make estimated payments. Payments are due on April 15, June 15, September 15 of 2008 and January 15, 2009. The document provides worksheets to help estimate tax liability and record payments made. It also includes the 2008 preliminary Vermont income tax rates schedules.New repform

New repformCareConfidant

Ėý

This new representative form from MyVideoTalk USA requires the representative to provide contact information and acknowledge company policies. The representative must sign and date the form, and attach a completed W-9 tax form, in order for commissions to be paid. Private Car Tax Return

Private Car Tax Return taxman taxman

Ėý

This document is a private car tax payment form from the New Hampshire Department of Revenue Administration. It provides instructions and lines for taxpayers to calculate their annual private car tax, any additions to tax such as interest or penalties, payments made, overpayment credits or amounts due. Taxpayers are directed to make payments for the annual tax and quarterly estimated tax payments by the specified due dates.1040EXT-ME extension payment voucher

1040EXT-ME extension payment vouchertaxman taxman

Ėý

This document is a payment voucher for an individual income tax extension in Maine. It provides instructions for taxpayers to make an extension payment electronically or by detaching the voucher and mailing it with a check or money order. The voucher requests the taxpayer's name, address, social security number, spouse's information if filing jointly, and the amount of the extension payment. It notes that a long form must be filed if using this voucher to make a payment.Application for Extension of Time to File Individual, General Partnership and...

Application for Extension of Time to File Individual, General Partnership and...taxman taxman

Ėý

This document is an application for an extension of time to file individual, general partnership, and fiduciary income tax returns for Kentucky. It provides instructions for taxpayers requesting a Kentucky extension only or a Kentucky extension along with a payment. It notes that a 6-month extension is requested, interest applies to late payments, and the form must be attached to the final return filed. The second section allows the taxpayer to provide payment along with their extension request.test again

- 1. * Important : Please see notes overleaf before Single Copy (to be sent to the ZAO) filling up the challan CHALLAN Tax Applicable (Tick One)* NO./ (0020) INCOME-TAX ON COMPANIES Assessment Year ITNS 280 (CORPORATION TAX) - (0021) INCOME TAX (OTHER THAN COMPANIES) Permanent Account Number Full Name Complete Address with City & State Tel. No. Pin Type of Payment (Tick One) Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax on Distributed Profits of Domestic Companies (106) Tax on Regular Assessment (400) Tax on Distributed Income to Unit Holders (107) DETAILS OF PAYMENTS Amount (in Rs. Only) FOR USE IN RECEIVING BANK Income Tax Debit to A/c / Cheque credited on Surcharge - - Education Cess D D M M Y Y Interest Penalty Others SPACE FOR BANK SEAL Total Total (in words) CRORES LACS THOUSANDS HUNDREDS TENS UNITS Paid in Cash/Debit to A/c /Cheque No. Dated Drawn on (Name of the Bank and Branch) Date: Rs. Signature of person making payment Taxpayers Counterfoil (To be filled up by tax payer) SPACE FOR BANK SEAL PAN Received from (Name) Cash/ Debit to A/c /Cheque No. For Rs. Rs. (in words) Drawn on (Name of the Bank and Branch) on account of Companies/Other than Companies/Tax Income Tax on (Strike out whichever is not applicable) Type of Payment (To be filled up by person making the payment) for the Assessment Year - Rs. Printed from www.taxmann.com

- 2. *NOTES 1. Please use a separate challan for each type of payment. 2. Please note that quoting your Permanent Account Number (PAN) is mandatory. 3. Please note that quoting false PAN may attract a penalty of Rs. 10,000/- as per section 272B of I.T. Act, 1961. 4. Please note that to deposit Appeal Fees either Major Head 020 or 021 (depending upon the tax payerâs status) has to be tocked under âTax Applicableâ. Followed by this; Minor Head: Self Assessment Tax (300) has to be ticked under âType of Paymentâ and the amount is to filled under Others in âDetails of Paymentsâ. 5. To deposit taxes, appeal fees, etc. in respect of block period cases, enter the first Assessment Year of the block period followed by the last Assessment Year of the period. For example, if the block period is 1/04/85 to 5/3/96, it would be entered as 1986-97 in the space indicated for Assessment Year. If taxes are being deposited, tick the box Self Assessment (300) under Type of Payment and fill up amount under âTaxâ while in respect of appeal fees, enter amount under âOthersâ. PLEASE USE THIS CHALLAN FOR DEPOSITING TAXES (TYPES OF PAYMENT) MENTIONED OVERLEAF. KINDLY DO NOT USE THIS CHALLAN FOR DEPOSITING TAX DEDUCTION AT SOURCE (TDS) KINDLY ENSURE THAT THE BANKâS ACKNOWLEDGEMENT CONTAINS THE FOLLOWING: 1. 7 DIGIT BSR CODE OF THE BANK BRANCH 2. DATE OF DEPOSIT OF CHALLAN (DD MM YY) 3. CHALLAN SERIAL NUMBER THESE WILL HAVE TO BE QUOTED IN YOUR RETURN OF INCOME. Printed from www.taxmann.com