Chapter 14 equilibrium effects and market conditions

- 1. Chapter 14: Equilibrium Effects and Market Conditions THOMAS STERNER Policy Instruments for Environmental and Natural Resource Management Presented by Warawut Ruankham 2 May 2021, NIDA, Thailand

- 2. Content of Presentation ŌĆó Part I: direct and indirect effect of economic instrument (tax) ŌĆó Abatement and Output Reduction ŌĆó Output effect ŌĆó Part II: Revenue and other effects ŌĆó General Equilibrium, Environmental Taxation, and the double dividend ŌĆó Part III: Market Conditions ŌĆó Market Condition and Environmental Taxes

- 3. Goal Fulfillment, Abatement, and Output Substitution Emission from economic activity depends on pollution intensity or ŌĆó Rate of emission (Ø£ē) ŌĆó Level of activity or size (q) ŌĆó Emission ØæÆ = Ø£ēØæ× where e can be reduced by (i) abatement technology and (ii) output reduction from certain market based policy instrument ŌĆó Goals: ŌĆó (i) to have certain appropriate policy with essentially no impact on total use of the product (i.e. chorine using for bleaching paper drafting tax in Sweden) ŌĆó (ii) Chosen instrument have the correct desirable ŌĆ£output effectŌĆØ

- 4. Importance of Abatement cost and demand elasticity Inelastic demand Elastic demand Figure B: ŌĆó No clean technology ŌĆó Reduce demand to reduce pollution ŌĆó Effectiveness of policy depends on elasticity of product (or slope of demand curve)

- 5. Importance of Abatement cost and demand elasticity Figure C: ŌĆó Both abatement and output are important ŌĆó Increasing in price due to tax can lower output Effect of policy: ŌĆó Øæ×ØæÜ -> Øæ×ØæÄ : resulted from abatement effect ŌĆó Øæ×ØæÄ -> Øæ×Øæ£ : resulted from tax effect

- 6. Output and Abatement Effect (Algebraically) ŌĆó Tax or permit (T) ŌĆó Output q(T) ŌĆó Emission is a function of ØÆå Øæ╗ = ØÆÆ(Øæ╗)ØØā(Øæ╗) ŌĆó Total differentiate ØææØæÆ ØææØæć = Øæ× ØææØ£ē ØææØæć + Ø£ē ØææØæ× ØææØæć ØææØæÆ ØææØæć Øæć ØæÆ = Øæ× ØææØ£ē ØææØæć Øæć ØæÆ + Ø£ē ØææØæ× ØææØæć Øæć ØæÆ ŌĆó Substitute ØæÆ = Øæ×Ø£ē ŌĆó Then, ØææØæÆ ØææØæć Øæć Øæ×Ø£ē = ØææØ£ē ØææØæć Øæć Øæ×Ø£ē + ØææØæ× ØææØæć Øæć Øæ× ŌĆó Express as elasticity Ø£ĆØæÆØæć = Ø£ĆØ£ēØæć + Ø£ĆØæ×Øæć -----------* ŌĆó total elasticity of demand = elasticity of abatement + elasticity of output ŌĆó The output effect is the interaction b/w slope of demand q=q(P) and shift in supply P=P(T) ŌĆó Or combined q=q[P(T)]

- 7. Output and Abatement Effect (Algebraically) ŌĆó Then, Ø£║ØÆÆØæ╗= Ø£ĆØæ×ØæāØ£ĆØæāØæć ŌĆó So, Ø£ĆØæÆØæć = Ø£ĆØ£ēØæć + Ø£║ØÆÆØæ╗ becomes Ø£║ØÆåØæ╗= Ø£║ØØāØæ╗ + Ø£║ØÆÆØæĘØ£║ØæĘØæ╗ ----------------** ŌĆó Total response in emission =possibility of reducing rate of emission + product of price and tax elasticity of marginal of supply (abatement elasticity)

- 8. Output and Abatement Effect (case of tax elasticity of supply : linear and separable abatement cost) ŌĆó Firms maximize profit ØØģ = ØæĘØÆÆ ŌłÆ ØÆä ØÆÆ ŌłÆ ØÆä(ØØāؤÄØÆÆ-e)ŌłÆØæ╗ØÆå ŌĆó FOC: Ø£ĢØ£ŗ Ø£ĢØæ× = Øæā ŌłÆ ØæÉŌĆ▓ Øæ× ŌłÆ ØæÉØ£ēØæ£ = 0 ; Øæ£Øæ¤ Øæā = ØæÉŌĆ▓ Øæ× + ØæÉØ£ē0 Ø£ĢØ£ŗ Ø£ĢØæÆ = ØæÉ ŌłÆ Øæć ; Øæ£Øæ¤ ØæÉ = Øæć ŌĆó Then, Øæā = ØæÉŌĆ▓ Øæ× + ØæćØ£ē0 ŌĆó Tax effect ØææØæā ØææØæć = Ø£ē0 ŌĆó Express as elasticity Ø£ĆØæāØæć = ØææØæā ØææØæć Øæć Øæā Ø£ĆØæāØæć = Ø£ē0 Øæć Øæā ; Øæā = ØæÉŌĆ▓ Øæ× + ØæćØ£ē0 Ø£ĆØæāØæć = ØæćØ£ē0 ØæÉŌĆ▓ Øæ× +ØæćØ£ē0 ŌĆó Tax elasticity of supply is the relative share of marginal environment tax and marginal production cost

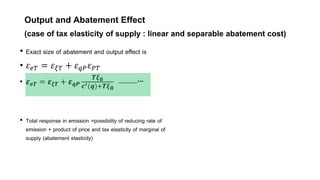

- 9. Output and Abatement Effect (case of tax elasticity of supply : linear and separable abatement cost) ŌĆó Exact size of abatement and output effect is ŌĆó Ø£ĆØæÆØæć = Ø£ĆØ£ēØæć + Ø£ĆØæ×ØæāØ£ĆØæāØæć ŌĆó Ø£║ØÆåØæ╗ = Ø£║ØØāØæ╗ + Ø£║ØÆÆØæĘ Øæ╗ØØāØ¤Ä ØÆäŌĆ▓ ØÆÆ +Øæ╗ØØāØ¤Ä -----------*** ŌĆó Total response in emission =possibility of reducing rate of emission + product of price and tax elasticity of marginal of supply (abatement elasticity)

- 10. Output Effect of Subsidies ŌĆó Rebound effect refers to the decline in emission due to higher product price ŌĆó Abatement subsidy (Baumol and Oates, 1988) suggested that (i) payment for emission reductions could exceed the abatement cost , (ii) when marginal abatement cost are constant, subsidy is a repayment of abatement cost

- 11. Output Effect of Subsidies From the figure: ŌĆó Tax (T) causes largest increase in MC and AC, higher tax and abatement cost increase market price which leads to exit ŌĆó A regulation (R) of emission would not have full output effect ŌĆó Subsidy (S) instead will lead to a price reduction and could delay exit (possibly encourages entry)

- 12. General Equilibrium, Environmental Taxation, and the double dividend ŌĆó Although taxes are optimal policy instrument in terms of allocative efficiency and intensive structure, they are often resisted by those who have to pay ŌĆó Then, ŌĆ£green tax reformsŌĆØ were proposed, whereby the revenues from environmental taxation were to be used to reduce other taxes. ŌĆó This idea give double or even triple dividend of environmental as well as economic improvement ( increased in employment and growth)

- 13. Taxation ŌĆó Generally, increasing in taxes makes higher price and lowers demand (loss in consumer surplus and excess burden of taxes) ŌĆó Inverse elasticity rules: ŌĆó Elastic good (i.e., luxuries good)- taxes seem to be effective tools as it might not distort demand ŌĆó Inelastic good (i.e., foods) ŌĆō taxes seem to be ineffective tools as it might distort demand, affect to the poor and income inequality Other rules ŌĆó Tax on labor (i.e., income tax) might distort allocation of working time (labor supply) and leisure ŌĆó Tax on factor input (i.e., land and forestry tax) which is undesirable to tax a intermediate goods (certain input will be taxed twice)

- 14. Environmental Taxation ŌĆó An optimal environmental tax operates through five effects (Goulder et al. 1999): 1. Abatement effect 2. Input substitution effect which refers to substitution of cleaner input 3. Output substitution effect 4. Revenue-recycling effect, a positive effect of the environmental tax that confirms a double dividend 5. Tax interaction effect, loss of consumer surplus and real wages that are due to distortion of the consumption (or input) basket and reduces labor supply and tax incomes, leading to further loss

- 15. Environmental Taxation A) Inelastic demand -steep demand -little reduction in E -large tax base B) elastic demand -large reduction in E -abatement is easy (E may go to zero) -tax base would be gone C) Non- linear demand -large reduction in E - Large tax base

- 16. Market Conditions ŌĆó Not all market are perfect competitive ŌĆó For some developing country, optimal tax for externality produced by monopoly less than standard ŌĆ£Pigovian taxŌĆØ ŌĆó Two imperfection on optimal tax ŌĆó Monopoly ŌĆó Oligopoly or cartel

- 17. Market Conditions ŌĆó Monopoly produces lower than social optimal at Qm and set higher price at Pm ŌĆó Social optimal output is at Q0 ŌĆó If tax set at ŌĆ£Pigovian ruleŌĆØ which equals to sum of marginal damage, then monopoly would lower Q lower than Qm ( to Qmt and set even higher price at Pmt) ŌĆó To calculate tax charge ØæćØæÜ = ØÉĘŌĆ▓ ØæÆŌłŚ ŌłÆ Øæā Ø£Ć Øæ×ŌĆ▓ ØæÆ ŌĆó However, this second-best charge might not always feasible or desirable

- 18. Market Conditions ŌĆó Then, the second-best would be ŌĆ£negative taxŌĆØ or ŌĆ£subsidiesŌĆØ for two main reasons ŌĆó Subsidize to increase supply (to overcome monopoly) ŌĆó Tax on emission (to overcome externality) ŌĆó However, it is not attractive to subsidize monopolist ŌĆó If monopoly is unavoidable, we should have free trade or liberalize trading to increase domestic supply ŌĆó Finally, policy packages should be with combined instruments (i.e., combination of an emission tax and subsidy per unit of production but not increase market power of monopolist)

![Output and Abatement Effect (Algebraically)

ŌĆó Tax or permit (T)

ŌĆó Output q(T)

ŌĆó Emission is a function of

ØÆå Øæ╗ = ØÆÆ(Øæ╗)ØØā(Øæ╗)

ŌĆó Total differentiate

ØææØæÆ

ØææØæć

= Øæ×

ØææØ£ē

ØææØæć

+ Ø£ē

ØææØæ×

ØææØæć

ØææØæÆ

ØææØæć

Øæć

ØæÆ

= Øæ×

ØææØ£ē

ØææØæć

Øæć

ØæÆ

+ Ø£ē

ØææØæ×

ØææØæć

Øæć

ØæÆ

ŌĆó Substitute ØæÆ = Øæ×Ø£ē

ŌĆó Then,

ØææØæÆ

ØææØæć

Øæć

Øæ×Ø£ē

=

ØææØ£ē

ØææØæć

Øæć

Øæ×Ø£ē

+

ØææØæ×

ØææØæć

Øæć

Øæ×

ŌĆó Express as elasticity

Ø£ĆØæÆØæć = Ø£ĆØ£ēØæć + Ø£ĆØæ×Øæć -----------*

ŌĆó total elasticity of demand = elasticity of

abatement + elasticity of output

ŌĆó The output effect is the interaction b/w

slope of demand q=q(P) and shift in supply

P=P(T)

ŌĆó Or combined q=q[P(T)]](https://image.slidesharecdn.com/chapter14equilibriumeffectsandmarketconditions-210618022500/85/Chapter-14-equilibrium-effects-and-market-conditions-6-320.jpg)