accounting for Debentures

- 2. Debentures: A debenture is a written acknowledgment of a debt taken by the company as these are issues under the seal of the company. According to section 2(30) of the companies act 2013 “debentures includes debenture stock, bonds and any other securities of the company whether

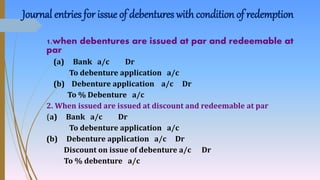

- 3. Accounting treatment for issue of debentures for cash ď‚´Debenture may be issued at par or at premium or at discount and may be redeemed at par or at premium. After taking into consideration the three possibility of issue (i.e., at par or at premium or at discount ) and two possibility of redemption ( that is at par or at premium) in this context three journal entries for different terms of redemption with their impact on the issue of debentures can be summarised in different modes

- 4. Journal entries for issue of debentures with condition of redemption 1.when debentures are issued at par and redeemable at par (a) Bank a/c Dr To debenture application a/c (b) Debenture application a/c Dr To % Debenture a/c 2. When issued are issued at discount and redeemable at par (a) Bank a/c Dr To debenture application a/c (b) Debenture application a/c Dr Discount on issue of debenture a/c Dr To % debenture a/c

- 5. 3. When debentures are issued at premium and redeemable at par (a) Bank a/c Dr To debenture application a/c (b) Debenture application a/c Dr To % denture a/c To securities premium reserve a/c 4. When debenture are issued at par and redeemable at premium (i.e., amount more than face value or nominal value) (a) Bank a/c Dr To debenture application a/c (b) Debenture application a/c Dr loss on issue of debenture a/c Dr TO % debenture a/c TO premium on redemption of denture a/c

- 6. 5. When debentures are issued at discount and redeemable at premium (a) Bank a/c Dr To debenture application a/c (b) Debenture application a/c Dr Discount on issue of debenture a/c Dr loss on issue of debenture a/c Dr To % denture a/c To premium on redemption of debentures a/c

- 7. 6. When debentures are issued at premium and redeemable at premium (a) Bank a/c Dr To debenture application a/c (b) Debenture application a/c Dr loss on issue of debenture a/c Dr To % denture a/c To securities premium reserve a/c To premium on redemption of debentures a/c

- 9. What is meant by debentures? ď‚´Debentures is an instrument acknowledging a debt issued by the company under a common seal

- 10. Mention any one feature of debenture ď‚´Itcontainsacontractfortherepayment ofprincipalsumatspecificperiodoftime oritprovidesforafixedrateofinterest.

- 11. Why would an investor prefer to invest in debentures of the company rather than its shares? An investor would prefer to invest in debentures of a company rather than its shares (i) to ensure the safety of his investment (ii) assured returns

- 12. How can debentures be categorised from point of view of security? From point of view of security debentures can be categorised as: (i) secured debentures (ii) unsecured debenture

- 13. What is nature of premium on redemption of debenture account? ď‚´ It is a personal account

- 14. State any two difference between shares and debentures A share is a part of owned capital so a shareholder is the owner of the company. A debenture is a part of the borrowed capital so a debenture holder is only a loan creditor The return on shares is known as dividend and may vary depending upon company’s profit. The profit on debentures is known as interest and is pre fixed.

- 15. What is meant by issue of debenture at discount? ď‚´Debentures are said to be issued at discount when their issue price is less than the face value