000 instructions for TI BA II Plus

- 1. Instructions for TI BA II Plus 1. MATHEMATICAL OPERATIONS 1.1. Exponent OPERATION Exponent (y)x GENERAL FORM Base Power = EXAMPLE (12)4 = 12 4 = Displays: 20,736.00 1.2. Root OPERATION Root x ŌłÜy GENERAL FORM Base Power = where power = 1/x EXAMPLE 4ŌłÜ20.736 = 20.736 0.25 = Displays: 12.00 1.3. Natural logarithm OPERATION Natural Logarithm LN (y) GENERAL FORM Base EXAMPLE LN (60) = 60 Displays: 4.09 (rounded) 1.4. Antilog OPERATION Antilog ex GENERAL FORM Natural Log

- 2. 2 EXAMPLE Antilog of 4.09 = 4.09 Displays: 59.74 (rounded) 1.5. Factorial OPERATION Factorial n ├Ś (n ŌĆō 1) ├Ś (n ŌĆō 2)ŌĆ” GENERAL FORM Base EXAMPLE Antilog of 4! = 4 Displays: 24 1.6. Clear Memory OPERATION Clear Memory GENERAL FORM EXAMPLE Clear the calculator before every problem! 2. STATISTICS 2.1. Input Data Set OPERATION Input Data Set GENERAL FORM X01 Y01 X02 Y02 ŌĆ” Scroll down inserting each observation using [DEL] and [INS] to make connections EXAMPLE Dataset: 25, 36, 42, 56 25 36 42 56 2.2. Descriptive Statistics OPERATION Descriptive Statistics: n, Øæź╠ģ, Øø┐ Øæź, Ø£ÄØæź

- 3. 3 GENERAL FORM Once all data is input Displays number of observations Displays mean Displays sample standard deviation Displays population standard deviation EXAMPLE Dataset: 25, 36, 42, 56 Displays LIN Displays: n = 4.00 Displays: Øæź╠ģ = 39.75 Displays: Øø┐ Øæź = 12.92 Displays: Ø£ÄØæź = 11.19 2.3. Clear Statistics Worksheet OPERATION Clear Statistics Worksheet GENERAL FORM Access Data Worksheet: Clear Worksheet: EXAMPLE Clear the calculator before every problem! 3. TIME VALUE OF MONEY 3.1. PV Lump Sum OPERATION Present Value Lump Sum GENERAL FORM $X,XXX Periods Rate EXAMPLE $100 invested for 2 years at 10% =

- 4. 4 100 , 2 , 10 , Displays: ŌĆō82.64 (disregard negative sign ŌĆō see Cash Flow Convention) 3.2. FV Lump Sum OPERATION Future Value Lump Sum GENERAL FORM $X,XXX Periods Rate EXAMPLE $100 invested for 2 years at 10% = 100 , 2 , 10 , Displays: ŌĆō121.00 (disregard negative sign ŌĆō see Cash Flow Convention) 3.3. PV Ordinary Annuity OPERATION Present Value Ordinary Annuity (payments received at the end of each period) GENERAL FORM End Mode: No symbols (BGN) on display $X,XXX Periods Rate EXAMPLE Present value of $100 annual payment received for 12 years at 10% = 100 , 12 , 10 , Displays: ŌĆō681.37 (disregard negative sign ŌĆō see Cash Flow Convention) 3.4. FV Annuity Due OPERATION Future Value Annuity

- 5. 5 GENERAL FORM Begin Mode: BGN is displayed Enter the same as ordinary annuity. Exit Begin Mode by repeating! EXAMPLE Future value of $100 annual payment received for 12 years at 10% = [BEGIN MODE] 100 , 12 , 10 , Displays: ŌĆō2,352.27 (disregard negative sign ŌĆō see Cash Flow Convention) 3.5. Solving For Any Variable OPERATION Solving for any variable GENERAL FORM Default: End Mode The keystrokes for solving for any variable are the same, ending with the key for the variable youŌĆÖre looking for. EXAMPLE An asset has an initial value of $10,000 and an ending value of $12,000 over 3 years the annual return is: 10,000 , 12,000 , 3 , Displays: 6.21(rounded) 3.6. Cash Flow Convention OPERATION Cash Flow Convention GENERAL FORM Cash inflows are treated as positive numbers and outflows as negative numbers. When only one cash flow is used as an input, simply disregard the negative sign on the output. However, when more than one is used as an input, their signs must be consistent with direction of the cash flows or an [ERROR 5] will display.

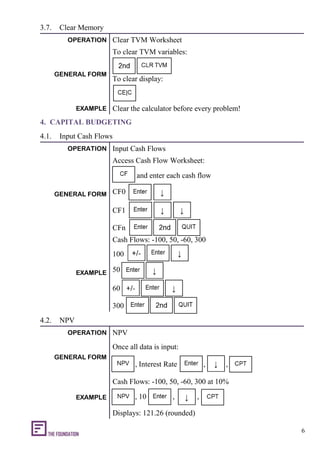

- 6. 6 3.7. Clear Memory OPERATION Clear TVM Worksheet GENERAL FORM To clear TVM variables: To clear display: EXAMPLE Clear the calculator before every problem! 4. CAPITAL BUDGETING 4.1. Input Cash Flows OPERATION Input Cash Flows GENERAL FORM Access Cash Flow Worksheet: and enter each cash flow CF0 CF1 ą▓ CFn EXAMPLE Cash Flows: -100, 50, -60, 300 100 50 60 300 4.2. NPV OPERATION NPV GENERAL FORM Once all data is input: , Interest Rate , , EXAMPLE Cash Flows: -100, 50, -60, 300 at 10% , 10 , , Displays: 121.26 (rounded)

- 7. 7 4.3. IRR OPERATION IRR GENERAL FORM Once all data is input: , EXAMPLE Cash Flows: -100, 50, -60, 300 , Displays: 47.39 (rounded) 4.4. Clear Memory OPERATION Clear Memory GENERAL FORM Access worksheet: Either or or Clear display: EXAMPLE Clear the calculator before every problem! 5. ASSET VALUATION 5.1. Continuous Compounding OPERATION Continuous Compounding PV = FVe-rt PV = PVert GENERAL FORM PV = Interest Rate in decimal Periods, , , Future Value FV = Interest Rate in decimal Periods, , , Present Value

- 8. 8 EXAMPLE Present value of $100 received in 2 years at 10% continuously compounded: PV = 0.10 2, , , 100 Displays: 81.87 5.2. Bonds: YTM OPERATION Bonds: YTM (assumes semi-annual coupons) GENERAL FORM Enter Bond Worksheet: Settlement date ŌĆō mm.ddyy , Coupon % , Maturity date ŌĆō mm.ddyy Par value % , scroll down To PRI = , Price YLD = EXAMPLE A.U.S. corporate bond is priced at 101 with a 3 percent coupon and matures in three years. The YTM is: (scroll to input variable) STD = 1.0100 , CPN = 3.00 , RDT = 1.0103 , RV = 100.00 , ACT = , 2/Y , YLD = 0.00 PRI = 101.00 ,

- 9. 9 YLD = 0.00 Displays: 2.65 5.3. Bonds: Price OPERATION Bonds: Price (assumes semi-annual coupons) GENERAL FORM Enter Bond Worksheet: Settlement date ŌĆō mm.ddyy , Coupon % , Maturity date ŌĆō mm.ddyy Par value % , scroll down To YLD = , Yield PRI = EXAMPLE A.U.S. corporate bond yields 2.65% with a 3 percent coupon and matures in three years. The Price is: (scroll to input variable) STD = 1.0100 , CPN = 3.00 , RDT = 1.0103 , RV = 100.00 , ACT = , 2/Y , YLD = 2.65 , PRI = 101.00 Displays: 101.00 5.4. Clear Memory OPERATION Clear Bond Worksheet

- 10. 10 GENERAL FORM To clear Bond Worksheet: Clear display: EXAMPLE Clear the calculator before every problem!

![2

EXAMPLE

Antilog of 4.09 = 4.09

Displays: 59.74 (rounded)

1.5. Factorial

OPERATION Factorial n ├Ś (n ŌĆō 1) ├Ś (n ŌĆō 2)ŌĆ”

GENERAL FORM Base

EXAMPLE

Antilog of 4! = 4

Displays: 24

1.6. Clear Memory

OPERATION Clear Memory

GENERAL FORM

EXAMPLE Clear the calculator before every problem!

2. STATISTICS

2.1. Input Data Set

OPERATION Input Data Set

GENERAL FORM

X01 Y01

X02 Y02 ŌĆ”

Scroll down inserting each observation using [DEL] and

[INS] to make connections

EXAMPLE

Dataset: 25, 36, 42, 56

25

36

42

56

2.2. Descriptive Statistics

OPERATION Descriptive Statistics: n, Øæź╠ģ, Øø┐ Øæź, Ø£ÄØæź](https://image.slidesharecdn.com/000instructionsfortibaiiplus-150923190640-lva1-app6891/85/000-instructions-for-TI-BA-II-Plus-2-320.jpg)

![5

GENERAL FORM

Begin Mode:

BGN is displayed

Enter the same as ordinary annuity.

Exit Begin Mode by repeating!

EXAMPLE

Future value of $100 annual payment received for 12 years at

10% =

[BEGIN MODE]

100 , 12 , 10 ,

Displays: ŌĆō2,352.27 (disregard negative sign ŌĆō see Cash Flow

Convention)

3.5. Solving For Any Variable

OPERATION Solving for any variable

GENERAL FORM

Default: End Mode

The keystrokes for solving for any variable are the same,

ending with the key for the variable youŌĆÖre looking for.

EXAMPLE

An asset has an initial value of $10,000 and an ending value

of $12,000 over 3 years the annual return is:

10,000 , 12,000 ,

3 ,

Displays: 6.21(rounded)

3.6. Cash Flow Convention

OPERATION Cash Flow Convention

GENERAL FORM

Cash inflows are treated as positive numbers and outflows as

negative numbers. When only one cash flow is used as an

input, simply disregard the negative sign on the output.

However, when more than one is used as an input, their signs

must be consistent with direction of the cash flows or an

[ERROR 5] will display.](https://image.slidesharecdn.com/000instructionsfortibaiiplus-150923190640-lva1-app6891/85/000-instructions-for-TI-BA-II-Plus-5-320.jpg)