01 health insurance

- 1. Introduction to Health Science Investigate the Various Aspects of Health Insurance

- 2. Why is Health Care so Expensive?

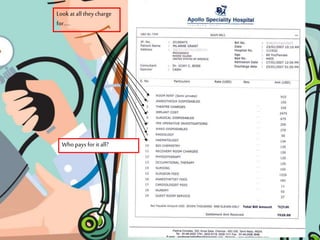

- 3. Look at all they charge forŌĆ”.. Who pays for it all?

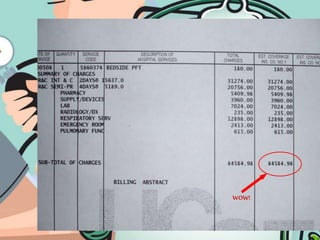

- 4. WOW!

- 6. Health Insurance ŌĆó Health care costs, including dental, are so high that most people have some type of insurance plan. ŌĆó Insurance companies require a fee in return for coverage for specific medical and dental care.

- 7. Premium ŌĆó Periodic payment for healthcare or prescription drug coverage.

- 8. Co-payment ŌĆó Amount the subscriber pays for medical service. ŌĆó Paid to the provider on the day of medical care.

- 9. Deductible ŌĆó Amount the subscriber must pay before insurance will pay.

- 10. Health Maintenance Organizations ŌĆó Require members to pay a co-payment for medical services. ŌĆó Must get medical care from providers that agree to the fee the HMO is willing to pay.

- 11. Preferred Provider Organization ŌĆó Physician groups and hospitals working together to give health care at a reduced cost to companies. ŌĆó Employees of these companies contract with PPOs and agree to see their providers.

- 12. Medicaid ŌĆó Health insurance funded by the state and federal government. ŌĆó Blind, disabled, and low income generally able to qualify.

- 13. Medicare ŌĆó Health insurance provided by the government to people over the age of 65.

- 14. TRICARE ŌĆó Health care program for active duty service members, retirees, and their families.

- 15. WorkersŌĆÖ Compensation ŌĆó Employees that get injured or die at work are covered by state workersŌĆÖ compensation laws. ŌĆó Includes illness resulting from the workplace.

- 16. Learn about YOUR Insurance ŌĆó Talk to your parents and fill out the worksheet and learn about the type of health insurance you have.