1 2 overview (2)

- 1. MERGERS & ACQUISITIONS Term V, PGDM, 2011-12 Prof. Raj K. Kovid (kovidrk@ifimbschool.com) Strategic Management Group IFIM Business School, Bangaluru, India

- 2. M&As: The Course • Students’ expectations • Depth-seekers • Approach: Text book, Papers • Cases, Readings • Project, Assignments • Groups • Data sources: Prowess, Thompson, mergerindia.com, B usiness Periodicals 2

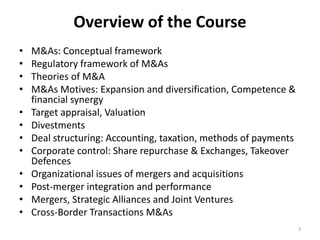

- 3. Overview of the Course • M&As: Conceptual framework • Regulatory framework of M&As • Theories of M&A • M&As Motives: Expansion and diversification, Competence & financial synergy • Target appraisal, Valuation • Divestments • Deal structuring: Accounting, taxation, methods of payments • Corporate control: Share repurchase & Exchanges, Takeover Defences • Organizational issues of mergers and acquisitions • Post-merger integration and performance • Mergers, Strategic Alliances and Joint Ventures • Cross-Border Transactions M&As 3

- 4. M&As in Strategy Settings • Corporate Strategy • Growth Strategy (expansion/diversification) – Organic – Inorganic: M&As • Alternatives to M&As – SA & JVs – Franchising – Others 4

- 5. M&As: Terminology • Takeover • Merger • Acquisition • Tender offer • Restructuring • Sell-off: Divestiture, Liquidation etc • Hive-off • LBO • … 5

- 6. Takeover, Acquisitions, Mergers • Relative meaning • Types: – Horizontal/ Vertical – Related/unrelated • Nature: friendly / hostile

- 7. Mergers and Acquisitions • Merger – Two/more firms agree to integrate their operations. – One firm survives (sometime change name post- merger) – Types: related/unrelated; horizontal/vertical • Acquisition – One firm buys a controlling, or 100% interest in another firm with the intent of making the acquired firm a subsidiary business within its portfolio. – Types: Hostile/Friendly © 2007 Thomson/South- 7–7 Western. All rights reserved.

- 8. 8