112612 fcs council presentation

- 1. City of The Dalles, Wastewater Plan: Oregon Financial Element City Council Meeting John Ghilarducci November 26, 2012 FCS GROUP 4380 SW Macadam Avenue, Suite 220, Portland, OR 97239 ’ü« 503-841-6543

- 2. Presentation Outline 1. Rate Findings ’é¦ Background ’é¦ Key Assumptions ’é¦ Rate Scenarios 2. SDC Findings ’é¦ Background ’é¦ SDC Calculation Summary ’é¦ Comparable SDCs FCS GROUP Page 2

- 3. What Should Rates Do? ’é¦ Generate sufficient revenues to sustain the utility system ’é¦ Charge for services provided ’é¦ Recover costs equitably ’é¦ Achieve City objectives ’é¦ Revenue stability ’é¦ Maintain minimum fund balances and meet other fiscal policies FCS GROUP Page 3

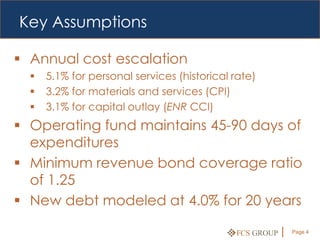

- 4. Key Assumptions ’é¦ Annual cost escalation ’é¦ 5.1% for personal services (historical rate) ’é¦ 3.2% for materials and services (CPI) ’é¦ 3.1% for capital outlay (ENR CCI) ’é¦ Operating fund maintains 45-90 days of expenditures ’é¦ Minimum revenue bond coverage ratio of 1.25 ’é¦ New debt modeled at 4.0% for 20 years FCS GROUP Page 4

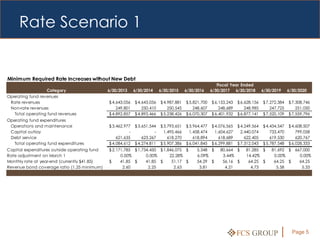

- 5. Rate Scenario 1 Minimum Required Rate Increases without New Debt Fiscal Year Ended Category 6/30/2013 6/30/2014 6/30/2015 6/30/2016 6/30/2017 6/30/2018 6/30/2019 6/30/2020 Operating fund revenues Rate revenues $ 4,643,056 $ 4,643,056 $ 4,987,881 $ 5,821,700 $ 6,153,243 $ 6,628,156 $ 7,272,384 $ 7,308,746 Non-rate revenues 249,801 250,410 250,545 248,607 248,689 248,985 247,725 251,050 Total operating fund revenues $ 4,892,857 $ 4,893,466 $ 5,238,426 $ 6,070,307 $ 6,401,932 $ 6,877,141 $ 7,520,109 $ 7,559,796 Operating fund expenditures Operations and maintenance $ 3,462,977 $ 3,651,544 $ 3,793,651 $ 3,964,477 $ 4,076,565 $ 4,249,564 $ 4,434,547 $ 4,608,507 Capital outlay - - 1,495,466 1,458,474 1,604,627 2,440,074 733,470 799,058 Debt service 621,635 623,267 618,270 618,894 618,689 622,405 619,530 620,767 Total operating fund expenditures $ 4,084,612 $ 4,274,811 $ 5,907,386 $ 6,041,845 $ 6,299,881 $ 7,312,043 $ 5,787,548 $ 6,028,333 Capital expenditures outside operating fund $ 2,171,785 $ 1,734,450 $ 1,846,075 $ 5,348 $ 80,664 $ 81,285 $ 81,692 $ 667,000 Rate adjustment on March 1 0.00% 0.00% 22.28% 6.09% 3.44% 14.42% 0.00% 0.00% Monthly rate at year-end (currently $41.85) $ 41.85 $ 41.85 $ 51.17 $ 54.29 $ 56.16 $ 64.25 $ 64.25 $ 64.25 Revenue bond coverage ratio (1.25 minimum) 2.60 2.25 2.63 3.81 4.21 4.73 5.58 5.33 FCS GROUP Page 5

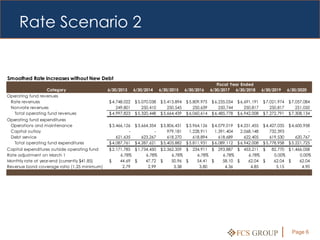

- 6. Rate Scenario 2 Smoothed Rate Increases without New Debt Fiscal Year Ended Category 6/30/2013 6/30/2014 6/30/2015 6/30/2016 6/30/2017 6/30/2018 6/30/2019 6/30/2020 Operating fund revenues Rate revenues $ 4,748,022 $ 5,070,038 $ 5,413,894 $ 5,809,975 $ 6,235,034 $ 6,691,191 $ 7,021,974 $ 7,057,084 Non-rate revenues 249,801 250,410 250,545 250,639 250,744 250,817 250,817 251,050 Total operating fund revenues $ 4,997,823 $ 5,320,448 $ 5,664,439 $ 6,060,614 $ 6,485,778 $ 6,942,008 $ 7,272,791 $ 7,308,134 Operating fund expenditures Operations and maintenance $ 3,466,126 $ 3,664,354 $ 3,806,431 $ 3,964,126 $ 4,079,019 $ 4,251,455 $ 4,427,035 $ 4,600,958 Capital outlay - - 979,181 1,228,911 1,391,404 2,068,148 732,393 - Debt service 621,635 623,267 618,270 618,894 618,689 622,405 619,530 620,767 Total operating fund expenditures $ 4,087,761 $ 4,287,621 $ 5,403,882 $ 5,811,931 $ 6,089,112 $ 6,942,008 $ 5,778,958 $ 5,221,725 Capital expenditures outside operating fund $ 2,171,785 $ 1,734,450 $ 2,362,359 $ 234,911 $ 293,887 $ 453,211 $ 82,770 $ 1,466,058 Rate adjustment on March 1 6.78% 6.78% 6.78% 6.78% 6.78% 6.78% 0.00% 0.00% Monthly rate at year-end (currently $41.85) $ 44.69 $ 47.72 $ 50.96 $ 54.41 $ 58.10 $ 62.04 $ 62.04 $ 62.04 Revenue bond coverage ratio (1.25 minimum) 2.79 2.99 3.38 3.80 4.36 4.85 5.15 4.90 FCS GROUP Page 6

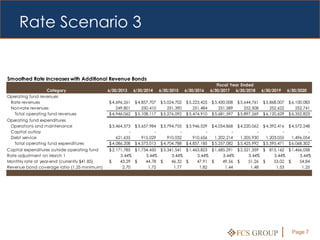

- 7. Rate Scenario 3 Smoothed Rate Increases with Additional Revenue Bonds Fiscal Year Ended Category 6/30/2013 6/30/2014 6/30/2015 6/30/2016 6/30/2017 6/30/2018 6/30/2019 6/30/2020 Operating fund revenues Rate revenues $ 4,696,261 $ 4,857,707 $ 5,024,702 $ 5,223,425 $ 5,430,008 $ 5,644,761 $ 5,868,007 $ 6,100,083 Non-rate revenues 249,801 250,410 251,390 251,484 251,589 252,508 252,622 252,741 Total operating fund revenues $ 4,946,062 $ 5,108,117 $ 5,276,092 $ 5,474,910 $ 5,681,597 $ 5,897,269 $ 6,120,629 $ 6,352,823 Operating fund expenditures Operations and maintenance $ 3,464,573 $ 3,657,984 $ 3,794,755 $ 3,946,529 $ 4,054,868 $ 4,220,062 $ 4,392,416 $ 4,572,248 Capital outlay - - - - - - - - Debt service 621,635 915,029 910,032 910,656 1,202,214 1,205,930 1,203,055 1,496,054 Total operating fund expenditures $ 4,086,208 $ 4,573,013 $ 4,704,788 $ 4,857,185 $ 5,257,082 $ 5,425,992 $ 5,595,471 $ 6,068,302 Capital expenditures outside operating fund $ 2,171,785 $ 1,734,450 $ 3,341,541 $ 1,463,823 $ 1,685,291 $ 2,521,359 $ 815,162 $ 1,466,058 Rate adjustment on March 1 3.44% 3.44% 3.44% 3.44% 3.44% 3.44% 3.44% 3.44% Monthly rate at year-end (currently $41.85) $ 43.29 $ 44.78 $ 46.32 $ 47.91 $ 49.56 $ 51.26 $ 53.02 $ 54.84 Revenue bond coverage ratio (1.25 minimum) 2.70 1.72 1.77 1.82 1.44 1.48 1.53 1.25 FCS GROUP Page 7

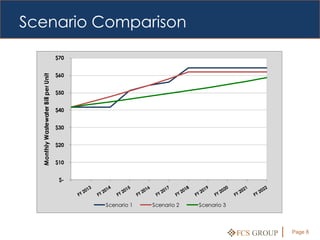

- 8. Scenario Comparison $70 $60 Monthly Wastewater Bill per Unit $50 $40 $30 $20 $10 $- Scenario 1 Scenario 2 Scenario 3 FCS GROUP Page 8

- 9. SDC Background Key Characteristics 1. SDCs are one-time charges, not ongoing rates. 2. SDCs are for capital only, in both their calculation and in ORS 223.297 - 314, defines their use. ŌĆ£a uniform framework for the imposition ofŌĆØ 3. Properties which are SDCs, ŌĆ£to provide already developed do not equitable funding for pay SDCs unless they orderly growth and ŌĆ£redevelopŌĆØ. development in OregonŌĆÖs 4. SDCs include both future communitiesŌĆØ and existing cost components. 5. SDCs are for general facilities, not ŌĆ£localŌĆØ facilities. FCS GROUP Page 9

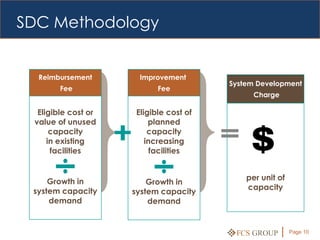

- 10. SDC Methodology Reimbursement Improvement System Development Fee Fee Charge Eligible cost or Eligible cost of value of unused planned capacity capacity in existing increasing facilities facilities Growth in per unit of Growth in system capacity capacity system capacity demand demand FCS GROUP Page 10

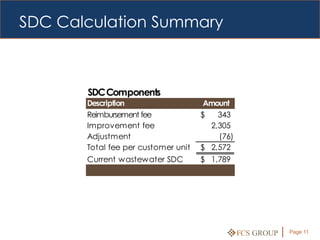

- 11. SDC Calculation Summary SDC Components Description Amount Reimbursement fee $ 343 Improvement fee 2,305 Adjustment (76) Total fee per customer unit $ 2,572 Current wastewater SDC $ 1,789 FCS GROUP Page 11

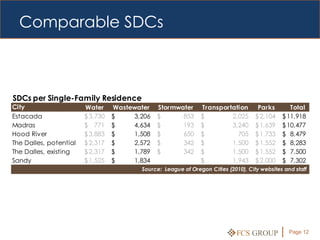

- 12. Comparable SDCs SDCs per Single-Family Residence City Water Wastewater Stormwater Transportation Parks Total Estacada $ 3,730 $ 3,206 $ 853 $ 2,025 $ 2,104 $ 11,918 Madras $ 771 $ 4,634 $ 193 $ 3,240 $ 1,639 $ 10,477 Hood River $ 3,883 $ 1,508 $ 650 $ 705 $ 1,733 $ 8,479 The Dalles, potential $ 2,317 $ 2,572 $ 342 $ 1,500 $ 1,552 $ 8,283 The Dalles, existing $ 2,317 $ 1,789 $ 342 $ 1,500 $ 1,552 $ 7,500 Sandy $ 1,525 $ 1,834 $ 1,943 $ 2,000 $ 7,302 Source: League of Oregon Cities (2010), City websites and staff FCS GROUP Page 12

Editor's Notes

- #5: There is purposefully no mention of growth assumptions.