12C_Abdelmonem Gabr_MB

- 1. The Role of Internal Audit in the Prevention and Detection of Fraud CPE PIN Code: 8232 Abdelmonem Hany Gabr, CIA, CRMA, CFSA Internal Audit Manager Ahli United Bank, Egypt

- 2. Presented By: Abdelmonem Hany Gabr, CIA, CRMA, CFSA, CICA Internal Audit Manager Ahli United Bank ŌłÆ Egypt The Role of Internal Audit in the Prevention and Detection of Fraud

- 3. Our Objectives for Today ŌĆó Understand governance and its tools. ŌĆó Become familiar with theThree Lines of Defense theory. ŌĆó Understand the nature of internal audit and its related standards regarding fraud. ŌĆó Increase the awareness of the importance of internal audit with regards to fraud. ŌĆó Discover new tips for internal auditors.

- 4. Agenda ŌĆó Corporate Governance ŌĆó Three Lines of Defense ŌĆó FraudTriangle ŌĆó 2014 Report to the Nations ŌĆō Figures & Indicators ŌĆó A Recent Fraud Case ŌĆó InternalAudit Role in Fraud Detection and Deterrence ŌĆó InternalAudit Role in Fraud Awareness ŌĆó InternalAudit Role in Fraud RiskAssessment ŌĆó Assessing the Effectiveness of a Fraud Program ŌĆó Internal audit role in fraud investigations ŌĆó InternalAudit Standards &Tips for InternalAuditors

- 5. Corporate Governance Building Corporate GovernanceERM InternalControl FraudMgt. InternalAudit

- 6. Corporate Governance Building Corporate Governance InternalAudit Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization's operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.

- 7. Corporate Governance Building Corporate Governance FraudMgt. Although all personnel within the organization have a responsibility to prevent & detect fraud, each organization has to establish a fraud management system in order to lead the process of fraud prevention and detection. The ACFE is the world's largest anti-fraud organization & premier provider of anti-fraud training and education. With more than 75,000 members, the ACFE is reducing business fraud worldwide and inspiring public confidence in the integrity and objectivity within the profession.

- 8. Corporate Governance Building Corporate Governance InternalControl Internal control is broadly defined as a process effected by an entity's board of directors, management, and other personnel, designed to provide reasonable assurance regarding the achievement of the organizationŌĆÖs objectives.

- 9. Corporate Governance Building Corporate GovernanceERM Enterprise risk management is a process effected by an entityŌĆÖs board of directors, management, and other personnel. It is applied in a strategy setting and across the enterprise and designed to identify potential events that might affect the entity, to manage risk to be within its risk appetite, and to provide reasonable assurance regarding the achievement of the entityŌĆÖs objectives.

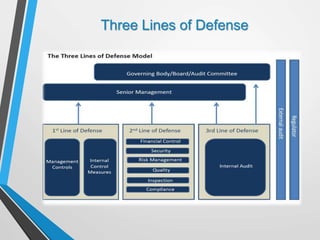

- 10. Three Lines of Defence ŌĆó Who is responsible for managing the risks? ŌĆó Who places controls and monitors their performance? ŌĆó Does senior management have a role; where should it be located? ŌĆó What are the differences between internal audit role & external audit role? Do we compete or cooperate?

- 11. Three Lines of Defense

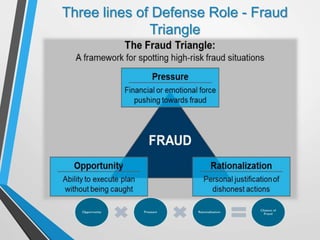

- 12. Three lines of Defense Role - Fraud Triangle

- 13. 5/7/2016

- 14. 2014 Report to the Nations Figures & Indicators 14

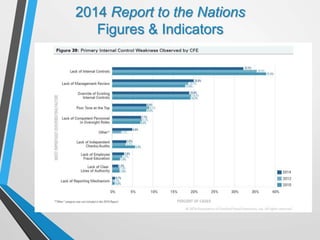

- 15. 15 2014 Report to the Nations Figures & Indicators

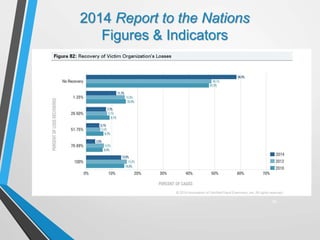

- 16. 2014 Report to the Nations Figures & Indicators 16

- 17. 2014 Report to the Nations Figures & Indicators 17

- 18. 2014 Report to the Nations Figures & Indicators 18

- 19. A Recent Fraud Case

- 20. What Are Internal Audit Roles in Fraud Management? ’āśFraud framework building: ’üČEducator ’üČFacilitator ’üČAssessor ’āśFraud monitoring program ’āśFraud processes assessment: ’üČConsultant ’üČAssurance ’üČInvestigation 5/7/2016

- 21. Internal Audit Role in Fraud Program Educator ŌĆó The senior management & board of directors have the ultimate responsibility to spread the fraud risk culture & awareness throughout the organization. ŌĆó Internal audit may contribute to any fraud training sessions organized by the management. ŌĆó Internal audit should ensure that contribution in such sessions will not impair or seem to impair the independence & objectivity of the internal audit function. ŌĆó Internal audit might include the review of the fraud awareness activity in the assignments.

- 22. Internal Audit Role in Fraud Program Facilitator ŌĆó While the responsibility of fraud management remains with senior management, the internal audit might play a facilitator role in the fraud workshops. ŌĆó As a facilitator, you are requested to encourage the interaction between individuals to enhance the generation of ideas. ŌĆó Internal audit should not make any input to the discussions and ideas generated. ŌĆó The facilitator collecting the ideas generated and submitted to the management. ŌĆó The internal audit should clarify that its role is to facilitate the project and that it has no ownership of responsibilities.

- 23. Internal Audit Role in Fraud Program Assessor ŌĆó Once the fraud program is structured, the internal audit may assess the effectiveness of its design. ŌĆó Internal audit may recommend control procedures/criteria to enhance the program and to fill the gaps analyzed. ŌĆó Internal audit should not recommend any specific controls or workflow for the fraud program. ŌĆó Internal audit should not decline managementŌĆÖs request to assess the program unless the required technical skills are not maintained by internal audit.

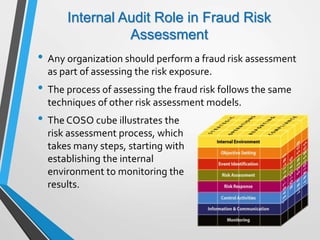

- 25. Internal Audit Role in Fraud Risk Assessment ŌĆó Any organization should perform a fraud risk assessment as part of assessing the risk exposure. ŌĆó The process of assessing the fraud risk follows the same techniques of other risk assessment models. 5/7/2016 ŌĆó The COSO cube illustrates the risk assessment process, which takes many steps, starting with establishing the internal environment to monitoring the results.

- 26. Internal Audit Role in Assessing Effectiveness of the Fraud Program ŌĆó Internal audit has to include fraud risks in the scope of each assurance assignment. ŌĆó Moreover, internal audit should schedule an assurance assignment to examine the effectiveness of the fraud program. ŌĆó The scope & objectives of such an assignment depends on the maturity of the organizationŌĆÖs fraud program, which varies from initialization to optimization. ŌĆó The evaluation of the fraud risk assessment should take place to assess the design of the fraud program.

- 27. Internal Audit Role in Assessing Effectiveness of Fraud Program ŌĆó Internal audit should also assist management by accepting the consulting assignments with regard to the fraud program. ŌĆó The Chief Audit Executive (CAE) should be keen on maintaining the different competencies required to conduct different consultancies. ŌĆó Finally, internal auditŌĆÖs report should highlight the red flags where the auditor believes a possibility of fraud exists. 5/7/2016

- 28. Internal Audit Roles in Fraud Investigations ŌĆó The CAE has to determine the level of involvement in an investigation. ŌĆó The involvement level depends on the nature of the fraud and the availability of internal audit professionals with related competencies. ŌĆó The CAE should continuously enhance the competencies and capabilities of internal audit individuals through training and professional development. 5/7/2016

- 29. Internal Audit Role in Fraud Investigations ŌĆó The internal audit role in fraud investigation should be communicated clearly to senior management & the board of directors. ŌĆó The CAE has to prepare a formal document (Internal Audit Charter), which determines the purpose, authority & responsibility in general. ŌĆó The Charter should include also the role of internal audit with regard to the fraud investigation.

- 30. Internal Audit Standards 1210 - Proficiency ŌĆó Internal auditors must possess the knowledge, skills, and other competencies needed to perform their individual responsibilities.The internal audit activity collectively must possess or obtain the knowledge, skills, and other competencies needed to perform its responsibilities. 1210.A2 ŌĆó Internal auditors must have sufficient knowledge to evaluate the risk of fraud and the manner in which it is managed by the organization, but are not expected have the expertise of a person whose primary responsibility is detecting and investigating fraud.

- 31. Internal Audit Standards 1220 ŌĆō Due Professional Care ŌĆó Internal auditors must apply the care and skill expected of a reasonably prudent and competent internal auditor. Due professional care does not imply infallibility. 1220.A1 Internal auditors must exercise due professional care by considering the: ŌĆó Extent of work needed to achieve the engagementŌĆÖs objectives; ŌĆó Relative complexity, materiality, or significance of matters to which assurance procedures are applied; ŌĆó Adequacy and effectiveness of governance, risk management, and control processes; ŌĆó Probability of significant errors, fraud, or noncompliance; and ŌĆó Cost of assurance in relation to potential benefits.

- 32. Internal Audit Standards 2060 ŌĆō Reporting to Senior Management and the Board The chief audit executive must report periodically to senior management and the board on the internal audit activityŌĆÖs purpose, authority, responsibility, and performance relative to its plan. Reporting must also include significant risk exposures and control issues, including fraud risks, governance issues, and other matters needed or requested by senior management and the board. 2210 ŌĆō Engagement Objectives Objectives must be established for each engagement. 1210.A2 Internal auditors must consider the probability of significant errors, fraud, noncompliance, and other exposures when developing the engagement objectives.

- 33. Internal Audit Standards 2120 ŌĆō Risk Management ŌĆó The internal audit activity must evaluate the effectiveness and contribute to the improvement of risk management processes. ŌĆó The internal audit activity may gather the information to support this assessment during multiple engagements. 2120.A2 ŌĆó The internal audit activity must evaluate the potential for the occurrence of fraud and how the organization manages fraud risk.

- 34. Tips for Internal Auditors ŌĆó Do not use the word fraud unless the investigation is over and the fraud is confirmed. ŌĆó Internal audit is not authorized to initiate a fraud investigation; this is a management decision. ŌĆó Internal audit has no direct responsibility to detect or prevent fraud during assignments. ŌĆó Internal audit has a responsibility to detect and highlight the fraud indicator (raise the red flag).

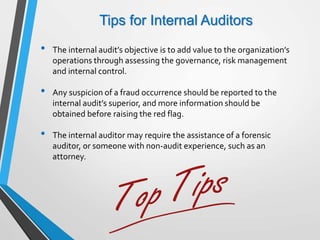

- 35. Tips for Internal Auditors ŌĆó The internal auditŌĆÖs objective is to add value to the organizationŌĆÖs operations through assessing the governance, risk management and internal control. ŌĆó Any suspicion of a fraud occurrence should be reported to the internal auditŌĆÖs superior, and more information should be obtained before raising the red flag. ŌĆó The internal auditor may require the assistance of a forensic auditor, or someone with non-audit experience, such as an attorney.

- 36. 5/7/2016

- 37. The Role of Internal Audit in the Prevention and Detection of Fraud CPE PIN Code: 8232 Abdelmonem Hany Gabr, CIA, CRMA, CFSA Internal Audit Manager Ahli United Bank, Egypt

Editor's Notes

- #15: We asked survey respondents what they thought were the primary internal control weaknesses that contributed to the frauds they had investigated. As noted in Figure 39, in nearly one-third of the cases, the victim organization lacked the appropriate internal controls to prevent the fraud, which reinforces the importance of targeted anti-fraud controls. A lack of controls played an even bigger role in those cases affecting small businesses; this was attributed as the primary weakness at more than 41% of cases at organizations with fewer than 100 employees. Additionally, according to the CFEs who participated in our study, one-fifth of the reported cases could have been prevented if managers had done a sufficient job of reviewing transactions, accounts or processes.

- #16: Sorting departments based on median loss shows that the largest frauds are committed by executives and upper management (see Figure 67). This is not surprising because this group tends to have the highest authority within an organization. Among the seven departments that each accounted for at least 5% of cases, the finance department caused the second-highest median loss, followed by purchasing, accounting, operations, sales and customer service.

- #17: Although the process of recovering the losses from a fraud can go on for years after a fraud examination is complete, we asked respondents to provide the percentage of the loss that the victim organization had recovered at the time of the survey. ŌĆ£No recoveryŌĆØ has been the most common response in past surveys, and this year we saw a substantial increase in this number. In 58% of cases reported in 2014, the victim organizations have seen no losses recovered, compared to 49% in 2012. At the time of our survey, only 14% of victim organizations had made a full recovery.

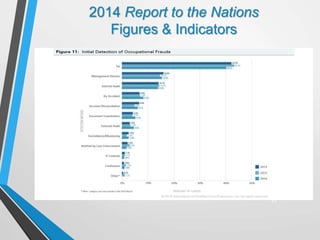

- #18: As Figure 11 demonstrates, tips are consistently the most common detection method for cases of occupational fraud by a significant margin, which has been an observed trend since we first began tracking this data in 2002. Management review and internal audit follow tips, which was also true for the 2010 and 2012 Reports.

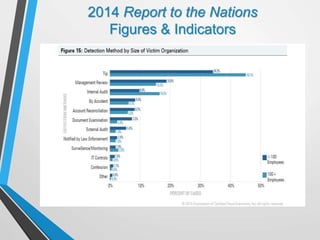

- #19: Large and small organizations often allocate resources differently for anti-fraud measures (see Figure 27), and the distribution of detection methods at these two types of organizations also varies. Small organizations (those with fewer than 100 employees) differed most from large organizations in the percentage of cases detected by tip (34.2% and 45.1%, respectively) and internal audit (9.8% and 16.5%); these findings are not surprising, given that small organizations are much less likely to have hotlines or internal audit departments (see Figure 27).