2013 march-polymers

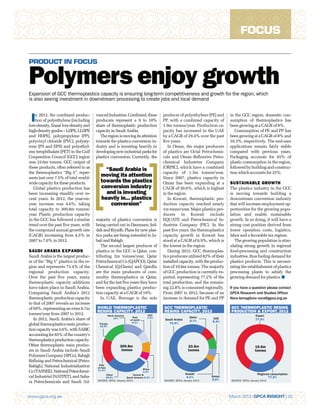

- 1. FOCUS PRODUCT IN FOCUS Polymers enjoy growth Expansion of GCC thermoplastics capacity is ensuring long-term competitiveness and growth for the region, which is also seeing investment in downstream processing to create jobs and local demand n 2012, the combined produc- vanced Industries. Combined, these producer of polyethylene (PE) and in the GCC region, domestic con- I tion of polyethylene (including low-density, linear low-density and producers represent a 9 to 10% share of thermoplastic production PP, with a combined capacity of 1.9m tonnes/year. Production ca- sumption of thermoplastics has been growing at a CAGR of 8%. high-density grades â LDPE, LLDPE capacity in Saudi Arabia. pacity has increased in the UAE Consumption of PE and PP has and HDPE), polypropylene (PP), The region is moving its attention by a CAGR of 29.4% over the past been growing at a CAGR of 8% and polyvinyl chloride (PVC), polysty- towards the plastics conversion in- ïŽve years. 10.3%, respectively. The end-user rene (PS and EPS) and polyethyl- dustry and is investing heavily in In Oman, the major producers applications remain fairly stable ene terephthalate (PET) in the Gulf developing new industrial parks for of plastics are Octal Petrochemi- compared with previous years. Cooperation Council (GCC) region plastics conversion. Currently, the cals and Oman ReïŽneries Petro- Packaging accounts for 45% of was 23.6m tonnes. GCC output of chemical Industries Company plastic consumption in the region, these products, often referred to as (ORPIC), which have a combined followed by building and construc- the thermoplastics âBig 5â, repre- âSaudi Arabia is capacity of 1.3m tonnes/year. tion which accounts for 25%. sents just over 7.5% of total world- moving its attention Since 2007, plastics capacity in wide capacity for these products. towards the plastics Oman has been expanding at a SUSTAINABLE GROWTH Global plastics production has conversion industry CAGR of 30.6%, which is highest The plastics industry in the GCC been increasing steadily over re- and is investing in the region. is moving towards building a cent years. In 2012, the year-on- heavily in... plastics In Kuwait, thermoplastic pro- downstream conversion industry year increase was 4.6%, taking conversionâ duction capacity reached nearly that will increase employment op- total capacity to 309.8m tonnes/ 1m tonne/year. Major plastics pro- portunities for the growing popu- year. Plastic production capacity ducers in Kuwait include lation and enable sustainable in the GCC has followed a similar majority of plastics conversion is EQUATE and Petrochemical In- growth. In so doing, it will have a trend over the past ïŽve years, with being carried out in Dammam, Jed- dustries Company (PIC). In the strong cost position derived from the compound annual growth rate dah and Riyadh. Plans for new plas- past ïŽve years, the thermoplastics lower operation costs, logistics, (CAGR) increasing from 4.5% in tics parks are being extended to Ju- capacity growth in Kuwait has labor and a favorable tax regime. 2007 to 7.6% in 2012. bail and Rabigh. stood at a CAGR of 6.9%, which is The growing population is stim- The second largest producer of the lowest in the region. ulating strong growth in regional SAUDI ARABIA EXPANDS plastics in the GCC is Qatar, con- During 2012, GCC thermoplas- food-processing and construction Saudi Arabia is the largest produc- tributing 2m tonnes/year. Qatar tics producers utilized 83% of their industries, thus fueling demand for er of the âBig 5â plastics in the re- Petrochemical Co (QAPCO), Qatar installed capacity, with the produc- plastics products. This is necessi- gion and represents 73.4% of the Chemical (Q-Chem) and QatoïŽn tion of 19.6m tonnes. The majority tating the establishment of plastics regional production capacity. are the main producers of com- of GCC production is currently ex- processing plants to satisfy the Over the past ïŽve years, many modity thermoplastics in Qatar, ported, representing 77.2% of the growing demand for plastics. thermoplastic capacity additions and for the last ïŽve years they have total production, and the remain- have taken place in Saudi Arabia. been expanding plastics produc- ing 22.8% is consumed regionally. If you have a question please contact Comparing Saudi Arabiaâs 2012 tion capacity at a CAGR of 19%. From 2007 to 2012, because of an GPCA Research and Studies Officer thermoplastic production capacity In UAE, Borouge is the sole increase in demand for PE and PP Nora Ismagilova nora@gpca.org.ae to that of 2007 reveals an increase of 69%, representing an extra 8.7m WORLD THERMOPLASTIC GCC THERMOPLASTIC GCC THERMOPLASTIC RESINS RESINS CAPACITY, 2012 RESINS CAPACITY, 2012 PRODUCTION & EXPORT, 2012 tonnes/year from 2007 to 2012. North America GCC Export Rest 7.6% Qatar In 2012, Saudi Arabiaâs share of 14% of world Saudi Arabia 8.7% UAE 77.2% 8.3% 8.3% global thermoplastics resin produc- Europe 73.4% 16.9% tion capacity was 5.6%, with SABIC accounting for 65% of the countryâs thermoplastics production capacity. Other thermoplastic resin produc- 309.8m 23.6m 19.6m ers in Saudi Arabia include Saudi tonnes tonnes tonnes Polymers Company (SPCo), Rabigh ReïŽning and Petrochemical (Petro- Rabigh), National Industrialization Rest of Asia Africa Co (TASNEE), National Petrochemi- 17.4% 1.4% China Central & Kuwait Regional consumption cal Industrial (NATPET), and Saha- 28.9% South America 5.4% 4.1% Oman 77.2% SOURCE: GPCA, January 2013 SOURCE: GPCA, January 2013 5.5% SOURCE: GPCA, January 2013 ra Petrochemicals and Saudi Ad- www.gpca.org.ae March 2013 | GPCA INSIGHT | 25