2013.4.2 david coe presentation slides

- 1. the power of REAL ESTATE inside your RETIREMENT ACCOUNT

- 2. Proprietary & Confidential, Property of Freedom Growth who we are Self Directed IRA Real Estate Consultants Investment Advisors

- 3. Proprietary & Confidential, Property of Freedom Growth what we do Self Directed IRA

- 4. Proprietary & Confidential, Property of Freedom Growth agenda ’éóIntro to self-directed retirement accounts ’éóActual Client Case Studies ’éóFinal Exam

- 5. Section 1 Introduction to Self-Directed Retirement Accounts Text ŌĆ£FreedomŌĆØ to 24587

- 6. Proprietary & Confidential, Property of Freedom Growth investment restrictions Prohibited Assets ’éóCollectibles ’éóLife Insurance Art ’éóS Corps

- 7. Proprietary & Confidential, Property of Freedom Growth disqualified persons Certain family members cannot do business with your IRA ŌĆó YOU! ŌĆó Your Spouse ŌĆó Your Parents ŌĆó Your Grandparents ŌĆó Your Children ŌĆó Your Grandchildren ŌĆó Spouses of Lineal IRA Descendants ŌĆó IRA Fiduciary

- 8. Proprietary & Confidential, Property of Freedom Growth what can go into an ira Cash Stocks Real Estate Mutual Funds Precious Metals Superbowl Tix IRA =Special Safe Private Biz Bonds Foreign Currency

- 9. takeaway #1 Self-Directed = Unrestricted

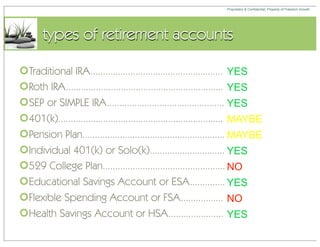

- 10. Proprietary & Confidential, Property of Freedom Growth types of retirement accounts ’éóTraditional IRA..................................................... YES ’éóRoth IRA............................................................... YES ’éóSEP or SIMPLE IRA............................................... YES ’éó401(k).................................................................. MAYBE ’éóPension Plan......................................................... MAYBE ’éóIndividual 401(k) or Solo(k).............................. YES ’éó529 College Plan................................................. NO ’éóEducational Savings Account or ESA.............. YES ’éóFlexible Spending Account or FSA................. NO ’éóHealth Savings Account or HSA...................... YES

- 11. Proprietary & Confidential, Property of Freedom Growth 3 step process 1. Open Account 2. Fund IRA 3. Invest

- 12. takeaway #2 #1 Set up SD IRA #2 Find an Investment

- 13. Proprietary & Confidential, Property of Freedom Growth the players CUSTODIANS PROFESSIONALS INVESTMENTS

- 14. Section 2 Case Studies Jim - SD IRA Barbara and William - SP LLC Gabby and Michael - Solo(k) Text ŌĆ£FreedomŌĆØ to 24587

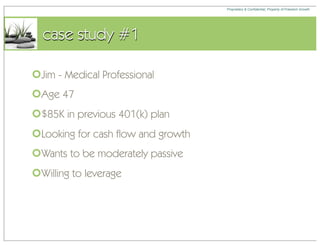

- 15. Proprietary & Confidential, Property of Freedom Growth case study #1 ’éóJim - Medical Professional ’éóAge 47 ’éó$85K in previous 401(k) plan ’éóLooking for cash flow and growth ’éóWants to be moderately passive ’éóWilling to leverage

- 16. takeaway #3 Start by Saving YOU CANŌĆÖT INVEST MONEY YOU DONŌĆÖT HAVE

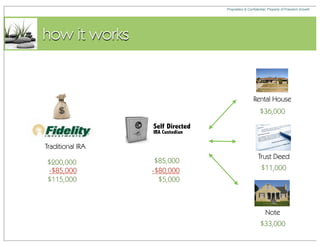

- 17. Proprietary & Confidential, Property of Freedom Growth how it works Rental House $36,000 Self Directed IRA Custodian Traditional IRA Trust Deed $200,000 $85,000 -$85,000 -$80,000 $11,000 $115,000 $5,000 Note $33,000

- 18. Proprietary & Confidential, Property of Freedom Growth taking title in an ira Self Directed IRA Custodian Owner Investment ’éóAnother Party in Escrow ’éóIRA takes title ’ü¼ŌĆ£IRA Custodian Name FBO Client Name #XXXXXXŌĆØ ’éóIRA ŌĆ£ownsŌĆØ property ’éóClient can manage the investment

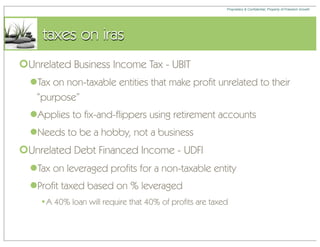

- 19. Proprietary & Confidential, Property of Freedom Growth taxes on iras ’éóUnrelated Business Income Tax - UBIT ’ü¼Tax on non-taxable entities that make profit unrelated to their ŌĆ£purposeŌĆØ ’ü¼Applies to fix-and-flippers using retirement accounts ’ü¼Needs to be a hobby, not a business ’éóUnrelated Debt Financed Income - UDFI ’ü¼Tax on leveraged profits for a non-taxable entity ’ü¼Profit taxed based on % leveraged ŌĆóA 40% loan will require that 40% of profits are taxed

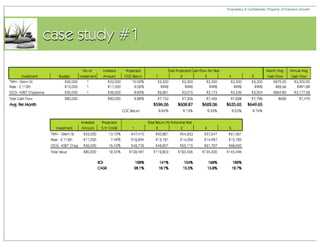

- 20. Proprietary & Confidential, Property of Freedom Growth case study #1

- 21. Proprietary & Confidential, Property of Freedom Growth sd ira real estate - pop quiz ’éóOwning real estate inside of your IRA doesnŌĆÖt make sense if there are no tax breaks, right? No ’éóIf I buy the property in Mammoth, can I use it for one week a year? No ’éóCan I rent it to my son if he pays full market rent? No

- 22. Proprietary & Confidential, Property of Freedom Growth sd ira real estate - pop quiz ’éóDo I have to hire a property manager if I want to hold real estate in my IRA? No ’éóCan I get a loan to create leverage? Yes ’éóIs it possible to avoid or minimize UDFI if I take a loan? Yes

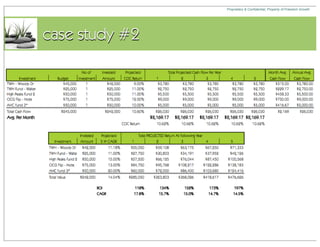

- 23. Proprietary & Confidential, Property of Freedom Growth case study #2 ’éóBarbara - Nurse, William - Auto Professional ’éóAge 65 & 67 ’éóRecently retired ’ü¼Barbara from large hospital group ’ü¼William from auto dealership ’éóBarbara, pension vs. lump sum distribution ’éóLooking for cash flow and capital preservation ’ü¼Utilizing cash flow for living expenses ’éóWant to be completely passive

- 24. Proprietary & Confidential, Property of Freedom Growth setting up a special purchase LLC ’éóBoth opened a SD IRA ’éóAttorney created LLC Husband ’éóLLC has separate bank account ’éóMake investments via LLC SP LLC ’ü¼Check writing capabilities ŌĆó Checkbook IRA or Real Estate IRA ’éóIRA owner is Manager Wife

- 25. Proprietary & Confidential, Property of Freedom Growth checkbook ira investing Note $42,000 SP LLC Special Purpose LLC Note Fund Pension Plan $25,000 $350,000 $250,000 -$350,000 -$245,000 $0 $3,000 MHP Fund $50,000 Self-Directed IRA Fund Flip $75,000 $350,000 -$250,000 $100,000 TD Fund $50,000

- 26. Proprietary & Confidential, Property of Freedom Growth flip renovations

- 27. takeaway #4 No sweat equity is allowed The IRS Prohibits Non-Cash Contributions

- 28. Proprietary & Confidential, Property of Freedom Growth case study #2

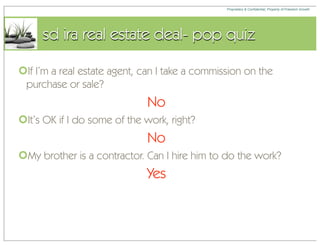

- 29. Proprietary & Confidential, Property of Freedom Growth sd ira real estate deal- pop quiz ’éóIf IŌĆÖm a real estate agent, can I take a commission on the purchase or sale? No ’éóItŌĆÖs OK if I do some of the work, right? No ’éóMy brother is a contractor. Can I hire him to do the work? Yes

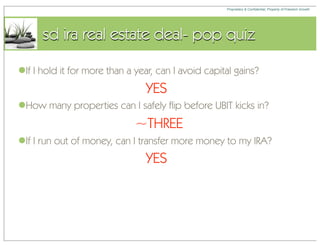

- 30. Proprietary & Confidential, Property of Freedom Growth sd ira real estate deal- pop quiz ’ü¼If I hold it for more than a year, can I avoid capital gains? YES ’ü¼How many properties can I safely flip before UBIT kicks in? ~THREE ’ü¼If I run out of money, can I transfer more money to my IRA? YES

- 31. Proprietary & Confidential, Property of Freedom Growth case study #3 ’éóGabby - Realtor, Michael - Attorney ’éóAge 54 & 56 ’éóGabby long time self-employed ’ü¼Entering her prime ’éóMichael long time employee at a firm ’ü¼Recently started his own practice ’éóWant to limit exposure to the stock market ’éóTwo kids in college

- 32. Proprietary & Confidential, Property of Freedom Growth solo(k)s are awesome ’éóSEP on steroids ’ü¼Contribute as employer and employee ’éóWhoŌĆÖs eligible ’ü¼Solo business owners with no full time employees ’éóAdvantages ’ü¼Higher contributions for moderate earners Individual 401(k) ’ü¼Faster to $50K per year or Solo(k) ’ü¼No income limitations on Roth ’ü¼Loans- can be used for college! ’ü¼UDFI exempt ’éóCustodian not necessary!

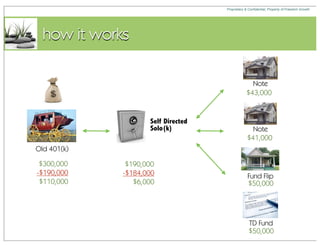

- 33. Proprietary & Confidential, Property of Freedom Growth how it works Note $43,000 Self Directed Solo(k) Note $41,000 Old 401(k) $300,000 $190,000 -$190,000 -$184,000 Fund Flip $110,000 $6,000 $50,000 TD Fund $50,000

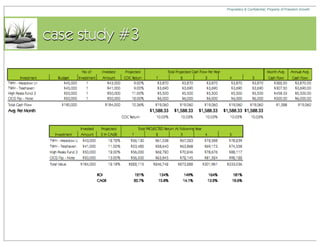

- 34. Proprietary & Confidential, Property of Freedom Growth case study #3

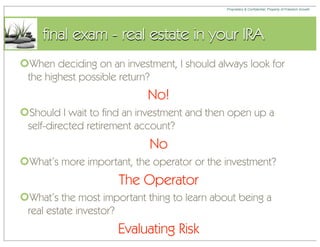

- 35. Proprietary & Confidential, Property of Freedom Growth final exam - real estate in your IRA ’éóWhen deciding on an investment, I should always look for the highest possible return? No! ’éóShould I wait to find an investment and then open up a self-directed retirement account? No ’éóWhatŌĆÖs more important, the operator or the investment? The Operator ’éóWhatŌĆÖs the most important thing to learn about being a real estate investor? Evaluating Risk

- 36. takeaway #5 WHO YOU INVEST WITH MATTERS MORE THAN WHAT YOU INVEST IN

- 37. Thanks! To get a copy of this presentation Text ŌĆ£FreedomŌĆØ to 24587 David Coe david@freedomgrowth.com www.freedomgrowth.com https://www.facebook.com/FreedomGrowth