2016 Economic Outlook2 [Compatibility Mode]

- 2. 1 AGENDA ÔÇó INTRODUCTIONS ÔÇó GLOBAL╠²ECONOMY ÔÇó UNITED╠²STATES╠²ECONOMY ÔÇó Q&A

- 3. 2 SPEAKERS GEOFFREY ALLEN PIGMAN, D.Phil. ÔÇó Consultant to public and private entities in Europe, N.A., Africa ÔÇó Political economist ÔÇó Research Associate, University of Pretoria and Research Associate at the Institute for Global Dialogue ÔÇó Published author ÔÇó D.Phil (Oxford), MA (Johns Hopkins SAIS), BA (Swarthmore) CHRISTOPHER W. YOUNG, Ph.D. ÔÇó Managing Director, Economist at Sobel & Co. [Valuation] ÔÇó Prof. Rutgers Business School ÔÇó Ph.D. (Rutgers), MBA (Rutgers), Mathematics, [CUNY]

- 4. 3 ÔÇ£The only function of economic forecasting is to make astrology look respectable.ÔÇØ John Kenneth Galbraith

- 5. 4 ÔÇ£The most reliable way to forecast the future is to try to understand the present.ÔÇØ John Naisbitt

- 6. 5 APPROACH ÔÇó Comprehensive ÔÇô not inclusive of all endogenous variables ÔÇó Normative based upon historical economic data ÔÇó Inclusive of opinions of other economists and financial service firms ÔÇó Includes discussion about exogenous market threats and opportunities ÔÇó END RESULT: Mosaic to consider when addressing future market and economic conditions

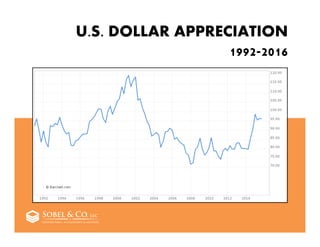

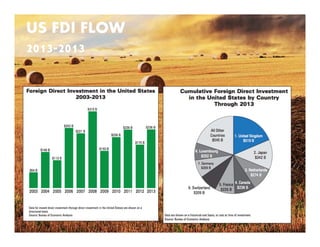

- 7. 6 GLOBAL CONSIDERATIONS ÔÇó Long-Term Growth in Trade ÔÇó The Dollar Impact ÔÇó Foreign Direct Investment ÔÇó Trade Policy ÔÇó Geopolitical Risk

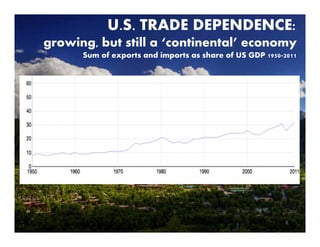

- 8. 7 End of gold standard 1st IT revolution ÔÇô EFT begins End of Cold War German reunification 2008 financial crisis GLOBAL TRADE % OF U.S. GDP 1950-2011 Brazil China Germany India Japan U.K. USA

- 9. U.S. TRADE DEPENDENCE: growing, but still a ÔÇÿcontinentalÔÇÖ economy Sum of exports and imports as share of US GDP 1950-2011 8

- 10. US TOP TEN TRADING PARTNERS: Jan-Nov 2015 Rank Country Exports╠² ($╠²B) %╠²Total╠² Exports 1 Canada 259.0 18.7% 2 Mexico 217.8 15.7 3 China 106.1 7.7 4 Japan 57.7 4.2 5 UK 52.0 3.8 6 Germany 45.9 3.3 7 S╠²Korea 40.1 2.9 8 Netherlands 37.2 2.7 9 Hong╠²Kong 33.8 2.4 10 Belgium 31.6 2.3 Rank Country Imports╠² ($╠²B) %╠²Total╠² Imports 1 China 443.9 21.5% 2 Canada 271.6 13.2 3 Mexico 271.6 13.2 4 Japan 119.8 5.8 5 Germany 113.4 5.5 6 S╠²Korea 66.4 3.2 7 UK 53.7 2.6 8 France 43.7 2.1 9 India 41.7 2.0 10 Italy 40.2 2.0 9 ~48% of US Goods imports were intra-firm and ~30% of US Goods exports were intra-firm

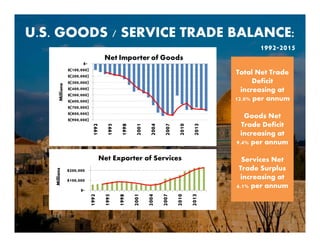

- 11. 10 U.S. GOODS / SERVICE TRADE BALANCE: 1992-2015 Total Net Trade Deficit increasing at 12.0% per annum Goods Net Trade Deficit increasing at 9.4% per annum Services Net Trade Surplus increasing at 6.1% per annum Net Exporter of Services Millions

- 14. GLOBALIZING THE SUPPLY CHAIN: intra-firm trade vs. outsourcing 13 Global market size of outsourced services 2000-2014 ($ Billions) THREE CATEGORIES OF OUTSOURCING: 1. Logistics, sourcing & distribution ÔÇó contract manufacturing 2. IT services: software creation, computer center management 3. business process outsourcing (BPO) ÔÇó call centers ÔÇó financial transaction processing ÔÇó HR management

- 15. TRADE AGREEMENTS 14 US implementation: Trade Promotion Authority (TPA) (formerly ÔÇÿFast TrackÔÇÖ) ÔÇô agreements get an up-or- down vote in Congress Treaty principles: most favored nation (MFN), non-discrimination, national treatment, reciprocity Bilateral/Regional ÔÇô NAFTA, FTAs with Israel, Australia, South Korea, Morocco, Jordan, etc. Multilateral ÔÇô World Trade Organization (WTO) ÔÇô GATT, GATS, Agreement on Subsidies & Countervailing Measures, Agreement on Agriculture

- 16. LOOKING AHEAD 15 New considerations for prospective trade agreements Plurilateral ÔÇô Trade in Services Agreement (TiSA) Mega-regional ÔÇô Trans-Pacific Partnership (TPP) ÔÇô Transatlantic Trade and Investment Partnership (TTIP) ÔÇô Regional Comprehensive Economic Partnership (RCEP) ÔÇô China, India, Japan, SE Asia (not USA)

- 17. GEOPOLITICAL RISK: China in transition * Supply- demand imbalance from exports to services and consumption * equities * markets 16 * Military: maritime expansionism, SCO * New Silk Road, energy sourcing * Regional Comprehensive Economic Partnership (RCEP) * Anti- corruption drive = Xi power push * Rivalries: PLA, provinces, etc. POLITICS ECONOMY SECURITY

- 18. ASSESSING GEOPOLITICAL RISK THREATS ÔÇó Migration/refugee flows ÔÇó War in the Levant/terrorism ÔÇó Putin ÔÇó Integrity of the European Union: ÔÇÿBrexitÔÇÖ, integrity of UK, Spain ÔÇó Hotspots: North Korea, Venezuela ÔÇó Domestic: shadow of 2016 election ÔÇó Trade agreements ÔÇó Cuba ÔÇó Iran ÔÇó African Union ÔÇó Domestic: post- election 17 OPPORTUNITIES

- 19. SUMMARY: IMPACT OF GLOBAL ECONOMY ON U.S. BUSINESS 4. Focus on sustaining sources of US power entrepreneurship, innovation, capital markets, regulatory leadership, transparency, rule of law, security umbrella 18 3. China rising and changing 2. US hegemony persistent 1. US dependence on cross-border flows of goods, services, capital and labor growing

- 20. 19 U.S. ECONOMIC THEMES ÔÇó CONSUMER ÔÇô slowing tailwinds in the forecast ÔÇó CORPORATE ÔÇô headwinds strengthening ÔÇó GOVERNMENT ÔÇô stand still, for now ÔÇó MARKET VOLATILITY

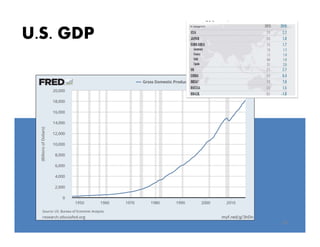

- 22. Real US GDP, per capita [to Q3 2015] 21

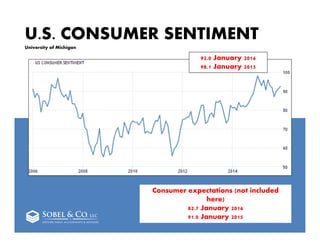

- 25. U.S. CONSUMER SENTIMENT University of Michigan 24 92.0 January 2016 98.1 January 2015 Consumer expectations (not included here) 82.7 January 2016 91.0 January 2015

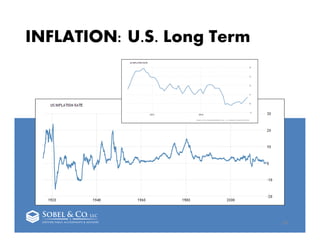

- 27. INFLATION: U.S. Long Term 26

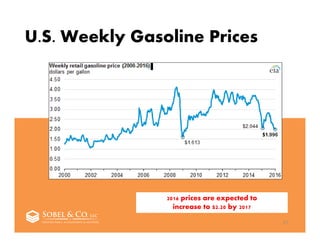

- 28. U.S. Weekly Gasoline Prices 27 2016 prices are expected to increase to $2.20 by 2017

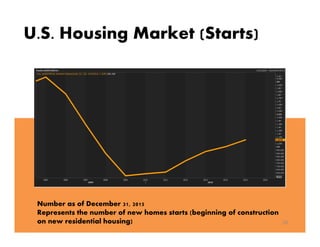

- 30. U.S. Housing Market (Starts) 29 Number as of December 31, 2015 Represents the number of new homes starts (beginning of construction on new residential housing)

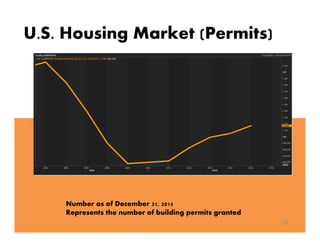

- 31. U.S. Housing Market (Permits) 30 Number as of December 31, 2015 Represents the number of building permits granted

- 32. U.S. Housing Market (Price) 31 Number as of December 31, 2015 Based on CaseShiller Index (tracks the prices of repeated residential home sales over time]

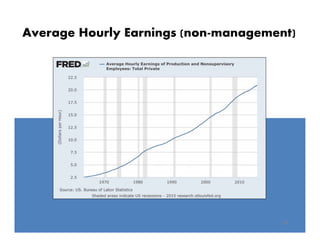

- 34. Average Hourly Earnings (non-management) 33

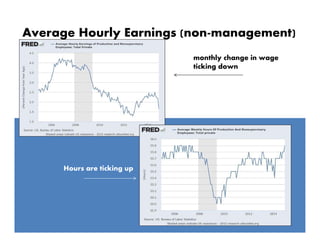

- 35. Average Hourly Earnings (non-management) 34 monthly change in wage ticking down Hours are ticking up

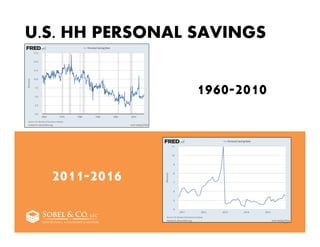

- 36. U.S. HH PERSONAL SAVINGS 35 1960-2010 2011-2016

- 38. US Student Loan Debt 37 $27k UG avg. $200k GRAD avg. DELINQUENCY RATE ~ 17%-30%

- 40. CORPORATE strengthening headwinds OR storm ahead? 39

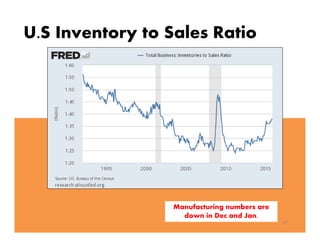

- 42. U.S Inventory to Sales Ratio 41 Manufacturing numbers are down in Dec and Jan.

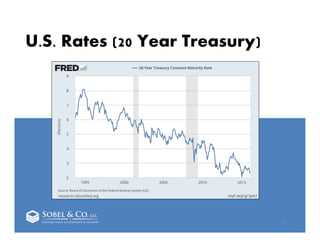

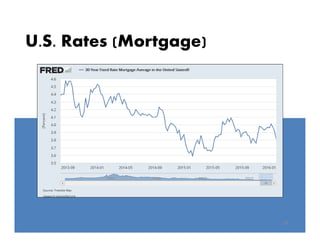

- 43. U.S. Rates (20 Year Treasury) 42

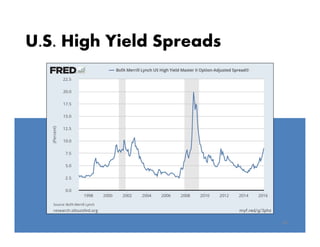

- 44. U.S. High Yield Spreads 43

- 45. MARKETS 44

- 46. U.S. Markets 45 VOLATILITY ÔÇô CANNOT SEE A FUTURE

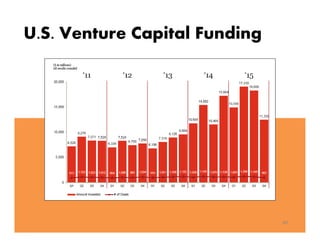

- 47. U.S. Venture Capital Funding 46

- 50. GOVERNMENT 49

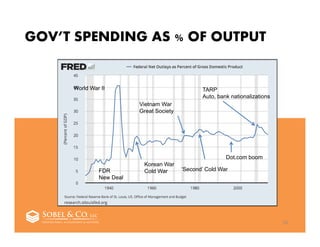

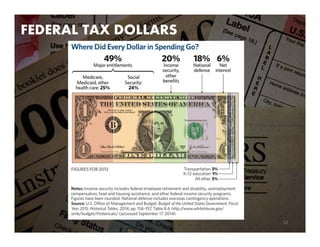

- 51. GOVÔÇÖT SPENDING AS % OF OUTPUT 50 World War II Korean War Cold War Vietnam War Great Society ÔÇÿSecondÔÇÖ Cold War Dot.com boom TARP Auto, bank nationalizations FDR New Deal

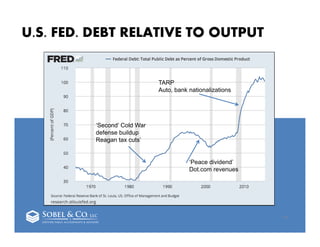

- 52. U.S. FED. DEBT RELATIVE TO OUTPUT 51 ÔÇÿSecondÔÇÖ Cold War defense buildup Reagan tax cutsÔÇÖ ÔÇÿPeace dividendÔÇÖ Dot.com revenues TARP Auto, bank nationalizations

- 54. THE BATTLE OF PENNSYLVANIA AVENUE: The White House v. Congress 53 3. Budget Control Act of 2011 2. National debt ceiling debate 1. Annual Fed. Budget appropriation process

- 55. RECAP 54 1. Expect to see a solid performance from the consumer in the first half of 2016 ÔÇô yet tailing off in back half of the year. 2. Corporates expected to see challenging year ÔÇô profits squeezed, margins decreasing and exports decreasing. 3. Exogenous international factors unknown but can have an impact on the global economy.

![2

SPEAKERS

GEOFFREY ALLEN PIGMAN, D.Phil.

ÔÇó Consultant to public and private

entities in Europe, N.A., Africa

ÔÇó Political economist

ÔÇó Research Associate, University of

Pretoria and Research Associate at

the Institute for Global Dialogue

ÔÇó Published author

ÔÇó D.Phil (Oxford), MA (Johns

Hopkins SAIS), BA (Swarthmore)

CHRISTOPHER W. YOUNG, Ph.D.

ÔÇó Managing Director, Economist

at Sobel & Co. [Valuation]

ÔÇó Prof. Rutgers Business School

ÔÇó Ph.D. (Rutgers), MBA (Rutgers),

Mathematics, [CUNY]](https://image.slidesharecdn.com/61fd84fe-9833-4d2f-bd1f-7d376cf9025d-160210175317/85/2016-Economic-Outlook2-Compatibility-Mode-3-320.jpg)

![Real US GDP, per capita [to Q3 2015]

21](https://image.slidesharecdn.com/61fd84fe-9833-4d2f-bd1f-7d376cf9025d-160210175317/85/2016-Economic-Outlook2-Compatibility-Mode-22-320.jpg)

![U.S. Housing Market (Price)

31

Number as of December 31, 2015

Based on CaseShiller Index (tracks the prices of repeated residential

home sales over time]](https://image.slidesharecdn.com/61fd84fe-9833-4d2f-bd1f-7d376cf9025d-160210175317/85/2016-Economic-Outlook2-Compatibility-Mode-32-320.jpg)