4. Insurance - Non-Life Insurance

- 2. Non-Life Insurance ŌĆó Also known as General Insurance, is a form of insurance mainly concerned with protecting the policyholder from loss or damage caused by specific risks. ŌĆó Categorized depending on the need level ŌĆō Property/ Casualty Insurance ŌĆō Health and Disability Insurance ŌĆō Business and Commercial Insurance

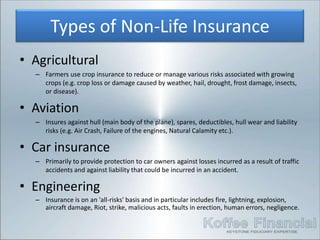

- 3. Types of Non-Life Insurance ŌĆó Agricultural ŌĆō Farmers use crop insurance to reduce or manage various risks associated with growing crops (e.g. crop loss or damage caused by weather, hail, drought, frost damage, insects, or disease). ŌĆó Aviation ŌĆō Insures against hull (main body of the plane), spares, deductibles, hull wear and liability risks (e.g. Air Crash, Failure of the engines, Natural Calamity etc.). ŌĆó Car insurance ŌĆō Primarily to provide protection to car owners against losses incurred as a result of traffic accidents and against liability that could be incurred in an accident. ŌĆó Engineering ŌĆō Insurance is on an 'all-risks' basis and in particular includes fire, lightning, explosion, aircraft damage, Riot, strike, malicious acts, faults in erection, human errors, negligence.

- 4. Types of Non-Life Insurance (Contd.) ŌĆó Fire ŌĆō Provides protection against damage to property caused by accidents due to fire, lightening or explosion. Also includes damage caused due to other causes like flood, burst pipes, earthquake etc. ŌĆó Health insurance ŌĆō Protect holders from costly medical bills in case of any emergency like ŌĆō critical incidents and hospital expenses. ŌĆō Critical Illness Insurance ŌĆó Home insurance ŌĆō Is a type of property insurance that covers private homes. ŌĆō A policy that includes losses occurring to home, its contents, loss of its use, or loss of other personal possessions of the homeowner. Also covers accidents that may happen at the home.

- 5. Types of Non-Life Insurance (Contd.) ŌĆó Marine ŌĆō Covers the loss or damage of ships, cargo, terminals, and any transport or property ŌĆō By which cargo is transferred, acquired, or held between the points of origin and final destination ŌĆó Motor ŌĆō For cars, trucks, and other vehicles. It is for protection against losses incurred as a result of traffic accidents. ŌĆó Shop/office insurance ŌĆō Provides cover for damage to shop and itŌĆÖs contents. ŌĆō Financial loss due to fraud and dishonesty of a specified employee. ŌĆō Loss of money at office premises or while transporting it due to accidents, robbery, break ŌĆō ins etc. ŌĆó Travel insurance ŌĆō It is purchased for Persons traveling or residing outside of their home country. It covers baggage loss, medical expenses and personal liability.

- 6. Tax Rebates in General Insurance ŌĆó The premium you pay towards health insurance is tax deductible under Section 80(D) of Income Tax Act, 1961.

- 7. Thanks! ŌĆó For more information, explore ŌĆō http://www.koffeefinancial.com/Static/Learn.aspx ŌĆó Or email us at learn@koffeefinancial.com