6

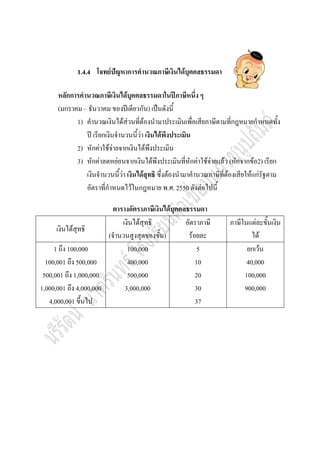

- 1. 1.4.4 F ╦å F F ╩Š ( ╩Š ) ╦ł 1) F F F ╩Š F F 2) F F F F 3) F F F F F F F ( F 2) F F F F F F F . . 2550 F F F F ( ) F F F 1 100,000 100,001 500,000 500,001 1,000,000 1,000,001 4,000,000 4,000,001 100,000 400,000 500,000 3,000,000 5 10 20 30 37 F 40,000 100,000 900,000

- 2. F 100,000 5% F F F F F F 100,000 F F 500,000 10% F F F 125000 -100000 = 25,000 F F 500,225000 100 10 =├Ś F 2,500 F 2,500 2,500 F 1 F 125,000 F F F

- 3. F 100,000 5% F F F F F F 100,001 500,000 10% ╦ł 000,40400000 100 10 =├Ś F F 500,001 625,150 20% ╦ł 030,25 100 20 125150 =├Ś F F F 40000+25030 = 65,030 F F 65,030 65,030 F 2 F F 625,150 F F F F

- 4. F 100,000 5% F F F F F F 100,001 500,000 10% ╦ł 000,40400000 100 10 =├Ś F F 500,001 1,000,000 20% ╦ł 000,100 100 20 500000 =├Ś F 1,000,001 2,564,000 30% ╦ł 200,469 100 30 1564000 =├Ś F ╦ł F 40000+100000+469200 = 609,200 ╦ł F F 5,000 F 1 ╩Š 12 ╦ł 000,60125000 =├Ś ╦ł F ╦ł 609200 60000 = 549,200 549,200 F 3 ╦ł F 2,564,000 F F 5,000 F ╩Š F F ╦ł F F F

- 5. F 80,000 5% F F F F F F F F 12 ╦ł 000,650012 =├Ś F F 6,000 6,000 F 4 F 80,000 F F F 500 ╩Š F F F F F